Blockchain stocks gained popularity as Bitcoin surged above $70k in 2024. The following companies we selected are developing blockchain infrastructure and tools, including Bitcoin mining. Some of these stocks posted marginal gains since the beginning of the year.

This article unveils a list of the top blockchain stocks to consider in your investment journey.

Best blockchain stocks in 2024

- CleanSpark (NASDAQ: CLSK) is a leading Bitcoin miner that distinguishes itself through its commitment to sustainability. Its data centers are powered by low-carbon energy sources such as wind, solar, nuclear, and hydro. This approach reduces environmental impact and aligns the company with sustainability-focused regulations and consumer preferences.

- Riot Platforms (NASDAQ: RIOT) is a leader in Bitcoin mining, boasting a long history in finance. They don’t just mine Bitcoin but offer data centers and engineering services for other large-scale miners. 2023 saw impressive results with record revenue and a strong Bitcoin holding.

- Iris Energy Limited (NASDAQ: IREN) is a leading sustainable Bitcoin mining company. It operates data centers powered by renewable energy to mine Bitcoin and provides high-performance computing services for AI.

- NU Holdings (NYSE: NU): Leveraging technology, Nu Holdings (NU) empowers millions in Latin America with a seamless digital banking experience. Their focus on mobile payments, instant account opening, and automated tools makes managing finances effortless.

- Block Inc. (NYSE: SQ) Block. Inc. builds financial ecosystems for businesses and individuals. Square equips sellers with payment processing, software, and hardware, while Cash App empowers individuals with money transfers, investing, and a linked debit card. Block further embraces the future of finance through TBD, an open developer platform for Bitcoin innovation.

- PayPal (NASDAQ: PYPL): Beyond consumer transactions, PayPal empowers small businesses by offering secure and efficient payment processing solutions. This allows them to focus on running their businesses without worrying about payment complexities. PayPal is also letting users buy, sell, and hold crypto directly within their PayPal wallets

- Robinhood (NASDAQ: HOOD) presents a user-friendly app that lets you trade stocks, ETFs, and cryptocurrencies commission-free. Active investors can utilize options and margin features, while beginners benefit from a streamlined interface.

- IBM (NYSE: IBM): IBM offers many technology solutions, including industry-specific blockchain applications. From secure food tracking to streamlined trade finance, IBM leverages its expertise to tackle complex challenges across various sectors.

Reviewing 8 of the best blockchain stocks in 2024

This section curates a list of the top 8 blockchain stocks in 2024, providing a springboard for your crypto-focused portfolio. Let’s dive into how these industry leaders are shaping the future of finance.

All the figures are expressed in USD

1. CleanSpark (CLSK): A Sustainable Bitcoin Miner

Founding Date: CleanSpark was founded in 1987, though the company transitioned to focus on Bitcoin mining more recently. This established track record demonstrates their ability to adapt and thrive in a changing technological landscape.

Their pivot towards crypto reflects their recognition of blockchain technology’s potential and commitment to staying at the forefront of innovation.

CleanSpark stands out among crypto miners for its commitment to sustainability. They operate data centers that mine Bitcoin, the leading cryptocurrency, using low-carbon energy sources like wind, solar, nuclear, and hydro.

This approach reduces their environmental impact and positions them well for the future, as regulations and consumer preferences increasingly favor companies prioritizing sustainability.

In contrast, many traditional crypto miners rely on high-emission fossil fuels like coal, contributing to climate change. CleanSpark’s dedication to clean energy makes it a leader in the environmentally conscious crypto mining space.

News: CLSK announced an expanded $800 million stock offering in March 2024. As a result, the stock plunged (due to the dilution), but a recovery has already occurred.

Analysts Ratings: Six analyst firms have issued recommendations for CLSK, with a consensus rating of “Strong Buy.” This positive outlook reflects analysts’ confidence in CleanSpark’s prospects. The average analyst price target of $17.64 per share suggests significant potential for upside growth.

source: yahoo finance

Pros

- Growing Hashrate: CleanSpark’s mining power is surging, suggesting rising Bitcoin production.

