S&P 500 didn‘t shake off the post-FOMC minutes selloff in the least – and credit markets don‘t offer much short-term clarity either. Probably the brightest sign comes from the intraday reversal in financials higher – but tech still isn‘t catching breadth, which is key to the 500-strong index recovery. Bonds remained in the count down mode, as in not yet having regained composure and risk-on posture.

Q3 2021 hedge fund letters, conferences and more

The bottom might not be in, taking more time to play out – if we see a really strong non-farm payrolls figure, the odds of Fed tapering and rate hiking seriously drawing nearer, would be bolstered – to the detriment of most assets. So, we could be looking at a weak entry to today‘s S&P 500 session. But as the data came in at measly 199K, more uncertainty is introduced – will they or won‘t they (taper this fast and hike) – which works to drive chop and volatility.

We‘re looking at another risk-off day today – and a reflexive but relatively tame rally in quality debt instruments. Crude oil is likely to be least affected, followed by copper as the red metals takes a second look at its recent weakness going at odds with broader commodities strength. Precious metals look to be a better bet in weathering the tightening into a weak economy storm than cryptos.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

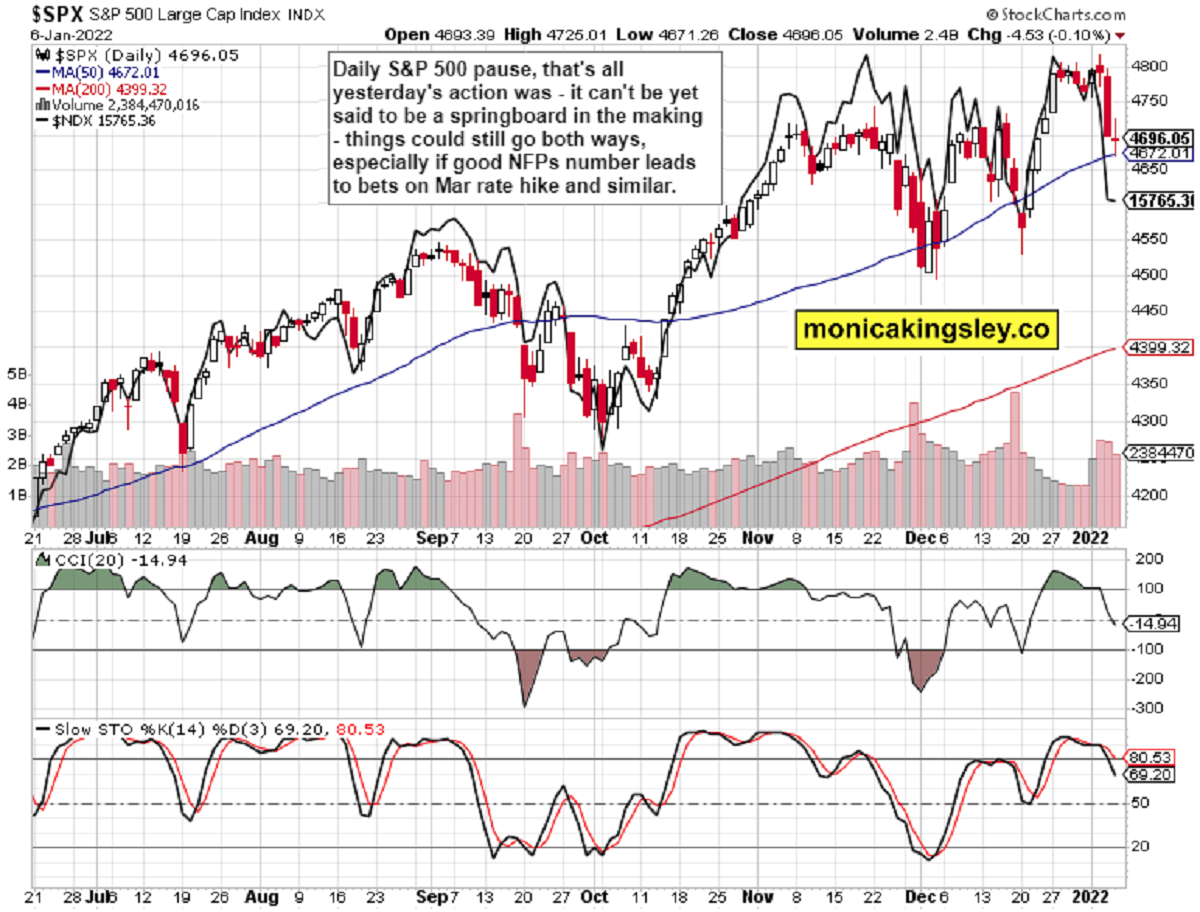

S&P 500 and Nasdaq Outlook

Neither tech nor value offered clues for today‘s session – the downswing overall feels as having some more to go still, and that‘s based on the charts only. Add in the fundamentals, and it could get tougher still.

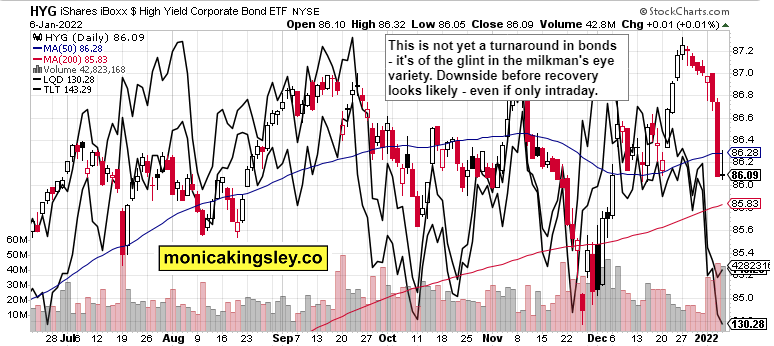

Credit Markets

HYG upswing solidly rejected, and not even high volume helped the bulls – the dust doesn‘t look to be settled here either.

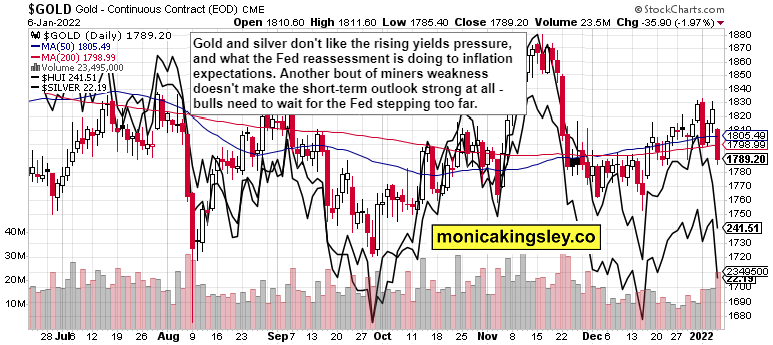

Gold, Silver and Miners

Gold and silver feel the heat, and it might not be yet over in the short run, miners say. Still, note the big picture – we‘re still in a long sideways consolidation where the bears are unable to make lasting progress.

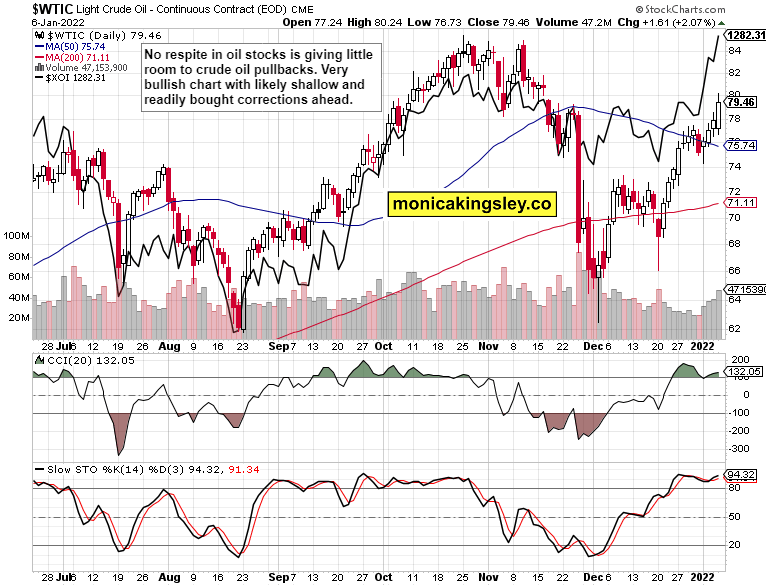

Crude Oil

Crude oil bulls are enjoying the advantage here – firmly in the driver‘s seat. Pullback are being bought, and will likely continue being bought – the upcoming maximum downside will be very indicative of bulls‘ strength to overcome $80 lastingly.

