Third Point Reinsurance Ltd. investor presentation for the month of November 2018.

OUR COMPANY

- Specialty property & casualty reinsurer based in Bermuda

- A- (Excellent) financial strength rating from A.M. Best Company

- Began operations in January 2012 and completed IPO in August 2013

- Investment portfolio managed by Third Point LLC

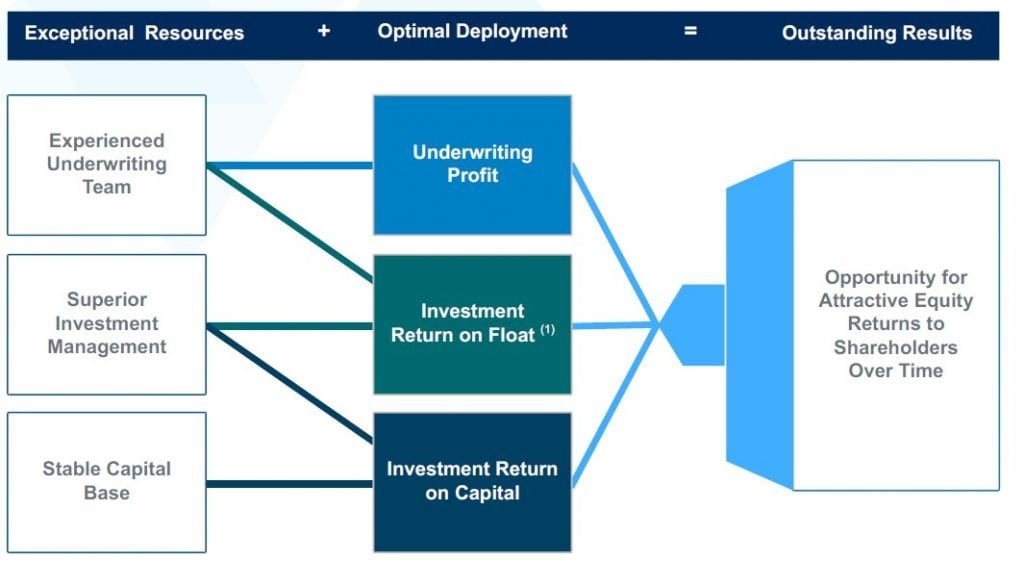

- Total return business model

- Flexible and opportunistic reinsurance underwriting

- Superior investment management

Q3 hedge fund letters, conference, scoops etc

RECENT DEVELOPMENTS

- Incrementally adding underwriting risk to reinsurance portfolio

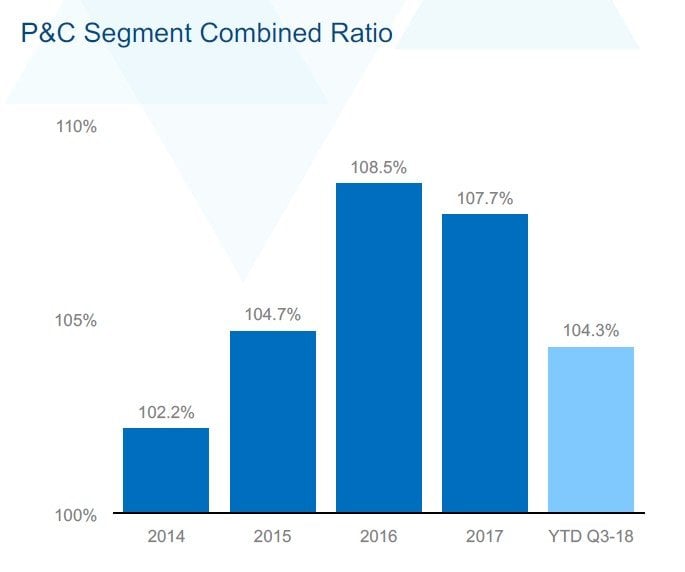

- We plan to get combined ratio under 100% during 2019

- We are targeting specialty lines of business with additional risk/ margin

- Will write a measured amount of property cat in 2019

- Recent hires of senior, well-respected reinsurance underwriters

- Steve Wilson - Former Head of Professional and Specialty Lines, Munich

- Dave Drury - Former Chief Risk and Underwriting Officer, ACE/Chubb Tempest Re Group

- Experience in writing existing lines as well as targeted lines as part of shift in underwriting risk appetite

- Restructuring of our investment account

- Change from separate account structure to fund structure

- Results in presentation of our investment in fund at NAV on balance sheet

- Similar expected exposures, returns, fees and liquidity features of our existing account in the new fund

