With inflation easing and interest rates likely to be cut, the Financial Times Stock Exchange reached new highs in April, proving that 2024 could be the perfect time to enter the market and invest in stocks.

But for new and inexperienced investors, the wealth of options can be overwhelming. Should you bet on an unproven but potentially lucrative newcomer like MicroSalt, a tried and tested large-cap stock like Apple, or a trending growth stock like Nvidia?

We’ll attempt to demystify this below, running through our picks of the best UK stocks to buy in 2024.

Our selections for the top UK stocks in 2024

Here is a quick overview of our recommendations for the best UK stocks to buy now. Our picks include a diverse range of options, from promising newcomers to market mainstays.

- Rolls-Royce Holdings (RR): One of the strongest performers on the FTSE of late, Rolls Royce went from nearing bankruptcy in 2020 to adding 167% to its value in the past 12 months.

- Marks and Spencer Group (MKS): MKS’ growth has faltered in 2024 after several years of exceptional growth. However, this could provide a great entry point for investors, with the firm currently staging an ambitious turnaround plan.

- Barclays (BARC): Barclays stock has rebounded dramatically in recent months. The bank’s share price hit a 52-week low of 128p in October 2023, but now sits 50% higher at 191p.

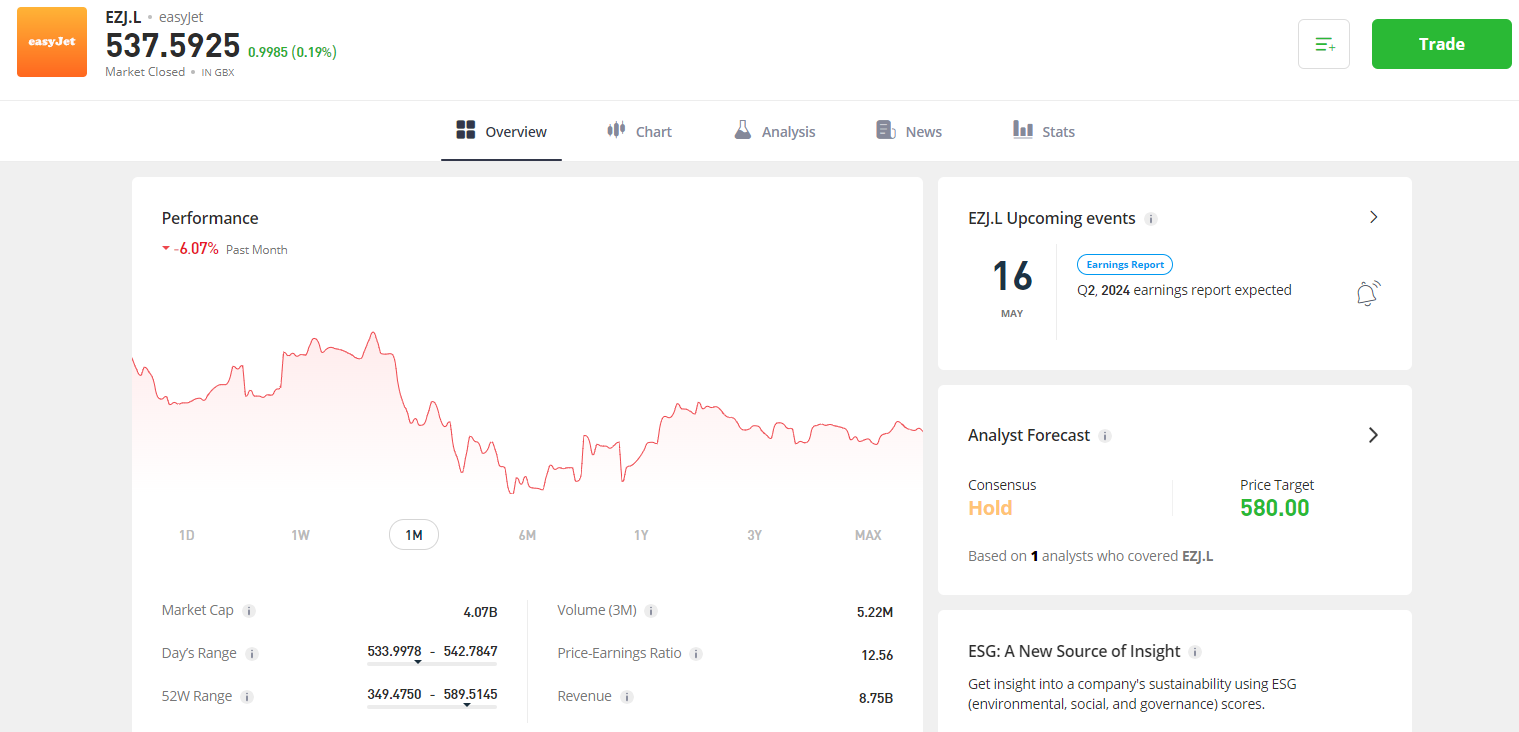

- easyJet (EZJ): Things are looking up for easyJet after the airline posted £50m lower-than-expected winter losses during the 2024 financial year. The firm’s growth and revenues are also up across the board.

