An international money transfer is the simple act of sending money between people and financial accounts in different countries, often in a different currency. The traditional way to send money internationally has been through your bank or a dedicated money transfer company. However, in recent years several new services appeared, offering an easy way to send money overseas online or over a mobile app at a fraction of the cost that banks charge for your international money transfers.

With increasing global migration, the amount of money sent internationally has skyrocketed. In some countries, such as Tonga, Haiti and Lebanon, remittances (inflows from a money transfered home from family members working abroad) account for more than a third of their gross domestic product. The global remittance market size reached approximately $607.43 billion in 2023, according to a report by Expert Market Research. That market is projected to grow at a compound annual growth rate (CAGR) of 4% between 2024 and 2032.

It’s not just remittances, though. Globalization means that we need to send money to friends and family or to pay for products and services abroad frequently. There is a slew of new money transferring services that have disrupted banks’ hold on international money transfers. To help you pick the one that’s best for your needs we reviewed the most popular money transfer services. Here are five of the best money transfer platforms that we have found:

Top international money transfer platforms

Take a look at an overview of five of the top money transfer platforms that are available at relatively low rates and their unique features:

- Remitly: The money transfer platform is known for being user-friendly and for its diverse set of delivery options, including bank deposits, mobile wallets, cash pickup locations spread across a large network, and even home delivery in some areas.

- Wise: The platform is known for its upfront pricing and for the fact it doesn’t mark up exchange rates. It’s also one of the faster money-transfer services, often delivering money the same day it’s sent.

- XE: It provides senders with plenty of flexibility, including the abiity to send 65 currencies to more than 170 countries. On the other ends, it allows recipients to pick up their funds at a store or bank.

- Xoom: The company prides itself on delivering money transfers within minutes in most cases while allowing users to track their payments by email, text or directly through Xoom’s sit. It’s owned by PayPal, one of the world’s largest providers of digital payment services.

- MoneyGram: The company supports a large network of agent locations around the world, especially in countries where banks are few and far between. It’s a good option for people who need to send money to less-developed areas.

An in-depth look at the best ways to send money overseas

Let’s take a more detailed look at each of these platforms and what makes them worth checking out.