- Significant operational and financial reporting efficiencies achieved

KEY METRICS

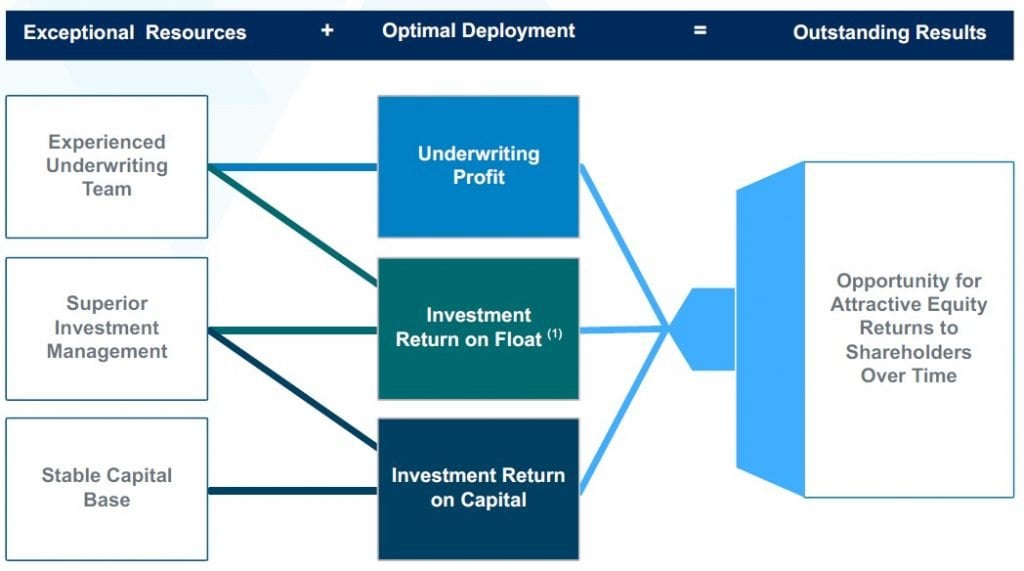

TOTAL RETURN BUSINESS MODEL DESIGNED TO DELIVER SUPERIOR RETURNS

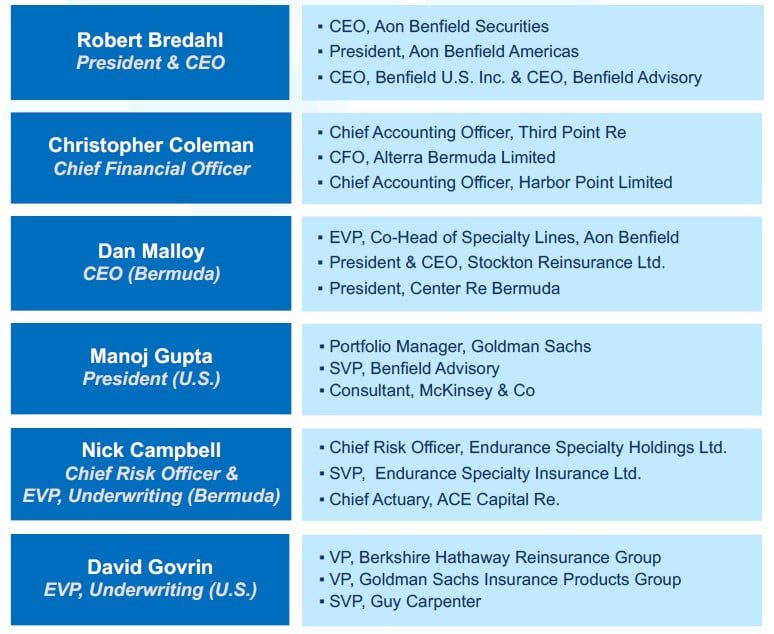

EXPERIENCED SENIOR MANAGEMENT TEAM

- Strong business relationships

- Expertise in writing all lines of property, casualty & specialty reinsurance

- Track record of capitalizing on market opportunities

- Significant businessbuilding experience

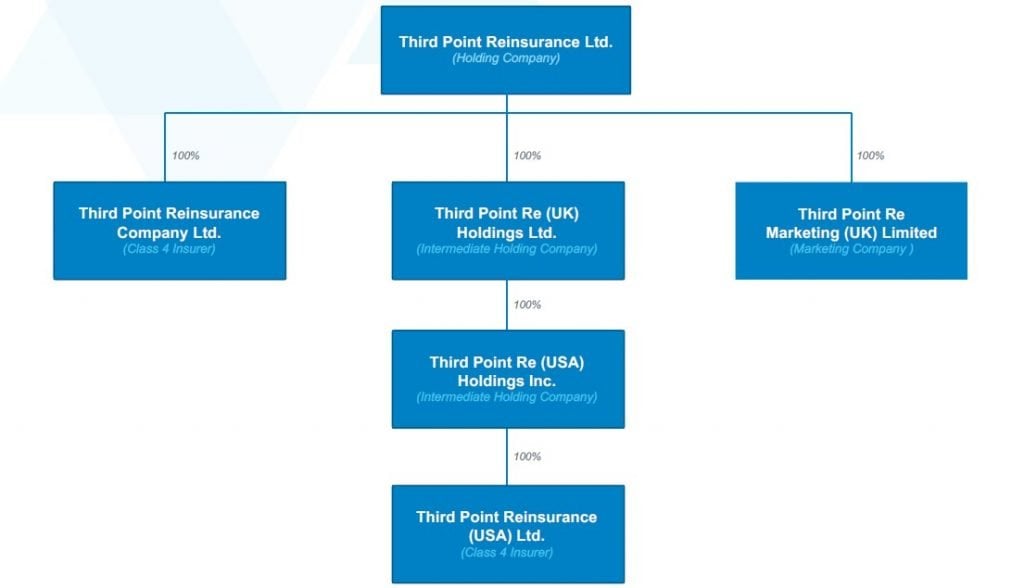

ORGANIZATIONAL STRUCTURE – KEY ENTITIES

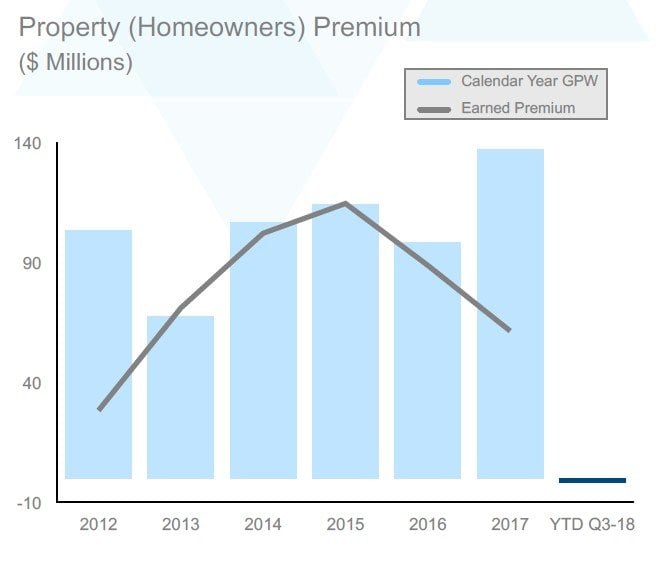

EVOLUTION OF OUR PORTFOLIO

- Portfolio of primarily Florida carriers built from past relationships and now also includes a Northeast carrier

- Identified Assignment of Benefits (AOB) issue in Florida early, but did not adequately price for it

- Renewed two contracts in Q4-17, on a two-year basis, at significantly improved ceding commissions