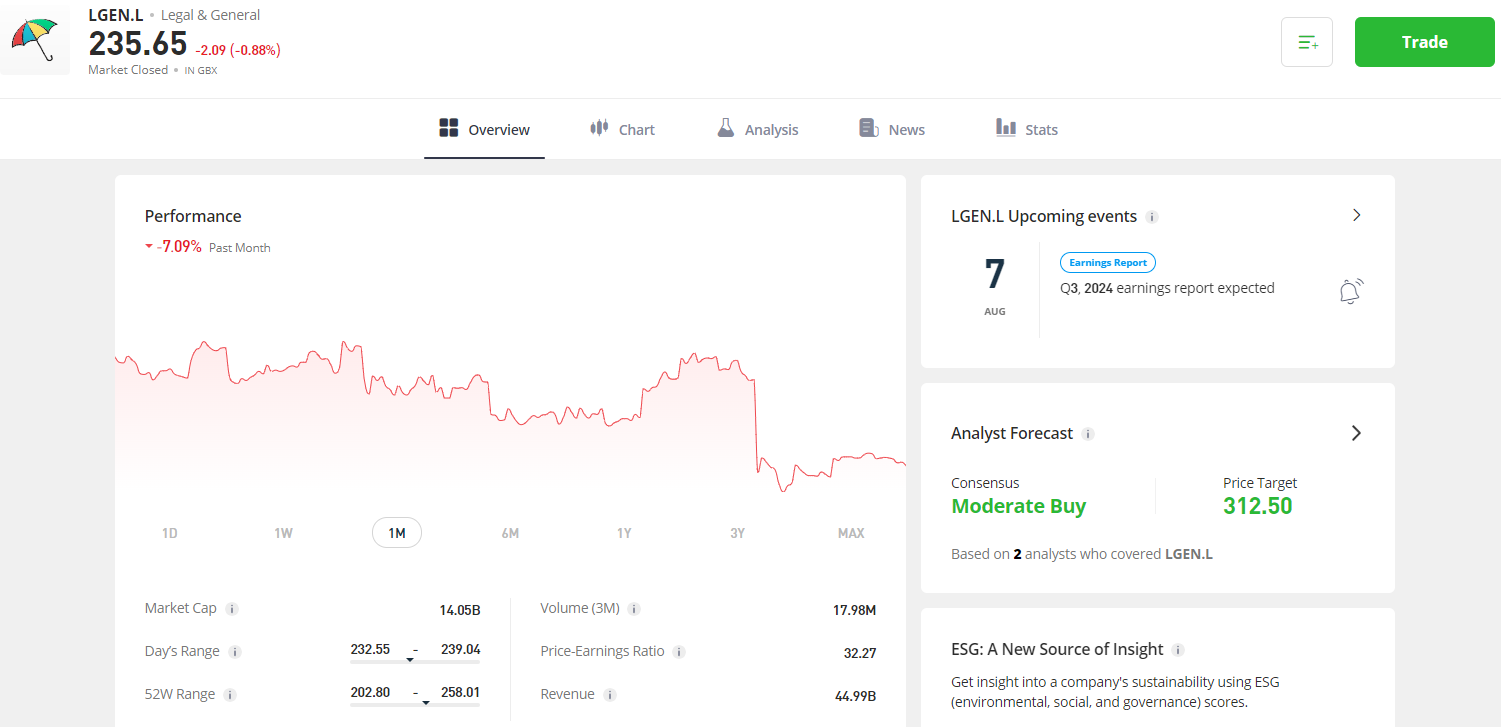

- Legal & General (LGEN): With a history of modest but steady growth, a price-to-earnings ratio far below the market average, and a high dividend yield, LGEN could be a great all-rounder for any portfolio.

