Canadians are flocking to Bitcoin ETFs. In 2024, Canadian Bitcoin ETFs witnessed a staggering inflow of $5.5 billion, marking a rise of $2.2 billion from the previous month.

This surge mirrors a similar trend in the United States, highlighting a growing desire for exposure to Bitcoin without the complexities of directly owning and storing it.

However, with numerous Bitcoin ETFs available in Canada, choosing the right one can be daunting.

This article explores the top 8 Bitcoin ETFs in Canada for 2024, including Spot Bitcoin ETFs that directly hold Bitcoin.

What are Bitcoin ETFs?

A Bitcoin ETF is an investment fund traded on stock exchanges, mirroring Bitcoin’s price movements. It offers investors exposure to Bitcoin without directly owning the asset.

Investors seeking exposure to Bitcoin have two main options: directly holding the cryptocurrency or utilizing futures contracts. This approach allows for portfolio diversification and potential gains from Bitcoin’s growth.

Additionally, it offers an alternative to physically acquiring and storing Bitcoin, appealing to both retail and institutional investors in the cryptocurrency space.

Like mutual funds, Bitcoin Exchange-Traded Funds (ETFs) pool investor capital to acquire a basket of assets tracking Bitcoin’s price. Unlike directly owning Bitcoin, investors hold shares in the ETF, managed by a provider who holds the underlying assets.

In our case, Bitcoin ETFs in Canada provide Canadians with a regulated, convenient, and liquid way to invest in Bitcoin.

Spot Bitcoin ETFs track Bitcoin’s price directly, offering exposure without futures. Traditional Bitcoin ETFs may use futures to mimic Bitcoin’s price movements, providing indirect exposure. Spot Bitcoin ETFs offer a more direct and transparent investment in Bitcoin, while traditional Bitcoin ETFs may introduce complexity through derivatives..

Where is the best place to buy Bitcoin ETFs?

Reputable brokerage platforms are excellent for buying Bitcoin ETFs. These platforms offer a wide range of ETFs, including those focused on Bitcoin and Ethereum.

Designed with user-friendliness, these platforms allow you to explore and invest in various ETFs. They aim to provide investors with comprehensive information, real-time prices, and seamless trading options.

Canada’s top 8 Bitcoin ETFs for purchase

Are you intrigued by Bitcoin but hesitant about directly owning cryptocurrency? Consider a Bitcoin ETF!

This section explores eight of the top Bitcoin ETFs available in Canada. Discover how these investment vehicles offer convenient exposure to Bitcoin’s price movements within a regulated framework.

Important: Bitcoin investments involve high risk and are unsuitable for all financial situations. Its value can fluctuate significantly, and due to its inherent volatility, you may lose your entire investment.

Note: All ($) prices and financials are expressed in USD.

1. Fidelity Advantage Bitcoin ETF [FBTC]: Direct Bitcoin exposure, secure custody by Fidelity

source: fidelity

The Fidelity Advantage Bitcoin ETF (FBTC) offers indirect exposure to Bitcoin’s price through a traditional stock exchange. Held in tax-advantaged accounts, it trades during stock market hours, bypassing the need for individual Bitcoin custody.

Fidelity Investments Canada ULC, a prominent investment management firm, manages FBTC, Canada’s first spot Bitcoin ETF.

Fidelity Clearing, Canada’s inaugural Investment Industry Regulatory Organization of Canada (IIROC), approved Fidelity, which provides institutional investors with Bitcoin trading and custodian services.

With Bitcoin’s extreme volatility inherent, FBTC carries a high-risk rating, mirroring Bitcoin’s price swings. The fund’s objective is straightforward: to invest in Bitcoin, with unit holders directly affected by its daily price fluctuations.

Unlike Bitcoin ETFs reliant on futures contracts, FBTC is physically backed by Bitcoin, resembling commodity ETFs. By May 6th, the fund held 5098.7332 Bitcoin, traded on the Toronto Stock Exchange.