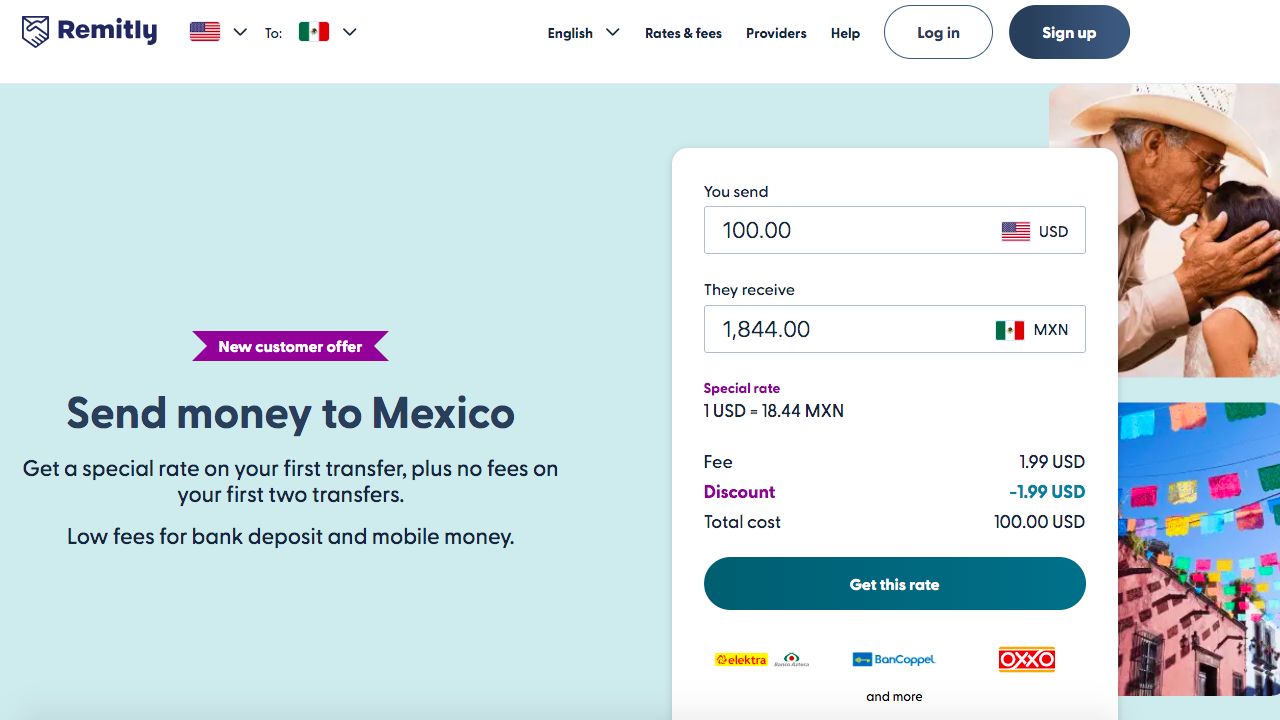

1. Remitly: Best money transfer for low fees

The Seattle company, founded in 2011, is the largest independent digital money transmitter in the US. On its first-quarter earnings call, it said it had 6.2 million quarterly active customers, 1.7 million more than in the same quarter last year. Remitly was founded as Beamit Mobile, a search engine for remittance services, but then moved into money transfers and changed its name to Remitly in 2012.

Its fees are relatively low and transparent, though they vary widely by country and where you send your money to. If you sent $1,000 to Mexico via Remitly, the recepient would get 18,380 pesos, not counting the $1.99 sender fee. As of July 1, a straight dollars-to-pesos conversion would mean $1,000 would be normally worth 18,400 pesos, going through Remitly would mean 20 fewer pesos for the recipient.

One unique option is users can transfer funds immediately for a fee that varies by country. There’s usually no extra fee to use the economy option, when the funds that are transferred take between 3 to 5 business days to reach the recipient.

Most customers who use Remitly do so from their phones, though the service can be accessed on a web browser. Remitly gets high marks for ease of use and for its customer service. Remitly is also scored high because recipients can get their funds at more than 3,000 banks and more than 350,000 pickup locations, and they can even get cash through mobile phone transfer or by home delivery.

Remitly features and fees

| Fees | The fee for all transactions varies by country, often it’s as low as $3.99. |

| Customer service | Phone in 15 languages or live chat in your choice of English, French, or Spanish. |

| International transfers | More than 100 currencies to more than 170 countries. |

| Maximum online transaction limits | $2,999 daily, $10,000 monthly, or up to $18,000 over a six-month period |

