The United States Securities and Exchange Commission (SEC) announced that it is ending its investigation into Ethereum 2.0, which sent the crypto market higher. In March 2024, it was reported that an undisclosed government was probing Ethereum. It was revealed the SEC was behind the investigation, attempting to classify ETH as security following its shift from Proof of Work (PoW) to Proof of Stake (PoS).

Ethereum initially dived -6.0% when the investigation was made public, lowering the odds for a spot ETH ETF approval at the time.

Consensys, a leading blockchain firm, revealed earlier today that the SEC is ending its investigation.

As a result, Ethereum is no longer ‘suspected’ of being a security. Consensys confirmed its lawsuit against the SEC stands despite the end of the investigation.

‘Our fight continues. In our lawsuit, we also seek a declaration that offering the user interface software MetaMask Swaps and Staking does not violate the securities laws.’

The Ripple (XRP) community is displeased with this news. The SEC is still waging a legal battle against Ripple. Some are hoping a settlement is near.

Whales increased their ETH holdings

Today’s decision came after David Hirsch, the head of the SEC Crypto Asset and Cyber Unit, recently resigned after 9 years. Hirsch made the resignation public on LinkedIn.

The win against the SEC is well-noted in ETH/USD. Ethereum is back above $3.5k, adding +4.0% in the past 24 hours, according to CoinGecko:

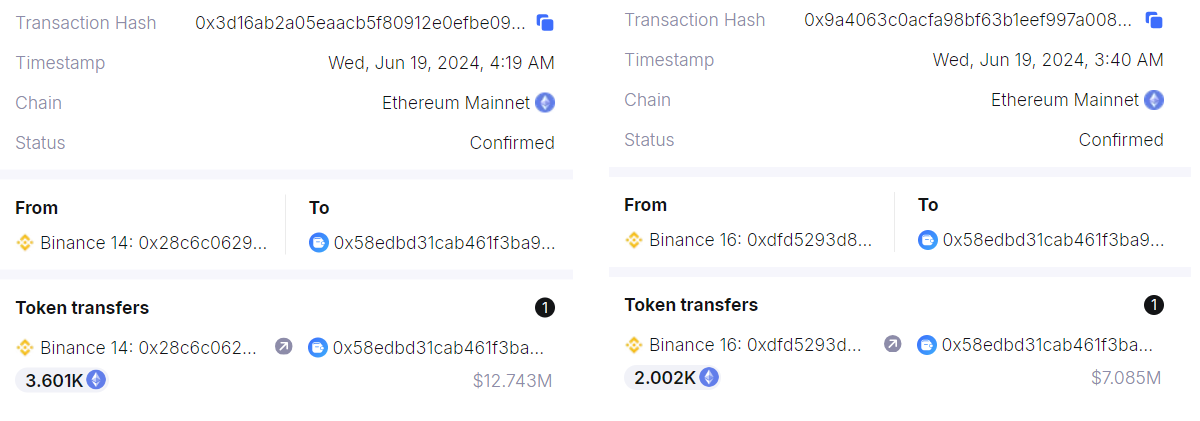

Spotonchain.ai spotted one whale that took advantage of the news. Following the SEC’s decision to cease its investigation, the crypto investor purchased ETH from Binance in two transactions worth over $19M.

It is worth noting that algorithms often track large transactions, including dominant addresses that suddenly sprung to life.

Crypto market reacts to ETH news

When the Mainnet posts marginal gains, tokens based on it tend to benefit from firmer price appreciation. While ETH gains are less than 5.0% at the time of this writing, other cryptocurrencies are in the spotlight.

| Token | Price appreciation |

| $DEGEN | +30.68% |

| $TURBO | +18.99% |

| $BRET | +17.40% |

| $FET | +16.38% |

| $ENS | +15.40% |

| $MKR | +10.98% |

| $FTM | +9.25% |

| $ONDO | +6.02% |

source: CMC

It is evident that traditional Decentralized Finance (DeFi) projects are ‘heavier’ than meme coins or ‘fun’ projects. This trend has been well-noted for some time.

