Copper is a major industrial metal used in wires and cables because it conducts electricity and heat well and also in plumbing and construction because it’s durable and resists corrosion.

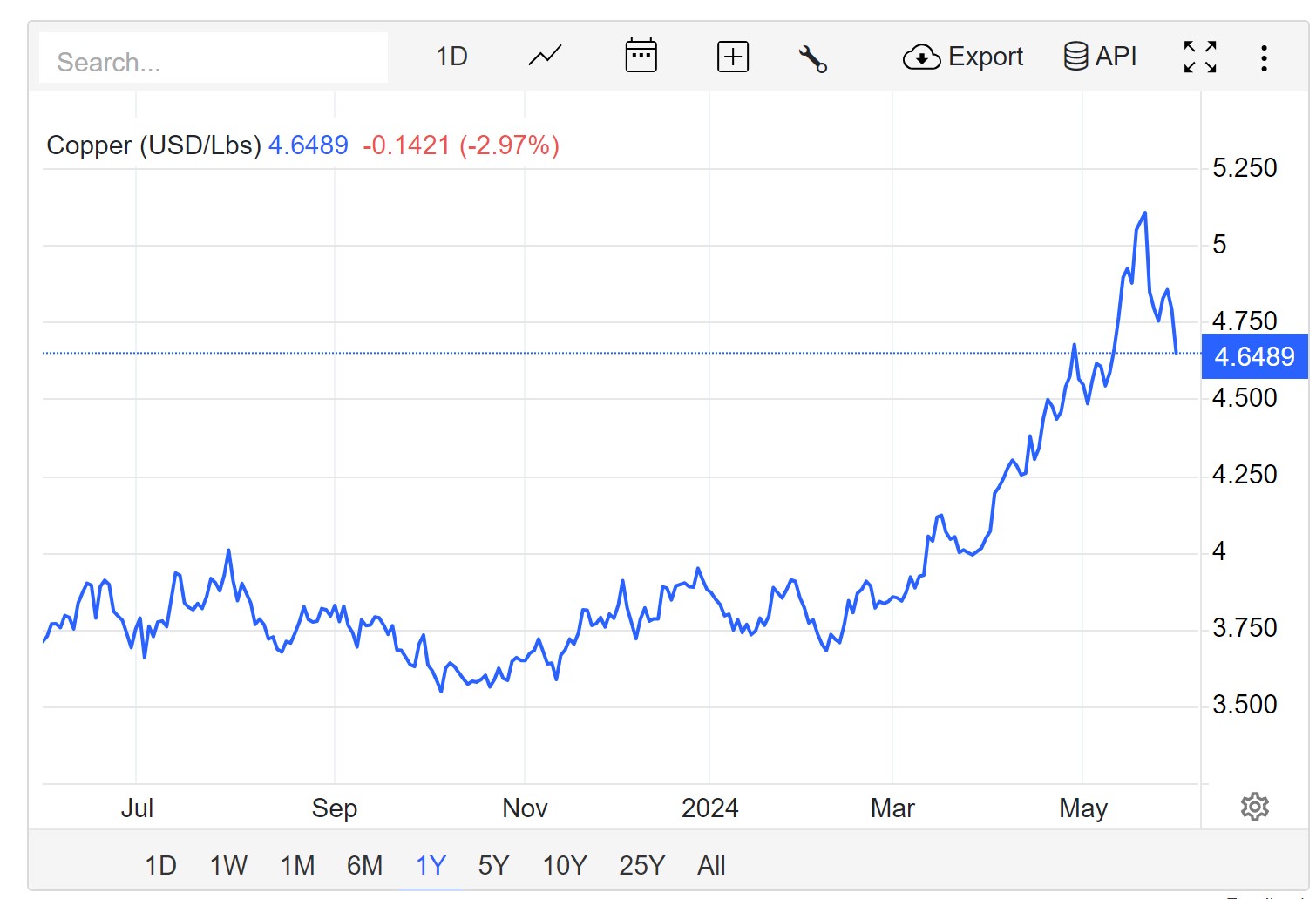

The price of copper is close to its all-time high after breaking the $11,000-per ton mark in May 2024. Copper mining companies become more profitable when the price of copper rises. With Canada being a major producer, we looked at some copper stocks on the Toronto Stock Exchange (TSX) that could benefit the most.

The brownish-red metal has been in high demand recently as governments have been pushing the use of green energy, in particular setting targets for more electric vehicles (EVs) on the road. The typical EV uses four times as much copper as a combustion-engine car. China, the largest consumer of copper, has also been purchasing more of the commodity.

