The importance of selecting the best trading platform for an individual investor is often overlooked. There are so many new trading platforms available in the UK for traders based in the country that it makes sense to look at each one’s pros and cons before choosing one for trading and investing.

Different trading platforms cater to various trader and investor types. Beginners might need a user-friendly interface with educational resources, while experienced traders might prioritise advanced research tools and charting capabilities. Aligning the platform’s features with your goals fosters informed decision-making and a smoother trading experience.

Depending on how you invest or trade, the trading fees and procedures at each platform can make a big impact on the performance of your trading positions. We analysed 10 of the best UK trading platforms to help you decide which one works best for you.

-

- 1. eToro: Best trading platform for versatility

- Pros

- Cons

- 2. XTB: Simplicity, speed for experienced investors

- Pros

- Cons

- 3. AvaTrade: Big advantages for large-scale investors

- Pros

- Cons

- 4. Pepperstone: Simple platform; comparative analysis tool

- Pros

- Cons

- 5. Trade Nation: Ideal for experienced margin traders

- Pros

- Cons

- 6. AJ Bell: Solid platform for inexperienced traders

- Pros

- Cons

- 7. IG: Big advantages for large-scale investors

- Pros

- Cons

- 8. IUX.com: Low trading costs, efficient trading times

- Pros

- Cons

- 9. Prime XBT: Focus on crypto; advanced trading tools

- Pros

- Cons

- 10. Trading 212: Best UK stock trading platform for passive income

- Pros

- Cons

- How do these UK stocks platforms stack up?

-

- 1. eToro: Best trading platform for versatility

- Pros

- Cons

- 2. XTB: Simplicity, speed for experienced investors

- Pros

- Cons

- 3. AvaTrade: Big advantages for large-scale investors

- Pros

- Cons

- 4. Pepperstone: Simple platform; comparative analysis tool

- Pros

- Cons

- 5. Trade Nation: Ideal for experienced margin traders

- Pros

- Cons

- 6. AJ Bell: Solid platform for inexperienced traders

- Pros

- Cons

- 7. IG: Big advantages for large-scale investors

- Pros

- Cons

- 8. IUX.com: Low trading costs, efficient trading times

- Pros

- Cons

- 9. Prime XBT: Focus on crypto; advanced trading tools

- Pros

- Cons

- 10. Trading 212: Best UK stock trading platform for passive income

- Pros

- Cons

- How do these UK stocks platforms stack up?

- Show Full Guide

The UK’s top trading platforms, at a glance

A quick overview of the 10 platforms we are recommending to help you choose the one that suits your investing habits and experience.

- eToro: eToro is popular with beginner investors because it offers an intuitive mobile app and web platform, along with zero-commission trading on stocks and ETFs, copy trading, graph trading scenarios, and various educational tools.

- XTB: The platform is based in Warsaw, Poland, and has been around since 2002. It has more than 500,000 customers and offers more than 5,800 investment options, including more than 2,800 stocks. You can also trade commodities, indices and ETFs with XTB.

- Avatrade: The Dublin-based platform has more than 400,000 customers and allows trades in stocks, commodities, cryptocurrencies, foreign exchange (forex) and indices.

- Pepperstone: It was established in Melbourne, Australia, in 2010. The platform has more than 400,000 clients and offers contracts for difference (CFDs) stock trading, as well as trading in forex, cryptocurrencies, indices, metals, and commodities.

- Trade Nation: The London-based platform was founded in 2014. It focuses on CFDs for stocks and forex trading, including trading on more than 1,000 assets, but does not allow non-CFD stock trading.

- AJ Bell: The Manchester-based platform is one of the largest in the UK and was established in 1995. It’s also a FTSE 250 company and has more than 490,000 clients. It operates in the advised and direct-to-consumer (D2C) market segments.

- IG: The platform, based in London, was founded in 1974 and has more than 300,000 clients. It’s listed on the London Stock Exchange and is part of the mid-cap FTSE 250 index.

- IUX.com: Based in Cyprus, the platform was formed in 2006 and is known for its fast order execution and for having lower average trading fees based on spreads than other platforms.

- Prime XBT: Established in 2018, the Marshall Islands-based platform already has more than a million users and operates in 14 countries, but not the US and Canada.

