The American consumer is the engine of U.S. economic growth.

Personal consumption expenditure makes up nearly 70 percent of gross domestic product (GDP). That’s up from around 60 percent in 1980.

So it’s only fair to ask – how is the U.S. consumer doing?

Let’s take a look at wages first.

Wages rising… at a crawl

As the chart below shows, it’s been a long, slow grind to get annual hourly earnings growth back to the levels we saw before the global financial crisis (GFC).

Even now, against the backdrop of just 4.1 percent unemployment, annual wage increases are running at around 2.5 percent, versus 3 to 3.5 percent pre-GFC.

Consumption has to be funded with money from somewhere. It can be through salary, debt, or your savings.

Looking at the salary part of the equation, unless we see wage inflation growing, it’s hard to see incomes driving increasing consumption going forwards.

———-Recommended Link———–

In 2010, these “hot commodities” soared 1,000% in just 10 months. And it’s going to happen again. Find out why… and what it can mean for your portfolio.

LEARN MORE HERE.

————————————————

What about debt?

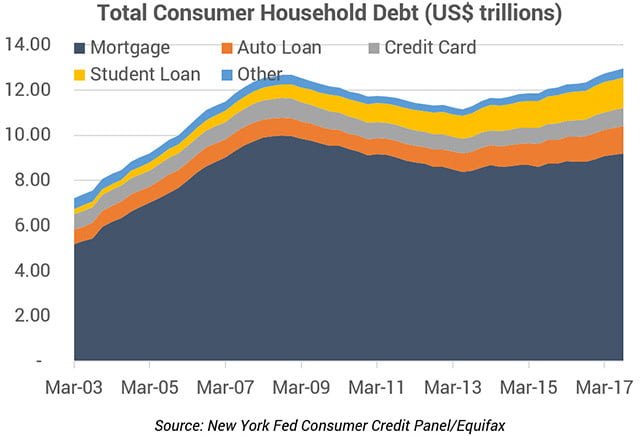

In the leadup to the GFC, U.S. consumers had accumulated US$12.7 trillion dollars’ worth of household debt – a 68 percent increase over the preceding five years.

As the chart below shows, the majority of that growth was through mortgage debt… not surprising, given the subprime lending bubble was a major culprit in the GFC.

We didn’t see much in the way of auto, credit card or student loan debt growth at the time.

Post-GFC, the consumer deleveraged – that is, got rid of debt. (The Federal Reserve did the opposite.) And by mid-2013, household debt had receded to $11.2 trillion. From the household mortgage debt side, saw a reduction and then a gradual increase since mid-2013…

But take a look at the other components of household debt, in particular student loans. Since mid-2010, Student debt has increased from $700 billion to $1.2 trillion… that’s a 72 percent increase.

Auto loans on the other hand, have gone from $760 billion to $1.4 trillion… a 78 percent increase.

(Whilst total household debt is at a new record of $13.0 trillion, the composition of that debt has changed. Whereas 21 percent was non-mortgage debt, it’s now 29 percent.]

When it comes to credit debt, at $810 billion, it’s still below the GFC peak of $870 billion, so perhaps there’s room for consumers to splurge on their AMEX cards, but it’s not enough to move the needle.

Saving less…

If debt and income aren’t going to drive consumer spending, then what about savings?

According to the below chart, it appears that American consumers are simply saving less and less of their pay cheques.

Saving as a percentage of disposable income has been falling now for the past couple of years. Now, just 2.9 percent of disposable income is saved compared to the 20-year average of 4.9 percent. What’s more, the trend is in clear decline.

Consumers can continue to simply save less and buy more, but I’d argue against the backdrop of meagre wage inflation (despite very low unemployment) and an increasing debt burden, that’s not sustainable in the long run. And as we saw in 2008/09, the initial consumer reaction to economic turmoil is to increase their savings and spend less.

Where do we go from here?

Most investors appear very optimistic on the U.S. economy right now. Equity markets are euphoric, and tax cuts and repatriation of overseas profits have triggered fresh highs and a 5.5 percent return in the S&P500 already this year.

Peter will be sharing his thoughts on this in the upcoming issue of The Churchouse Letter. And I remain cautious on just how much the consumer can contribute to growth at this stage in the economic cycle.