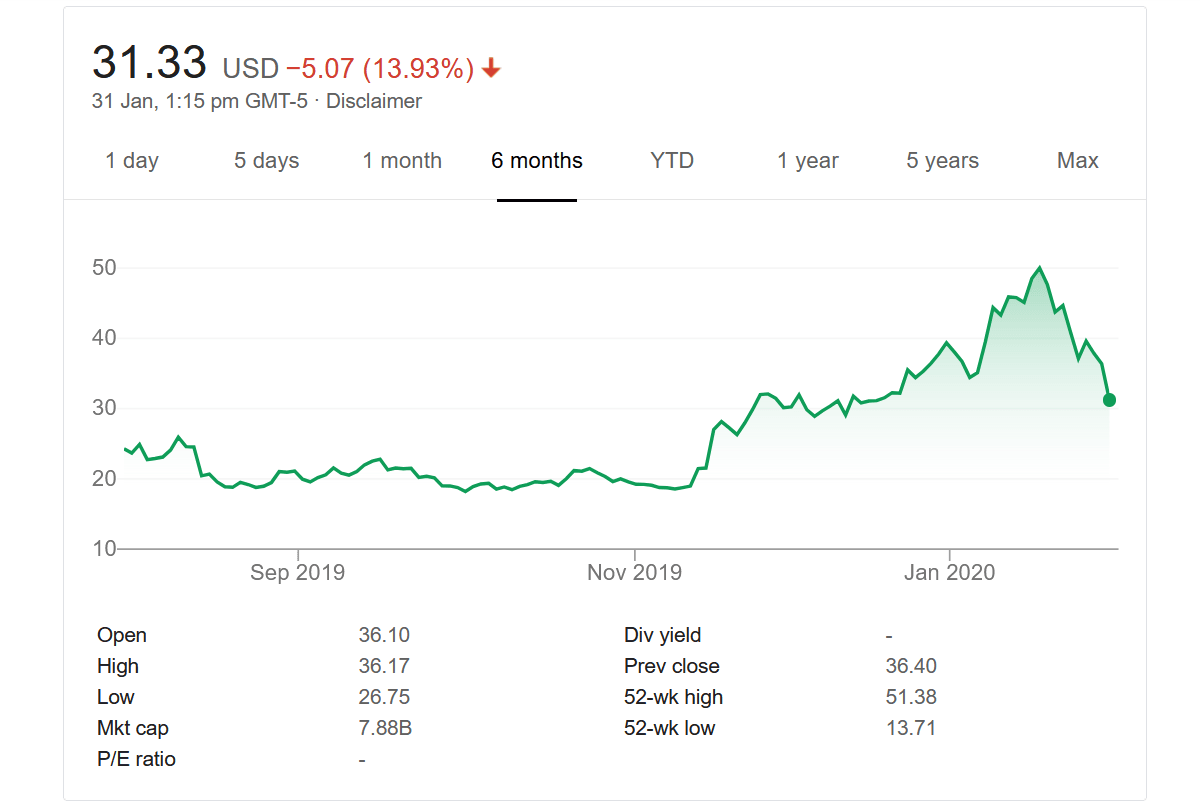

Luckin Coffee just held its initial public offering this past May, and now Muddy Waters says it’s shorting company, calling it a “fraud” and “fundamentally broken business.” The firm received an anonymous report about the Chinese company, which it views as credible. ValueWalk was able to obtain a copy of the report. Luckin Coffee stock has climbed 160% in a little over two months.

Fraud alleged at Luckin Coffee

Luckin Coffee is trying to make coffee drinking very popular in China by offering deep discounts and free coffee. According to the anonymous report, the company “evolved into a fraud” after its $645 million IPO.

The writer who submitted the report to Muddy Waters also alleges that Luckin Coffee has been “fabricating financial and operating numbers” since the third quarter. The company revealed results that showed a significant inflection point that drove its stock price up. Following that increase, it then raised another $1.1 billion this month. The writer believes the company knows what investors are looking for and how to position itself as a “growth stock with a fantastic story.” They also allege that the company knows which metrics “to manipulate to maximize investor confidence.”

Smoking guns for Luckin Coffee stock

The report then went on to mention several “smoking guns” and red flags. For example, the writer accuses the company of inflating the number of items sold every day by at least 69% in the third quarter and 88% in the fourth quarter. They cite evidence from more than 11,000 hours of store traffic video. However, they say the company’s items per order fell from 1.38 in the second quarter to 1.14 in the first quarter.

The writer looked at nearly 26,000 customer receipts and claims that Luckin Coffee inflated its net selling price by at least 12.3%. However, they claim the store level loss is between 24.7% and 28%. Excluding the products that were given away free, they say the actual selling price was 46% of the price that was listed, rather than 55% as management said.

Red flags for Luckin Coffee stock

Among the red flags given in the report shared with Muddy Waters is insider selling as management cashed out 49% of their Luckin Coffee stock or 24% of the outstanding shares through stock pledges, which exposed investors to margin call risk. The writer of the anonymous report also claims that Luckin Chairman Charles Zhengyao Lu and a number of private-equity investors took $1.6 billion from CAR Inc., sticking minority shareholders with deep losses.

The writer alleges that Lu used the Borgward acquisition to transfer millions from UCAR to his related party, which is Baiyin Wang. They also claim the company’s unmanned retail strategy, which was funded through a follow-on offering and convertible bond offering, “is more likely a convenient way for management to siphon large amount [sic] of cash from the company.”

They also called attention to the company’s independent board member, who they say has served on the board of some “very questionable Chinese companies,” and co-founder and Chief Marketing Officer Fei Yang, who reportedly was sentenced to 18 months in prison for illegal business operations.

Flaws

The report sent to Muddy Waters also highlighted a number of problems with Luckin Coffee stock due to flaws in its business model. For example, the writer argues that the company is wrongly targeting core functional coffee demand in China. The nation’s citizens take in an average of 86 mg of caffeine per day, and 95% of that is from tea.

Additionally, they said the company’s customers are very sensitive to pricing, and “generous price promotion” is driving retention. They believe it will be possible to decrease the offered discount level while increasing same store sales.

They also believe the company’s unit economics cannot become profitable and that its dream “to be part of everyone’s everyday life, starting with coffee,” probably won’t come true because the company isn’t competent on non-coffee products. They also feel the company lacks brand loyalty and customers only buy its products because of the sales.

Finally, the writer sees significant compliance risk to Luckin Tea’s franchise business because it isn’t registered with the relevant authority because it launched the franchise in September without having at least two directly-operated stores up and running for at least a year.

ADR shares of Luckin Coffee stock plunged 14% during regular trading hours on Friday following the Muddy Waters tweet and release of the anonymous report.