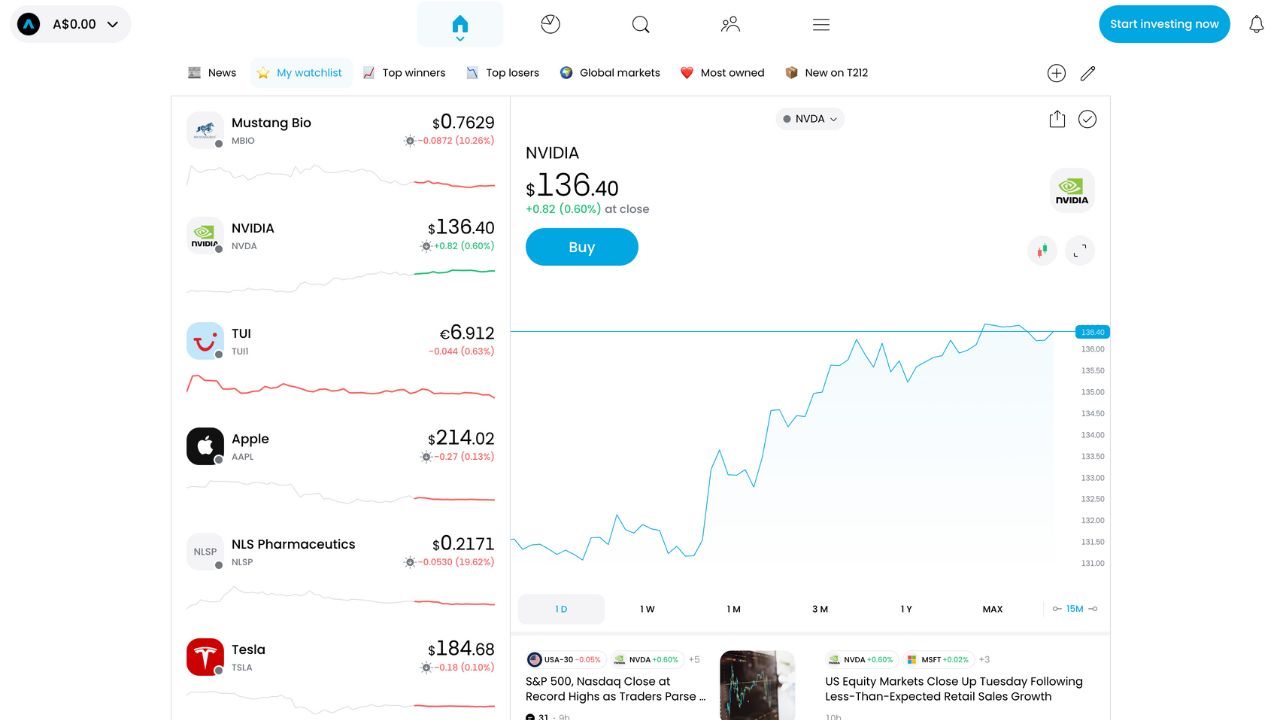

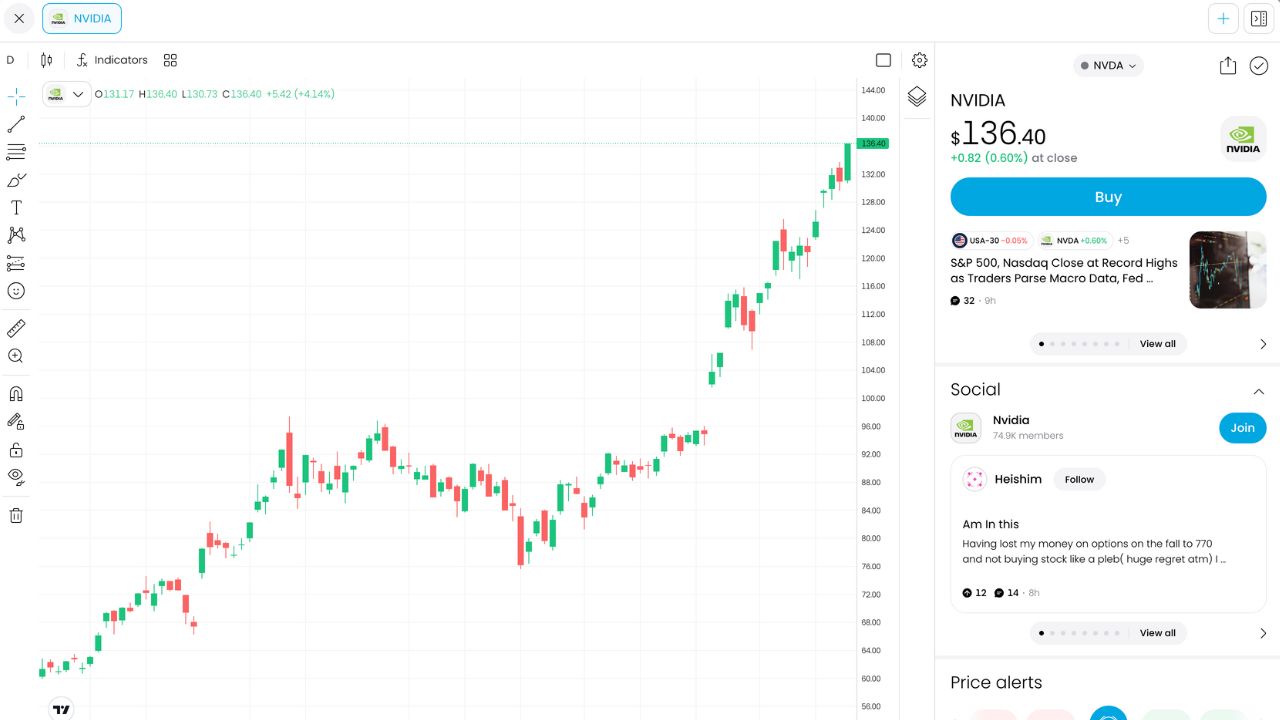

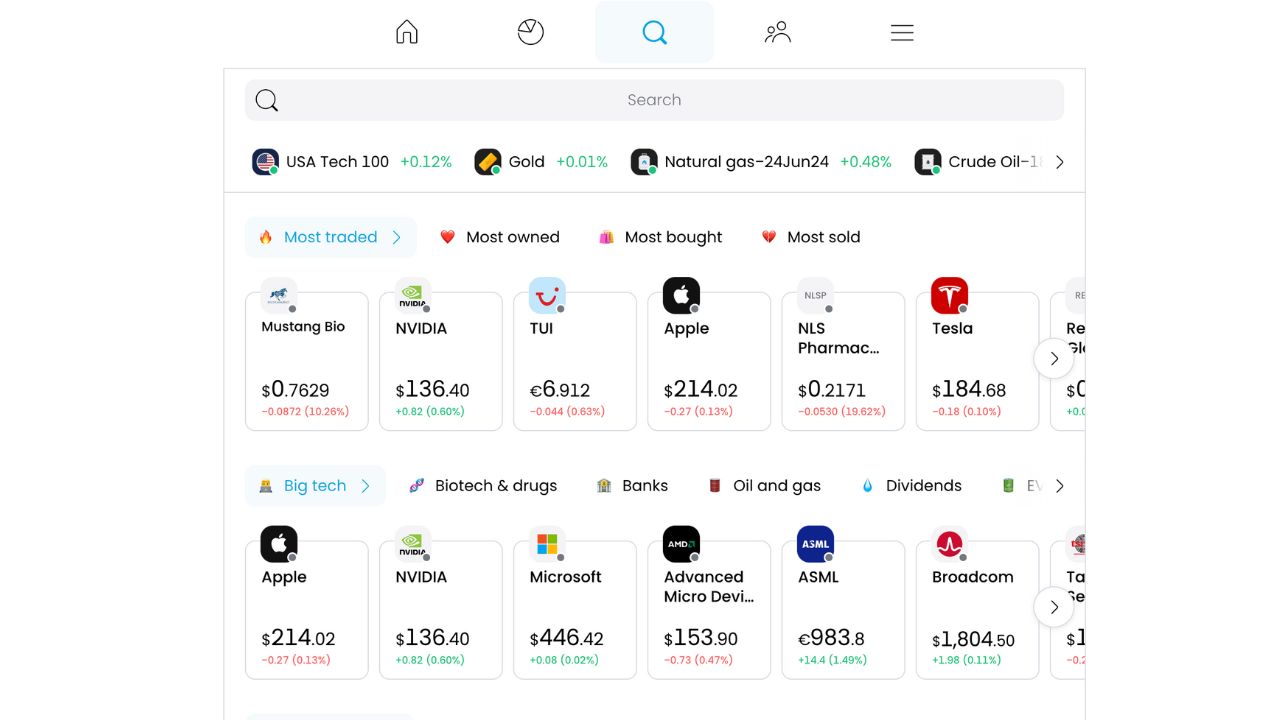

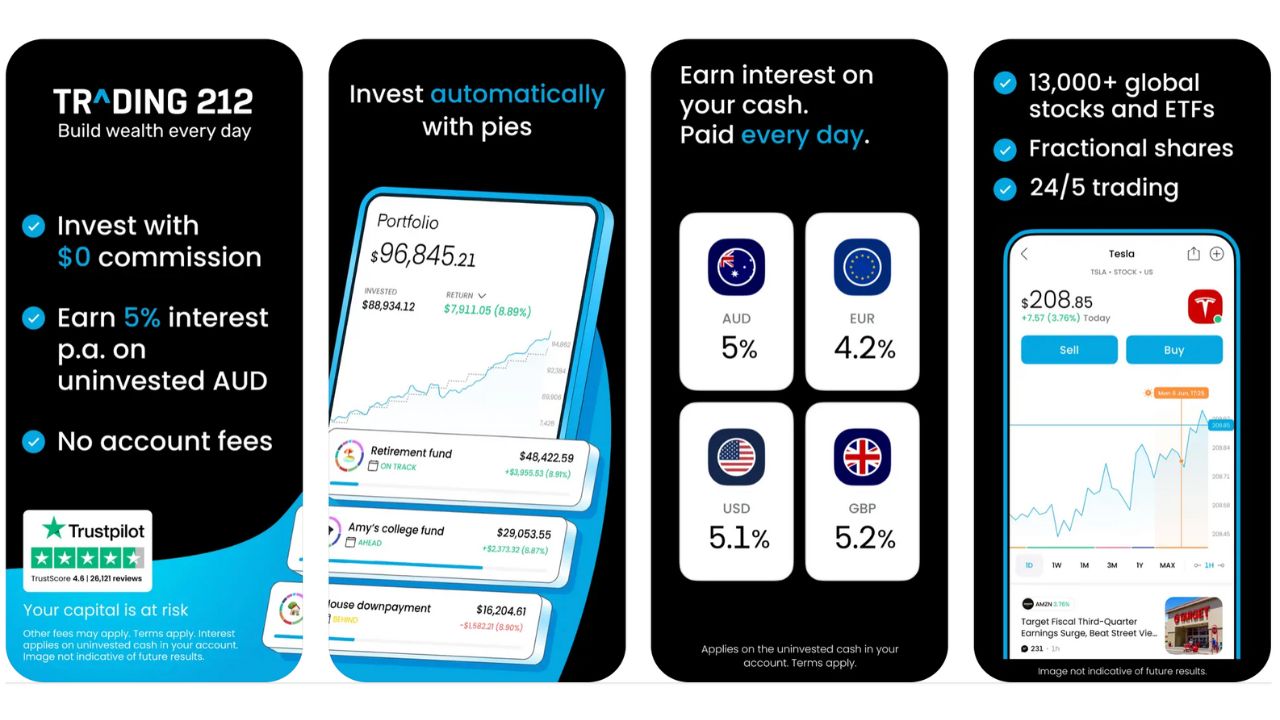

- Trading212: The London-based fintech was the first broker in the UK to allow commission-free trading and has more than 3 million accounts and offers more than 7,000 equities to trade.

An in-depth look at the UK’s best trading platforms

Let’s take a more detailed look at the top trading platforms offered to traders based in the UK, ranging from those designed for new traders to the platforms that are best suited for experienced traders:

1. eToro: Best trading platform for versatility

eToro was founded in 2006 and has more than 30 million users worldwide. It has made inroads because of its offering of versatile instruments to trade, including equities as well as more than 30 cryptocurrencies. It also offers spot Bitcoin ETFs. It’s a private company, however CEO Yoni Assia in March, told Reuters that the company is considering an IPO in London or New York.

