Logica Capital commentary for the month ended February 28, 2022.

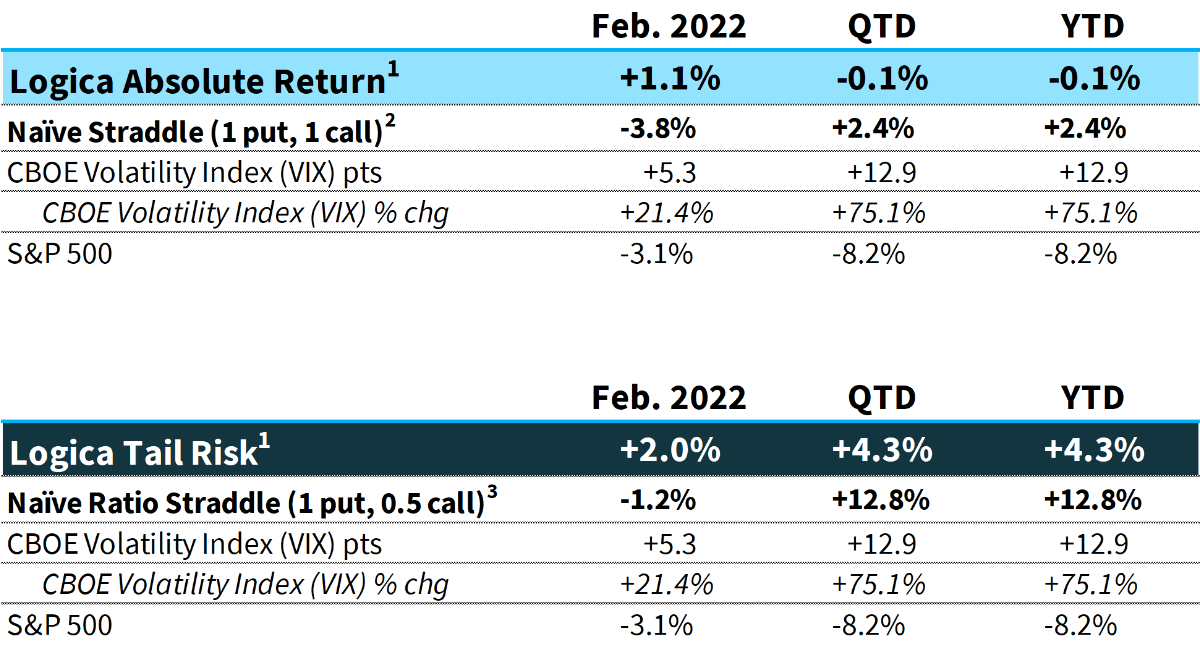

Logica Absolute Return (LAR) – Upside/Downside Convexity – No Correlation

- Tactical/dynamic balanced Put/Call allocation – Straddle

Logica Tail Risk (LTR) – Max Downside Convexity – Strong Negative Correlation

- Tactical/dynamic downside tilted Put/Call allocation – Ratio Straddle

Q4 2021 hedge fund letters, conferences and more

Summary:

Fueled by geopolitical uncertainty, the S&P 500 continued its measured march downward, ending (for now) with a violent reversal on February 24th. The peak-to-trough drawdown considering the intra-day low on the 24th was more than -10%, and more than 2.5% lower than the January lows. However, quite surprisingly, VIX failed to make a new high, even given the S&P500’s lower low. This continues the theme of elevated volatility, but, as of the end of February, not yet dramatic fear in the market.

1 Returns are net of fees and represent the returns of Logica Absolute Return Fund, LP and Logica Tail Risk Fund, LP

2 Naïve Straddle Return: a 1.5 month out, S&P 500 at-the-money put and call bought on the final trading day of prior month and sold on the final trading day of current month. This return on premium is divided by a factor of 6 to be comparable to Logica’s typical AUM-to-premium ratio.

3 Naïve Ratio Straddle Return: a 1.5 month out, S&P 500 at-the-money put and at-the-money call (divided by 2) bought on the final trading day of prior month and sold on the final trading day of current month. This return on premium is divided by a factor of 6 to be comparable to Logica’s typical AUM-to-premium ratio.