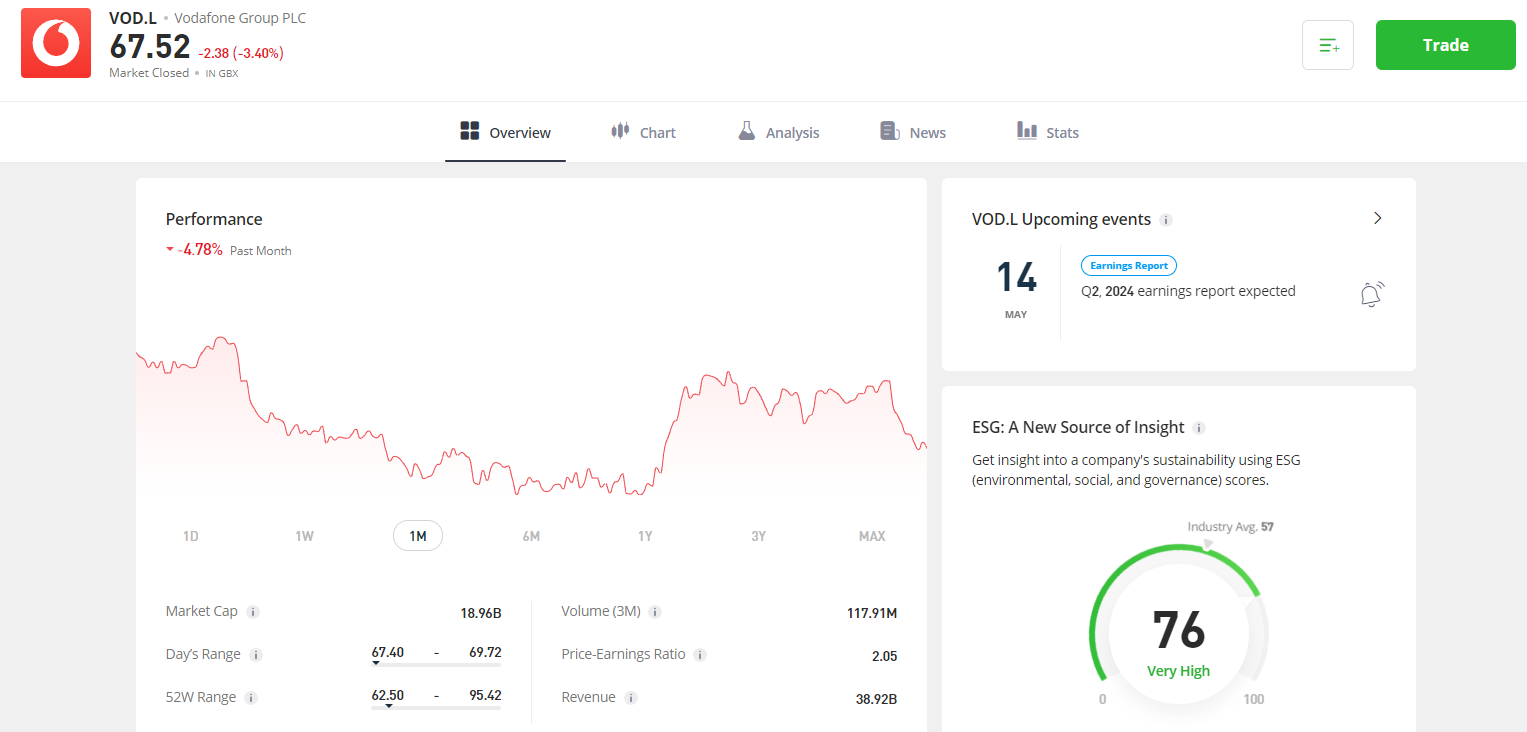

- Vodafone (VOD): Despite relentlessly shedding value in recent years, a double-digit dividend yield and a 21% share buyback could make Vodafone stock a steal in 2024.

