Growing up in a small town in Ohio, I remember being able to ride my bike to the nearest Dollar General Corp. (NYSE:DG) store. In fact, I rode that route many times in my youth.

Q3 2020 hedge fund letters, conferences and more

During her bi-weekly grocery shopping trips, my Mother would sometimes forget to grab a small consumable item, like toothpaste for example. Instead of driving 20 minutes to the nearest Kroger, she would send her son on the important mission for dental hygiene.

Another routine deployment of mine would be when a birthday, wedding, or other important event occurred. I was sent to fetch a card for $1.00 that we could quickly sign, stamp, and throw in the mailbox. Crisis averted!

This kind of convenience and simplicity is a business model that allowed me to save the day many times over for my family. But how does Dollar General’s business model translate for shareholders?

Dollar General Corp's Business Breakdown

This post is in collaboration with friend and fellow blogger Thomas Chua at Steady Compounding. Check out his breakdown of Dollar General’s business model and operations.

Once you understand the basic business model of Dollar General, come back here for the valuation piece.

Dollar General’s Past Performance

Core Four

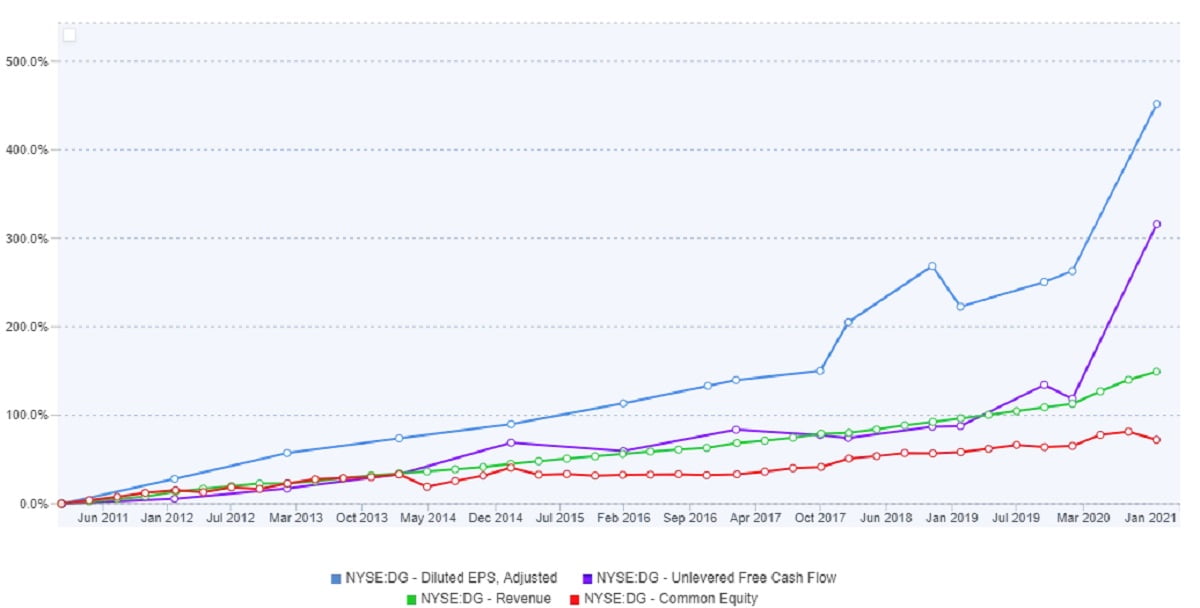

When analyzing the long-term growth of a company, I like to examine four different metrics to ensure the company is growing in alignment with shareholders. I like to call these metrics the “Core Four”. They are:

- Revenue

- Diluted Earnings (Net Income)

- Free Cash Flow (FCF)

- Book Value (or Equity)

If all four of these Core Four metrics are steadily compounding over time, then congratulations! You have likely found a great business to invest in!

Back to Dollar General Corp. (DG). Let’s check out the performance of its Core Four metrics over the past 10 years.

As you can see, Dollar General Corp’s Core Four growth metics have been staggering. DG has seen a nearly perfect increase in all metrics over the past decade, with a major increase to FCF and EPS just within the last year.

Revenues have climbed at a steady 8% per year, with book value not far behind at over 6% per year.

More impressive however have been EPS and FCF, compounding at 18% and 17% per year, respectively.

This growth has translated into incredible returns for shareholders. DG has seen its stock price appreciate 660% since 2011, or around 22% annually.

