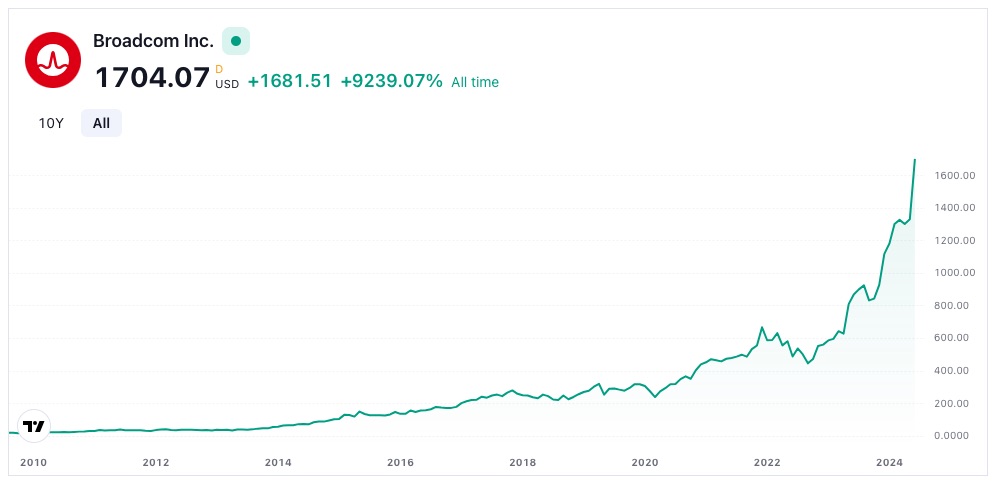

Semiconductor company Broadcom (NASDAQ:AVGO) made news this week when it announced a 10-for-one stock split. Shares of Broadcom stock immediately surged on the news, rising some 12% on Thursday to roughly $1,680 per share. In fact, the price temporarily surpassed $1,700 per share during the day on Thursday.

However, the stock split was not the only catalyst, as Broadcom has been one of the top-performing stocks on the market in recent years, fueled by its artificial-intelligence chips that are used to connect networks.

Over the past five years, Broadcom has posted an average annualized return of 35%. However, it has gone into overdrive in recent years, rising 104% in 2023 and 55% year to date (YTD) in 2024.

When the company’s stock split is implemented on July 15, its share price will drop from wherever it is on that date to one-tenth of that price. For example, if the stock split were conducted today, the shares would drop from where they are now at roughly $1,700 to around $170 per share.

The stock split is being done to make Broadcom stock more accessible to investors, particularly those who might have been priced out of it. However, the shares have not always been this high.

In fact, just 10 years ago, Broadcom stock was trading at around $71 per share on June 13, 2014. Let’s do the math to see how much you would have now if you had invested $5,000 in Broadcom 10 years ago.

From $71 to $1,700

It should be noted that going back 10 years includes the two years before Avago Technologies acquired Broadcom Corp., in February 2016.

At that point, the acquiring firm, Avago, was trading on the Nasdaq under the ticker “AVGO.” However, the merged company decided to use the Broadcom name and the “Avago “AVGO” ticker.

Both companies had been top-10 semiconductor firms before the merger. Afterwards, the combined company became a top-four chipmaker with annual revenue of $15 billion and a market cap of $77 billion.

For the sake of this exercise, let’s go back to June 13, 2014, two years before Avago bought Broadcom. AVGO stock was trading at $71 per share. As such, if you had invested $5,000 in the future Broadcom on that date, you’d be pretty pleased with the results right now.

Turning $5K into $145K

A $5,000 investment in the company that would become Broadcom back then would have netted you approximately 70 shares of the stock at $71 apiece. Over the next 10 years, Broadcom would turn into what is known as a 20-bagger, meaning it increased by 20 times — almost 25, in fact.

On a cumulative basis, you’d have racked up a return of nearly 2,300% over that time. On an annualized basis, you’d have an average annual return of 37%. Counting dividends, the total annualized return would be 40%.

By comparison, the S&P 500 has had an average annualized return of 12.9% over that same period, including dividends reinvested.

Thus, investing $5,000 to buy 70 shares in 2014 would make your investment worth about $145,000 right now, based on the 40% average annualized return. If you had contributed an additional $50 per month to that stock over the past 10 years, you’d have approximately $194,000 right now.

A new opportunity

With the stock split coming on July 15, Broadcom’s new price will make the entry price much more reasonable. The post-split share price will be based on what the closing price is on July 11.

Thus, assuming there are no major changes in the price between now and July 11, it should be somewhere between $165 and $175 per share. That would roughly be where it was eight years ago, when Avago and Broadcom merged to form the company we see today.

Considering that Broadcom is now one of the best AI stocks on the market and one of the 10 largest U.S. companies with a market cap of roughly $780 billion, investors may want to consider being part of Broadcom’s next generation of growth.