- Market conditions vary widely by state, segment and carrier

- We are opportunistically targeting carrier deals with good historical results

- Carefully watching today's tight labor market's impact on results

- Have started to write some lower layer excess covers

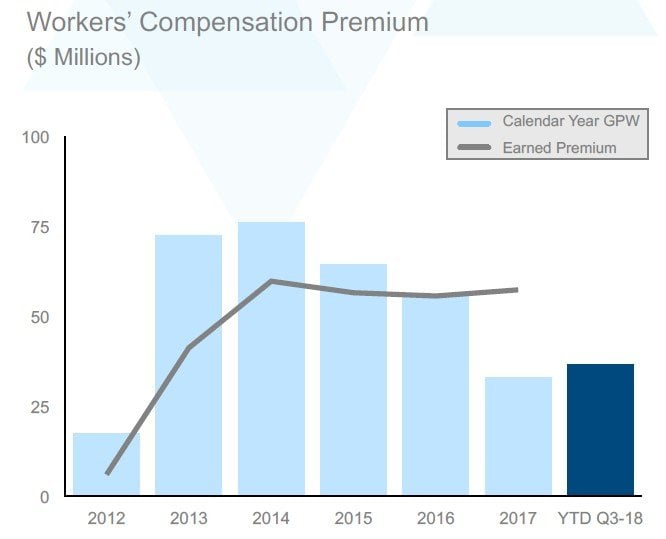

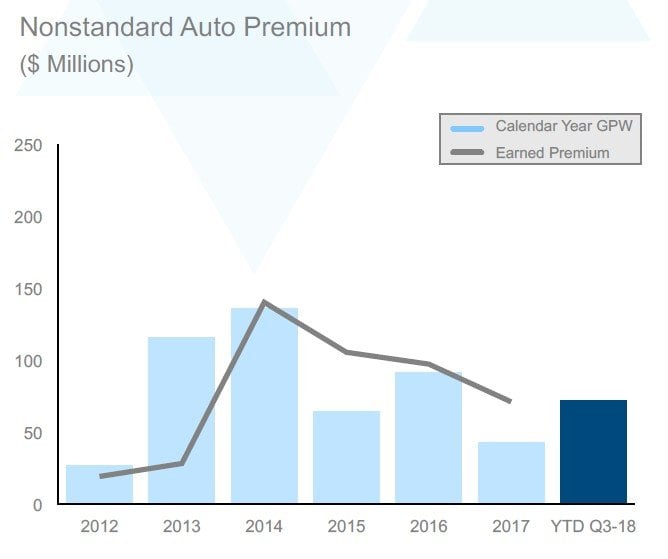

- Portfolio of MGA-driven nonstandard auto business built from past relationships

- Re-oriented our approach to focus on best-in-class carriers/ MGAs with the size and differentiation to navigate difficult market conditions

- Harder market conditions due to recent poor results are providing an increased flow of opportunities

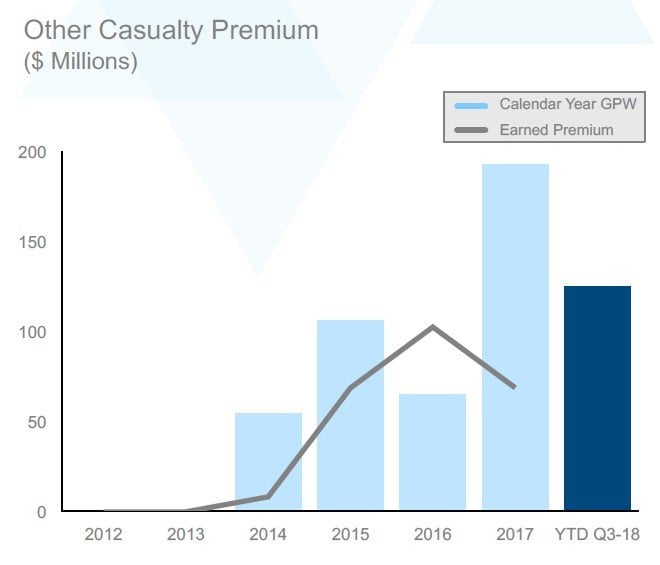

- Portfolio is dominated by broad casualty retrocession deals

- We also write a growing number of transaction liability and professional lines reinsurance treaties