- Financials Shine: Strong revenue growth and positive net income position them for future investment.

- Transparency Wins Trust: CleanSpark prioritizes transparency, building trust with investors in the crypto space.

Cons

- Competitive Squeeze: The growing number of Bitcoin miners could squeeze CleanSpark’s market share.

- Regulatory Risk: Evolving cryptocurrency regulations could impact their operations.

Our thoughts

This U.S. company is a compelling option for investors seeking exposure to blockchain technology through a sustainable and responsible Bitcoin miner. Its focus on clean energy aligns with growing environmental concerns, while its strong financial performance positions it well for future growth.

| Ticker | NASDAQ: CLSK |

| Service | Bitcoin infrastructure developer |

| Market Cap. | $3.728B |

| (2023) Revenues | $214.38M |

| Founded | 1987 |

Your capital is at risk.

2. Riot Platforms (RIOT): Mines Bitcoin, builds crypto infrastructure

Founding Date: Established in 2000, RIOT Platforms boasts a long history in the financial sector. This background positions them well to navigate the complexities of the cryptocurrency market and blockchain technology.

RIOT Platforms isn’t a one-trick pony in the blockchain world. While their primary focus is on mining Bitcoin, the world’s leading cryptocurrency, their reach extends beyond.

They also provide data center hosting and engineering services specifically tailored to the needs of large-scale Bitcoin miners. This creates a vertically integrated business model in which RIOT mines Bitcoin and helps others do the same.

News: Kerrisdale Capital recently issued a negative report on the stock. Sahm Adrangi, the Chief Investment Officer, said Riot Platforms focuses more on energy arbitrage than providing value to shareholders via crypto mining. Kerrisdale Capital also shared that it is shorting the stock, which caused Riot Platforms to be hit by short sellers.

Analysts Ratings: Analysts are bullish on RIOT. With a consensus “buy” rating and a price target of $23.21, many see significant upside potential. This positive outlook aligns with RIOT’s impressive 2023 performance, which included record revenue and significant Bitcoin holdings.

source: yahoo finance

Pros

- Vertical integration: RIOT’s vertically integrated business model controls mining and infrastructure, reducing reliance on external players and potentially increasing profitability.

- Focus on efficiency: RIOT focuses on low-cost mining, maintaining competitiveness despite price fluctuations.

- Expansion: The completion of the Corsicana facility positions RIOT to be the world’s largest dedicated Bitcoin mining facility.

Cons

- Environmental impact: Bitcoin mining’s energy usage raises environmental concerns, risking negative publicity and stricter regulations.

- Limited product diversification: RIOT’s success is heavily tied to Bitcoin’s performance, which could be risky without diversification.

Our thoughts

RIOT Platforms offer a unique way to gain exposure to the cryptocurrency market through Bitcoin mining. Unlike traditional stocks, which represent ownership in a company, blockchain stocks provide a way to invest in the underlying technology of blockchain and cryptocurrencies.

By investing in RIOT, you’re betting on the future of Bitcoin and blockchain technology. With Bitcoin’s price on the rise and blockchain technology continuously evolving, RIOT could be a valuable addition to a well-diversified portfolio looking for exposure to this exciting new asset class.

| Ticker | NASDAQ: RIOT |

| Service | Securities, Financial Services, Bitcoin Mining |

| Market Cap. | $2.816B |

| (2023) Revenues | $280.68M |

| Founded | 2000 |

Your capital is at risk.

3. Iris Energy Limited (IREN): Sustainable Bitcoin miner using 100% renewable energy

Founding Date: Established in 2019, Iris Energy (IREN) is a leader in sustainable Bitcoin mining.

Tech Offered: IREN goes beyond simply mining Bitcoin. They own and operate next-generation data centers specifically designed to handle the intensive computational demands of Bitcoin mining, AI cloud services, and other power-dense computing applications.