- Ocado (OCDO): Down more than 60% from its 2023 high, now could be a great time to buy Ocado stock, with recent figures cementing the firm as the UK’s fastest-growing grocer.

A closer look at the best UK stocks to watch in 2024

Here is a closer look at our picks for the 7 best UK stocks to buy now, with a deeper analysis of revenues, company activity, and wider market trends.

All stock data on this page was taken from eToro’s in-built charting and analysis tools

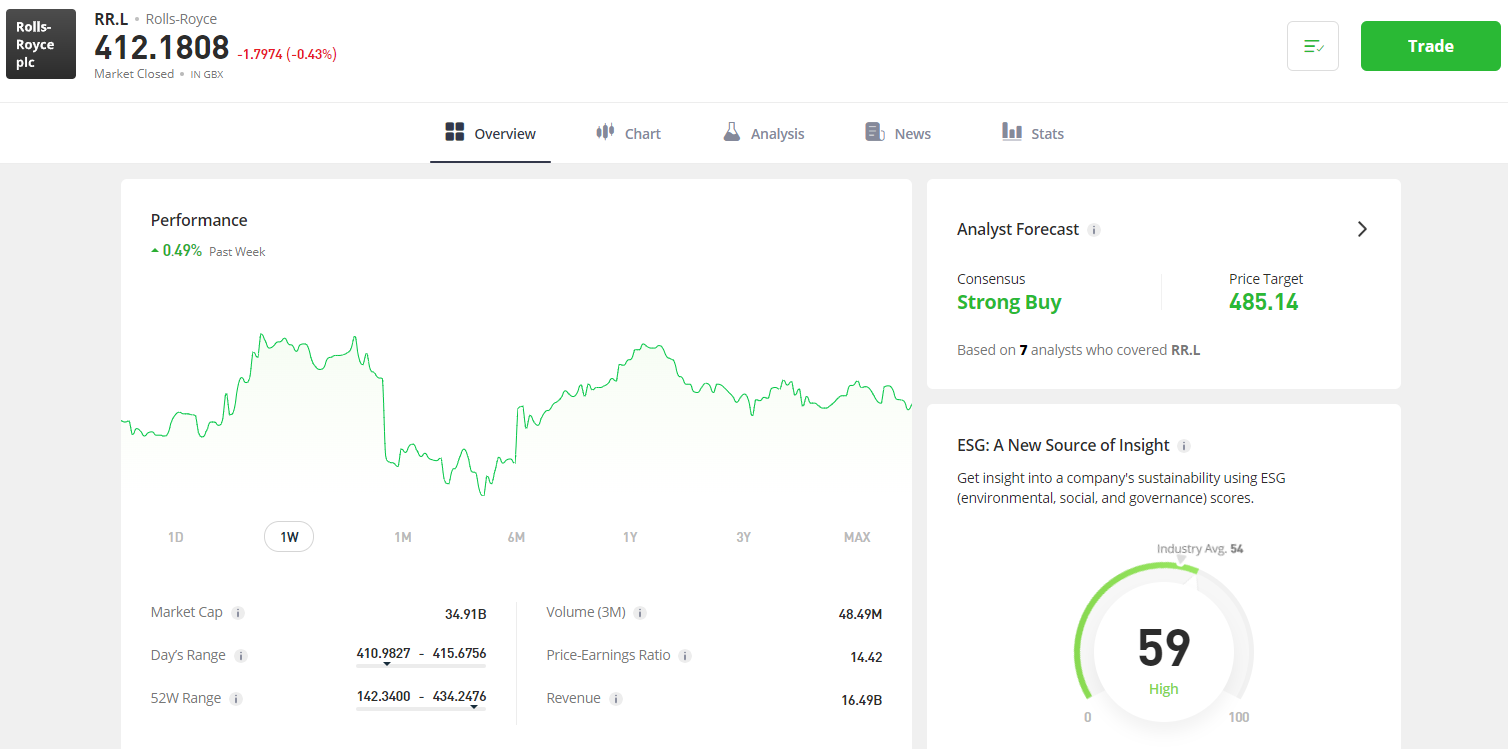

1. Rolls-Royce Holdings (RR): A FTSE high-flyer with the potential for more growth

Comfortably among the top UK stocks by trading volume, Rolls-Royce has enjoyed an incredible stock market run of late, with its share price up by nearly 300% since April 2021.

This growth rate has only increased in 2024, with the firm revealing in February that its underlying profits for 2023 had jumped by £938 million. The news sparked an 9% value increase overnight, with the share price later hitting its highest price in over a decade at £4.35.

Despite stagnating slightly in April, there could be further growth on the horizon for RR stock. The conflict in Ukraine and an increase in defense spending, for instance, is driving market demand. Similarly, the firm saw an uptick in demand for its engines in 2023 – a trend that is likely to persist in 2024.

Moreover, Rolls-Royce’s price-to-earnings ratio is by far the lowest of its market peers at just 13. This could be a strong indicator that the stock is undervalued.

