Summary

- As a fundamental investor, you may face a situation when the market price drops below your purchase price. How do you decide whether it is time to get out or continue to hold?

- Lennar Corporation (Lennar) market price had declined by about 30% since its peak in Dec 2021. If you had bought it at a price higher than the current price, I have a decision framework to help you think through whether to hold or exit.

- It is a framework where the comparison between price and intrinsic value is still core. Also, it addresses the various behavioural biases and opportunity costs when deciding whether to hold or exit.

Investment Thesis

Lennar Corporation (NYSE:LEN) is fundamentally strong. The decision to invest thus depends on the margin of safety. In my article in Dec 2021, I concluded that there was no margin of safety at the then-market price of USD 106 per share.

The market price of Lennar is today USD 85 per share. However, if you had bought GNRC at a higher price, my recommendation is

- Hold if you had bought it at USD 75 per share.

- Sell if you have bought it at USD 115 per share.

- If you have bought it at USD 95 per share, you should hold it if you have an optimistic view of the company. Otherwise, sell.

The above recommendations are based on my decision framework as presented in the following sections.

Background

Lennar’s share price had declined from its peak of USD 117 per share in Dec 2021 to about USD 65 per share in Jun 2022. It has since risen to USD 85 per share as of 25 Aug 2022.

In my Dec 2021 article titled “Lennar Is Not A Growth Stock But A Cyclical One”, I concluded that Lennar was fundamentally strong. It had a good track record in creating shareholders’ value. It is also financially sound with a decreasing Debt Equity ratio over the past 12 years.

However, there was no margin of safety at the then-market price of USD 106 per share.

This of course presupposes that you have not invested in Lennar. Unfortunately, many investors have bought Lennar at prices much higher than that. Think of those who bought it at the peak.

Seeing a decline in the share price after you have bought it is a common feature for many investors. The challenge is how to decide what to do when this happens. Should you hold and hope for the price to recover or do you cut loss and live to fight another day?

Over the years, I have had situations when I sold off my stocks too early. I later found out that a year or two after I sold it, the stock price rose. I lost money when I sold it off. If I had held onto it, I would have made money.

I have also had the bad experience of holding onto the stocks for too long. The stocks never returned to their peak performance or recovered to my purchased price level. In such instances, I lost more money compared to if I had sold earlier.

I have since adopted a decision-making framework that helps to reduce the mistake of selling off too early or holding on for too long.

I will illustrate my approach with Lennar.

My Hold or Exit Decision Framework

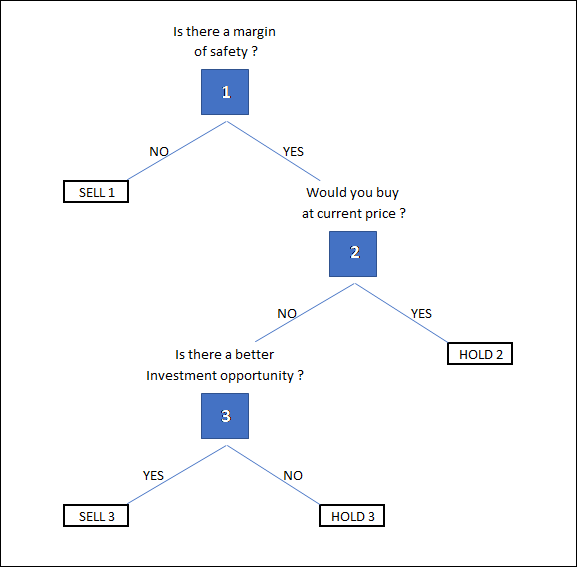

This decision framework assumed that the current market is lower than the purchase price. I would summarize the decision framework with the following decision tree.

You can see that there are 3 decision stages, 2 Sell positions and 2 Hold positions

Decision 1. When the price drops below your purchased cost, the first question you need to ask is whether your cost is still lower than the intrinsic value. This is especially if the price drop occurs after some major shock to the economy. You should review the intrinsic value to cater for the changing prospects.