These data centers are powered entirely by renewable energy, making IREN a unique player in the blockchain and crypto space. By focusing on renewables, IREN helps to decarbonize energy markets and promotes the sustainability of the Bitcoin network.

Analyst Ratings: Analysts are bullish on IREN, with a consensus rating of “Strong Buy.” This suggests they believe the stock is likely to outperform the market significantly in the near future. The average analyst price target is $11.17, with a high estimate of $18.50.

source: yahoo finance

Pros

- Diversified Revenue Streams: IREN’s AI cloud services go beyond Bitcoin mining, creating new revenue streams.

- Scalability Potential: Secured access to power capacity allows IREN to grow their data center operations.

- Positive Environmental Impact: Underutilized renewable energy sources power operations and support local electrical grids.

Cons

- High upfront costs: Next-gen data centers require capital investment, affecting profitability.

Our thoughts

IREN is experiencing impressive growth. Their Bitcoin mining hash rate is expected to reach 20 EH/s by year-end, significantly increasing their Bitcoin production capacity.

Their AI cloud services business is also tripling, indicating strong demand for high-performance computing services. Additionally, a new 1,400MW data center development site promises substantial future growth.

| Ticker | NASDAQ: IREN |

| Service | Decarbonization of energy markets and the global Bitcoin network |

| Market Cap. | $1.372B |

| (2023) Revenues | $122.51M |

| Founded | 2018 |

Your capital is at risk.

4. NU Holdings (NU): Brazil’s digital bank leader

Founded in 2013, Nu Holdings (NU) is a Brazilian digital banking leader with over 70 million customers across Latin America. They leverage technology to offer a suite of financial products, including accounts, cards, loans, and insurance. NU stands out for its focus on simplicity, affordability, and a user-friendly mobile experience.

Tech Offered: Nu leverages its proprietary technology platform to create a seamless and efficient banking experience. This includes instant account opening, mobile payments, and automated savings tools.

Nu’s tech stack is built for scalability, allowing them to onboard new customers quickly and efficiently. Additionally, Nu is actively exploring blockchain technology.

Blockchain can revolutionize many aspects of finance, including payments, lending, and asset management. By investing in blockchain research and development, Nu is positioning itself as a leader in the future of digital finance.

Analyst Ratings: Analysts are bullish on NU, with a consensus rating of Strong Buy. The average 12-month price target sits at $12.68, with a high estimate of $15. NU’s recent financial performance reflects this optimism. They boast a 67.54% year-on-year revenue growth and a strong % annualized ROE of 21%.

source: yahoo finance

Pros

- Strong Brand Recognition: Square enjoys a strong brand reputation for its innovative payment solutions.

- Diversified Revenue Streams: Block.Inc goes beyond payments, offering services like Cash App and point-of-sale systems.

- Focus on Innovation: Block.Inc invests heavily in research and development, constantly pushing boundaries in fintech.

Cons

- Data Breaches: Block.Inc’s user data volume makes it a target for cyberattacks, potentially damaging trust.

- Limited Reach: Expanding globally is challenging due to regulations and cultural differences.

Our thoughts

Nu Holdings (NU) could be an interesting option. While NU isn’t purely a blockchain play, its focus on technology and its potential involvement in blockchain development make it a company to watch in this evolving space.

With its strong track record of innovation and commitment to building a user-friendly financial platform, Nu could be a leader in adopting blockchain technology in the financial sector.

| Ticker | NYSE: NU |

| Service | Digital banking platform, digital financial services |

| Market Cap. | $56.847B |

| (2023) Revenues | $8.03B |

| Founded | 2013 |

Your capital is at risk.

5. Block Inc. (SQ): Financial tools for everyone

Block. Inc. (SQ), formerly known as Square, stands out among blockchain stocks for its unique approach. Founded in 2009, Block builds ecosystems that cater to specific customer segments.

Block boasts an impressive track record, serving 56 million users and 4 million businesses. The company processes a staggering $228 billion annually.