Pros

- Offers home delivery of transfers

- Fees are low and transparent

Cons

- High fees for transfers to certain countries

- Its mobile app supports only 14 languages

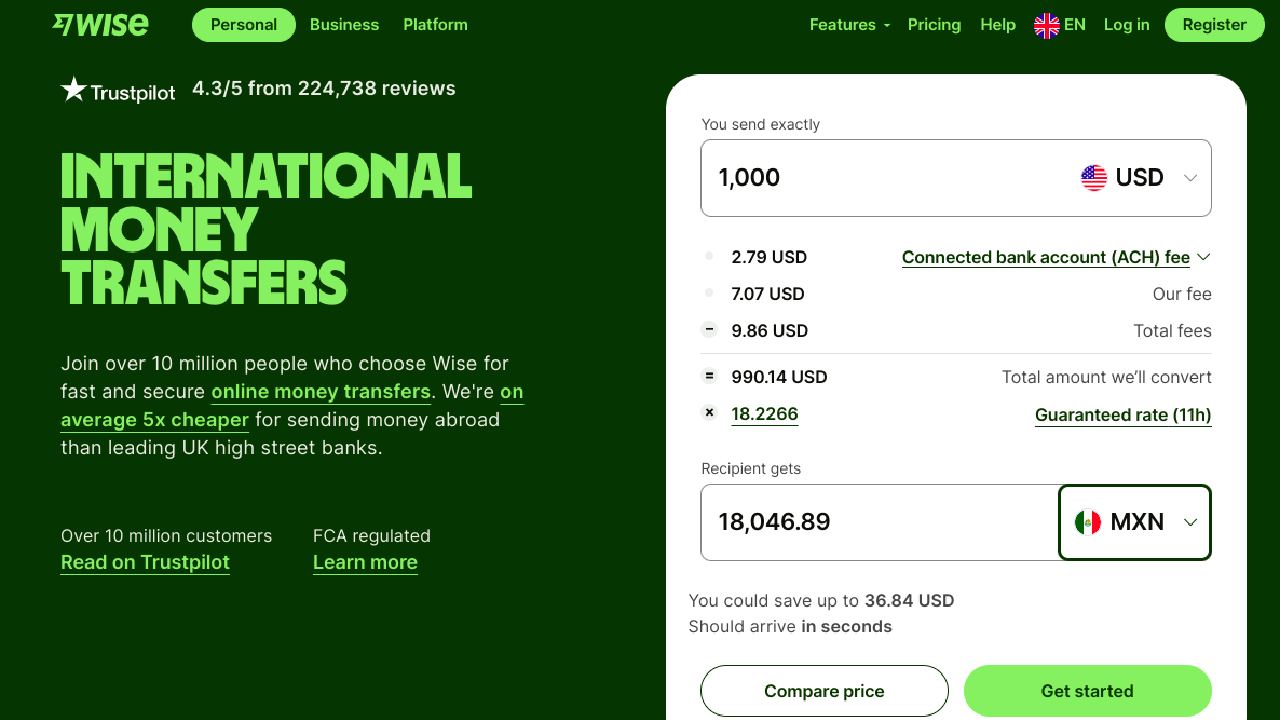

2. Wise: Best Money Transfer Service for Customer Service

Wise, founded as TransferWise in 2011, is based in London. The company said it processes more than £9 billion in international money transfers every month. It handles more than 40 currencies and can send payment to more than 160 countries. In fiscal 2024, it grew active customers by 29% to 12.8 million, according to its earnings report.

Fees for sending transfers vary and start at 0.33%, but the company helps make up for that by not marking up currency exchange rates. Wise also has a surprisingly deep education and news section for a money transfer site. If you sent $1,000 from the US to Mexico via Wise, your recipient would receive 18,195 pesos, a loss of 200 pesos compared to the conversion rate.

Over the past year, the company has said it plans to look for more ways to cut costs to consumers to make it more competitive, CFO Kingsley Kemish said. The company also plans to integrate its service with payment service SWIFT to improve its availability.

While Wise isn’t the least expensive service, it’s definitely fast, with 62% of end-to-end payments arriving within 20 seconds. It has more than 85 global partners with pay platforms, including Google Pay and Monzo.

Wise features and fees

| Fees | Varies by transaction amount, currency, and delivery method; fees for sending transfers start at 0.33%. |

| Customer service | Phone in 15 languages or live chat in your choice of English, French, or Spanish. |

| International transfers | More than 40 currencies to more than 160 countries |

| Maximum online transaction limits | $2,999 daily, $10,000 monthly, or up to $18,000 over a six-month period |

