Discusses the latest financial results, outlook of the company and looks into retail and institutional ownership activity

Global push-to-talk and cellular booster systems provider Siyata Mobile (NASDAQ:SYTA) moved 2.3% higher in after hours trading on Thursday after reporting second quarter earnings. Leading into the result, SYTA rallied +3.8% but has traded -78% lower since the beginning of 2022.

Q2 2022 hedge fund letters, conferences and more

The company plans to host a conference call at 8:00am ET time on Friday, August 19th pre-market.

The Q2 results showed another quarter of improving financials with the company generating top line revenue of $970,000, growing +172% in the same quarter in 2021 and +16.4% when compared to Q1 of 2022.

Siyata generated $109,000 in gross profits compared to -$466,000 in 2021. This figure however fell from the first quarter's $255,000 gross profit with management noting that the quarter was negatively impacted by low margin sales of a legacy product in the EMEA region and offset by higher-margin sales of the SD7 rugged handset.

The largest positive came from Siyata posting its lowest net loss of -$4.3 million, which came in as a significant improvement to the -$10.9 million loss in 2021 and a slight improvement on the -$4.7 million Q1 net loss. The net loss equated to earnings per share of -$0.29 compared to -$2.26 in 2021.

Founder and CEO of SYTA, Marc Seelenfreund commented on the result stating; “We delivered on our plans to continue building our channel infrastructure during the second quarter, achieving multiple significant wins that we believe set the stage for fast and broad customer adoption of our game changing SD7 device and accessories in the quarters ahead”

Future Outlook

The outlook commentary on the result highlighted that the company is seeing strong sales momentum so far in the third quarter.

In the Rugged Handset segment outlook, the company noted that the unit has only been sold to date in international markets and is now being targeted towards the 47 million enterprise task and public sector workers across North America. Management believes the MCPTT SD7 device has the potential to disrupt the land mobile radio (LMR) industry because of its unique form factor, competitive price point and purpose-built functionality.

The in-vehicle device segment has seen many large-scale programs being delayed due to the pandemic, which they believe is creating pent-up demand for the solutions. Siyata has resumed customer trials in 2022 which they believe will translate into product line growth in the future.

The cellular booster category continues to be sold under the “Uniden” brand predominantly in North America.

Retail and Institutional Ownership Activity

The stock has gained 25 positions this week and is currently the 206th most popular stock among retail investors who have linked their portfolios with the Fintel platform for free.