The Bitcoin Sub-Custodian securely stores 98% of FBTC’s Bitcoin offline in cold storage, temporarily using “hot” storage for deposits and redemptions.

| Price (As of publication) | $27.58 |

| Launched | 2021 |

| Assets under management ($) | 489.1M |

| Average daily volume (ADV) | 45,457 |

| Management fee | 0.39% |

| Management Expense Ratio | 0.95% |

| One year return to date (YTD, %) | 103.99% |

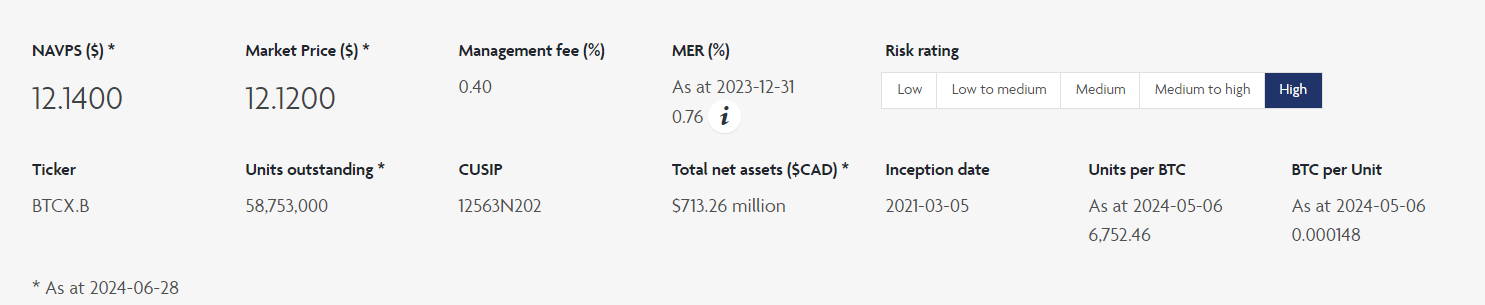

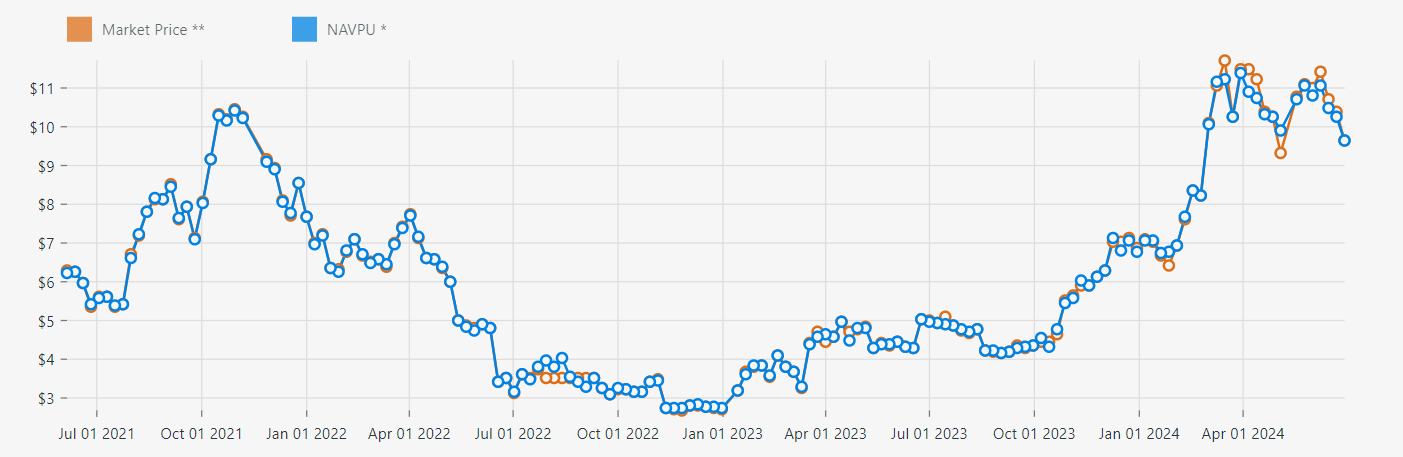

2. CI Galaxy Bitcoin ETF [BTCX.B]: Invest in Bitcoin with CI Galaxy’s expertise

source: cifinancial

CI Galaxy Bitcoin ETF, managed by Galaxy Digital Capital Management LP, offers exposure to Bitcoin through an institutional-quality fund platform.

It tracks Bitcoin’s price movement, providing streamlined access without additional features. The fund invests directly in Bitcoin, priced using the Bloomberg Galaxy Bitcoin Index (BTC), administered by Bloomberg Index Services Ltd. The

CI Galaxy Bitcoin ETF stands out for its competitive price point and CI and Galaxy’s extensive experience in managing digital assets.

This Canadian-based Bitcoin ETF also benefits from a low-cost management fee and Bitcoin storage in a segregated cold storage system, following industry-leading protocol.

Managed by GDAM’s veteran portfolio management team, it offers convenient trading and eligibility for registered plans like TFSAs and RRSPs.