Tech Offered: Block operates through two main segments: Square and Cash App. Square offers sellers a complete commerce solution, including payment processing, software tools, hardware, and even financial services.

On the other hand, Cash App empowers individuals with peer-to-peer payments, Bitcoin and stock investing, and a linked debit card. Block’s commitment to blockchain is evident through TBD, an open developer platform focused on the Bitcoin ecosystem.

Analyst Ratings: Block has garnered positive attention from analysts. With a consensus rating of “buy,” the average price target for Block sits at $90.42, representing a potential upside of 6.90% from its current price.

source: yahoo finance

Pros

- Early Mover Advantage in Mobile Payments: Square’s early entry gives Block a strong user base in a growing market.

- Financial Inclusion with Cash App: User-friendly features promote financial access for a broader demographic.

- Strong Brand Recognition: Square and Cash App build trust for Block’s financial ecosystem.

Cons

- Data Security Risks: Block’s massive user data puts them at risk for cyberattacks.

- Evolving Fintech Regulations: Uncertainty from changing regulations can hinder Block’s innovation.

Our thoughts

While Block doesn’t solely focus on blockchain technology, its Cash App with Bitcoin investments and its TBD platform solidify its position as a player to watch in the crypto and blockchain stock space.

| Ticker | NYSE: SQ |

| Service | Financial services, Digital payments |

| Market Cap. | $40.172B |

| (2023) Revenues | $21.92B |

| Founded | 2009 |

Your capital is at risk.

6. PayPal (PYPL): A familiar face for crypto-curious investors

Founded in 1999, PayPal has been a global fintech leader at the forefront of the digital commerce revolution for over two decades. It offers an online payment system in most countries, serving as a secure and convenient digital alternative to traditional checks and money orders.

Beyond personal transactions, PayPal also processes payments for millions of online vendors, auction sites, and other commercial users, charging a fee for its services.

Tech Offered: PayPal embraces the world of cryptocurrencies beyond its core payment processing. Users can directly buy, sell, and hold cryptocurrencies within their PayPal wallets.

This integration positions PayPal at the forefront of bridging the gap between traditional finance and the new world of crypto.

By allowing users to buy and sell cryptocurrencies alongside their traditional financial holdings easily, PayPal is making the crypto space more accessible to a broader audience. As crypto adoption rises, this could be a significant growth driver for PayPal.

Analysts Ratings: Analysts see promise in PayPal (PYPL) as a crypto stock. With a “Hold” rating from a majority (57.14%), analysts see stability. However, a significant portion (23.81% + 19.05%) recommend “Strong Buy” or “Buy,” indicating growth potential. The average analyst price target of $67.69 suggests a modest upside.

source: yahoo finance

Pros

- Global Reach: Accepts payments in most countries, facilitating international transactions.

- Seamless Integration: Integrates with online shopping platforms for a smooth checkout experience.

- Financial Services Suite: Offers additional services like business tools, credit, and invoicing.

Cons

- Account Restrictions: Strict account limitations can occur due to PayPal’s security measures.

- Customer Service Issues: Reported difficulties reaching customer support for account problems.

- Seller Fees: Fees charged to businesses using PayPal can be higher than some competitors.

Our thoughts

For investors interested in the blockchain/crypto space but hesitant about directly investing in volatile cryptocurrencies, PayPal offers a compelling alternative.

As a well-established financial services company with a strong track record, PayPal provides a familiar and trusted platform to engage with the crypto world.

By offering users the ability to buy, sell, and hold cryptocurrencies within their existing PayPal accounts, PayPal is lowering the barrier to entry for crypto investment. This could be a significant advantage for PayPal as more and more people look to participate in the crypto market.

| Ticker | NASDAQ: PYPL |

| Service | Financial technology |

| Market Cap. | $68.929B |

| (2023) Revenues | $29.77B |

| Founded | 1999 |

Your capital is at risk.