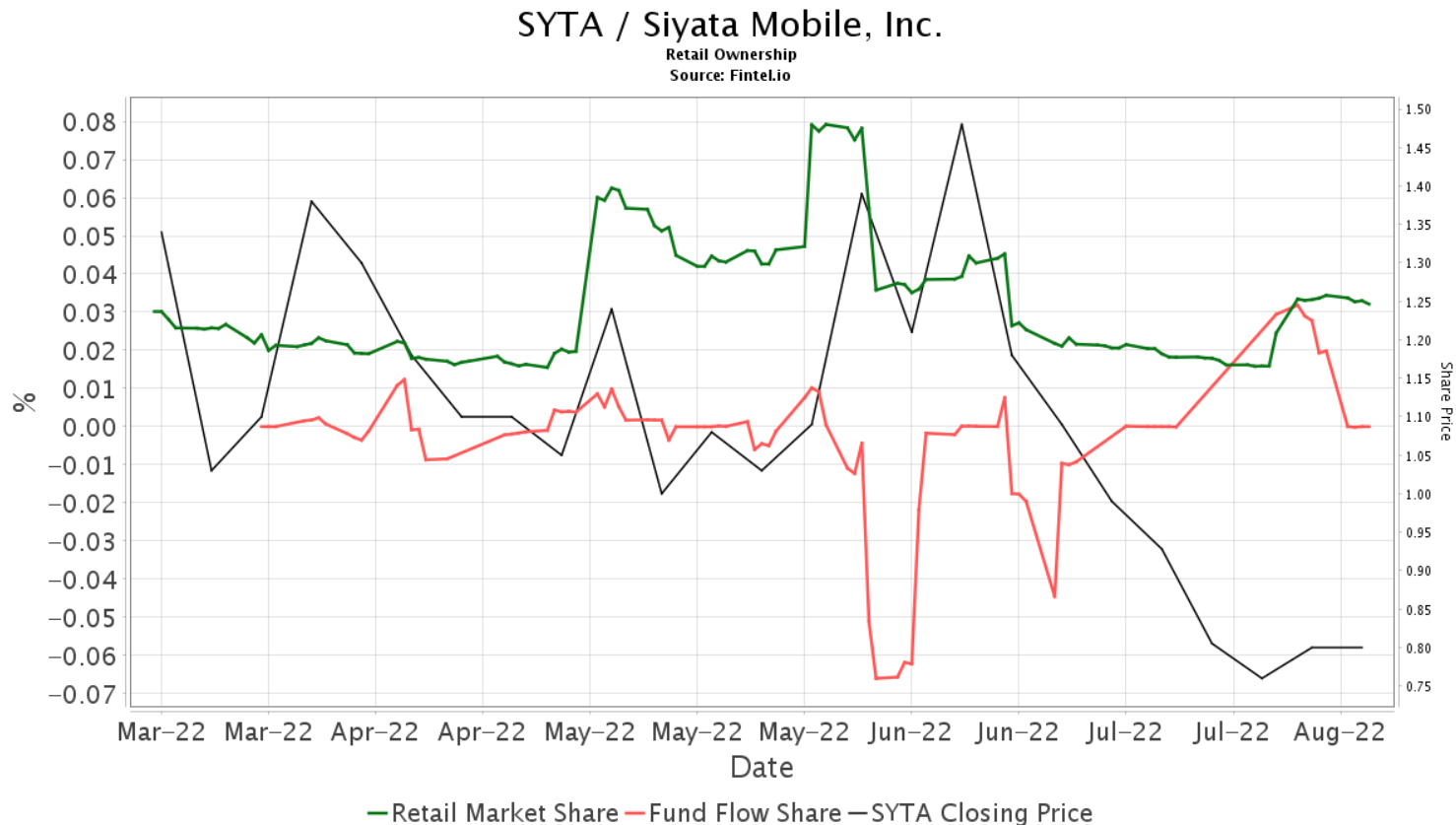

The chart to the right displays the level of activity by retail investors over the past few months against the share price. It displays the divergence between the share price with investors topping up positions in early August.

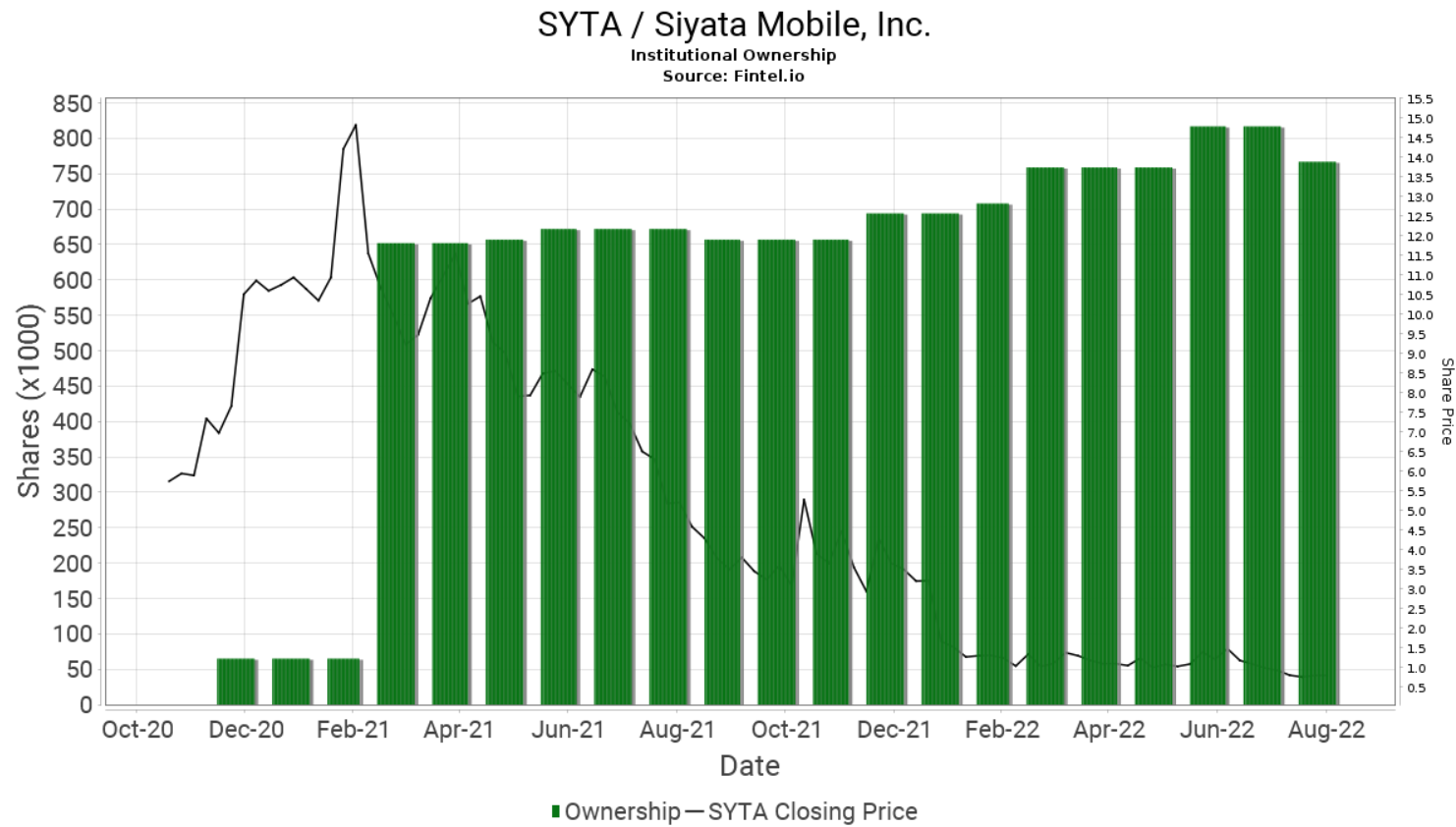

For some comparison to retail investor sentiment, a second chart has been provided below that shows the level of institutional ownership in the company over the past 3 years. SYTA has gained one institution since the last time Fintel reported on the stock, bringing the total to 14. Some of these institutions include Phoenix Holdings, Virtu FInancial, Two Sigma and Geode Capital. Fintel's ownership accumulation score of 45.72 is bearish as it places SYTA in the bottom 44% of 36,774 screened companies.

Article by Ben Ward, Fintel