Decision 2. If there is still a margin of safety, you should ask whether the business is a buying opportunity if you did not own any shares. You would analyse the business prospects as well as the downside risk. I have this step to avoid the various behavioural biases.

Decision 3. The reason to sell and crystalized the loss is that you think you can make better returns. But this is not guaranteed. You want to check that the returns from an alternative investment far outweigh the prospects of the stock turning around.

Sell 1. The sell decision is because the intrinsic value had declined to be below your purchased cost. From a value investment perspective, it would be tough for the price to rise above the intrinsic value.

Sell 3. The sell decision is because you are more likely to make money from the alternative investment than with the existing stock. This is even if the purchased cost for the current stock is lower than the intrinsic value.

Hold 2. You hold because this is still a good investment. The intrinsic value is still higher than the current market price. You have also checked that it is a rational decision ie, not one due to some behavioural bias.

Hold 3. While you would not buy more, you hold because it is still better than alternative investments.

Lennar Case Study

I will use Lennar to illustrate the thought process using this decision framework. For this case study, I will look at three scenarios based on the purchased price of Lennar:

- Scenario 1 – you had bought Lennar at USD 75 per share.

- Scenario 2 – you had bought Lennar at USD 95 per share.

- Scenario 3 – you had bought Lennar at USD 115 per share.

Stage 1

The first step is to update the estimates of intrinsic value. In my earlier article, I valued Lennar based on its performance over the Housing Starts cycle. It was based on the financial data till FYE 2021. Since the intrinsic values were estimated based on a “normalized” approach, the is no need to update the estimated values.

This would not be the case if the company was not a cyclical one or if there was some fundamental change to the business prospects.

In my earlier article, I have already provided the details on my valuation approach and assumptions. Refer to it if you want them.

I have two Earnings-based values of Lennar:

- An Earnings Power Value (EPV) of USD 85 per share.

- An Earnings with 4.3 % growth (EV with g) of USD 106 per share.

The next step is then to compare your purchased price with the updated intrinsic values. Refer to Table 1.

| Scenarios | Purchased price

(USD per share) |

Intrinsic value

EPV (USD per share) |

Intrinsic value

EV with g (USD per share) |

| Scenario 1 | 75 | 85 | 106 |

| Scenario 2 | 95 | 85 | 106 |

| Scenario 3 | 115 | 85 | 106 |

Table 1

Your decision will of course depend on your purchased price and the estimates of intrinsic value.

- Based on Scenario 1, there is a margin of safety under both the EPV and EV with g valuations. You would not sell and proceed to Stage 2.

- Under Scenario 3, you would sell as there is no margin of safety. You made a mistake when you first bought it.

- Under Scenario 2, you would sell if you relied on the EPV as the estimate of intrinsic value. However, if you accept the EV with g estimate of USD 106 per share, you would proceed to Stage 2.

As can be seen, the decision hinges on your estimates of the intrinsic value. The objective of this article is to share my decision framework so I would not debate the computation of intrinsic value.

But if you had bought Lennar at USD 115 per share or higher, I would suggest that you relook at your valuation. You are challenging the current “wisdom of the crowd” and you have to be sure that you are right if you believed that it is worth more than USD 115 per share.

Stage 2.

I am a strong believer that investing success is due to a combination of investing knowledge and behaviour. We all know the various behavioural issues – confirmation bias, overconfidence and framing bias to name a few.

The goal of this Stage is to check for such biases. One way to do this is to look at what others have done. I read other analysts’ reports. I scan sites like ValueWalk for other opinions.

There are two issues to consider here when looking at such reports – the business prospects and the financial risks.

The US Housing Starts in July 2022 were reported to be 8.1 % below the July 2021 rate. The debate then is whether this confirms the downtrend in the current Housing Starts or whether this is just volatility. In other words, the uptrend in the Housing Starts that began in 2010/11 is still intact.

