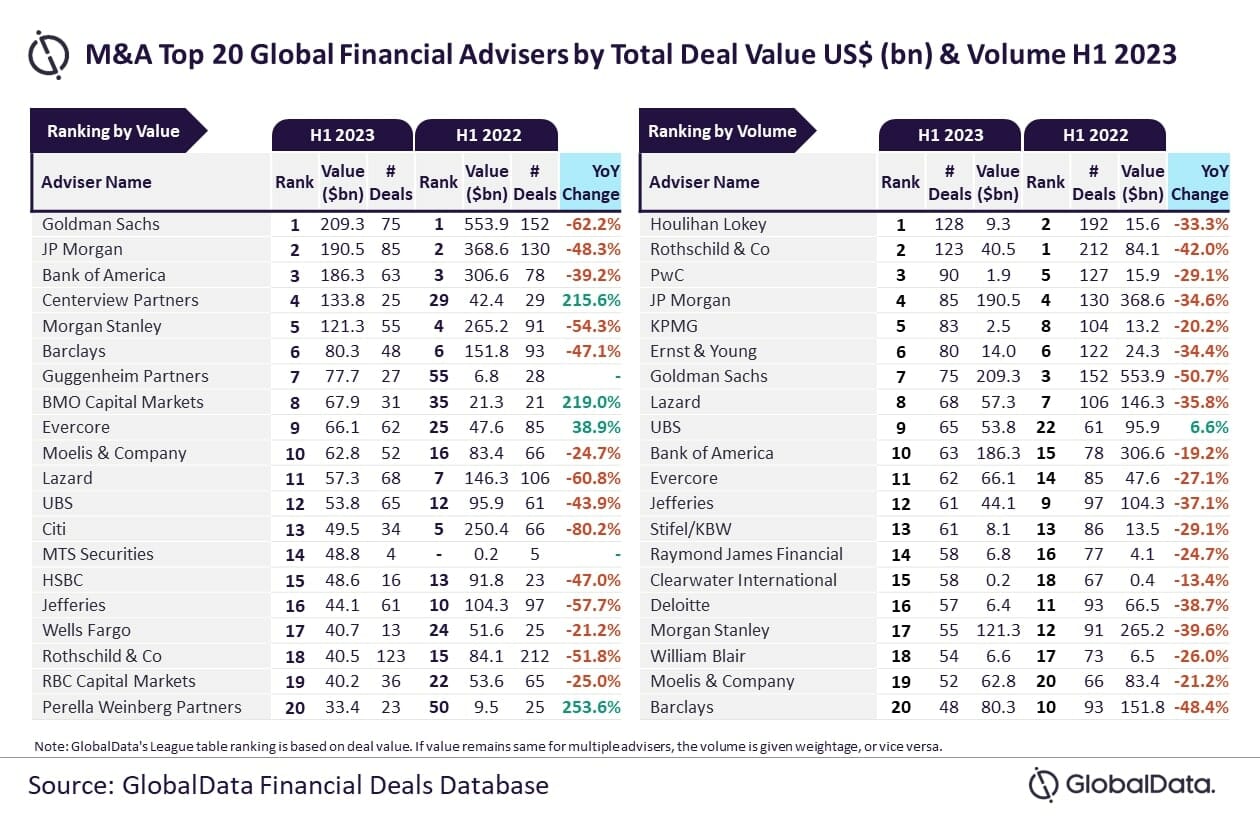

GlobalData has announced the latest updates to its Financial and Legal Adviser League Tables, which rank advisers by the total value and volume of merger and acquisition (M&A) deals they advised on in H1 2023. See the rankings and findings below.

Goldman Sachs And Houlihan Lokey Top M&A Financial Advisers In H1 2023

Goldman Sachs and Houlihan Lokey have emerged as the top mergers and acquisitions (M&A) financial advisers by value and volume for H1 2023 on the latest Financial Advisers League Table by GlobalData, which ranks financial advisers by the respective value and volume of M&A deals on which they advised.

Based on its Financial Deals Database, the leading data and analytics company has revealed that Goldman Sachs achieved its leading position in the deal value rankings by advising on $209.3 billion worth of deals. Meanwhile, Houlihan Lokey led by volume by advising on a total of 128 deals.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Goldman Sachs managed to retain its leadership position by deal values, despite a decline in the total value of deals advised by it in H1 2023 compared to H1 2022. Moreover, it was the only firm to surpass a total deal value of $200 billion in H1 2023. The company advised on 35 billion-dollar deals*, of which seven were mega deals valued more than $10 billion. Involvement in such big-ticket deals helped Goldman Sachs top the chart by value.”

“Meanwhile, Houlihan Lokey, despite registering a fall in the number of deals advised by it, managed to improve its ranking by volume and went ahead from occupying the second position in H1 2022 to lead by this metric in H1 2023. However, there was a close competition from Rothschild & Co for the top spot by volume.”

An analysis of GlobalData’s Financial Deals Database reveals that Rothschild & Co occupied the second position in terms of volume by advising on 123 deals, followed by PwC with 90 deals, JP Morgan with 85 deals, and KPMG with 83 deals.

Meanwhile, JPMorgan occupied the second position in terms of value, by advising on $190.5 billion worth of deals, followed by Bank of America with $186.3 billion, Centerview Partners with $133.8 billion, and Morgan Stanley with $121.3 billion.