Pros

- Fees are transparent before making a transaction

- It’s able to transmit money quickly and safely

Cons

- Its transfer fees are higher than many competitors

- Its mobile app supports only 15 languages

- No options for delivery of cash

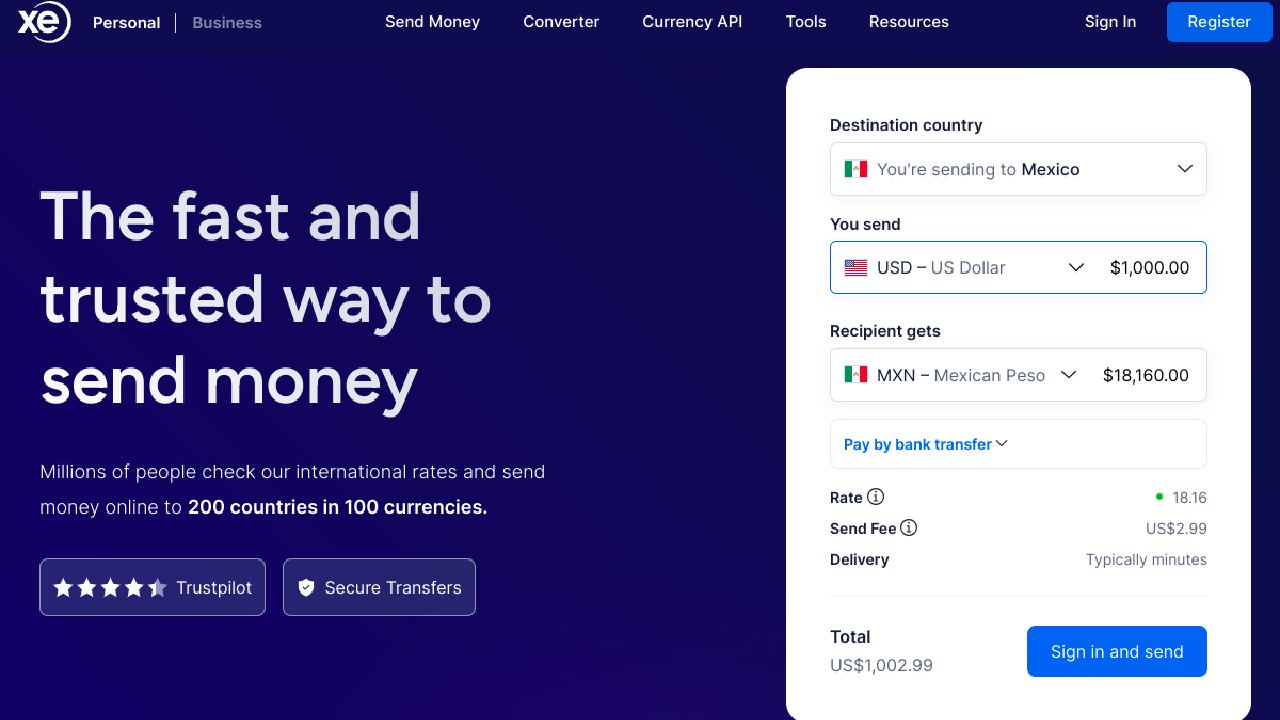

3. XE: Solid money transfer service for security

Based on the standards of Internet currency exchange rate providers, XE has been around for a long time, being established in 1993 in Ontario, then known as Xenon Laboratories. At the time, the company focused on computer consulting and internet services. Beginning in 2000, it turned its focus to currency and foreign exchange tools. Today, it’s part of Euronet Worldwide (along with HiFx and Ria), which is the third-largest money transfer business in the world. That gives it a higher level of security and stability and it generally gets high trust marks from consumers.

XE allows you to make money transfers internationally 24/7 through its website or mobile app. It allows the transfer of more than 98 currencies to more than 130 countries. It doesn’t charge fees if you do a direct transfer but makes its money from the spread on the currency rate. If you were to send $1,000 to Mexico via XE, the recipient would get only 18,160 pesos, a loss of 240 pesos, after the spread is taken into account.

Also, XE is only fee-free if you send money through a direct wire transfer, and the transfer will take up to three days. XE charges a send fee of $5 for a transfer paid for by debit card and a $30 send fee if you pay with a credit card. Generally, if you send money via XE, the recipient will still get more of what you sent than if you do the money transfer by a traditional bank.

XE features and fees

| Fees | Fees are built into the spread for wire or bank transfers. There is a $5 send fee for a transfer via a debit card and a $30 send fee for a transfer sent with a credit card. |

| International transfers | More than 98 currencies to more than 130 countries. |