But in the case of Lennar, I do not see any fundamental changes to its long-term business prospects or financial position since my Dec 2021 article. I have taken the view then that it is a cyclical business and expected the Housing Starts to eventually decline. I had already accounted for the decline in my analysis and valuation.

Any debate on whether the drop in price was market sentiments driven rather than a change in the business prospects is thus not relevant here. As such, I would buy more Lennar shares at the current price. The decisions for the various Scenarios are:

- For Scenario 1, the decision is to hold.

- For Scenario 2, the decision to hold or sell is dependent on your view of the intrinsic value.

- For Scenario 3, you would have sold under Stage 1.

If the business prospects had deteriorated or if the company was not financially strong, you would proceed to Stage 3.

Stage 3.

While Stage 2 is to check against behavioural biases, Stage 3 is a cut-loss analysis.

You reach Stage 3 because there were doubts about your analysis or valuation. In the case of Lennar, this is the situation for Scenario 2 with the purchase price of USD 95. You would hold based on one view of the intrinsic value and sell based on another.

For Stage 3, you want to see whether it is better to cut loss and recoup it via another investment or to continue to hold. It is obvious that the option to hold or sell depends on your purchase price and what you can achieve with alternative investments.

When looking at the gain from alternative investments, I suggest that you look at your stock portfolio return as the reference. This is because you do not know how a particular stock will perform and picking the wrong stock as a reference may lead to a wrong decision.

Let me illustrate this for Lennar’s Scenario 2. Assume that your stock portfolio has historically achieved a compounded 10 % per annum total return. On a per-share basis, we have:

- Current market price = USD 85.

- Portfolio gain over the next 5 years at 10 % CAGR = 61 %. Based on USD 85, this 61 % gain = USD 52.

- But you would incur a loss of USD 10 (current price of USD 85 minus purchase price of USD 95) by selling Lennar to buy the alternative.

- So, the net gain is USD 52 – USD 10 = USD 42.

- To break even by holding onto Lennar, its price in 5 years must be USD 85 + USD 42 = USD 127.

If you are confident that in 5 years the market price of Lennar would reach USD 127 per share, then you would hold onto the share. If you do not think that the price will reach this level, then you should sell now and reinvest the money into another undervalued stock.

This USD 127 per share is very much higher than the EV with g of USD 106 per share. As such I would exit.

You can see that this decision would depend very much on when you undertake the analysis. At some price points, you would hold. At some price points, you would exit. That is why I regularly review the stock position.

Conclusion

When you buy a stock, there is no guarantee that the price will go up. There may be a large drop in price after you have bought it. I hope that if you ever meet such a situation, instead of reacting emotionally, you can use my framework to think it through.

It is of course a value investing framework where the comparison between price and intrinsic value is still core. Also, it addresses the various behavioural biases and opportunity costs when deciding whether to hold or exit.

If you are trading based on buying and selling pieces of paper, this is not the framework for you.

I also hope that this case study of Lennar has illustrated the nuances. This is not to suggest that this is a mechanical decision process. There are still judgement calls to make. But I hope that it provides a consistent basis to decide what to do.

The decision framework is not without its weaknesses.

- Stages 1 and 2 are dependent on how you determine the intrinsic values.

- Stage 3 requires you to determine the return from the alternative investments.

- The decision would be different depending on when you carry out such an analysis. This affects the price vs intrinsic value assessment as well as the Stage 3 comparison.

The framework assumes that you follow the Stages sequentially ie you reach Stage 3 only after going through Stages 1 and 2. It is not meant for Stage 3 to be independent of Stages 1 and 2. Similarly, you do not jump to Stage 2 without going through Stage 1.

I am very sure that all investors would have faced this hold or exit situation. I hope I have provided a useful framework. If you have a different approach, I would be very interested to hear from you.

Editor’s Note: The article is from H.C. Eu who blogs at Investing for Value. He is a self-taught value investor and has been investing in Bursa Malaysia and SGX companies for more than 15 years. He has recently published a value investing book “Do you really want to master value investing” on Amazon. This is going to be available for free download on 13 Sept 2022, Pacific Date Time.