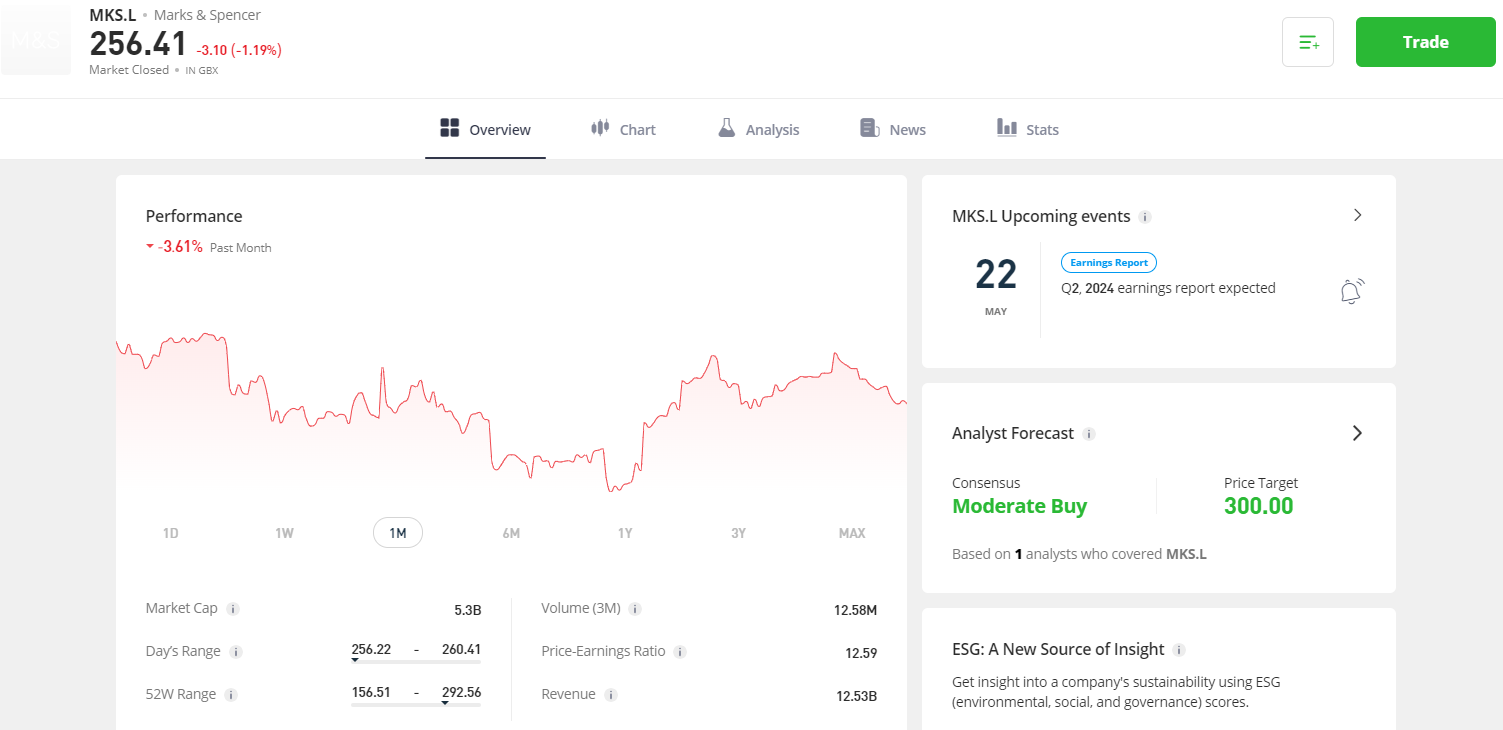

2. Marks and Spencer Group (MKS): Potentially on the upturn after a turbulent period

It’s been a bumpy ride for Marks and Spencer shareholders over the past decade. The stock has enjoyed a series of impressive runs, but ultimately failed to establish sustained growth.

Most recently, after hitting close to an all-time low in October 2022, the retailer saw a subsequent run of good fortune. Owing to strong sales momentum in its grocery and clothing divisions, the company enjoyed a 200% uptick in value over the following 15 months, peaking in January 2024.

As trading conditions and wage increases threaten future growth, momentum has once again been lost, with share prices down 10% from the January peak.

However, this could provide the ideal entry point for investors, with the firm currently staging a fresh plan to capture a further 1% of the UK’s food and grocery market share by 2028, in addition to attaining food margins of more than 4%.

So far, this appears to be going to plan, with the company not just raising prices in line with inflation, but actually selling more, with a 4.6% uptick in online sales in the six months to September 2023.

