Inflation is now showing up in multiple sectors, mostly stemming from raw materials costs, higher transportation rates, and supply chain disruptions. Companies are raising prices because of these higher costs. It is not yet clear if this rise is a temporary or long-term inflationary occurrence. It certainly is a concern, especially because of the rising cost of commodities. This uncertainty drums up concerns in major companies, small businesses, and individual consumers alike. Some turn to cryptocurrencies like Bitcoin and Ethereum for a hedge. Others turn to precious metals, and some are leading a charge on the price of silver. You may have heard of the silver raid back in February. This did not end. Now, the raid organized through Reddit returns with an organized attack on May 1.

Q1 2021 hedge fund letters, conferences and more

Start of the Price of Silver Raid

The start of the silver raid began in February. Partly inspired by the GameStop and AMC short-selling rally, the first attack by the subforum Wallstreet Silver left many retailers backlogged with orders. This was so significant that many websites had a disclaimer at the top of every page indicating that shipping and processing could take 5-10 business days.

The goal of the raid was to push back against precious metals manipulation, specifically targeting JP Morgan. On February 2, 2021, people dove into SLV. That day now carries an infamous connotation as "the day of the greatest felony in the silver market ever." Basically, the greatest inflow of buying happened that day, and yet the price plunged. This is what revealed to many how the paper silver market is easily manipulated.

Consequently, the forum began to discuss buying up physical silver instead. This is what Wallstreet Silver is promoting. The idea now is to drain the supply to spark a short-covering rally that would yield a “fair and accurate price of silver.” If there is a short supply, the price will go up. Additionally, many individual Silverbacks, “apes,” as they prefer to go by, are eager to hurt the eight major banks that have been shorting silver for years. Instead of an uncoordinated attack, this time there is a plan.

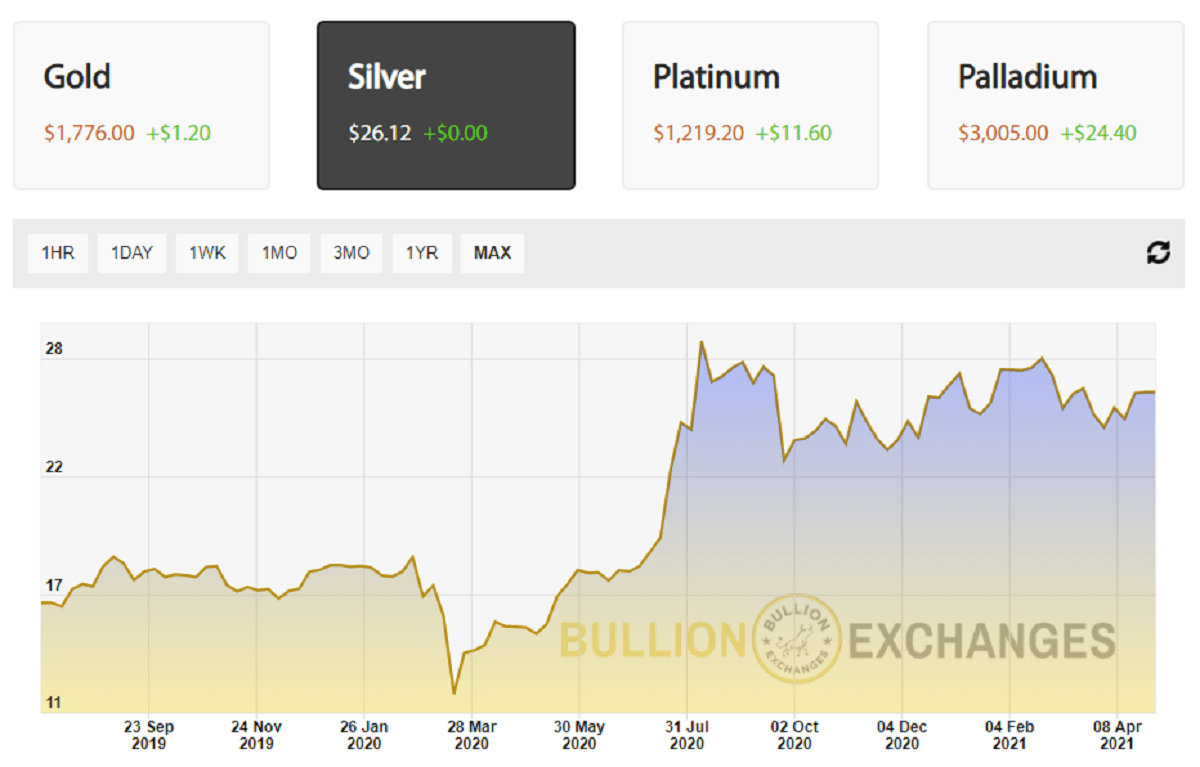

Source: Bullion Exchanges

Second Silver Squeeze to Call for May Day?

Demand is propping up the price of silver, keeping it well above $24 per oz. To put this into perspective, it bottomed around $12 per oz in March 2020.

People may have thought the raid was over, but the subreddit has not lost traction. In fact, it has grown to over 65,000 people with very deep pockets. It is not irregular to see people buy ten 1 kilogram bars, which is worth approximately $10,000 today. Sometimes, people share their massive silver hauls:

Source: Twitter

So what is the plan now? On May 1, the forum members want to attack COMEX. Their goal is to assemble 100,000 people to buy 100 oz of silver each on Saturday. This is not necessarily an impossible feat. One major buyer like the one who just bought $800,000 worth of physical silver could make another major order. Plus, this new effort to cause a silver squeeze, similar to the GME squeeze, seems to be more coordinated than the first attempt. Although the market is closed over the weekend, it is possible to buy silver online and process it on Monday.

Does this call to action really bear weight on the silver market? Some would say no, that dealers are the only ones benefiting from this. However, some “officials” have come out during the past week to assert that there is no silver shortage at this time. They further backed up that such a raid on the silver industry will not have any difference in the price of silver. Some might say that is interesting timing for these statements.

This is especially true considering in February 2021, London reports indicated it was merely a week away from running out of silver. Moreover, COMEX now reports incredible volumes of gold and silver outflows in recent history. But where is this demand coming from?

Where Is the Demand for Silver Coming From?

Do not forget that silver is a highly industrial metal in addition to being a precious metal. Silver has demand on multiple fronts including the members of Wallstreet Silver, major tech and vehicle industries, and hedge funds to protect against inflation. Both individuals and companies are waiting on delivery at contract expirations instead of rolling over. The biggest consumers include electric car producers, phone manufacturers, battery companies, and more. These may very well be the biggest outflows awaiting deliveries from the COMEX, buying in bulk as the silver raid continues.

Although the intentions behind buying silver right now may vary, the demand for silver is there. As a result, there will need to be a response by the price of silver. The attack on the silver market is three months strong now, and it doesn’t show signs of stopping. Although the silver price might not suddenly spike to $483, like GameStop, the silver price could potentially reach $30 and above. When this happens, silver raiders will start to see the silver raid making a difference, perhaps inspiring new stackers.

Will we be able to see the silver price reach $30 next week from this weekend’s raid?