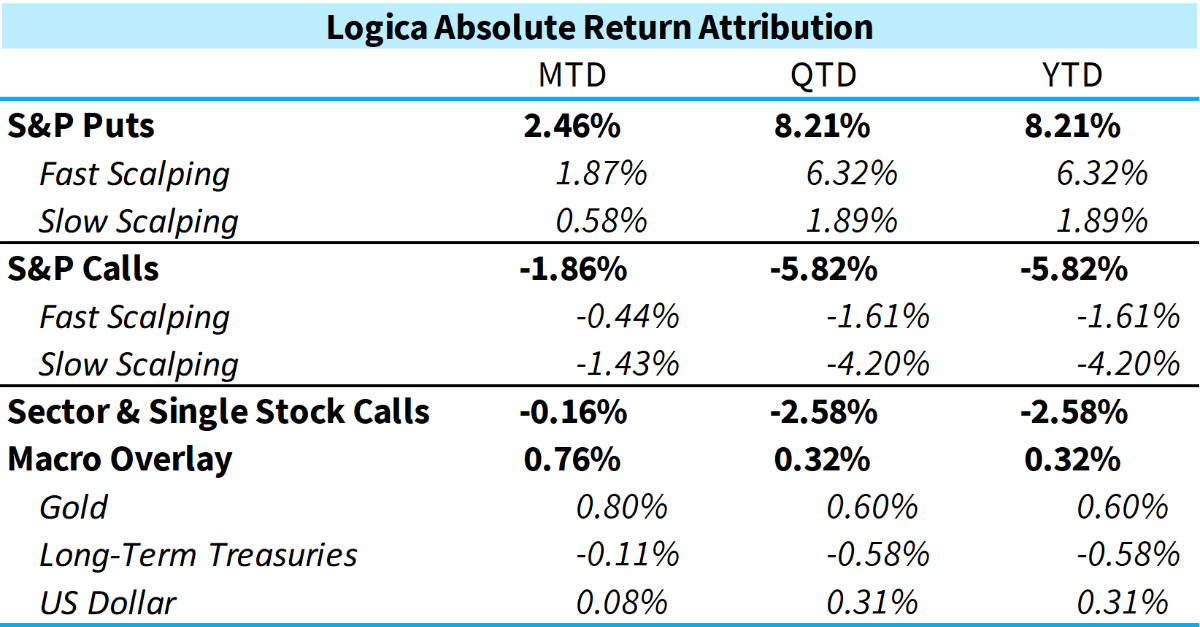

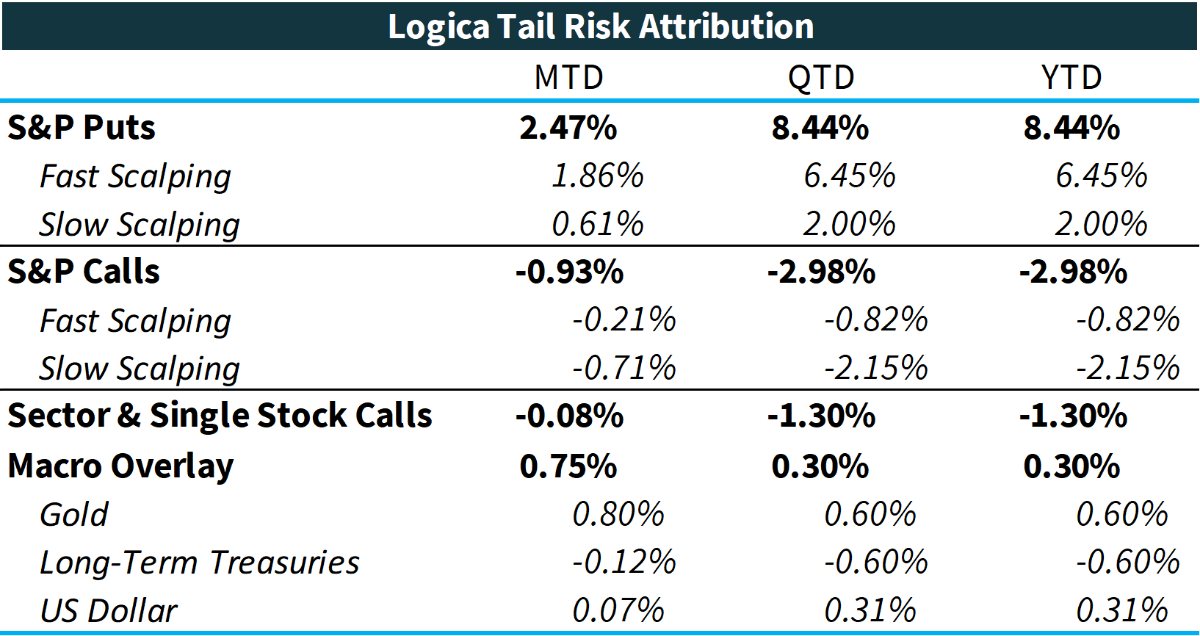

Commentary & Portfolio Return Attribution

*Attribution returns are composed of daily returns, gross of fees

February began with the S&P 500 Index threatening to resume its bull run after a brief detour below its 200-day moving average, but quickly met resistance and continued its downward grind, culminating in a new intra-day low on February 24th, although closing the day rather well on a massive reversal. As mentioned above, the interesting thing to note here is that while implied vol was certainly rising, which did provide a tailwind for our options positions, as expected, we’re still not seeing an implied volatility pop as one might expect given the geopolitical climate. The biggest pops so far seem to have been in “macro” assets, such as Gold, Oil, the US Dollar, etc…and while we saw a little bit of life in Treasuries toward the latter half of the month, we remain skeptical on their long-term viability. With that said: the star of the month was our Macro Overlay, led by Gold and buoyed by our decision last month to trim some exposure to Treasuries. The US Dollar also contributed nicely on the month and the year thus far. Sector & Single Stock Calls had another phenomenal month with a very meager downside contribution of -0.16% in LAR and approximately half that in LTR (as LTR holds half the number of calls as compared to LAR). In February, the delta notional exposure of this module was roughly on par with our S&P Call exposure. Given that, we are very pleased that this basket of our model’s selections held its own so well, and materially outperformed the S&P 500 Index. In fact, stepping out wider, one of our biggest sources of alpha over the past 12-18 months has been our Logica Focus Diversified (LFD) module. While we spend plenty of time internally lamenting the things we’ve gotten wrong – so as to improve upon those - the LFD performance continues to be a boon to the portfolio.