These five Canadian mining stocks traded on the TSX could benefit from these trends:

An in-depth look at these top Canadian copper stocks

Now, let’s take a detailed look at our picks of the best Canadian copper stocks and what makes them good investments right now.

1. Taseko Mines Ltd.: Average annualized 5-year return of 44.21%

The Vancouver-based company’s primary asset is the Gibraltar copper mine in British Columbia, Canada’s second-largest open-pit copper mine. Taseko Mines Ltd. (TSX: TKO) now owns 100% of the mine after buying the 12.4% it didn’t already own in March for CAD117 million ($85.34 million). Gibraltar is expected to deliver copper and molybdenum (a mineral used to strengthen steel alloys) through at least 2044.

Taseko is also developing the Florence Copper Mine in the US just south of Phoenix and expects it to begin production in 2025. It’s expected to produce for 22 years and deliver 85 million tonnes of copper yearly. Taseko expects to break even on the $325 million it has invested in the mine in only 2.6 years. The Florence mine will have an average cost per pound of $1.11, less than half of Gibraltar’s.

In the first quarter of 2024, revenue rose 27.2% year on year to CAD 146.9 million ($107.15 million). Earnings per share (EPS) was $0.07, falling 41.6% from the year earlier, due to the purchase of the rest of Gibraltar.

Despite the stock’s triple-digit increase this year, its valuation is still attractive at a price-to-earnings ratio of 11.03.

2. Hudbay Minerals: Average annualized 5-year return of 15.88%

The Toronto-based miner is the third-largest copper producer in Canada, with operations in British Columbia, Manitoba, Peru and Arizona. While 62% of its revenue came from copper in 2023, it also produces gold and zinc, giving it some diversification.

Hudbay Minerals (TSX: HBM) has gained 84% this year, helped by long-term prospects for its mines. Hudbay operates the Constancia mine in Cusco, Peru, the Snow Lake project in Manitoba and the Copper Mountain mine in British Columbia. It’s building Copper World in Arizona, where it expects 92,000 tons of copper production annually over the next decade, as well as the Mason project in Nevada.

Hudbay has been active in acquisitions. In June, it spent CAD 439 million ($320 million) to buy Copper Mountain Mining Corporation. In September, it bought out Rockcliff Metals Corp., its 49% joint venture partner on its Talbot project.

In the first quarter, revenue rose 77.8% from a year earlier to $524.9 million. EPS rose 150% from a year earlier to $0.05, driven by higher sales volumes and prices for gold and copper. Hudbay sold 42.4 million shares to the public in May, raising $402.5 million to spend on short-term projects.

3. Teck Resources: Average annualized 5-year return of 23.32%

The Vancouver-based company has a deal in place to sell its steel-making coal assets to Swiss miner Glencore for $9 billion. The move gives Teck Resources (TSX: TECK-B) additional cash to reduce debt and focus on base metals mining, in particular its copper business.

In the first quarter, Teck’s revenue rose 5% from a year earlier to CAD 3.98 billion, while EPS fell 70.8% from the same period last year to CAD 0.65. The company’s copper production increased by 74% to 99,000 tons, led by its Quebrada Blanca project in northern Chile, which delivered 43,000 tonnes of copper in the quarter. The mine is just beginning to ramp up production and is expected to have a life of 27 years with an expected production of 320,000 tonnes of copper every year.

Teck rewarded investors with $2.5 billion in share buybacks and CAD 1.4 billion in dividends from 2019 to 2023.

4. Barrick Gold: Average annualized 5-year return of 10.84%

As the name suggests, the Toronto company’s primary focus is gold, though it sees plenty of potential in copper. Barrick operates 17 sites across 18 countries. It has one of the largest portfolios of Tier One gold and copper assets among mining companies. Tier One assets are large, long-life mines.

Barrick Gold (TSX: ABX) produced 4.1 million ounces of gold last year and around 420 million pounds of copper. Higher copper prices and a projected shortage of the mineral has led the company to bulk up its copper facilities. CEO Mark Bristow said the company plans to more than double its copper production to a billion pounds per year by 2031.

Its $7 billion Reko Diq mine in Pakistan will be one of the top 10 copper mines in the world when it begins production in 2028. Barrick expects an annual output of 530 million pounds of copper from its Lumwana project in Zambia by 2028.