In the past, only tokens on Ethereum posted the strongest gains when the ETH broke higher. As more Layer-1 chains were added, it is no longer the case. The rally may take place across a number of chains.

Interestingly, the tokens on BASE benefited from moderate gains compared to other chains. Base Dawgz, a new token on BASE, has already raised $1.8M. High-appeal projects are worth tracking.

Young crypto investors are setting the tone

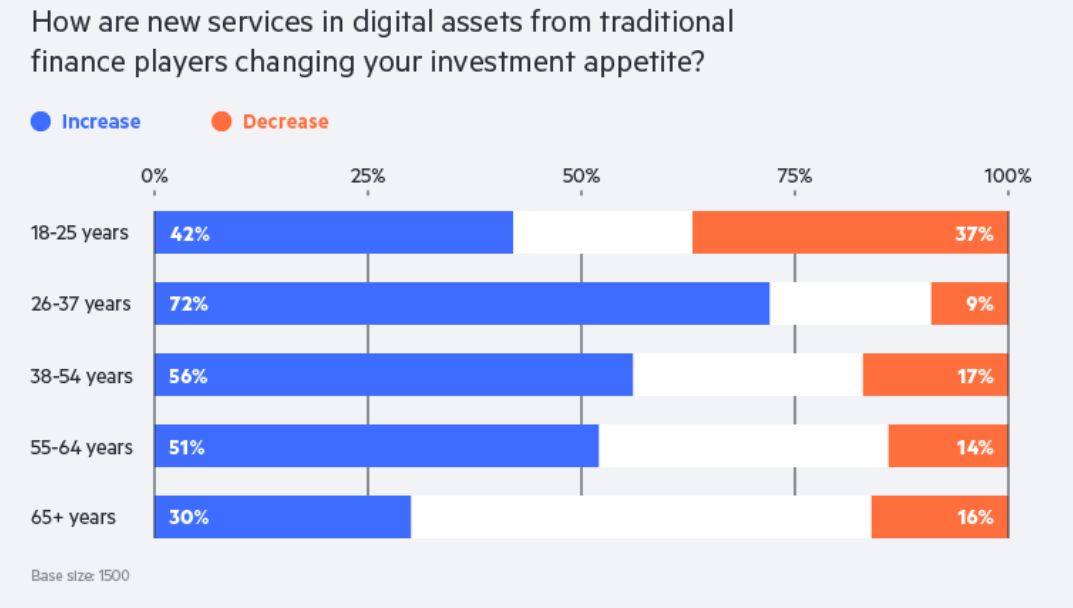

Some suggest that young investors are drawn to crypto due to its accessibility. Young crypto investors seek high and fast returns, which explains why altcoins are drawing greater attention.

With crypto trading popularity rising in Asia among young investors, meme coins will continue dominating the market.

When major news breaks for the top blockchain networks, Bitcoin, Ethereum, and Solana, altcoins may benefit from greater risk appetite than DeFi projects.

This correlation is yet to be reflected in non-fungible tokens (NFTs).

Will ETH rally continue?

On some occasions, despite positive news for the chain, the rallies did not last. Listing the spot ETH ETF in the United States may be a major event for Ethereum. Investors want to assess whether it will attract similar demand to Bitcoin ETFs.

It has been speculated that the new spot, Ethereum ETF, will be listed on July 02, 2024.

Ethereum 4hr chart shows the price is held in a range. A break outside the range (above or below, marked in purple) may reaffirm the trend at an intraday level.

source: tradingview

To conclude, the end of the US SEC investigation is good news for Ethereum. Had it been before the approval of the spot ETH ETF, the reaction may have been greater.

The focus will gradually shift to listing the ETFs, possibly in July. The US election polls may trigger further volatility.