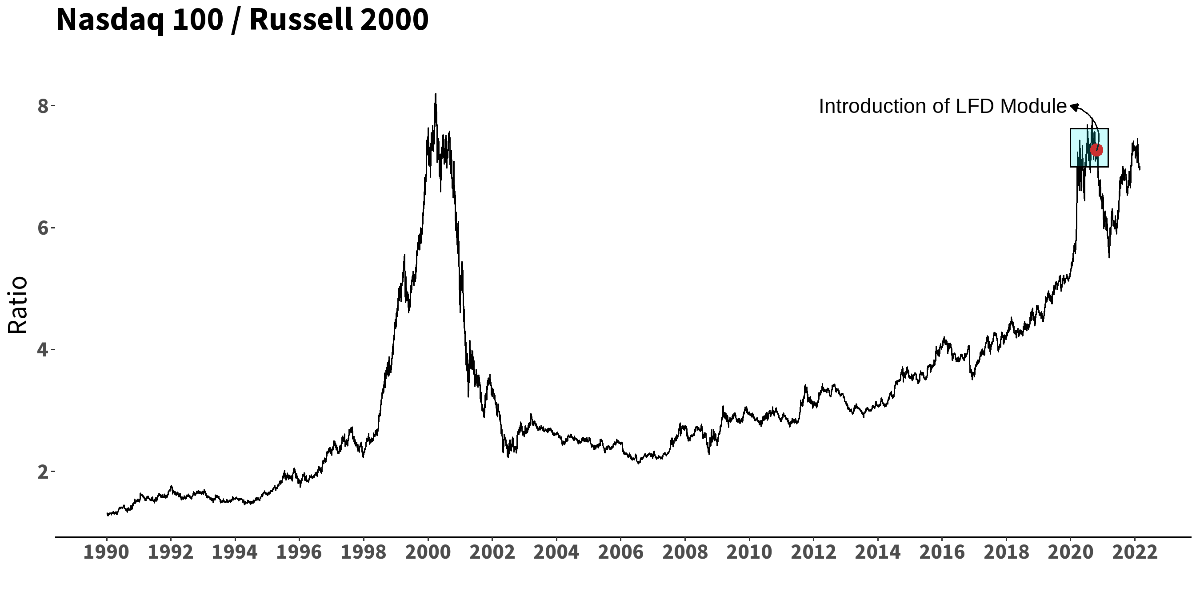

In our January 2021 letter introducing our LFD module that had been implemented just a couple of months prior as a result of extensive R&D we had done on factor volatility, we wrote (emphasis at the end is our addition in the present day): “One of the challenges we have experienced has been the relative underperformance of momentum strategies. While positive in aggregate, the past year has seen nearly unprecedented factor volatility, defined as daily reversions of factor returns. On Monday, momentum works brilliantly and value stumbles… on Tuesday the reverse happens… etc.To address this challenge, Logica deployed a new module, “Logica Focus Diversified” (LFD) within our single stock call module. This is analogous to the “anti-momentum” LFB module we deployed in April [2020] following the market crash; and like that deployment, LFD has been instrumental in providing positive returns for the month of January [2021], accounting for all the gain we experienced in single stocks. The increased diversification of return sources (or more broadly, factor exposures) both lowers volatility and raises returns – a win-win we are excited about.” If we had to attribute the success of LFD since its introduction in late 2020, there would be two clear answers: first, that we believe our models generate alpha in the selection and ranking process, and second, that the innovation in our allocation models stemming from this research initiative a few years back did fairly well at timing market rotations, for example, from momentum to anti-momentum and back (while we are price behavior focused, if viewed fundamentally one might equally describe rotations as being from growth to value, and back, etc...).Looking at this rotation effect in markets over recent times, we see the early part of this year starting with a heavy rotation away from growth/tech. But right before this, we had just experienced some major swings on both sides. These can be seen in our familiar NASDAQ 100 / Russell 2000 Index chart, which also highlights the inception of our LFD module. From LFD’s inception, we’ve seen 2 distinct periods: first, a rotation out of NASDAQ 100 for about 6 months, and then, a rotation out of Russell 2000 for approximately the last 12 months. The LFD module, designed specifically with factor rotation dynamics in mind, has performed equally well in both periods, establishing the successful outcome for which it was built: robustness across different regimes (as many of you may recall, before building the LFD module, we had a higher concentration in momentum exposure, which hurt us a few times, driving the innovation that led to this more regime independent LFD module).

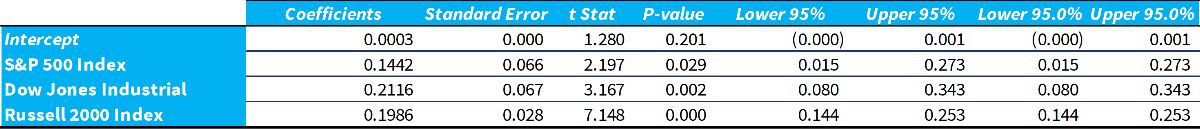

As we’ve previously shared, and as originally built to offset our momentum exposure, LFD tends to more often align with “defensive” exposures that one might see within an index like the Dow Jones and sometimes has some overlap with a smaller cap index like the Russell 2000. As it is long a diverse basket of call options on sector ETFs and single stocks, we would expect it to have a very positive relationship to these broader market indices. Moreover, as rigorous quants, we need to confirm that what we’re seeing is true alpha, rather than some kind of beta and/or risk transfer that poses some as yet unforeseen exposure (instead of a “paper tiger” we might call this “paper alpha”).

As a brief aside, we feel the concept of “alpha” is nebulous. There is a statistical definition which is clear by the math (the y-intercept), and there is a conceptual definition that varies mildly depending on who you ask. Our belief, however, is that the statistical and/or mathematical definition is materially insufficient given the nonlinear dynamics of capital markets. Thus, while we present these metrics below, we look at them more as a helpful guide, only to be considered in proper context and with further investigation of the embedded risks in a source of alpha – some of which may have not yet expressed themselves in a particular timeline, which is common of a return generating process with a negatively skewed distribution: it simply transfers the risk to a later date, appearing to be providing “alpha” in the meantime, but on its journey toward an inevitable risk event.