- Adverse loss trends in some lines are being offset by underlying rate increases and some improvement in reinsurance terms

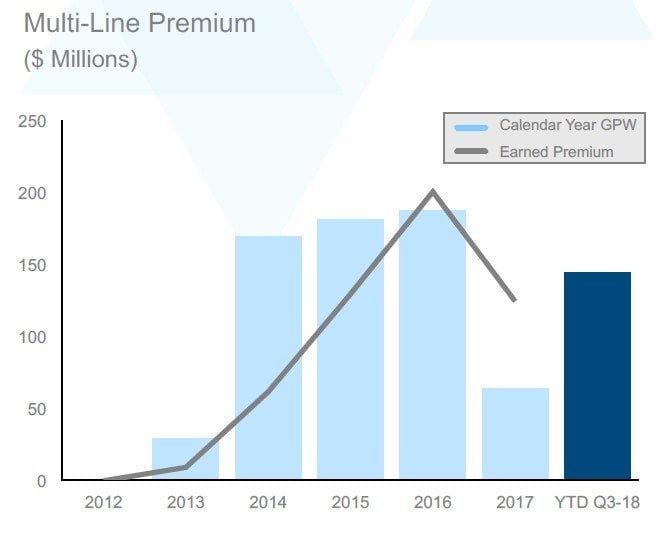

- Portfolio is primarily quota share and retrocessional contracts of Lloyds entities and reinsurance companies

- Have seen an increase in inquiries following recent cat events

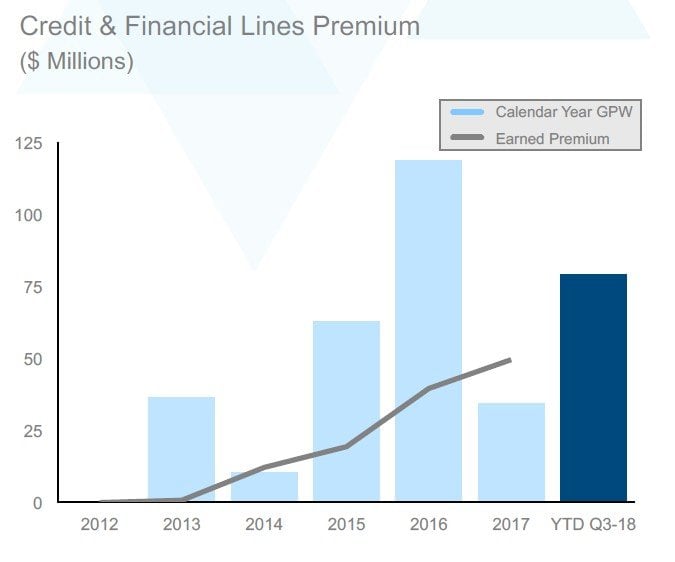

- Portfolio is primarily mortgage but also includes political risk, trade credit, structured credit, surety, title and residual value

- We believe pricing and terms & conditions of mortgage risk have held up well due to rapidly increasing demand

- Traditional credit and political risk insurance is highly competitive. We favor market leads with the capacity and expertise to transact in less commoditized areas

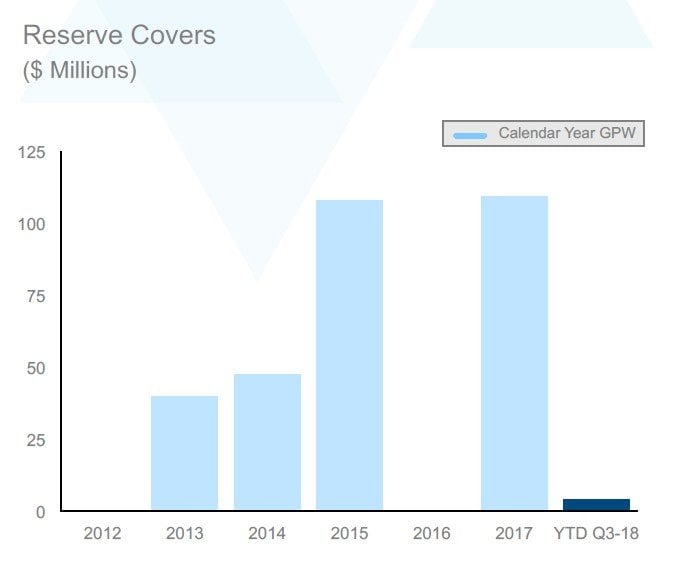

- Written premium earned and losses incurred at inception

- Reserve covers provide clients with capital benefit and work particularly well within Lloyds and Solvency II capital regimes

- Increased capital requirements imposed by Lloyds on its member syndicates is generating demand