The platform requires around $100 to start trading for UK users or $500 if done by bank transfer. However, after your first deposit with the platform, there is a minimum deposit amount of only $10 in the UK.

eToro has three features that are excellent for new investors. It offers a $100,000 virtual account, which allows investors to practice trading. It also has a copy trading platform that allows traders to shadow successful traders’ portfolio. It also offers fractional trading.

Some of eToro’s negatives include relatively pricey spreads on contracts for difference and a $5 withdrawal fee, with the minimum amount you can withdraw set at $30. It also has a $10 monthly inactivity fee applied to accounts that have been inactive for more than 12 months.

eToro features

| Assets | Stocks, ETFs, crypto, forex and commodities |

| Trading commission | Trading fees are built into the spread |

| Payment methods | Bank transfer, debit card, eToro money |

| Customer service | Web chat |

| Regulation | Financial Conduct Authority (FCA) |

Pros

- Ability to do copy trades of successful investors

- $100,000 virtual account for practice trading

- More than 30 cryptocurrencies available to trade

Cons

- Limited customer service

- CFDs are high-risk investments

- High charges on the spread and a $5 withdrawal fee

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

2. XTB: Simplicity, speed for experienced investors

While XTB has offices in 13 countries, it has grown in the UK, thanks to its relative ease of use and speed of execution, which is an important feature for more seasoned traders. It doesn’t charge to open or close an account and there are no management fees. One of its best features is it pays interest on deposits in customer accounts, which at the time of writing was 5.2%.

