Think emerging-market debt (EMD) might as well be managed passively? Think again.

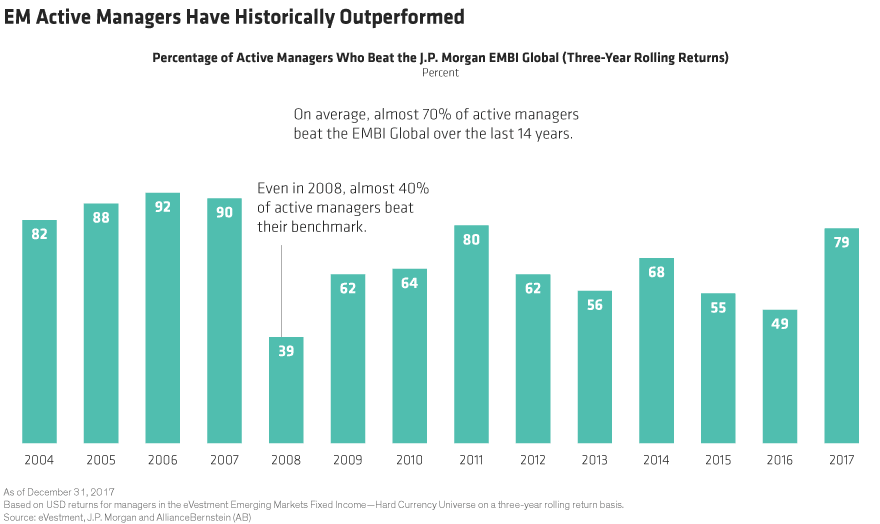

Over the last 14 years, 69% of EMD active managers beat the J.P. Morgan EMBI Global over three-year rolling periods. Even in 2008, almost 40% of active managers beat their EMD benchmark.

That’s not just a run of good luck. Emerging markets are a rich source of opportunities for active managers and a potential minefield for passive investors. That’s because emerging markets contain, well, emerging opportunities and freshly developing risks.

So stay active in emerging markets. Because in EMD, passive investing may be cheap, but more often than not, it’s been costly.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Article by Alliance Bernstein