- Reserve covers provide TPRE with float

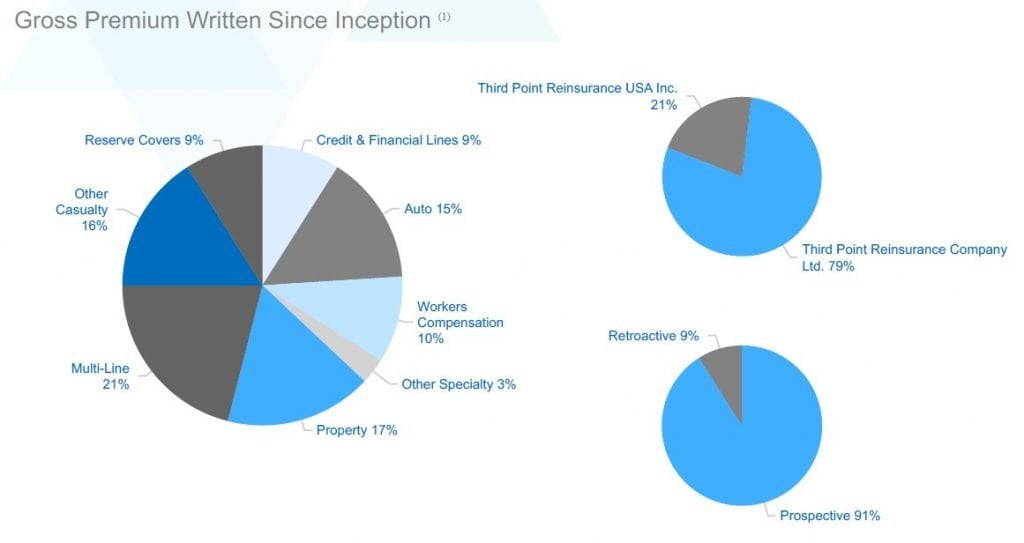

DIVERSIFIED PREMIUM BASE

REINSURANCE RISK MANAGEMENT

Risk Management Culture

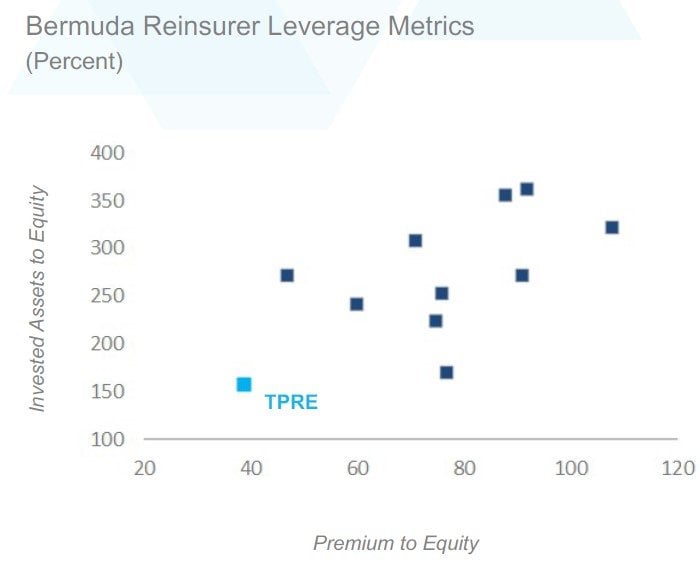

- Reinsurance business plan complements our investment management strategy: premium, reserve and asset leverage lower than peer group

- Company-wide focus on risk management

- Robust underwriting and operational controls

- Close interaction between underwriting and risk management functions

Holistic Risk Control Framework

- Measure use of risk capital using internally-developed capital model, A.M. Best BCAR model and Bermuda Monetary Authority BSCR model

- Developed a comprehensive Risk Register that we believe is appropriate for our business model

- Risk appetite and limit statements govern overall risk tolerances in underwriting and investment portfolios

Ongoing Risk Oversight

- Own Risk Self Assessment (ORSA) report produced quarterly with outcomes and results provided to management / Board of Directors

- Quarterly reporting provides management with meaningful analysis relative to our current capital requirements and comparisons to our risk appetite statements

- Low premium leverage and asset leverage compared to peer group

- Limited legacy reserves

- Limited catastrophe risk

MARKET-LEADING INVESTMENT MANAGEMENT BY THIRD POINT LLC

- Third Point LLC owned and led by Daniel S. Loeb

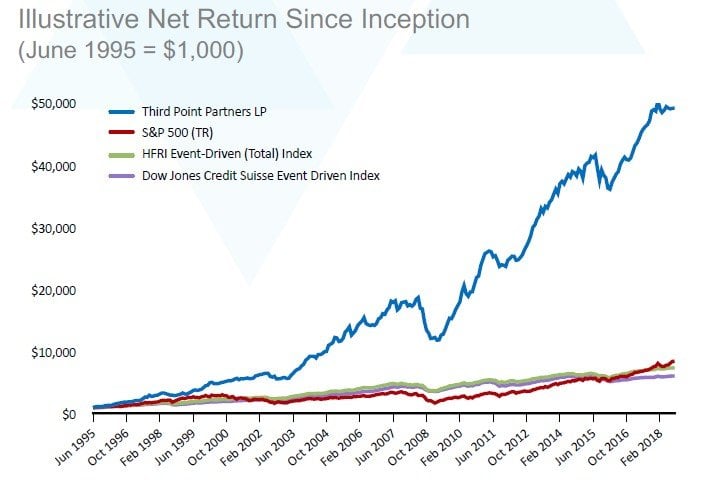

- 18.2% net annualized returns for Third Point Partners LP since inception in 1995(1)

