The exchange-traded fund (ETF) applications by VanEck and 21Shares for a spot in Solana ETF may have triggered a race to ‘SOL mountain’, but there is a catch.

When the U.S. Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs, spot ETH, SOL, XRP, and APT ETF applications were anticipated.

Following the U.S. SEC’s approval of a spot ETH (launch delayed due to the SEC comments, possibly towards late July), seeing new applications for Solana was unsurprising.

However, SOL did post some gains in reaction to the news:

source: defilama

Matthew Sigel, VanEck’s Head of Digital Assets Research, confirmed that as the deadline for a response is by March 2025, the firm is counting on Donald Trump to win the US elections in November 2024.

Trump reversed his tone on crypto. If elected as the new U.S. President, Trump may replace Gary Gensler, the current SEC chair.

Gensler did not hide his views on cryptocurrencies, stating, ‘We don’t need more digital currency… we already have digital currency, it’s called the U.S. dollar.’

Trump’s victory may unleash a fresh, bullish wave across a basket of cryptocurrencies, particularly if (some say when) the SEC chair is replaced. L1s, L2s, and DeFi projects that have not been bathed by the crypto bulls for a while.

Other ETF providers, including BlackRock, are likely assessing whether to join the race.

Will BlackRock apply for a spot Solana ETF?

There were Unconfirmed rumors that BlackRock will join the SOL ETF race this month. As we near the U.S. elections and Trump continues to lead the polls, the odds of an application may be higher.

President Joe Biden has underperformed (to say the least) in the recent Presidential debate with Trump, which tilted the polls in Trump’s favor.

ABC News will host the second debate on September 10 at 9 p.m. Eastern Time. If President Biden does not quit the presidential race, another disastrous performance could send Trump ‘to the moon’ in the election polls.

ETF providers may then determine that seeking approval for a SOL ETF is appropriate. Likewise, if Solana posts strong gains, possibly above the $200 mark, it may spark new applications by other firms.

BlackRock joining VanEck and 21Shares may have a greater impact on the market.

Are SOL CME futures a major hurdle?

It was first reported in May 2024 that CME has no intention to offer Solana futures:

Some do see it as a major obstacle to a green light when no futures are available (as opposed to Bitcoin and Ethereum).

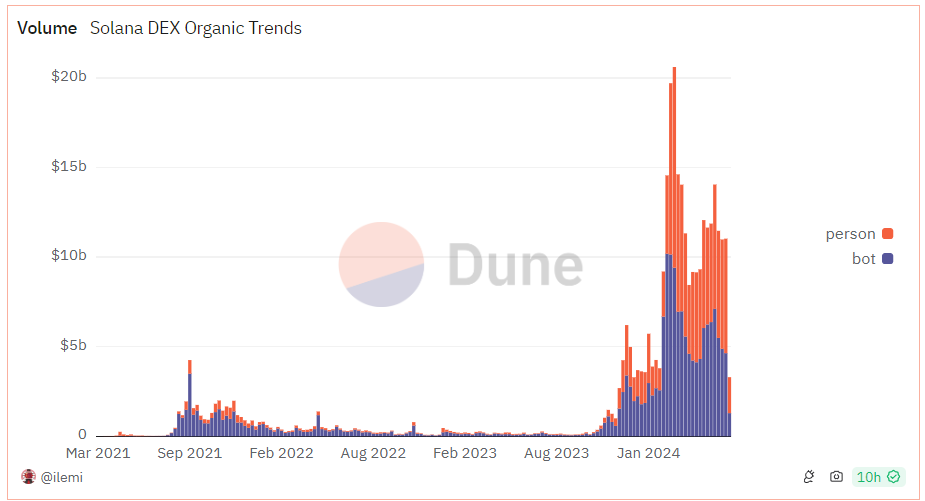

It is worth noting that Solana suffered from congestion at the time due to bot transactions. SOL-based meme coins saw a sharp volume increase, attracting crypto bots.

source: dune

Another point to consider is that Solana futures may not be required for approval. Sigel from VanEck believes surveillance sharing agreements (SSA) with spot crypto exchanges may be sufficient.

What will happen if a Solana ETF is approved by the SEC?

The initial impact is expected to be seen if the SEC chair is replaced, which may only occur if Trump re-enters the White House.

If the above materializes, the crypto markets may be pushed higher, led by SOL, due to other ETF applications.

Approval may also lead to other applications. As far-fetched as it may sound at the moment, a meme coins ETF tracking the MEMECOIN index is a possibility.

All eyes will be on the US elections polls and a possible speech from Trump at a Bitcoin convention in Nashville later in July.