| Customer service | Web chat, plus phone service in the US |

| Maximum online transfer limits | $535,000 |

Pros

- Plenty of currency options

- No fees for wire or bank transfers

- Has a feature to show current currency mid-market rates

Cons

- Exchange rates include a big markup

- No options for cash pay in or pay out

- Transfer fees apply when you pay by card

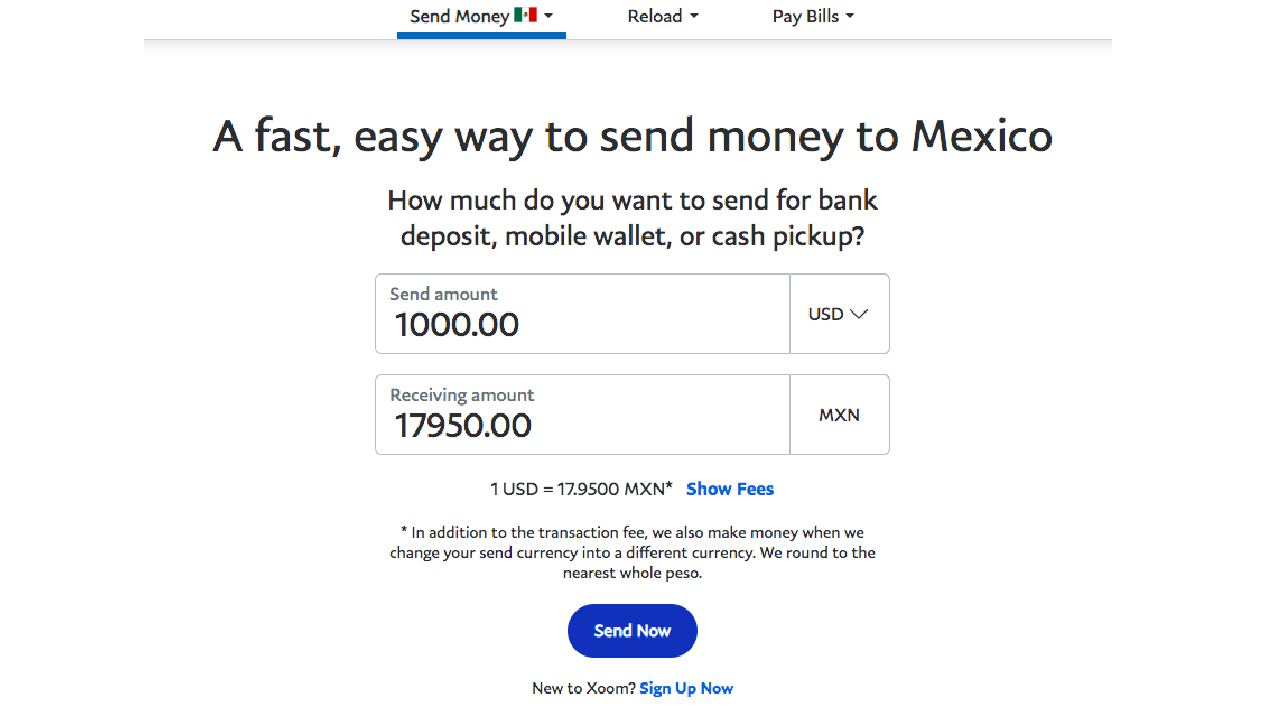

4. Xoom: Best money transfer service for speed

Xoom was founded in 2001 and its headquarters is in San Francisco. In 2015, it was bought by PayPal. Xoom is a service that allows users to send money, pay bills, and reload phones to friends and family in more than 160 countries. Xoom offers a variety of options, including: cash for pickup or delivery, direct deposit to a bank account or debit card, and mobile wallets. It recently added the ability for US users to send money via PayPal stablecoins with no no crypto sale fee.

To use Xoom, you have to register for an account and download its mobile app. Money transfers can be funded by debit or credit cards, a bank account or PayPal balance. You can also track the progress of your transfer within the app and can get email updates on when the transfer goes through.

Xoom is trusted, but its services are a bit pricey. For example, if you were to send $1,000 to Mexico using Xoom, the recepient would get only 18,068 pesos, a loss of 332 pesos, and that doesn’t include the fee for the overall transfer. However, it’s often the top option if speed is of the essence, with same-day service available to many countries. Xoom is relatively flexible, as recipients of transfers can receive their payment in cash and users can pay bills through the app.