It appears to be a good platform for intermediate or expert traders. It offers trading in CFDs on shares, indices, ETFs, raw materials, forex currencies, cryptocurrencies, real shares and real ETFs, but doesn’t offer bonds, mutual funds, options or futures. It has more than 5,800 assets available for trading, including more than 2,800 stocks from 16 major exchanges around the world.

The platform also provides a free demo account for 30 days which holds virtual funds of £85,000. It also has a trading academy, but not many English-speaking videos yet. The money it makes off the spread is higher than some platforms. The platform does a good job of educating investors, with a knowledge center of more than 1,000 articles, as well as a regularly updated news feed.

XTB features

| Assets | Stocks, ETFs, crypto, forex and commodities, but only by CFD |

| Derivatives | CFDs |

| Trading commission | Trading fees are built into the spread. |

| Payment methods | Credit card, debit card, bank transfer |

| Customer service | Live chat, phone, email |

| Regulation | FCA |

Pros

- High interest rate on uninvested deposits

- No minimum deposit needed

- Free demo account for practice

Cons

- Only CFD trading

- Not a good platform for beginners

- Inactivity fee after one year

Disclosure: 77% of retail investor accounts lose money when trading CFDs with this provider.

3. AvaTrade: Big advantages for large-scale investors

AvaTrade offers VIP clients the ability to earn up to 2.7% on uninvested deposits, therefore it’s favoured by investors with more funds in their trading accounts. It also has an AvaSocial platform, where investors can mimic the strategies of top traders and automatically replicate their trades.

The platform allows trading on more than 1,260 stocks, but it doesn’t permit US stock trading, and while it permits crypto CFD trading, it doesn’t offer physical cryptocurrencies to trade. Though it accepts UK clients, it isn’t regulated by the FCA. It’s regulated by the Central Bank of Ireland (CBI) and ASIC in Australia, though.

The company recently expanded into futures trading, with a separate trading platform, AvaFuture. It offers micro, mini and standard future contracts. While futures trading isn’t for inexperienced traders, it allows more savvy investors to use futures contracts to hedge against market volatility, leverage positions for better profits and to diversify their holdings across various asset classes. AvaFuture will allow traders to go long or short with no overnight interest, allowing them to benefit from the potential in rising and falling markets.

The company is also looking to grow its presence in the EU, as it is attempting to obtain a regulatory license in Spain.

AvaTrade features

| Assets | Stocks, ETFs, forex and commodities |

| Derivatives | CFDs for crypto, stocks and commodities, futures |

| Trading commission | Trading fees are built into the spread |

| Payment methods | Credit card, debit card, bank transfer |

| Customer service | Live chat, phone, email |

| Regulation | CBI in Ireland, ASIC in Australia. Not regulated by FCA in the UK |

Pros

- Pays interest rate on uninvested deposits

- AvaSocial platform allows traders to mimic successful traders

- Good customer support

Cons

- Limited number of assets to trade

- No physical crypto trading

- Not regulated by FCA in the UK

Disclosure: 76% of retail investor accounts lose money when trading CFDs with this provider

4. Pepperstone: Simple platform; comparative analysis tool

It has an easy-to-use interface which doesn’t require any software downloads. Investors can, via a web browser, directly access the Pepperstone Proprietary Trading Platform, MT4, MT5, and cTrader platforms. The only problem for investors is they cannot make non-leveraged stock trades through Pepperstone, only CFD trades.

It has relatively low forex and non-trading fees. Its education section is good for forex, but relatively minimal for share trading. One positive for inexperienced traders is Pepperstone’s comparative analysis feature, which juxtaposes users’ trading patterns with peers, to help them gain perspective and refine their trading strategies.

Pepperstone features

| Assets | Indices, ETFs, forex and commodities, but only by CFD |

| Derivatives | CFDs, futures |

| Trading commission | Trading fees are built into the spread for standard account. On Razor account, trading fees vary. |

| Payment methods | Credit card, debit card, bank transfer |

| Customer service | Live chat, phone, email |

| Regulation | FCA |

Pros

- Speedy execution of orders

- Low spreads on trades

- Good customer support

Cons

- Limited stocks to trade

- Few educational resources

- Not regulated by FCA in the UK

Disclosure: 81% of retail investor accounts lose money when trading CFDs with this provider.