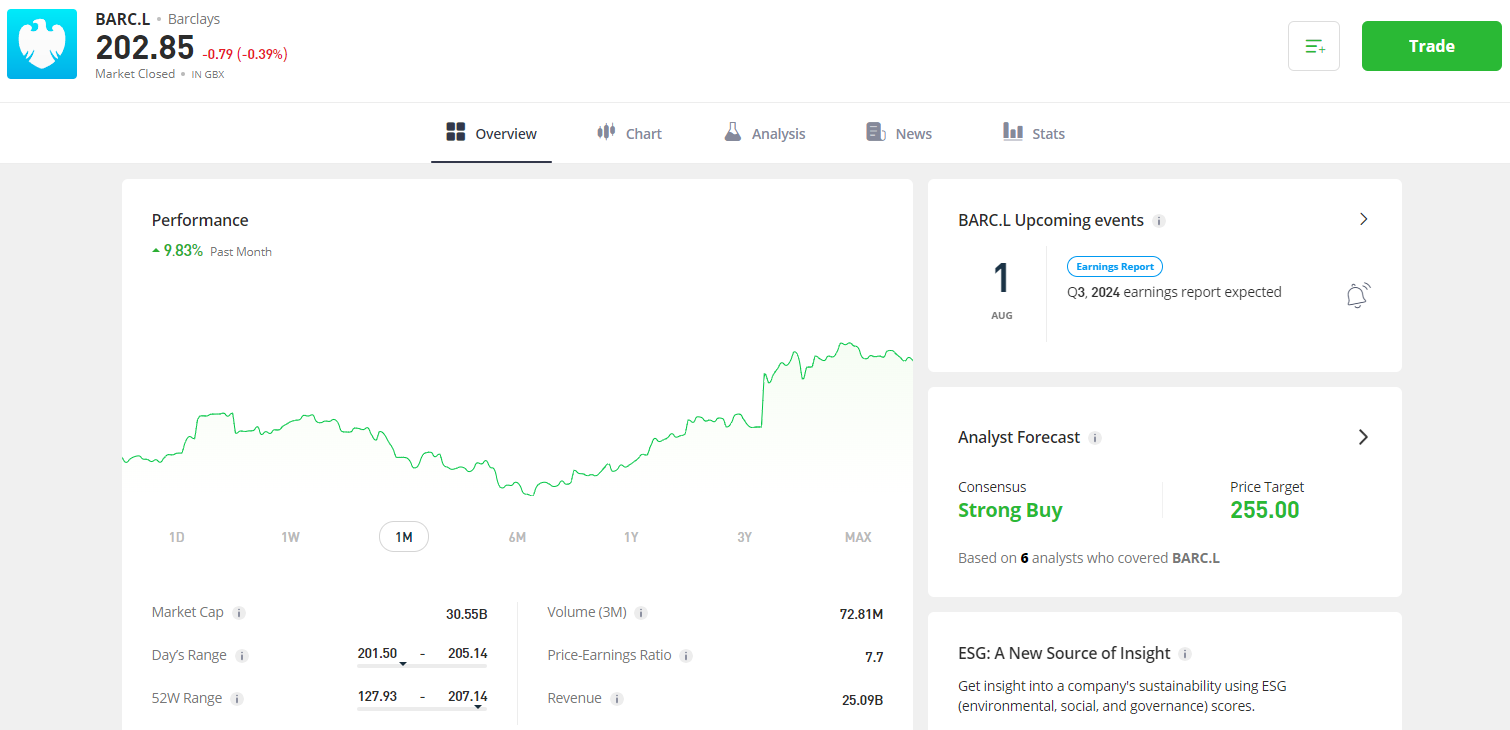

3. Barclays (BARC): Severely undervalued with a generous dividend yield

Barclays stock has been thriving in 2024, emphatically outperforming the FTSE100 with a value increase of more than a quarter since the turn of the year.

Crucially, this run of good fortune represents a major rebound, with the high street bank’s share price hitting a 52-week low of 128p in October 2023. Now hovering around the 192p mark, the firm’s stock has risen by more than 50% during this six-month period.

Even if you’ve missed the boat on this run, investing in Barclays may still be a smart move. This is primarily due to valuation, with the stock’s price-to-earnings ratio sitting around the 7% mark, and forecasts suggesting it could drop as low as 6.4 in 2024 and 4.2 by 2026.

This, in the grand scheme, is remarkably good value for investors, although the bank’s forthcoming Q1 2024 earnings report will add vital context.

Moreover, the firm offers a dividend yield of more than 4%, which is anticipated to reach 5.5% in 2026. This, combined with the potential for ROI, could make the stock highly attractive in 2024.

4. easyJet (EZJ): Staging an emphatic post-pandemic recovery

As with all airlines, easyJet has had a tough ride due to the pandemic, with its share price halving in the five years to April 2024.

However, as of November 2023, things have started to look up, with the firm’s full-year figures showing a £455 million pre-tax profit versus a £178 million loss the year prior. The figures triggered a stock market run, with share prices up by close to 30% since.

This good fortune looks set to continue, with the company announcing in April 2024 that its winter losses fell £50 million short of the previous year. The airline also revealed an 8% rise in passenger numbers, a 9% rise in ticket yields, and 206% more pre-tax profit from its holidays business line.

easyJet’s share price jumped by close to 4% overnight in response to the news – a strong indicator of its significance.

With at least 35% of further customer growth expected by the end of the current financial year, 2024 could be an excellent time to get onboard with easyJet.

5. Legal & General (LGEN): Steady growth and great value

Another of the FTSE100’s most popular stocks, financial services firm Legal & General, looks to be offering outstanding value to investors in 2024.

While the global financial uncertainty of recent years has often proved troublesome for financial services firms, LGEN has recovered strongly, with steady share price growth of more than 20% in the six months to April 2024.

This can be partly attributed to the firm’s 2023 financials, which show 10% growth in its retirement division.

Beyond this, the firm’s financial performance was rather average, but share prices have remained relatively stable regardless. This may be because the firm promised a “fresh perspective” following the results, assuring investors its five-year growth plan is still on track.