*Deals valued more than or equal to $1 billion

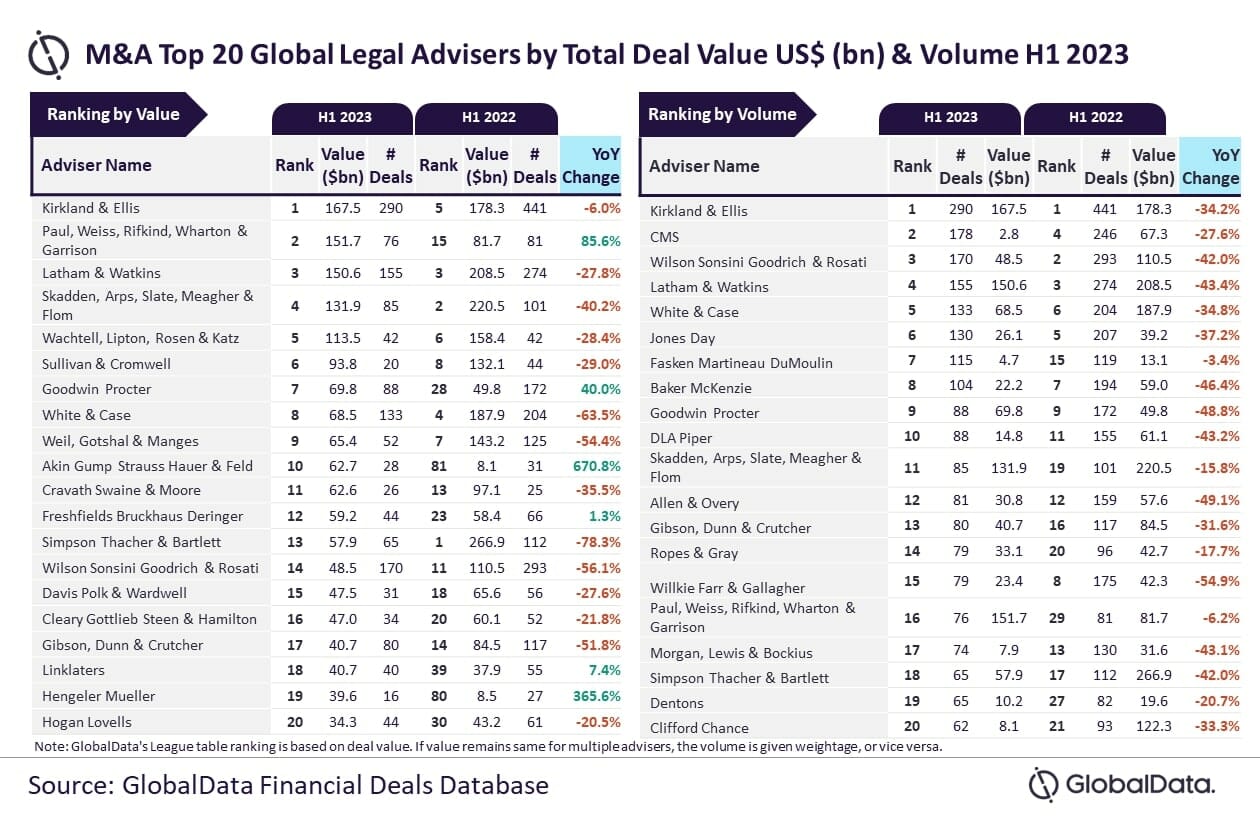

Kirkland & Ellis Top M&A Legal Advisers In H1 2023

Kirkland & Ellis has emerged as the top mergers and acquisitions (M&A) legal adviser for H1 2023 in terms of both value and volume on the latest Legal Advisers League Table by GlobalData, which ranks legal advisers by the respective value and volume of mergers and acquisition (M&A) deals on which they advised.

Based on its Financial Deals Database, the leading data and analytics company has revealed that Kirkland & Ellis achieved the leading position by advising on 290 deals worth $167.5 billion.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Kirkland & Ellis emerged as a clear winner by volume as it was the only firm to advise on more than 200 deals during H1 2023. In fact, Kirkland & Ellis fell short of only 10 deals from touching the 300 deals volume mark thereby outpacing its peers by a significant margin.”

“Moreover, it was also among the only three firms with total deal value surpassing $150 billion in H1 2023. Kirkland & Ellis advised on 40 billion-dollar deals*, which also included three mega deals valued more than $10 billion. Involvement in these high-value transactions helped Kirkland & Ellis top the chart by value as well.”

An analysis of GlobalData’s Financial Deals Database reveals that Paul, Weiss, Rifkind, Wharton & Garrison occupied the second position in terms of value, by advising on $151.7 billion worth of deals, followed by Latham & Watkins with $150.6 billion, Skadden, Arps, Slate, Meagher & Flom, Meagher & Flom with $131.9 billion, and Wachtell, Lipton, Rosen & Katz with $113.5 billion.

Meanwhile, CMS occupied the second position in terms of volume by advising on 178 deals, followed by Wilson Sonsini Goodrich & Rosati with 170 deals, Latham & Watkins with 155 deals, and White & Case with 133 deals.

About GlobalData

4,000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.