The Broad Market Index was down 0.29% last week and 38% of stocks out-performed the index.

Many Securities and Exchange Commission (SEC) financial statements appeared last week lifting our Otos 1st quarter update to 85% complete. Sales growth continues to fall with only 31% of companies reporting an improvement (accounting for 28% of total market capital). Average sales growth is currently 11.7%, this is down from 15.2% last quarter; and 27% at the virus recovery peak in 2021.

Sales Are Down

This is the 5th consecutive quarter in a sales growth decline that typically lasts 8 to 12 quarters. The frequency of improvement in sales is low and lower in this period, suggesting that more top line growth weakness is to come. Makes you wonder what is supporting the current market valuations.

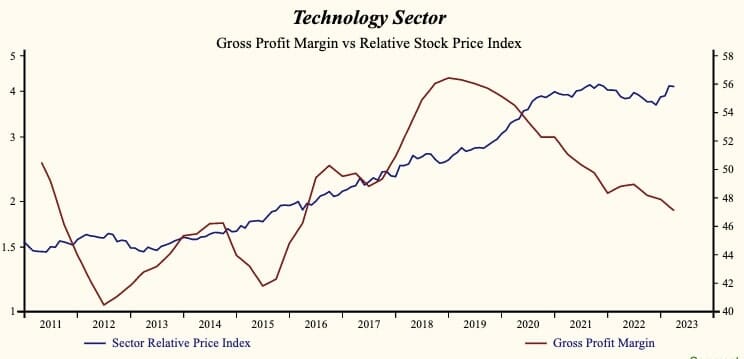

Profits Are Up – Tech Is Up

Gross profit margins were up on average but less frequently; except for the technology sector where the firing of 186,000 employees in the quarter produced a gross margin improvement. Sales growth in technology fell to 4%, near the lowest in the history of the sector.

Share prices of the biggest technology companies rose to a new high and valuation (price to sales) is the highest in the history of the sector.

No Credit Crunch

With headline inflation down and short-term interest rates now higher than measured inflation we might expect that interest rate hikes might be over. So far, we are seeing only the higher costs of money and no signs yet of any curtailment of loanable funds.

Quite the opposite as the Federal Reserve has flushed liquidity into the banking system to support banks dealing with runs on deposits. Sales of Autos and Housing (industry) remain very high and those two important industries suggest that inflation will remain elevated.

Inflation Tied To Oil

The entirety of the decline in inflation so far has been the result of lower energy costs. Meanwhile US energy companies continue to underinvest in new supply suggesting that the balance will soon tip back to higher oil prices.

That will press inflation higher while corporate growth is falling more frequently and on average. With the major indexes near to all-time high prices relative to long bonds and valuation near records, the broad stock market indexes remain very vulnerable.

Meanwhile it is important to keep our portfolio positions with accelerating attributes (tall green Moneytree in a golden pot) and sell stocks of companies that lose those attributes.

That means raising more cash but with return to cash at over 5%, it is our only haven until growth improves more broadly.

Maintaining large cash balances to defend against a market decline is now easier than ever. With short-term interest rates near 5% makes the loss to inflation lower. Still, cash is not a good long-term strategy. Buy shares of accelerating companies displaying accelerating top line attributes companies, such as:

Lockheed Martin Corp (LMT) $450.790 BUY This Rich Company Getting Better

Lockheed Martin Corp (NYSE:LMT) has been an exceptionally profitable company with persistently high cash return on total capital of 17.4% on average over the past 21 years. Over the long term, the shares of Lockheed Martin Corp have declined by 20% relative to the broad market index.

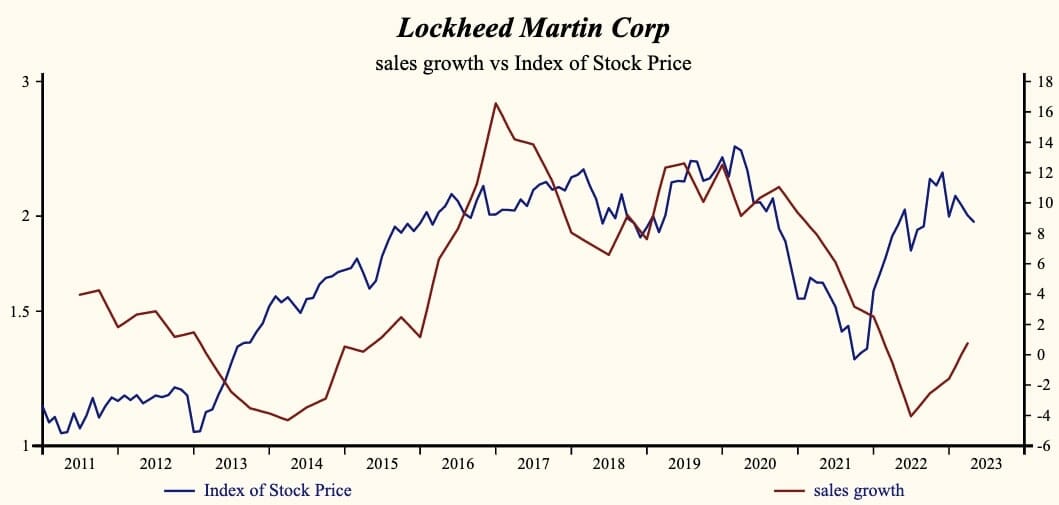

Sales Growth Continues

Currently, sales growth is 0.8% which is low in the record of the company but has risen for a third consecutive quarter. The direction of the share price has been correlated with sales growth.

