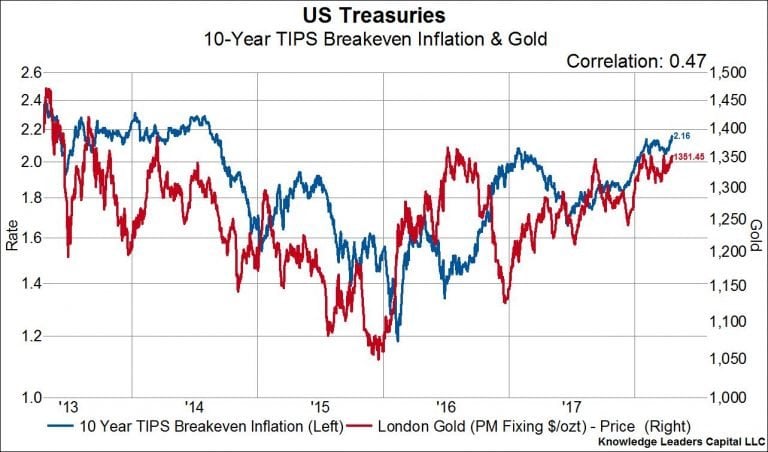

After spending the last four months consolidating gains, crude oil is breaking higher again, and it’s taking inflation expectations with it (charts 1 & 2). The break higher in crude isn’t surprising given that oil fundamentals haven’t been this good in years. Neither is the break higher in inflation, which we expect to tend towards 3% over the coming quarters for headline CPI and 2.5% for core CPI. The two are related, of course, to the extent that rising oil prices feed into inflation. Still, it’s helpful for investors to receive confirmatory signals from multiple asset classes of a particular outcome, in this case rising oil prices and higher inflation expectations. At this juncture, it’s also noteworthy that gold – an obvious beneficiary of higher inflation expectations – is at the top of its multi-year trading range, but has not yet broken out of that range (chart 3). A sustained move higher inflation expectations could be the catalyst that pushes gold to multi-year highs too.

Q1 hedge fund letters, conference, scoops etc

Article by Bryce Coward, CFA - Knowledge Leaders Capital