Xoom features and fees

| Fees | A $4.99 fee, plus the spread for wire or bank transfers. There is a $30.49 send fee for a transfer via a debit card or with a credit card. If your transfer requests a cash pickup, there is a $4.99 fee if done through your PayPal account or $20.49 fee if done by credit card or debit card. |

| Customer service | Phone or email. |

| International transfers | More than 27 currencies to more than 130 countries. |

| Maximum online transaction limits | Xoom has three account levels, with daily limits of $2,999, $10,000, and $50,000, respectively. |

Pros

- A big number of countries where transfers are allowed

- The ability to do cash pickup

- Fast, secure transfers

- Recipients don’t need to use the Xoom app

Cons

- Exchange rates include a markup

- High transfer fees apply when you pay by card

- No live chat support

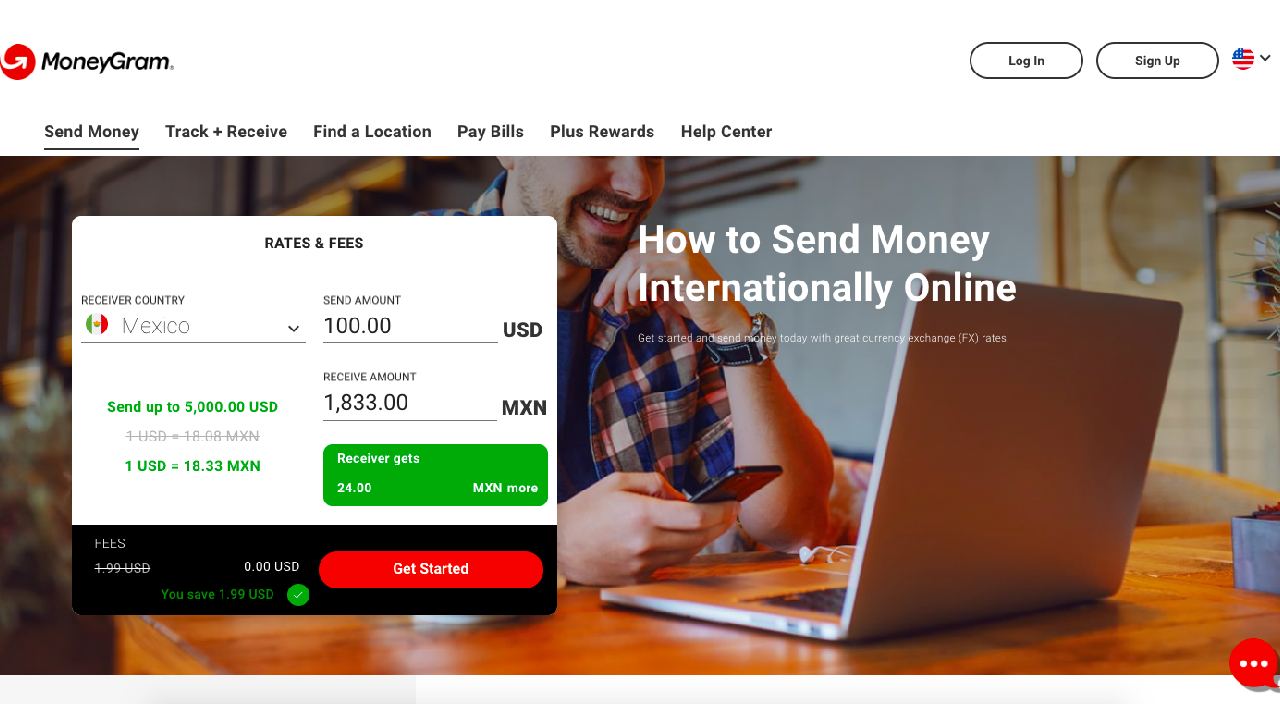

5. MoneyGram: Best money transfer company for ease of use

MoneyGram, headquartered in Dallas, Texas, is the second-largest money transfer company in the world behind Western Union. It was founded in 1940, making it one of the oldest companies in money transfers. The company said it processes more than $200 billion every year in transfers.

MoneyGram’s biggest advantage is its user-friendly service where funds can be sent 24/7, using cash at certain locations, as well as online by credit card, debit card or by bank accounts.

While MoneyGram is considered secure, it did have to pay out more than $115 million to users who were scammed connected with fraud schemes processed by MoneyGram.

MoneyGram will allow users to send funds in more than 135 currencies to more than 200 countries. The downside of MoneyGram is its fees are higher than what many other services charge. For example, it costs a flat $1.99 fee to transfer funds by a bank account, debit card or credit card, regardless of the amount sent. On the other end, if the recipient wishes to be paid in cash, the fee rises to $5.99 if the money being sent is from a bank account, or $13.99 if being sent by debit card or credit card.