5. Trade Nation: Ideal for experienced margin traders

The platform is good for experienced traders on margin. The big downside is not being able to trade non-CFD shares. It does have a demo account that walks you through the functionality of the platform before you sign up.

It has a small amount of investor news, including news from the Dow Jones News Wire and curated articles for pro and part-time traders. It also has a TradeCopier app that allows you to mimic the trades of successful investors.

The platform has grown in recognition in the UK, thanks to its partnership with the Aston Villa Football Club, where it is the official sleeve and trading partner of the team, and its sponsorships of race car driver George Jaxon and the Somerset Cricket Club. The company, in just around a decade, has grown from 10 people in two offices in London and Sydney to more than 120 employees with teams in the UK, Australia, South Africa, Malaysia, the Seychelles and The Bahamas.

One downside is it that while it has a chatbot, there is no live chat available for customer service. While most of its fees are low, and no trading commissions, its fees for forex are higher than some platforms.

Trade Nation features

| Assets | Forex, stocks and indices, but only on CFD |

| Derivatives | CFDs |

| Trading commission | Trading fees are built into the spread. |

| Payment methods | Credit card, debit card, bank transfer, Skrill |

| Customer service | Telephone, email |

| Regulation | FCA |

Pros

- No minimum deposit

- Low spreads on trades

- Free training simulator

Cons

- Limited stocks to trade

- Few educational resources

- No live chat for customer support

Disclosure: 75% of retail investor accounts lose money when trading CFDs with this provider

6. AJ Bell: Solid platform for inexperienced traders

This customer-service friendly platform may be more suited for less experienced investors who don’t have a lot of money in their trading account, as it charges an annual fee of 25% on investors assets held on its platform. While it offers more than 19,000 investments, it doesn’t allow trading in cryptocurrency, foreign exchange (forex), or trades in fractional shares. It also doesn’t have a community or social trading forum for investors.

The company’s Dodl account is good for beginning investors as there are no trading fees, though there is a charge of 0.15% of the value of your investments per year, including a minimum of £1 per month. There are, however, the usual type of charges. For example, some funds have ongoing transaction costs and charges, UK shares have stamp duty fees and US shares will have a current charge of 0.75% for transactions up to £10,000.

A regular AJ Bell account charges £5 for share trading, though that falls to £3.50 per trade if you made 10 or more trades in the prior month. Fund trading costs are lower at £1.50. The regular account charges 0.25% of your holdings as an annual fee, though that is capped at £42 a year for share trading. The company offers tools such as stop-loss orders and pays interest on cash balances on trade accounts, individual savings accounts (ISAs) and Self-Invested Personal Pensions (SIPPs). The platform is also known for its customer service and provides telephone service six days a week, plus live chat on its website.

AJ Bell features

| Assets | Stocks, ETFs, bonds, funds |

| Derivatives | None |

| Trading commission | £5 for shares, up to 10 trades, then £3.50; £1.50 for funds |

| Payment methods | Bank transfer, debit card, credit card, direct deposit |

| Customer service | Web chat, email |

| Regulation | Financial Conduct Authority (FCA) |

Pros

- Dodl accounts are good for beginning investors

- 19,000+ assets across global markets

- Dependable customer service

- Earn interest on stocks and cash

Cons

- Regular account charges of 0.25% of holdings can get expensive

- Fees of £5 for share trading

- No trading in cryptocurrency

7. IG: Big advantages for large-scale investors

IG is a large platform with more than 13,200 stocks available to trade as well as nearly 3,000 ETFs and 200 investment funds. The global trading platform has an easy-to-use site and is great for investors with larger portfolios, but not so great for beginner investors, because of the relatively high fees it charges.

There is a minimum deposit of £250 to open an account. It charges relatively high share trading fees, but lowers those fees for investors who trade more frequently. For example, it charges £8 a trade on UK shares, but that drops to £3 per trade if you trade more than three times a month. Similarly, for US stocks, it charges £10 per trade but waives the fee if you trade more than three times a month.

It also charges a quarterly custody fee of £24, unless you make at least three trades a quarter or if you invest at least £15,000 in one of IG’s Smart Portfolios. One other area where IG hurts beginning investors is it does not offer trading on fractional shares, so if you want to buy shares of Burberry Group (LON: BRBY) and don’t have the £1,054 it’s trading for, you’re out of luck.

