Are Short Sellers Informed? Evidence from Credit Rating Agency Announcements

- Jian Shi, Junbo Wang, Ting Zhang

- Journal of Financial Research

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

This research focuses on the relationship between the frequency of unexpected short selling behavior and abnormal returns surrounding credit watch and rating change announcements in the equity market. It is notable that it employs a unique database that affords the authors the opportunity to study the behavior of unexpected short selling around credit rating agency (CRA) announcements on a daily basis.

- Is there an increase in unexpected short selling in the days prior to the publication of negative credit rating agency announcements?

- Is the abnormal short selling observed prior to CRA announcements inversely related to the post-announcement abnormal returns in the equity market?

- Is there a significant relationship between abnormal short selling and the magnitude of the abnormal returns observed after the CRA announcement?

What are the Academic Insights?

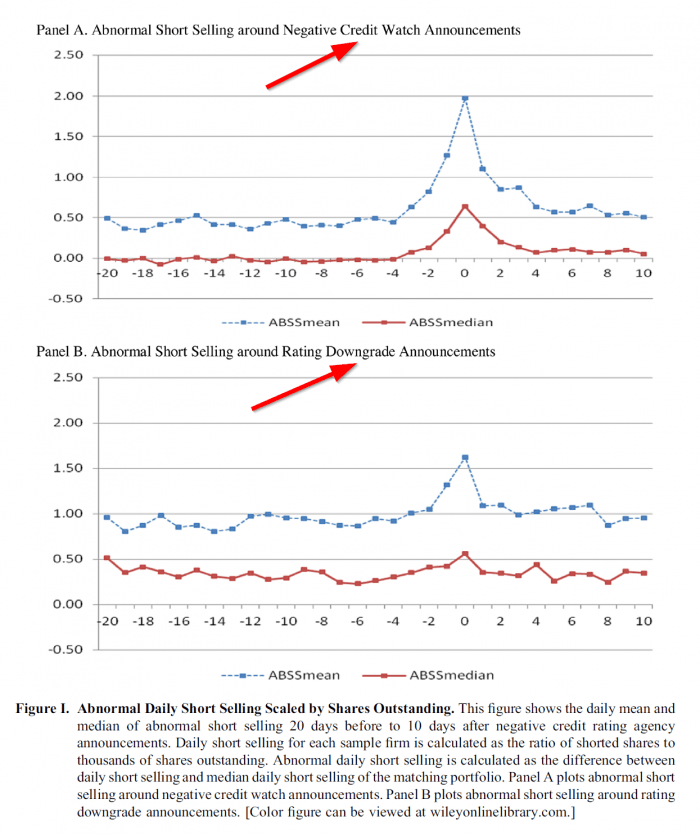

- YES. The mean abnormal short selling over two days prior to the publication is twice the amount as during the 6 to 15 days prior to publication (1.216 vs. .565, sig 1%). This result supports the notion that the short selling is driven by private information.

- YES. There is a significant negative relationship between abnormal short selling two days before the announcement and the abnormal returns at the announcement date and one day after. The relationship is both negative and significant for credit watch announcements. It was similarly negative for rating downgrades, however, it was a statistically significant relationship.

- YES. The relationship for negative credit watches is positive and correlated with larger price declines during the post-announcement period. The relationship for downgrades, although positive, were of a smaller magnitude and were again, not statistically significant. However, if the downgrades involved more than a one “notch” change, then abnormal short selling exhibited a stronger relationship and exhibited a larger price decline. The relationship for one “notch” only downgrades was weaker and exhibited a smaller price decline.

Why does it matter?

There is an ongoing debate that the source of short seller trading advantage is a result of either: (1) having access to inside information; or, (2) a superior ability to analyze publicly available information. This study contributes to the debate by providing evidence in support of the former. Apparently, the excess returns obtained by short selling around CRA announcements has more to do with access to inside information, tips and personal sources than with superior analytical skill.

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

Although constrained by rules and regulations, informed short selling (tipping) is present before negative credit watch and certain types of rating downgrade announcements. Using entity credit rating and daily short sale data from April 2004 to December 2009,we find that preannouncement abnormal short selling significantly increases toward the announcement dates and is negatively related to postannouncement stock returns. Furthermore, short selling driven by tipping is more pronounced before more severe and more surprising rating downgrades. This study provides evidence favoring the private information hypothesis (tipping) in the ongoing debate of the informational advantage of short sellers.

- The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

- Join thousands of other readers and subscribe to our blog.

- This site provides NO information on our value ETFs or our momentum ETFs. Please refer to this site.

The post “Short Sellers Profitably Trade Prior To Credit Rating Agency Announcements” appeared first on Alpha Architect.