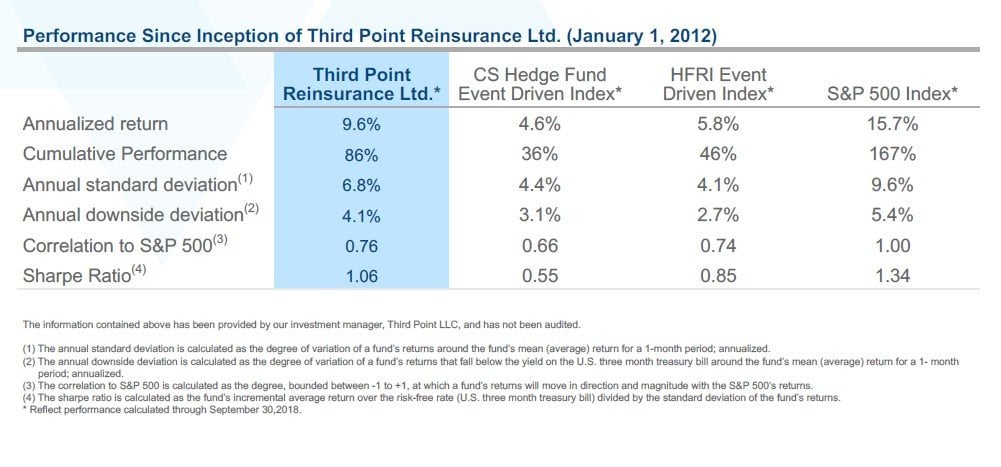

- 9.6% net annualized return on TPRE managed account since inception (Jan. 1, 2012)(1)

INVESTMENT RETURNS PROFILE

RELATIONSHIP WITH THIRD POINT LLC

Limited Partnership Agreement

- Exclusive relationship through 2021, followed by successive 3-year terms on renewal

- Investments are managed on substantially the same basis as the main Third Point LLC hedge funds

- We pay a 1.5% (exposure adjusted) management fee and 20% performance allocation. The performance allocation is subject to a standard high water mark

Risk Management

- Restrictions on leverage, position concentrations and net exposure limits

- Key man and performance termination provisions

- Allowed to diversify portfolio to address concerns of A.M. Best or regulator

Liquidity

- Weekly redemption rights to pay claims and expenses as well as manage required capital

- Portfolio concentrated in large cap long equity positions

- No material changes in liquidity by moving to fund structure

THIRD POINT LLC PORTFOLIO RISK MANAGEMENT

- Portfolio diversification across industries, geographies, asset classes and strategies

- Highly liquid portfolio – investment manager can dynamically shift exposures depending on macro/market developments

- Security selection with extensive diligence process

- Approach includes index and macro hedging and tail risk protection

- Institutional platform with robust investment and operational risk management procedures

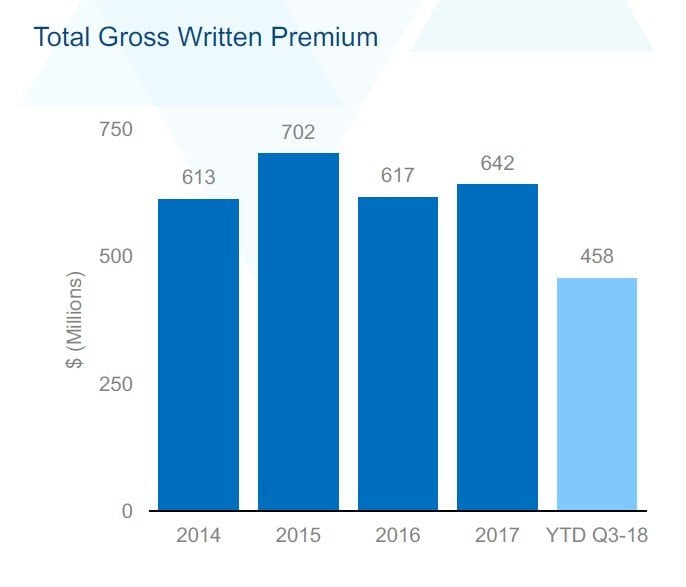

GROSS PREMIUM WRITTEN

- Broad range of lines of business and distribution sources (brokers)

- Management believes the company has a strong pipeline of opportunities

- We may experience volatility in the amount of gross premiums written and period to period comparisons may not be meaningful

IMPROVING REINSURANCE MARKET CONDITIONS

- Underlying pricing combined with reinsurance terms and pricing are keeping pace with loss cost trends

- We plan to further reduce our combined ratio by incrementally increasing the risk profile of our underwriting portfolio

- We continue to carefully manage expenses

INVESTED ASSET LEVERAGE

- If the underlying reinsurance risk is attractive, generating float allows a reinsurer to access investment “leverage” at low or no cost

- Certain lines of business provide reinsurers with float for several years

- We are currently operating at what we believe is our optimal level of investment leverage