In the first quarter, EPS jumped 143% year over year to $0.17, and revenue rose 4% from a year earlier to $2.75 billion. Barrick’s quarterly dividend of $0.10 equals a yield of around 2.36%, well above the rest of the stocks in this list.

5. Ero Copper: Average annualized 5-year return of 13.86%

The Vancouver company explores, develops and mines copper, silver and gold in Brazil. Its primary asset is a majority interest in Mineração Caraíba S.A., which mines at several locations in Brazil. It also owns a majority stake in Xavantina Operations, a gold and silver mine in Mato Grosso, Brazil.

Ero Copper’s (TSX: ERO) first-quarter revenue rose 4.6% year over year to $105.8 million. Due to costs of ramping up its Tucumã Project, which is projected to go online in the third quarter, Ero posted a loss per share of $0.07, compared to EPS of $0.26 a year earlier. The potential of the Tucuma Project has driven up its share price 40% this year. The open-pit copper mine, located in Pará, Brazil, will help Ero double its copper production by 2025.

Looking ahead, Ero purchased a 60% stake in the Furnas copper project in the Carajás Mineral Province in Pará State, Brazil. It is partnering with Salobo Metais S.A, part of the Vale Base Metals business, on the project. Raymond James analyst F. Hamed has predicted that Ero will post EPS $0.87 by the first quarter of 2025, a big turnaround from the first quarter of 2024.

What are Canadian copper stocks?

Canadian copper stocks are those listed on the Toronto Stock Exchange (TSX) or other Canadian stock exchanges that are involved in the exploration, mining, and development of copper deposits.

The companies range from large, established producers such as Taseko Mines, Teck Resources or Hudbay Minerals, which have large mines in production and already have significant revenue from copper sales. There are other companies where copper is a secondary source of revenue, such as Barrick Gold, which sees most of its revenue from gold sales. Lastly, there are newer companies that don’t have mines in production yet, such as Canadian Copper Inc. (CNSX: CCI) and Quetzal Copper Ltd. (TSX.V: QTZ).

What are the pros and cons of investing in Canadian copper stocks?

Here are the advantages:

There are plenty of reasons to consider investing in Canadian copper stocks. There’s also a general connection between copper and the overall economy as the cost of copper is often tied to how well the economy is doing overall.

Increased copper demand: The need for copper is rising, mainly because of its use in renewable energy technologies and electric vehicles. The increased demand is likely to mean higher copper prices, which benefits copper mining companies and their shareholders.

Potential for growth: Many Canadian copper companies are increasing their production capacity and seeking new copper deposits. This growth strategy could lead to increased revenue and profitability in the long run.

Lower risk: Copper is a base metal with a greater range of industrial applications than precious metals, such as gold. This diversification makes copper stocks less volatile. On top of that Canadian copper companies are considered more stable because their mines are generally in countries with stable governments.

However, there are some drawbacks to Canadian copper stocks:

Commodity price fluctuations: The price of copper is a commodity and can fluctuate significantly based on market forces. Over the past few years, it has consistently been higher than $4 a pound, but that could change if supply increases.

Speculation: While copper’s price has fallen slightly from its all-time high, the rise in the metal’s price has attracted investors and that, in turn, has driven up the shares of companies. A sudden drop in the price of copper could send those stocks falling.

Mining risks: Mining operations are inherently risky and can be impacted by unexpected events or environmental regulations. Many mining companies carry significant debt and if a project has to shut down or underperforms, the stock can crater.

Company performance: While the long-term potential of copper is promising, the success of your investment will depend on the specific copper company you choose. Take a long look at the company’s financials and prospects before investing.

Methodology: How we made our picks

Mining stocks carry significant risk. We focused on Canadian copper mining stocks that are already seeing increased revenue and have significant long-term projects that are just beginning to ramp up or are on the cusp of beginning operations. We also looked at stocks with relatively large market caps because they tend to be less volatile and have enough resources to weather a significant downturn.

Canadian copper stocks FAQS

How to buy Shares of Copper Mining Companies?

How to invest in a Copper ETF?

Why are copper stocks popular in Canada?

Do I need to pay taxes on stocks in Canada?

References

Taseko Announces Improved Economics for its Florence Copper Project, Taseko Mines Ltd, 2023

Teck Reports Unaudited First Quarter Results for 2024, Teck Resource Ltd, 2024

Barrick Q1 Results, Barrick Gold Corporation, 2024

Ero Copper Reports First Quarter Operating and Financial Results, Ero Copper Corp., 2024

Ero Copper secures option to earn 60% stake in VBM’s Furnas project, NS Energy, 2023