With annual distributions, CI Galaxy Bitcoin ETF provides a reliable avenue for Canadian investors to gain exposure to Bitcoin within a regulated framework.

Additionally, CI GAM’s leadership in digital assets extends to its other offerings, including the CI Galaxy Bitcoin Fund and the upcoming CI Galaxy Ethereum ETF (ETHX), which is expected to be the first ETF globally to invest directly in Ether, the cryptocurrency powering the Ethereum blockchain.

| Price (As of publication) | $12.12 |

| Launched | 2021 |

| Assets under management ($) | 713.26M |

| Average daily volume (ADV) | 365,306 |

| Management fee | 0.40% |

| Management Expense Ratio | 0.76% |

| One year return to date (YTD, %) | 65.40% |

3. Evolve Bitcoin ETF [EBIT]: Pure Bitcoin play in a convenient ETF format

source: evolve etfs

Evolve Bitcoin ETF (EBIT) stands out as Canada’s pioneering Bitcoin ETF, offering investors a straightforward and secure avenue to engage with the cryptocurrency market.

Listed on the Toronto Stock Exchange (TSX), EBIT diverges from other Bitcoin ETFs by directly holding physical Bitcoin, ensuring investors partake in the actual asset’s price movements. This distinguishes it from those tethered to derivatives.

EBIT presents numerous advantages. Firstly, it’s easily tradable via brokerage accounts, akin to stock transactions. Secondly, investors can nestle EBIT within registered accounts such as RRSPs and TFSAs, fostering tax-sheltered growth.

EBIT comprises two share classes: EBIT denominated in Canadian dollars (CAD) and EBIT.U in US dollars (USD), catering to diverse investor preferences.

Despite its merits, EBIT echoes Bitcoin’s inherent volatility, thus necessitating a risk-tolerant stance from investors. The cryptocurrency’s price fluctuations underscore the need for a cautious approach, particularly for those unaccustomed to heightened market unpredictability.

Evolve Bitcoin ETF (EBIT) emerges as a prime option within Canada’s burgeoning Bitcoin ETF landscape. It provides investors with a seamless gateway to engage with cryptocurrency while navigating associated risks and opportunities.

| Price (As of publication) | $29.55 |

| Launched | 2021 |

| Assets under management ($) | 200.80M |

| Average daily volume (ADV) | 59,611 |

| Management fee | 0.75% |

| Management Expense Ratio | 1.69% |

| One year return to date (YTD, %) | 47.15% |

source: 3iQ

The 3iQ Coinshares Bitcoin ETF, listed on the Toronto Stock Exchange (TSX), tracks Bitcoin’s price movements, providing regulated exposure without directly purchasing Bitcoin.

Acting as a feeder fund domiciled in Australia, it grants access to the 3iQ CoinShares Bitcoin ETF and Ether ETF, listed on TSX. These ETFs invest in Bitcoin and Ether, respectively. These holdings are sourced from vetted exchanges and OTC trading partners.

With investment objectives focused on exposing Unitholders to Bitcoin’s price and daily US dollar fluctuations, 3iQ aims for long-term capital growth.

Investors have benefited from 3iQ’s extensive digital asset expertise since its inception in 2012. Compared to direct cryptocurrency transactions, 3iQ offers transparent costs and risk mitigation.

Liquidity is ensured through trading on Cboe and daily unit redemptions, while its dual-regulated structure, compliant in Australia and Canada, offers added security. Notably, it boasts historically low tracking errors among digital asset-based ETFs in Canada.

The 3iQ Coinshares Bitcoin ETF provides a secure and simplified avenue for investors to participate in Bitcoin’s potential growth. It leverages established market mechanisms while benefiting from 3iQ’s expertise and transparent operational model.