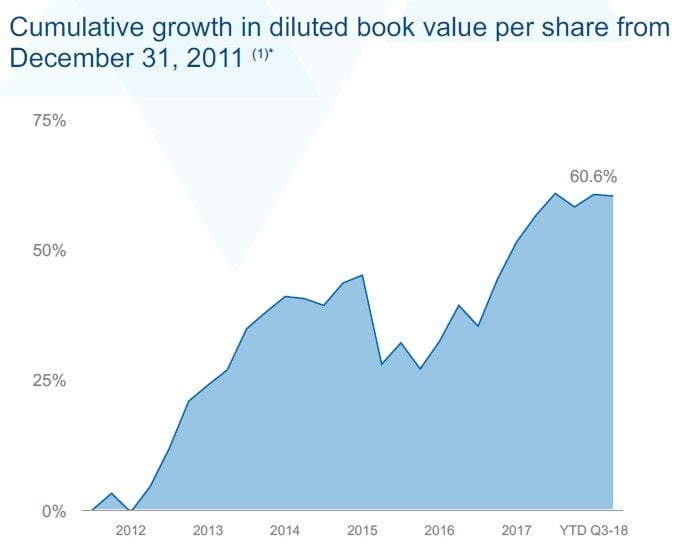

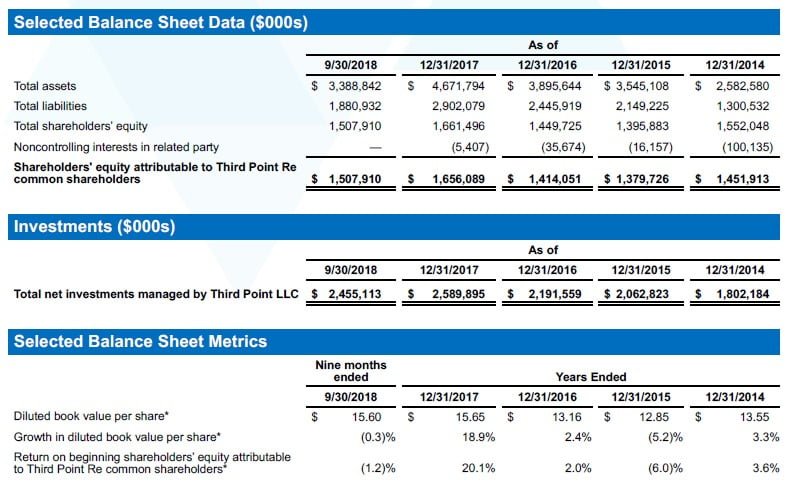

STRONG GROWTH IN DILUTED BOOK VALUE PER SHARE SINCE INCEPTION

- Market leading 20.1% ROE in 2017, a challenging year for the reinsurance market

- Active capital management - Share repurchases of $181.6 million since Q2-2016

TOTAL RETURN BUSINESS MODEL DESIGNED TO DELIVER SUPERIOR RETURNS

Appendix

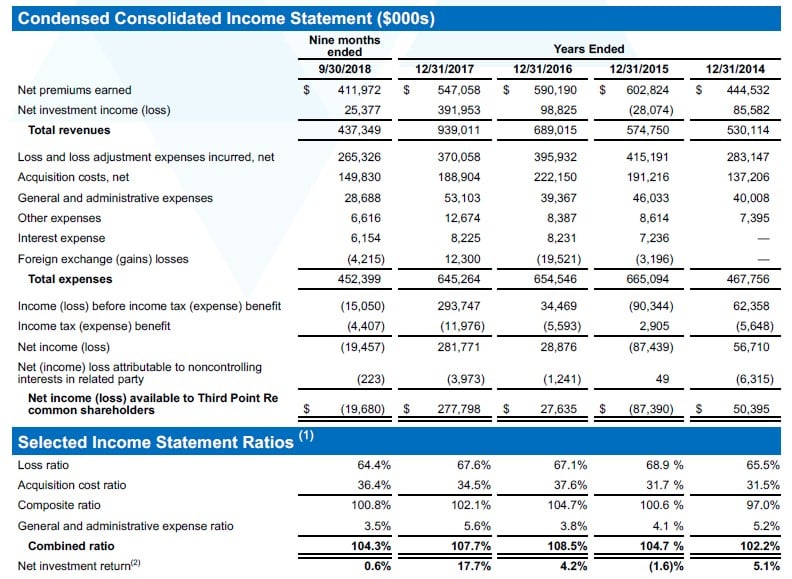

KEY FINANCIAL HIGHLIGHTS

Highlights

- Generated $3.6 billion of gross premiums written from inception to date.

- Interest expense relates to 2015 debt issuance.

- Income tax (expense) benefit relates to U.S. operations and withholding taxes on investment portfolio.

- FX primarily due to the revaluation of GBP loss reserves.

Highlights

- $286.0 million of capital raised with 2013 IPO.

- $115.0 million of debt issued in 2015.

- 85.8% cumulative net investment return through September 30, 2018 (1).