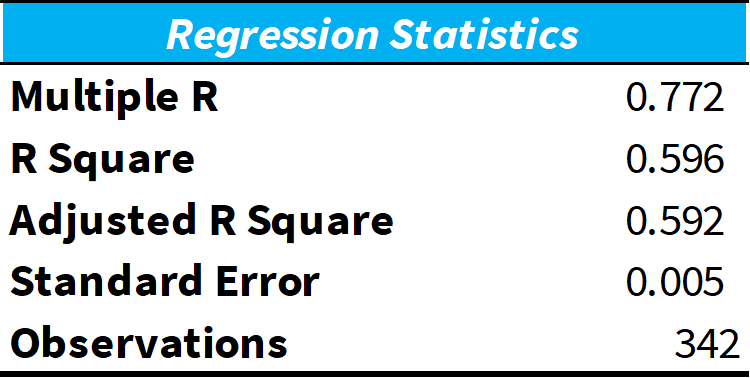

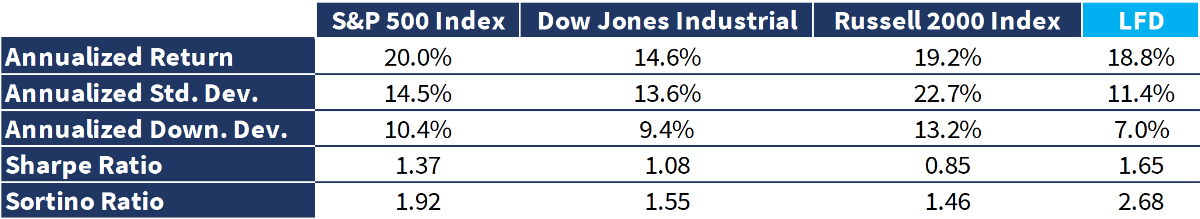

To that end, we show the results of a multivariate regression:

We can see from the R Square value that there is a significant amount of variance unexplained by these 3 major indices. Further, we see a fairly low number for the coefficient for each, meaning the beta of LFD to these indices has been low (the highest individual beta for LFD is the Dow at 0.60). More importantly, we see a positive number for the intercept, or alpha, for LFD, which from our daily analysis, results in approximately 10% annually. Additionally, we can see the Sharpe and Sortino ratios have outpaced all 3 major indices in this comparison:

Given these metrics, alongside the lack of explained variance and minimal beta, we are officially comfortable being very proud of this module that was a result of so much R&D prior to its introduction into our portfolio; all with the aim of capturing juicy “right shoulder” payoffs with cheaper convexity, while materially offsetting the existing momentum exposure that previously dominated our up-capture portfolio.

That said, while we present the LFD module’s success, we do so not to celebrate a win while ignoring other parts of the portfolio which may have detracted (at the end of 2021 we wrote about our momentum module lagging its benchmarks, and the changes we implemented as a result), but merely to provide a window so that those curious might be able to better understand our process and results.

Looking elsewhere, we again saw muted returns across some comparable hedge fund and tail risk indices:

HFRX Macro Index: -0.42%

HFRX Equity Hedge Index: +0.34%

HFRX Absolute Return Index: -0.03%

Cambria Tail Risk ETF (TAIL): +1.07%

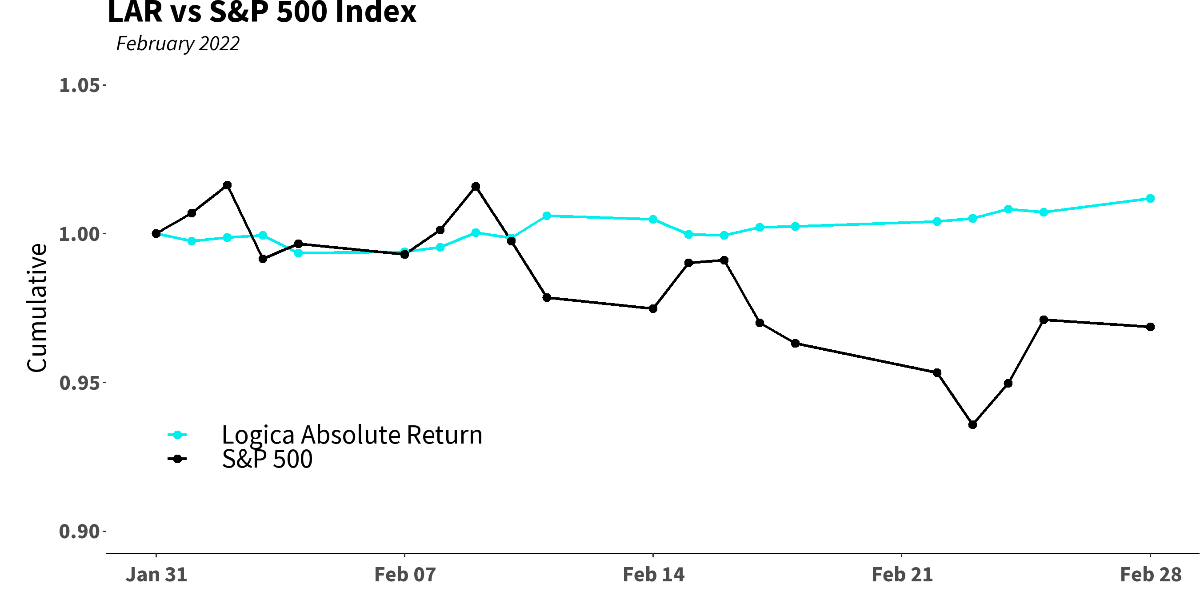

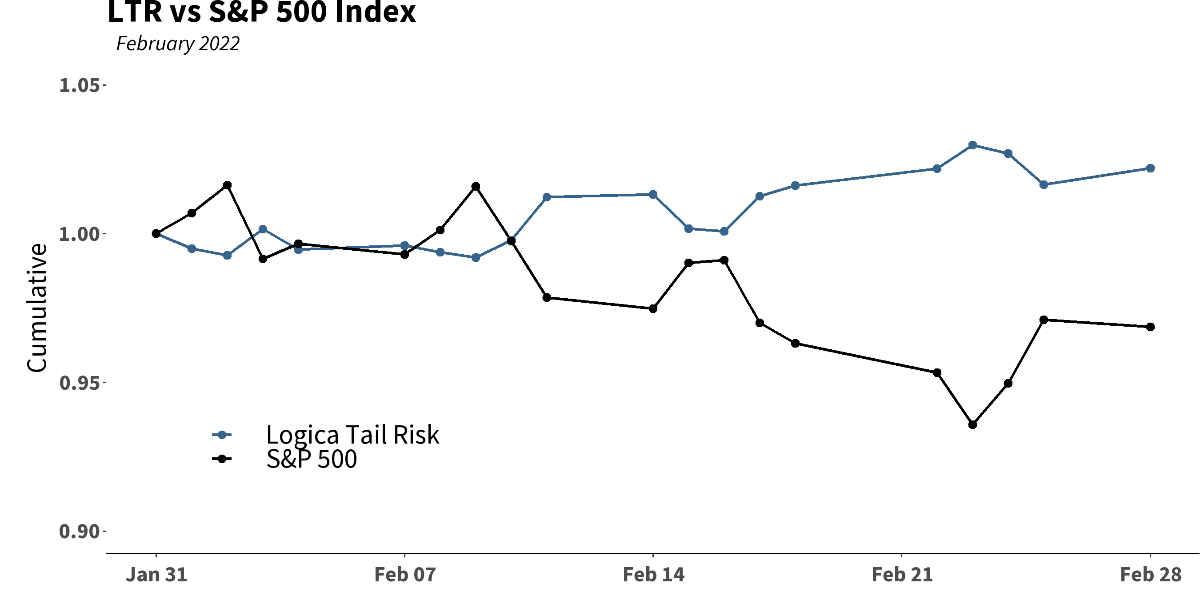

CBOE Eurekahedge Tail Risk Hedge Fund Index: +1.07%**Comprised of Funds that have reported as of 3/10/2022Lastly, we see some nicely uncorrelated and/or negatively correlated behavior when looking at our strategies versus the S&P 500 Index in February:

Logica Strategy Details

If you would like to learn more about our strategies, please reach out to:[email protected]