| Price (As of publication) | $13.10 |

| Launched | 2021 |

| Assets under management ($) | 318.95 |

| Average daily volume (ADV) | 25,522 |

| Management fee | 1.00% |

| Management Expense Ratio | 1.75% |

| One year return to date (YTD, %) | 59.0% |

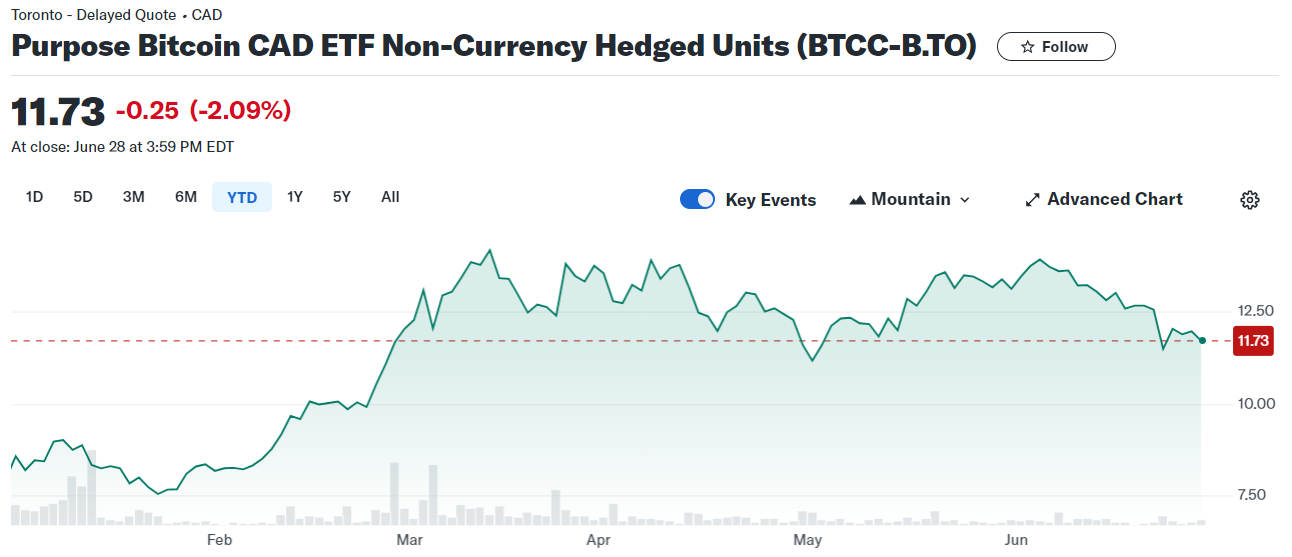

5. Purpose Bitcoin ETF [BTCC.B]: Simple and secure way to access Bitcoin

Purpose Investments debuted the world’s inaugural Bitcoin ETF in February 2021. Purpose Bitcoin ETF is distinctively backed by physical Bitcoin rather than derivatives and mirrors the structure of traditional precious metal ETFs on the TSX.

Offering a seamless avenue for Bitcoin investment, BTCC is available through regulated brokerage platforms, ensuring investor protection under the Canadian Investor Protection Fund (CIPF) if brokerage insolvency arises.

This ETF exclusively allocates assets to physically settled Bitcoin, eschewing other holdings. BTCC.B, tracking the TradeBlock XBX Index, serves as a US Dollar-denominated benchmark for Bitcoin’s price.

Traded on the TSX under three ticker symbols, BTCC provides investors with diverse options. BTCC hedged against US dollar exposure, is purchasable in Canadian dollars.

Conversely, BTCC.B, also acquirable with Canadian dollars, must hedge against US dollar fluctuations. Lastly, BTCC.U, denominated in US dollars, caters to investors seeking direct exposure without currency conversion hassles.

| Price (As of publication) | $11.73 |

| Launched | 2021 |

| Assets under management ($) | $1.91B |

| Average daily volume (ADV) | 482,206 |

| Management fee | 1.00% |

| Management Expense Ratio | 1.50% |

| One year return to date (YTD, %) | 53.43% |

6. Evolve Cryptocurrencies ETF [ETC]: Go beyond Bitcoin with Evolve’s diversified crypto ETF

The Evolve Cryptocurrencies ETF (ETC) mirrors the daily price movements of selected digital assets, focusing on market capitalization. Managed actively, it invests in publicly offered investment funds to minimize tracking errors.

ETC, a Canadian investment fund, exposes Bitcoin and Ethereum, the leading cryptocurrencies. Traded on the Toronto Stock Exchange (TSX), it functions similarly to a stock.

Accessible through regular brokerage accounts, ETC offers an alternative to crypto exchanges and is compatible with Canadian retirement savings accounts.

ETC’s performance aligns with the combined market capitalization of Bitcoin and Ethereum, with monthly weighting adjustments. This ensures a dynamic portfolio that reflects the changing values of these assets.