NON-GAAP MEASURES & OTHER FINANCIAL METRICS

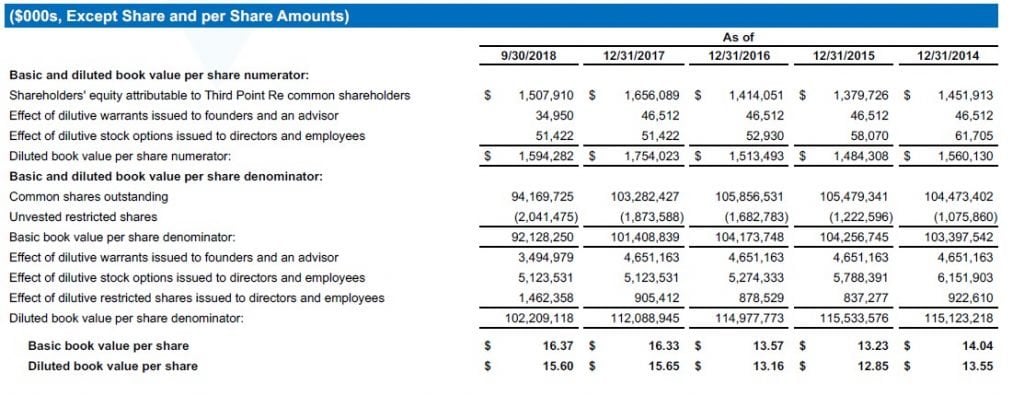

Basic Book Value per Share and Diluted Book Value per Share

Basic book value per share and diluted book value per share are non-GAAP financial measures and there are no comparable GAAP measures. Basic book value per share, as presented, is a non-GAAP financial measure and is calculated by dividing shareholders’ equity attributable to Third Point Re common shareholders by the number of common shares outstanding, excluding the total number of unvested restricted shares, at period end. Diluted book value per share, as presented, is a non-GAAP financial measure and represents basic book value per share combined with the impact from dilution of all in-the-money share options issued, warrants and unvested restricted shares outstanding as of any period end. For unvested restricted shares with a performance condition, we include the unvested restricted shares for which we consider vesting to be probable. Change in basic book value per share is calculated by taking the change in basic book value per share divided by the beginning of period book value per share. Change in diluted book value per share is calculated by taking the change in diluted book value per share divided by the beginning of period diluted book value per share. We believe that long-term growth in diluted book value per share is the most important measure of our financial performance because it allows our management and investors to track over time the value created by the retention of earnings. In addition, we believe this metric is used by investors because it provides a basis for comparison with other companies in our industry that also report a similar measure. The following table sets forth the computation of basic and diluted book value per share as of September 30, 2018, December 31, 2017, 2016, 2015 and 2014:

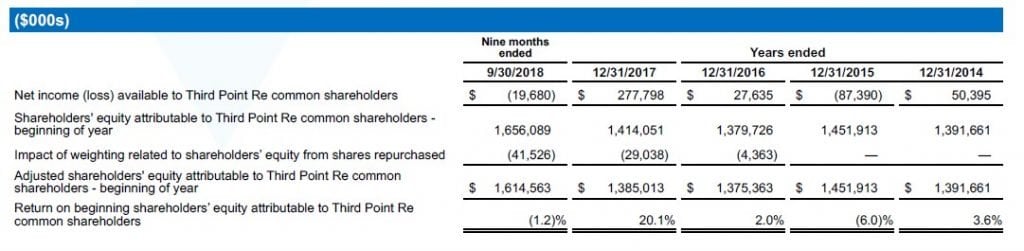

Return on Beginning Shareholders’ Equity Attributable to Third Point Re Common Shareholders

Return on beginning shareholders’ equity attributable to Third Point Re common shareholders, as presented, is a non-GAAP financial measure. Return on beginning shareholders’ equity attributable to Third Point Re common shareholders is calculated by dividing net income (loss) available to Third Point Re common shareholders by the beginning shareholders’ equity attributable to Third Point Re common shareholders. We believe that return on beginning shareholders’ equity attributable to Third Point Re common shareholders is an important measure because it assists our management and investors in evaluating the Company’s profitability. For the 2018, 2017 and 2016 periods, we have also adjusted the beginning shareholders’ equity for the impact of the shares repurchased on a weighted average basis. This adjustment increased the stated returns on beginning shareholders’ equity.

Net Investment Return on Investments Managed by Third Point LLC

Net investment return represents the return on our net investments managed by Third Point LLC, net of fees. The net investment return on net investments managed by Third Point LLC is the percentage change in value of a dollar invested over the reporting period on our net investment assets managed by Third Point LLC. Effective August 31, 2018, we transitioned from our separately managed account structure to investing in the TP Fund, managed by Third Point LLC. In addition, certain collateral assets supporting reinsurance contracts held by Third Point Re BDA and Third Point Re USA (the “Collateral Assets”) are managed by Third Point LLC from the effective date. See Note 4 to our condensed consolidated financial statements included in our Quarterly Report on Form 10-Q for the period ended September 30, 2018 for additional information. The net investment return reflects the combined results of investments managed on behalf of Third Point Re BDA and Third Point Re USA prior to the transition date of August 31, 2018 and the investment in the TP Fund and Collateral Assets from the date of transition. Prior to the transition date of August 31, 2018, the stated return was net of noncontrolling interests and net of withholding taxes, which were presented as a component of income tax expense in our condensed consolidated statements of income. Net investment return is the key indicator by which we measure the performance of Third Point LLC, our investment manager.