7. Robinhood (HOOD): Commission-free trades for stocks, ETFs, and crypto

Founded in 2013 by Vlad Tenev and Baiju Bhatt, Robinhood was one of the first fintech companies to popularize commission-free stock trading through its user-friendly mobile app. This innovation democratized investing, making it accessible to a new generation of investors who may have been discouraged by traditional brokerage fees.

Tech Offered: Robinhood’s core functionality centers around its mobile app, designed for a streamlined and accessible investing experience. Users can buy and sell stocks, exchange-traded funds (ETFs), and cryptocurrencies all through the app.

Beyond basic investing, Robinhood caters to active traders with features like options trading. Options allow investors to make leveraged bets on stock prices, offering the potential for amplified returns (or losses). Margin lending is another feature geared toward experienced investors.

Margin allows users to borrow money from Robinhood to purchase additional securities, magnifying their buying power. However, margin trading also magnifies potential losses, so it’s crucial to understand the risks involved before using it.

Notably, Robinhood integrates crypto trading, making it a one-stop shop for investors interested in traditional and digital assets. Despite not being a blockchain company, Robinhood’s crypto integration makes it a relevant player for those interested in building a portfolio around blockchain and cryptocurrencies.

Analysts Ratings: Analysts are currently divided on Robinhood (HOOD). The consensus rating is “Hold,” with a mix of buy, hold, and sell recommendations. While the sentiment leans positive, the average price target sits below the current stock price. Investors considering HOOD should conduct further research before buying.

source: yahoo finance

Pros

- Fractional Shares: Buy slivers of expensive stocks, ideal for beginners and diversification.

- Cash Management: Earn interest on uninvested cash, a small perk for holding funds.

- Learning Tools: Built-in educational resources empower new investors.

Cons

- Limited Support: Getting help can be tricky with fewer customer support options.

- Outage Issues: Past outages disrupted access and frustrated investors.

- Active Focus: Geared more towards active traders, overwhelming for casual investors.

Our thoughts

Robinhood isn’t solely focused on blockchain technology. They offer a broader range of investment options. Consider including other companies on your blockchain stocks list if you seek pure blockchain exposure.

| Ticker | NASDAQ: HOOD |

| Service | Electronic trading platform |

| Market Cap. | $19.56B |

| (2023) Revenues | $1.865B |

| Founded | 2013 |

Your capital is at risk.

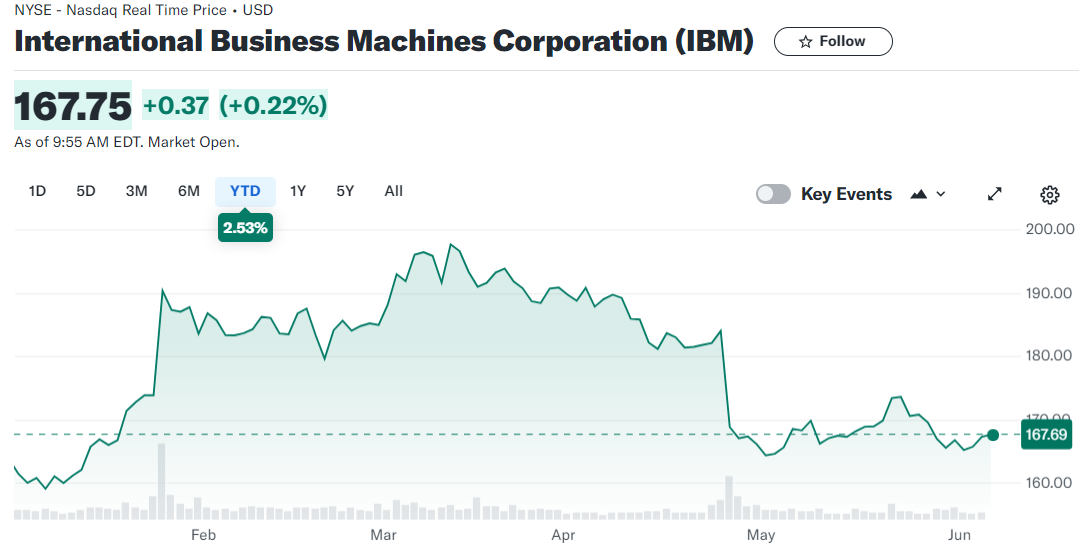

8. IBM (IBM): Bridging legacy tech with blockchain innovation

Founding Date: Established in 1911, IBM is a tech titan with a history of over a century. This longevity indicates the company’s ability to adapt and innovate throughout the ever-changing technological landscape.