The company also charges relatively high costs on its spreads on exchange rates. For example, if you sent $1,000 to Mexico via MoneyGram, the recipient would only get 18,116 pesos, a loss of 284 pesos.

Despite the costs, the big advantage for MoneyGram is it isn’t just an online business. It has more than 400,000 locations around the world, either operated by a business agent or directly by MoneyGram.

MoneyGram features and fees

| Fees | The fees MoneyGram charges to send money overseas varies based on where you’re sending money, how much money you send, and how you’re paying for the transfer. The markup on exchange rates can also be as high as 5%, which is more than many banks. |

| Customer service | Phone or email |

| International transfers | More than 135 currencies to more than 200 countries |

| Maximum online transaction limits | For most countries, you can send up to $10,000.00 per online transfer, and up to $10,000.00 every 30 calendar days |

Pros

- A large number of countries where transfers are allowed

- Fees are transparent before the transactions

- Well-established company with reliable customer service

Cons

- Exchange rates include a large markup

- No live chat support

How to send money internationally

Most banks or money transfer companies follow similar procedures in helping you send money internationally.

- Create an account and sign in: Once you choose a money transfer system, create an account using your ID, whether that be a passport or driver’s license.

- Identify your recipient: Once you sign into your money transfer account’s app, enter the name and banking details of the recipient of your money transfer. In some cases, this might mean the recipient’s name, address, bank account number, and bank’s SWIFT BIC. Some services may also require the recipient’s account type as well. Make sure your recipient’s name will make his or her ID exactly. Choose the location where your recipient will pick up the money.

- Pay for your transfer: Choose how much money to send and in what currency you are sending. Then pay for your transfer with a direct transfer from your bank or with a credit and debit card. Depending on which money transfer service you are using, your payment source will make a difference on the fees. Usually paying for a transfer using your bank account is the least expensive option.

- Track your transfer: Most apps enable you to track your money transfer’s status, along with expected delivery time and date.

How to choose the best way to transfer money overseas

While the way you transfer money overseas will probably come down to costs, figuring out the best way or service to use isn’t always simple. A few things to look for:

Understand the fees: Compare companies transfer fees and exchange rates. They vary wildly depending on how you send the money and where you send the money to. Most reputable apps will allow you to see exactly how much money your recipient will receive after the fees and exchange rates are taken into account. After you have looked around, pick the service that meets your needs best.

Continue to shop around: Companies change fees and exchange rates so frequently that you’ll need to do comparison shopping each time you decide to do an international money transfer.

Our methodology, explained

We looked for five of the best money transfer companies in terms of costs, taking into account both fees and the rates they provide for converting currencies. For consistency, we looked at how much each service would deliver to a recipient if someone from the UK sent the recipient £1,000. However, the money transfer service’s fees vary widely depending on how much is sent, how it’s sent and where it’s sent. For that reason, you’ll need to follow up with your own research.

Other factors we considered were security, ease of use and which services had the most options, both for sending and receiving money.

International Money Transfer FAQs

What is the least expensive way to transfer money internationally?

The answer may depend on where you are sending from and where you are sending to. However, generally money transfer services charge lower fees and have better exchange rates than banks. Also, if you pay for the money transfer by a direct wire from your bank account, instead of using a debit card or credit card, it will be less expensive.

How long does an international money transfer take?

An international money transfer typically takes anywhere from one to five business days to reach the recipient’s account. Money transfer apps such as Xoom and Wise are often much faster, but with an added cost compared to other money transfer platforms, such as MoneyGram, Remitly or XE.

How can I send money internationally without fees?

The short answer is you can’t. Every service involves some cost, even if it’s hidden. A few things to keep in mind: Some services with lower base fees might be better for smaller transfers while larger transfers might benefit from services with better exchange rates. You can save money if you are transferring using a money transfer service while paying for the funds directly from your bank account. If you pay by debit card or credit card, the fees tend to go up.

What is the best international money transfer app?

Of the apps we tested, Remitly scored highest on costs and also scored high for its customer service options.

References

Remitly first-quarter earnings report

Wise full-year results presentation