The company has one big advantage over newer platforms and that is it has high levels of trust among customers, thanks to its longevity and substantial holdings. It also is thriving with 2023 being its fourth consecutive year of record revenue. It also has a substantial presence in the US, where it’s the third-largest retail foreign exchange dealer. Its site is strong on investor education, offering 10 hours of daily live programming, news and original content, as well as webinars and tutorials on investing.

IG features

| Assets | Stocks, ETFs, crypto, forex and commodities |

| Derivatives | CFDs, futures |

| Trading commission | Trading fees are built into the spread. |

| Payment methods | Credit card, debit card, bank transfer |

| Customer service | Live chat, phone, email |

| Regulation | FCA |

Pros

- Plenty of investment options

- High satisfaction ratings among customers

- Easy-to-use web site

Cons

- Minimum deposit of £250 to open an account

- Relatively high trading fees

- Not as good for novice investors

8. IUX.com: Low trading costs, efficient trading times

IUX is a good brokerage for more experienced investors, with relatively low spreads. It’s best known as a CFD and forex broker. It lists only 120 stocks but has more than 60 currencies available for trading.

One thing that separates IUX from other platforms is its Introducing Broker Program, which allows individuals to earn revenue share by introducing other traders to the platform. The payouts are made daily and have multiple commission tiers and continue as long as the referred clients remain active traders on IUX.

It has seen strong growth, thanks to its relatively low spreads on trades and quick execution. As of its first quarter, it had more than 219,482 active users, up more than 50% over the fourth quarter of 2023 and a trading volume of $920.21 billion, up 70%, over the prior quarter.

Day traders like IUX because of its zero commissions and relatively low floating spreads. Its low swaps also helps swing traders whose positions may last longer than one day.

One big downside of IUX is some customers have said they have had difficulty withdrawing funds. The site is also somewhat lacking in research and educational resources.

IUX features

| Assets | Indices, Shares, commodities |

| Derivatives | CFDs, futures |

| Trading commission | Trading fees are built into the spread |

| Payment methods | Credit card, debit card, bank transfer |

| Customer service | Live chat, phone, email |

| Regulation | The Financial Services Authority (FSA) of St. Vincent and the Grenadines |

Pros

- Speedy execution of orders

- Low spreads on trades

- Good customer support

Cons

- Limited stocks to trade

- Few educational resources

- Not regulated by FCA in the UK

9. Prime XBT: Focus on crypto; advanced trading tools

Prime XBT: primarily a cryptocurrency exchange that offers leveraged trading for several digital assets, including Bitcoin, Ethereum, and Litecoin. For the moment, it only offers margin trading for forex, stock indices and commodities.

The platform is best suited for experienced traders. It offers leveraged trading up to 100 times the amount you contribute and plenty of technical tools. It also allows investors to practice trading on a demo platform using virtual funds. For less experienced investors, it has a feature, “Covesting” which allows you to copy top traders on Prime XBT.

The platform’s biggest negative is it isn’t FCA regulated, and it isn’t available in 14 countries, including the US and Canada.

On the positive side, it just revamped its system to make it a little more intuitive. It also reduced fees on CFDs, increased leverage on crypto to up to 200x and added Thai and Vietnamese language versions of the app.

Prime XBT features

| Assets | Cryptocurrency, plus CFD trading for indexes, forex and commodities |

| Derivatives | CFDs, futures |

| Trading commission | For crypto, there is a 0.01% maker and 0.02% taker fee and a 0.05% applies to all other orders. |

| Payment methods | Credit card, debit card, crypto, e-Wallets |

| Customer service | Support ticket through the PrimeXBT Help Center or live chat |

| Regulation | Not FCA regulated |

Pros

- Good technological tools and charts

- You can trade some crypto on leverage up to 100x

- Fast order execution

Cons

- Only CFD trading

- Few educational resources

- Not regulated by FCA in the UK

10. Trading 212: Best UK stock trading platform for passive income

Trading 212 is our best pick for UK customers who want to earn passive income on their investments.

Interest is earned on stocks via the share lending feature or in a cash ISA. The interest rate is variable; different stocks generate different interest payments. The cash ISA is protected by the Financial Services Compensation Scheme (FSCS) and interest is paid daily.

Other features include 24-hour trading five days a week, no commissions or custody fees, as well as interest paid on stocks and cash held in your account.

Bank transfers to your trading accounts are free, as are withdrawals. Currency conversion fees are limited to 0.15% – lower than many trading platforms.

Trading 212 also offers CFD trading, which allows you to buy on margin, although this is only suited to experienced traders. CFDs offered by Trading 212 include forex, stocks, ETFs, commodities, cryptocurrencies, and a range of futures.