Tech Offered: Beyond its traditional hardware offerings like computers and servers, IBM is a major player in the blockchain space. They offer a comprehensive suite of blockchain solutions designed to address industry-specific challenges.

For example, IBM Blockchain can help financial institutions streamline transactions and enhance security.

Their solutions can improve data tracking and patient record management in healthcare. The technology can also be applied to optimize supply chains and ensure product authenticity.

This diverse range of blockchain applications positions IBM as a relevant player for investors interested in blockchain stocks.

Analyst Ratings: Analysts are bullish on IBM. A consensus “Buy” rating and an average price target of $192.58 suggests potential for significant upside. This positive sentiment adds to its appeal for investors considering blockchain stocks.

source: yahoo finance

Pros

- Tech Expertise: IBM’s decades of tech experience bolster their blockchain development.

- Industry-Specific Solutions: IBM’s blockchain solutions cater to specific industry needs, offering tailored applications in finance, healthcare, and supply chain management.

Cons

- Large and Complex Organization: IBM’s size and complexity can make it slow to adapt to rapidly changing technological landscapes like blockchain.

- Focus Beyond Blockchain: While IBM has a strong blockchain presence, their core business isn’t exclusively focused on blockchain technology. This may be a consideration for investors seeking pure-play blockchain stocks.

Our thoughts

IBM’s reputation as a leading technology company and its comprehensive IT solutions addressing industry-specific challenges make it a compelling investment for those considering blockchain stocks.

However, it’s important to acknowledge that IBM has also had some failed blockchain projects, such as the TradeLens collaboration with Maersk. Investors should consider the potential and the risks before investing in IBM as a blockchain stock.

For investors looking to diversify their holdings within the blockchain sector, IBM should be considered alongside other companies with a strong focus on blockchain technology and a proven track record of success. A balanced portfolio can help mitigate risk.

| Ticker | NYSE: IBM |

| Service | Computer technology, industrial research, information technology consulting |

| Market Cap. | $153.929B |

| (2023) Revenues | $61.860B |

| Founded | 1911 |

Your capital is at risk.

What is the future of blockchain?

The future of blockchain holds immense potential across various sectors. In government, blockchain promises increased transparency and efficiency in record-keeping.

Blockchain’s decentralized nature benefits cybersecurity, enhancing data protection and preventing unauthorized access. In healthcare, blockchain can revolutionize patient data management, ensuring privacy and facilitating secure sharing among healthcare providers.

Financial transactions are set to become more streamlined and cost-effective through blockchain technology, reducing intermediaries and increasing transaction speed. Blockchain stocks present an opportunity for investors to capitalize on this burgeoning technology.

As interest in crypto assets grows, so does the demand for blockchain stocks. Investors seeking exposure to this sector can explore a diverse range of blockchain stocks, including those focused on infrastructure development, cryptocurrency mining, and blockchain-based applications.

When compiling a list of blockchain stocks, investors should consider factors such as the company’s technological innovation, market position, and regulatory compliance.

While blockchain technology is still in its early stages, its potential to transform industries and drive innovation is undeniable. As adoption continues to grow, blockchain stocks will likely remain a compelling investment opportunity for those bullish on the future of decentralized technology.

Countries that are adopting blockchain technologies

Blockchain technology is rapidly gaining traction worldwide, with several countries emerging as frontrunners in its adoption. This presents exciting opportunities for investors interested in blockchain and crypto stocks [blockchain stocks list].