By investing in ETC, individuals gain a regulated avenue to participate in cryptocurrency markets within a familiar investment framework. However, it’s crucial to acknowledge that ETC’s value is subject to the volatility of Bitcoin and Ethereum prices.

| Price (As of publication) | $9.91 |

| Launched | 2021 |

| Assets under management ($) | $39.371M |

| Average daily volume (ADV) | 15,785 |

| Management fee | 0.75% |

| Management Expense Ratio | 1.71% |

| One year return to date (YTD, %) | 48.80% |

7. YieldMax Bitcoin Option Income Strategy ETF [YBIT]: Earn income on Bitcoin with YieldMax’s strategy

The YieldMax Bitcoin Option Income Strategy ETF (YBIT) aims to generate current income through a synthetic covered call strategy on select U.S.-listed exchange-traded products (Bitcoin ETPs).

Under the management of ZEGA Financial, YBIT does not make direct investments in Bitcoin ETPs, Bitcoin, or any digital assets.

Additionally, it does not invest in derivatives tracking Bitcoin or digital assets. Investors seeking direct exposure to Bitcoin’s price should explore alternatives to YBIT.

This ETF offers a unique approach for investors interested in Bitcoin ETFs in Canada. It provides an avenue for income generation within the Bitcoin market without direct exposure to its underlying assets.

For those navigating the landscape of Bitcoin ETFs in Canada, YBIT presents an option to consider alongside traditional spot Bitcoin ETFs.

| Price (As of publication) | $17.45 |

| Launched | 2024 |

| Assets under management ($) | $15.14M |

| Average daily volume (ADV) | 102,975 |

| Management fee | 0.29 |

| Management Expense Ratio | 0.99 |

| One year return to date (YTD, %) | N/A |

What is a Spot Bitcoin ETF?

A spot Bitcoin ETF directly holds physical Bitcoin, offering investors exposure to the cryptocurrency’s current market price movements.

Unlike futures-based ETFs, spot ETFs do not rely on derivatives contracts. This structure mirrors owning Bitcoin, allowing investors to track its price without directly owning the digital currency.

Spot Bitcoin ETFs provide a straightforward way for investors to gain exposure to Bitcoin’s price fluctuations without the complexities of managing digital wallets or trading on cryptocurrency exchanges.

In Canada, the introduction of spot Bitcoin ETFs offers investors a regulated and accessible avenue to invest in Bitcoin through traditional brokerage accounts.

As interest in Bitcoin ETFs continues to grow in Canada, spot ETFs provide an attractive option for individuals seeking exposure to Bitcoin’s price movements within the confines of a regulated investment vehicle.

Are Bitcoin ETFs volatile?

Bitcoin ETFs, including spot Bitcoin ETFs, can exhibit volatility due to the inherent nature of cryptocurrency markets.

Prices of Bitcoin and other cryptocurrencies can experience rapid fluctuations influenced by various factors such as market demand, regulatory developments, and investor sentiment.

While Bitcoin ETFs provide exposure to digital assets without requiring direct ownership, they can still be subject to price swings similar to those experienced by Bitcoin.

Investors should know the potential for volatility when considering investing in Bitcoin ETFs in Canada. Conducting thorough research and understanding the risks involved is essential for individuals looking into Bitcoin ETFs in Canada.

Despite the volatility, Bitcoin ETFs can offer an opportunity for investors to participate in the cryptocurrency market through regulated and accessible investment vehicles.

What are the risks of buying Bitcoin ETFs?

The performance of Bitcoin ETFs Canada is directly tied to the cryptocurrency market, subjecting investors to market-specific risks. For instance:

- Volatility: Bitcoin prices can fluctuate dramatically.

- Regulatory uncertainty: Changes in regulations may impact ETF performance.

- Liquidity risk: Spot Bitcoin ETFs in Canada may have lower trading volumes.

- Cybersecurity threats: Potential theft or loss of digital assets.

- Market risk: Influenced by global economic conditions and investor sentiment.

- Currency risk: Bitcoin operates independently of traditional currencies.

Thorough research and understanding of these risks are essential before investing in Bitcoin ETFs.

FAQs

Several Bitcoin ETFs trade on Canadian exchanges. Choosing the “best” depends on your investment goals. Consider factors like Management Expense Ratio (MER) fees, whether the ETF trades in Canadian dollars (CAD) or US dollars (USD), and if it offers additional features like dividend payouts.

Yes, Canada has numerous Bitcoin ETFs, also called Spot Bitcoin ETFs. These ETFs hold actual Bitcoin, allowing investors indirect exposure to Bitcoin’s price movements without directly owning it.

There is no single “best” Bitcoin ETF. Before choosing, research and compare factors like MER fees, CAD or USD trading, and unique features.

The best-performing Bitcoin ETF can vary over time and depends on market conditions. Investors should conduct thorough research and consider historical performance, expense ratios, and tracking errors.