Trading 212 also has an active community forum and is highly rated on community review websites like Trustpilot and app stores. Customer service is available via live web chat and email, although customers have complained about chat bots and how long it takes to connect with a human.

While Trading 212 is an excellent platform for traders of all skill levels, CFDs should be avoided by novice investors due to the high level of risk they carry.

Trading 212 features

| Assets | Stocks, ETFs, crypto, forex and commodities |

| Derivatives | CFDs, futures |

| Trading commission | Zero |

| Payment methods | Bank transfer, debit card, credit card |

| Customer service | Web chat, email |

| Regulation | Financial Conduct Authority (FCA) |

Pros

- 24-hour trading 5 days a week

- 13,000+ assets across global markets

- Zero commissions or custody fees

- Earn interest on stocks and cash

Cons

- Long wait times for customer service web chat

- CFDs are available, but high-risk

- Lacks news and research that other platforms offer

How do these UK stocks platforms stack up?

| Platform | Minimum balance | Fees per equity trade |

| eToro | $100 to start trading, but after you begin only $10 in the UK | Trading fees vary and are built into the spread. |

| AJ Bell | No minimum deposit, but there is an annual platform fee between 0.10% and 0.25%. | £5 for share trading, £1.50 for fund trading. |

| IG | It costs £250 to open an account. | £8 per trade in the UK (£3 per trade if you have at least three trades a month). |

| XTB | You can open an account with £0 but the minimum amount for buying shares is £10, or $10 if buying U.S. shares and €10 for European shares. | Trading fees vary and are built into the spread. |

| Avatrade | In the UK, the minimum balance for opening an account is £50. It’s $100 in the US and E100 in the rest of Europe. | Trading fees vary and are built into the spread. |

| IUX.com | The minimum balance to make a trade is $10. | Trading fees vary and are built into the spread. |

| Pepperstone | No minimum balance, though it recommends the equivalent of $200 for margin trading. | Trading fees vary and are built into the spread. |

| Prime XBT | The minimum balance to trade on the S&P 500 is 0.001 BTC. | Trading fees vary and are built into the spread. |

| Trade Nation | No minimum balance. | Trading fees are fixed and are built into the spread. |

| Trading 212 | £1 for equity and ISA trades, £10 for CFD trades | Trading fees vary and are built into the spread (the difference between the buy price and the sell price.) |

How to choose the right platform

Online trading platforms allow investors to buy and sell stocks, bonds, and funds and invest in currency. Unlike traditional brick-and-mortar brokers, online brokers are for do-it-yourself investors looking to save costs and simplify investing by doing their trading on the internet.

Choosing a stock trading platform depends on your needs and investment style. What to look for.

Investor, know thyself:

- Investment goals: Are you saving for retirement, building a short-term portfolio, or day trading?

- Experience level: Are you a beginner, occasional trader, or active investor?

- Investment amount: How much money are you starting with?

Research platform options:

- Look for platforms catering to your investment style (beginner-friendly vs. advanced features).

- What financial instruments are you looking to invest in? Cryptocurrency, forex, stocks, or a combination of the three. Each platform has different focuses, so the financial categories that you are looking to invest in matter. Some trading platforms don’t allow basic stock trades while others don’t allow forex or cryptocurrency trades.

Prioritize your needs in a platform:

- Fees: Commission fees, account minimums, and inactivity fees.

- Investment options: Stocks, ETFs, options, or mutual funds.

- Trading platform: User-friendly interface, research tools, charting capabilities.

- Customer service: Availability, responsiveness, and support options.

Deep dive into potential platforms:

- Narrow down your options based on step 2 and 3.

- Visit broker websites for detailed information on fees, account types, and features.

- Look for free trials or demos offered by some platforms.

Don’t forget the basics in your research:

- Regulation and security: Make sure the broker is registered with reputable financial authorities (e.g., FCA) and offers account protection.

- Minimum stake size: This could restrict your trades if you’re starting small.

- Margin trading: If you plan on using borrowed money to trade, check the platform’s margin requirements and interest rates.

- Fractional shares: Do they allow buying fractions of shares, which can be helpful for expensive stocks.

Be flexible in your choice:

- Once you’ve thoroughly compared platforms, pick the one that best aligns with your needs and investment style.

- Don’t be afraid to open multiple accounts with different brokers if they cater to different aspects of your strategy.

Our methodology

We looked exclusively at trading platforms with a strong presence in the UK, striving to find a mix of platforms that would appeal to beginning investors and more experienced traders. We looked, in particular, for platforms with easy-to-use interfaces and lower trading fees.