- El Salvador became the first mover, adopting Bitcoin as legal tender in 2021. This bold move signifies the potential for blockchain technology to reshape traditional financial systems.

- Singapore is actively exploring blockchain through Project Ubin. Led by its central bank, this project investigates blockchain’s role in streamlining interbank payments and securities settlement. The focus here is on enhancing efficiency and security within the financial sector.

- Switzerland‘s “Crypto Valley” fosters innovation in decentralized finance (DeFi) and blockchain applications. Startups in this region are developing solutions that could revolutionize traditional financial structures, from secure identity management to asset tokenization.

- India is leveraging blockchain to transform governance. Aadhaar-based projects utilize blockchain for secure identity verification. This exemplifies India’s commitment to using technology to streamline processes, fight fraud, and strengthen data security.

- Estonia is a leader in e-governance, utilizing blockchain to secure its digital identity system. Their innovative e-Residency program allows individuals worldwide to access Estonian government services remotely through secure blockchain-based authentication.

- China‘s Blockchain Service Network (BSN) aims to accelerate the development and adoption of blockchain applications. This global infrastructure project provides businesses a cost-effective platform for integrating blockchain into various industries.

These examples showcase the diverse applications of blockchain technology worldwide. As countries embrace this transformative technology, the potential for related stocks will likely surge.

Blockchain adoption rate forecasts

Before diving into the world of blockchain stocks, understanding the technology’s adoption rate is crucial. Here’s a glimpse into what leading analysts predict:

- Reaching Critical Mass: Bloomberg Intelligence analyst Jamie Coutts forecasts that if the current trend continues, blockchain technology could have a staggering 100 million daily users by 2028. This signifies a significant leap in adoption and mainstream integration.

- Crypto User Boom: A joint study by BCG, Bitget, and Foresight Ventures predicts a surge in crypto users. Their research suggests the number of crypto users globally could reach 1 billion by 2030, representing over 11% of the world’s population. This highlights the growing interest in cryptocurrencies, which often intertwine with blockchain technology.

- Market on the Rise: Fortune Business Insights estimates the global blockchain technology market to reach a staggering $825.93 billion by 2032. This significant growth reflects the increasing demand for blockchain solutions across various industries.

These forecasts paint a promising picture for the future of blockchain technology. As adoption accelerates, blockchain and crypto stocks become even more attractive for investors seeking exposure to this revolutionary trend.

FAQs

What is blockchain?

This is the power of blockchain. Blockchain stocks allow you to invest in companies developing and using this exciting technology.

Are blockchain stocks a safe investment?

Do blockchain stocks rise if Bitcoin’s value increases?

Where to buy blockchain stocks?

What is the best stock for blockchain?

Consider factors like a company’s experience, leadership, and specific application of blockchain technology. Use blockchain stock lists as a starting point for your research.

Is blockchain good to invest in?

Who is the best blockchain company?

How do you invest in blockchain?

Sources:

- https://www.barrons.com/market-data/stocks/

- https://www.marketwatch.com/investing/stock/

- https://www.marketscreener.com/quote/stock/

- https://www.nasdaq.com/market-activity/stocks/

- https://markets.businessinsider.com/stocks/riot-stock

- https://www.mas.gov.sg/schemes-and-initiatives/project-ubin

- https://www.fortunebusinessinsights.com/industry-reports/blockchain-market-100072

- https://blockchain.news/news/riot-platforms-bolsters-hash-rate-with-a-974m-purchase-of-microbt-miners

- https://investors.cleanspark.com/news/news-details/2024/CleanSpark-Announces-Strategic-Agreement-for-up-to-160000-Bitmain-S21-Miners-Path-to-50-EHs/default.aspx

Disclaimer

This communication is for information and education purposes only. It should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments.

This material has been prepared without considering any particular recipient’s investment objectives or financial situation and has not been prepared following the legal and regulatory requirements to promote independent research.

Any references to past or future performance of a financial instrument, index, or packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.