For weekend reading, Gary Alexander, senior writer at Navellier & Associates, offers the following commentary:

In 1849, the Scotsman Thomas Carlyle dubbed a new field of study called Economics, “The Dismal Science,” partly because a famous economist (really a doomsday preacher) Thomas Malthus said we would all starve to death, and a few Scrooges tried to justify sweatshops and slavery under the false flag of profits.

That calumny continued in the 20th Century in the major definitions of economics, which focused on scarcity. Paul Samuelson, author of the dominant economics textbook since 1948, defined economics as “the study of how societies use scarce resources to produce valuable commodities and distribute them among different people.” British economist Lionel Robbins echoed that line: “Economics is the science which studies human behavior as a relationship between ends and scarce means with alternative uses.”

Our favorite economist, Ed Yardeni, begs to differ. In his 2018 book Predicting the Markets, he writes:

“I’ve learned that economics isn’t a zero-sum game, as implied by the definition [cited above]. Economics is about using technology to increase everyone’s standard of living. Technological innovations are driven by the profits that can be earned by solving the problems posed by scarce resources. Free markets provide profit incentives to motivate innovators to solve this problem.

“As they do so, consumer prices tend to fall, driven by their innovations. The market distributes the resulting benefits to all consumers. From my perspective, economics is about creating and spreading abundance, not about distributing scarcity.” – Ed Yardeni, in “Predicting the Markets”

I have long argued the same point, and now we hear a similar retort to the mantra of “scarce resources” in a July 21 Op-Ed in the Wall Street Journal, “We Will Never Run Out of Resources,” by Marian L. Tupy, co-author of “Superabundance: The Story of Population Growth, Innovation and Human Flourishing on an Infinitely Bountiful Planet” and David Deutsch, author of “The Beginning of Infinity: Explanations that Transform the World.”

Recall Thomas Malthus, that dismal economist who wrote in 1798 that people reproduce geometrically (2-4-8-16), while food only grows arithmetically (1-2-3-4), netting famine. Tupy and Deutsch point out that the global population has grown 8-fold since he wrote that (geometrically, that is 2 to the 3rd power) while food has grown far more than 10-fold, netting a super-abundance of food.

By the way, I have one word to defy Malthus: Chicken! Is chicken food or population? Answer me, Tom!

Furthermore, the authors argue that the world hasn’t run out of a single metal or mineral, while “proven resources” of most have grown due to technological improvements in finding those resources, motivated by higher prices – the reward for finding those resources. “Geologists have surveyed only a fraction of the Earth’s crust, let alone the ocean floor. As surveying and extracting technologies improve, geologists and engineers will go deeper, faster, cheaper and cleaner to reach hitherto untouched minerals.”

Eventually, materials will run out, of course, and that’s why we’re using less of almost everything. Our technological revolution calls for miniaturization – smaller and lighter everything. We’re using less wiring in our wireless society and much lighter packaging, with less need for travel, too. Knowledge is the ultimate resource and that comes from human ingenuity more than mining deeper into earth’s crust.

Sadly, Most Economists are Still Dismal (and Therefore Mostly Wrong)

In my 55+ years of following major economic gurus, I was seduced by the voices of doom for a quarter century until I realized they were mostly wrong. It’s seductive (and strangely “hip” or “cool”) to be more negative and cataclysmic in your predictions than the next guy. It’s strategically smart to corner the low end of the market prediction sweepstakes. The Dow will fall 30%…no, it will fall 50%, Oh, why not 90%!

Well, I wised up in 1990 and formed the whimsical organization “Apocaholics Anonymous” for former prophets of doom who wised up. So far, nobody else has joined my organization of reformed doomsday writers. True to form, in the past year nearly every pundit predicted a recession, and no such recession has happened….yet.

Most notably, the prestigious Conference Board reported on April 12, 2023, that the probability of a recession was “near 99 percent … within the next 12 months,” reasoning that, “the Federal Reserve’s interest rate hikes and tightening monetary policy will lead to a recession in 2023.”

As I reported recently, economists are finally backing off of that consensus (see the July 15, 2023 Wall Street Journal, “Economists Are Cutting Back Their Recession Expectations”), but that recent Journal survey still finds that 54% of economists still expect to see a recession in the next 12 months, down from 61% in the prior two surveys (the latest survey was conducted July 7-12, just before the June 3% CPI was released on July 12, showing only a 3% year-over-year inflation rate increase, vs. 9.1% in June of 2022).

The most concentrated agglomeration of dismal economists may be at the Federal Reserve Board in Washington, DC, which is staffed by 400 or more dismal Ph.D. economists, and they have also long been forecasting a recession – at every FOMC meeting this year. As Ed Yardeni summarizes their reports:

“The January FOMC minutes noted: ‘The sluggish growth in real private domestic spending expected this year and the persistently tight financial conditions were seen as tilting the risks to the downside around the baseline projection for real economic activity, and the staff still viewed the possibility of a recession sometime this year as a plausible alternative to the baseline.’

The March FOMC minutes indicated that a mild recession forecast was now the staff’s baseline: ‘Given their assessment of the potential economic effects of the recent banking-sector developments, the staff’s projection at the time of the March meeting included a mild recession starting later this year, with a recovery over the subsequent two years.’ That outlook held firm in the May FOMC minutes and June FOMC minutes.”

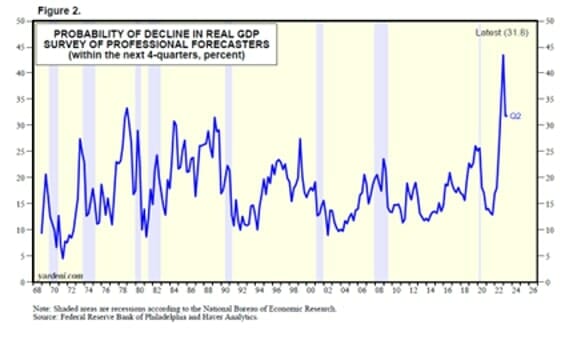

Another sign of dismal prospects is the Philly Fed’s Survey of Professional Forecasters, also known as the “Anxiety Index.” This survey asks a panel of experts to estimate the probability that real GDP will fall in the current quarter and each of the following four quarters. That’s a pretty high bar of pessimism – four declining quarters in a row. The average probability over the last 50 years runs at about 20%. Well, the Q2 estimate was 31.8%, down from the previous all-time high over 40%, worse than even 2008 or 1979.

Economists may be chronically dismal, but a true understanding of economics begets prosperity.