Management

DG has been growing very well over the past decade. This is mainly due to stellar management, who have been able to put the company in a great position to capitalize on this growth.

DG executives have been able to recognize patterns in its business and consumer base, which have allowed them to expand and maximize profits simultaneously. These are difficult tasks for any business, yet DG’s management has risen to the occasion, especially during COVID-19.

Here is some of the impressive work DG has been able to accomplish recently for all its stores:

- 31 consecutive years of same store growth

- Dollar General Mobile App

- “DG Pickup” for online ordering and contactless shopping

Additionally, management has its eyes on opening more stores, as well as making them more efficient. Here are some long-term plans the DG team already has in the works:

- Open new store chain Popshelf

- Rollout of self-distribution model “DG Fresh” for refrigerated foods

- Non-Consumables Initiative to offer consumers products that provide DG with higher margins

This stellar determination to compound the business has enabled Dollar General Corp to become even more profitable within the last year, as noted by its increase in FCF and EPS. Most notably, its profitability is in the top percentile of its industry.

On top of all this, DG is even rewarding its frontline employees with pay bonuses for their resilience during COVID-19. It doesn’t get much better than this.

A Wonderful Business

So, we have clearly been able to see that Dollar General is a wonderful business with fantastic management. How do we determine what price to pay?

Roll up your sleeves, it’s time for some valuation work.

Intrinsic Valuation

The gold standard of stock valuation is the Discounted Cash Flow method. If you are unfamiliar with this concept, then check out my detailed overview of calculating intrinsic value.

Let’s plug in our inputs.

Let’s explain these numbers a bit. With any investment, I am looking for no less than a 15% return, and my default margin of safety is also 15%.

Choosing growth rates is always the most challenging elements of stock valuation. DG has grown FCF at an astounding pace of 17% per year over the past decade.

I went with somewhat aggressive growth rates of 14% and 10% respectively because I have confidence that management will continue to find opportunities to compound the business as we emerge from COVID-19.

Terminal value was determined to be 17x as it is the current (and historical) Price/FCF.

A Good Buy?

Lucky us! According to our calculations, Dollar General Corp’s intrinsic value is currently undervalued, as it is currently trading around $211.

However, with its current value of $211, DG is not significantly undervalued. If we were to buy now at $211 and sell in a year at $226, we would only be making about an 8% return.

Therefore, DG’s current share price does not represent a great value opportunity. If DG was trading under $200 per share, we could then quite possibly make our target of 15% in one year’s time.

So how else should we value DG? Let’s look at a long term hold situation.

Equity Bond Valuation

Let’s try and value DG as more of a long-term, buy and hold stock, by using the Equity Bond method.

Firstly, in order for DG to qualify for this method of valuation, it has to have a previous record of a high ROE (>15%) for long periods, while increasing book value. Let’s see if it qualifies:

Sure enough, Dollar General Corp has posted phenomenal ROE over the last decade, never once dipping below 15%. More impressively, it has increased it’s ROE and book value nearly every year, with current ROE levels reaching nearly 40%!

Now that we know DG qualifies for this method, let’s input our numbers for the calculation.

According to our calculations, DG is currently operating at a 35% ROE and offering an Equity Bond (earnings yield) of 4.8%. If DG can maintain this ROE and dividend payout ratio, then we could see our investment compound at nearly 27% per year, with an Equity Bond yielding over 24% at the end of 10 years.

Lofty Expectations?

Now, if you think these projections seem a little lofty, that’s probably because they are. DG is currently operating at an extremely high ROE, (its highest ever) which is not easy to maintain. Also, we are continuing to deal with the effects of COVID-19, which will likely continue for some time.

That being said, DG performed phenomenally in 2020 throughout the adversity. Because of their stellar track record, I am confident that management can pull off ROEs at least 25%. The continued plans and incentives may allow for even better performance.

Also, let’s not forget that over the last decade, DG shares appreciated approximately 22% per year, not too far from our 27% projection. Nothing is impossible, but it is always good to remain grounded when valuing stocks.

Conclusion

Dollar General Corp is operating a wonderful business that offers great value to both customers. Similarly for Wall Street, it offers a high-quality stock with solid growth potential at a respectable price.

For this reason, I included DG in my VVI Portfolio as a long-term, buy and hold investment. It operates with two critical elements for any company to succeed: a durable and resilient business model and outstanding management.

Article by Vintage Value Investing