Moreover, and perhaps most importantly, LGEN stock still looks to be offering great value, with its price-to-earnings ratio around 30% lower than the market average, and an attractive 8% dividend yield to match.

6. Vodafone (VOD): Potentially set for growth after a poor run

Vodafone’s inclusion in this list may be puzzling to some, as the telecommunications giant’s value has more than halved during the past five years. However, this could be a classic case of buying the dip, with good fortunes potentially on the horizon for the stock.

One noteworthy point is the firm’s dividend scheme. At 11.4%, with poor financial performance, it was evidently unsustainable for the firm. While the full amount will be paid to shareholders this year, it will be halved in 2025, potentially pointing to more sustainable growth.

A restructuring is also on the horizon for the company, with CEO Margherita della Valle having ended the firm’s Italian and Spanish enterprises in a bid to operate strictly in growing markets. The total cash proceeds from the move are expected to be around £10 billion.

In addition to improving cashflow, the sale also acted as a catalyst for a £3.4 billion share buyback – another boost for shareholders and prospective investors.

Taking these factors into account, the future could be bright for Vodafone stock, with 2024 posing a great opportunity for investors to get ahead of the curve.

7. Ocado (OCDO): Volatile history could be offset by NYSE switch

Ocado has had a rough ride lately, with the stock shedding more than 60% of its value between 2021 and 2024.

This poor performance has continued into 2024. Despite a small uptick in December 2023, the grocer’s stock has fallen by a further 50% since the turn of the year. Its market cap is now at £3 billion, down from £22 billion in September 2020.

However, as with Vodafone, this extreme dip could pose an opportunity for investors.

It’s worth noting that, in a bid to boost its financial prospects, the retailer is facing increasing pressure from investors to switch from the FTSE to the New York Stock Exchange. While dealing a blow to the UK stock market, the move would likely be favourable for Ocado.

The firm’s full-year 2023 financial results may also be a source of optimism. Announced in February 2024, the report showed a pre-tax loss of £403.2 million – ahead of the forecasted £410 million, and down significantly from 2022’s £500 million.

Along with the results, the firm’s CEO, Tim Steiner, said he was confident of “faster growth, stronger cash flows, and higher returns” in 2024 and beyond.

Best UK stocks to buy now comparison table

| Stock | Current price (£) | 1M (%) | 6M (%) | 1Y (%) | P/E ratio (%) | Dividend (%) |

| RR | 4.15 | -1 | +104.7 | +172.1 | 14.5 | N/A |

| MKS | 2.57 | +3.6 | +20 | +56.4 | 12.8 | 0.4 |

| BARC | 1.90 | +4.9 | +43.4 | +25.8 | 7 | 4.2 |

| EZJ | 5.34 | -1.6 | +45.6 | +8.5 | 12.7 | 0.84 |

| LGEN | 2.50 | -1.73 | +21.3 | -0.7 | 34.4 | 8.1 |

| VOD | 0.86 | -0.1 | -4.9 | -23.5 | 2.1 | 11.4 |

| OCDO | 3.66 | -20.1 | -19.4 | -28% | 9.8 | N/A |

Methodology

Our panel spend several hours researching each product, developing a deep understanding of its features, utility, and pros and cons.

While our panel is comprised mostly of seasoned financial experts, some have little to no expertise in the area. This provides us with a wide range of perspectives, ensuring our verdicts are objective.

FAQs

What are the safest stocks to invest in UK?

Dividend stocks are generally considered safer than growth stocks as they are typically less volatile and offer guaranteed returns. From the list above, Legal & General and Barclays are great options for dividend-paying stocks.

What is a hot stock right now?

Rolls–Royce is an exceptionally popular stock right now, with the second-highest trading volume on the FTSE. This is likely due to its sustained growth and healthy future prospects.

Which stock is good to buy now?

Aside from Rolls-Royce, Vodafone could be an excellent stock option in 2024. While slightly riskier, the recent poor performance could provide a great entry point. The firm is also showing positive signs for the future.