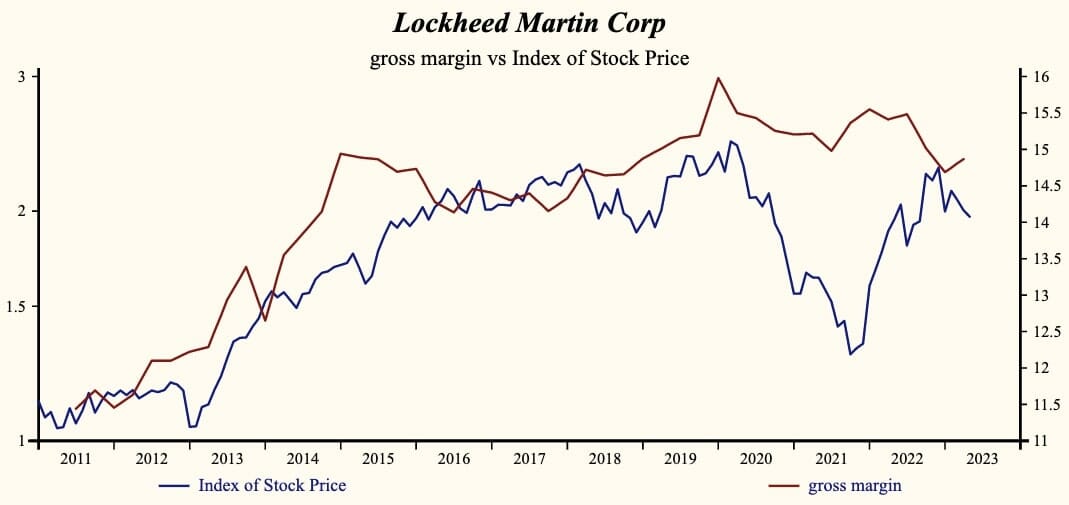

Continued sales growth has produced a rising gross profit margin for the first time since early 2022.

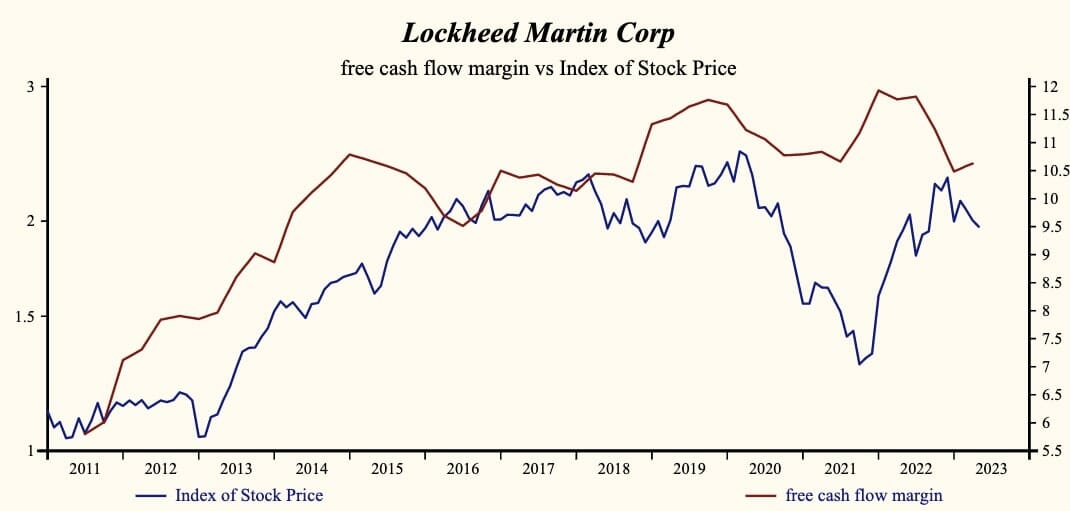

Cashflow Rebounding

As a percentage of sales, free cash flow measures the relationship between cash flow growth and capital expenditures. The stronger gross margin and lower costs is producing an acceleration in the EBITDA profit margin thereby accelerating free cash flow growth.

Strong Buy

More recently, the shares of Lockheed Martin Corp have advanced by 49% since the October, 2021 low. The shares are trading at lower-end of the volatility range in a 19-month rising relative share price trend.

The current depressed share price provides a good opportunity to buy the shares of this evidently accelerating company.

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.

Learn more and sign up for our Otos NOtos notifications at OTOS.io and experience your financial reality as FREEDOM AND EMPOWERMENT.