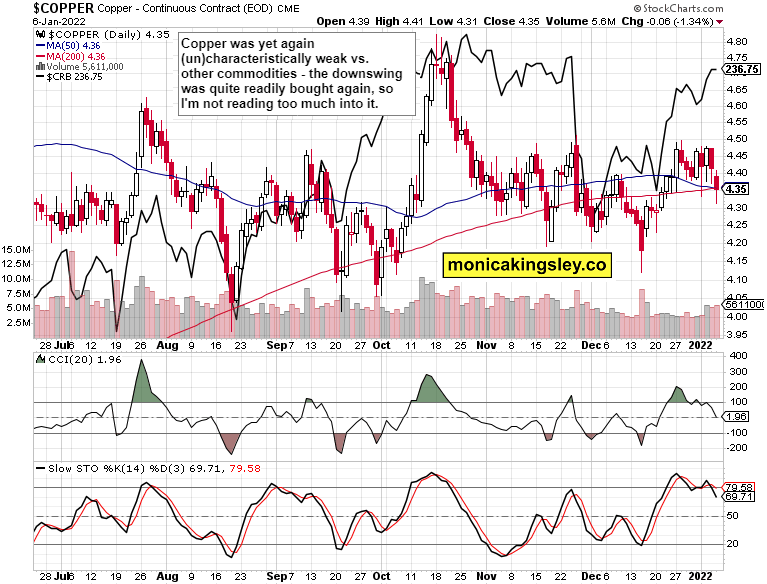

Copper

Copper‘s misleading weakness continues, and similarly to precious metals, it‘s bidding its time as no heavy chart damage is being inflicted through this dillydallying.

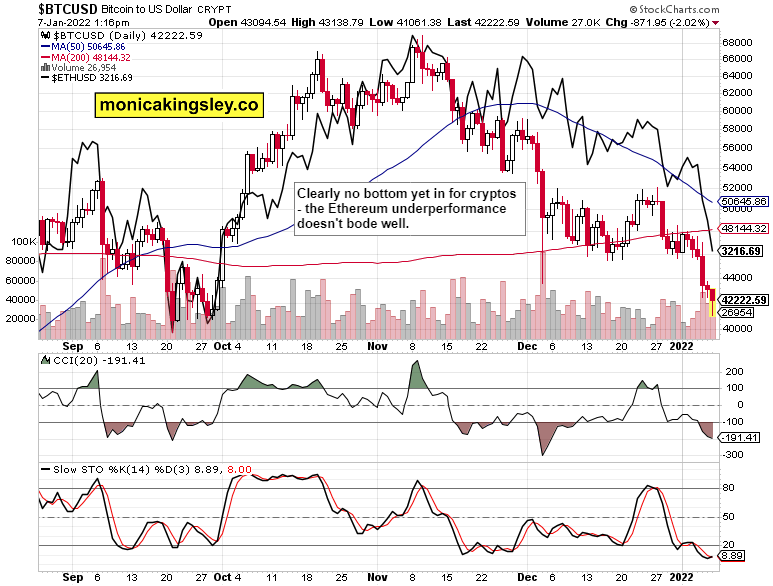

Bitcoin and Ethereum

Bitcoin and Ethereum are in a weaker spot, and the bearish pressure may easily increase here even more. This doesn‘t look to be the time to buy yet.

Summary

S&P 500 still remains on edge and under pressure until convincing signs of turnaround develop – yesterday‘s session didn‘t qualify. With further proof of challenged real economy, a fresh uncertainty (how‘s that going to weather the hawkish Fed, and are they to listen and attenuate, or not?) is being introduced – short-term chop would give way to an increase in volatility. In the non-farm payrolls aftermath, markets haven‘t yet made up their minds – it‘s the riskier end of the asset classes to take the heat the most here (starting with cryptos). Don‘t look though for a tremendous rush into Treasuries – tech decoupling from the rising yields would be a first welcome sign of a local bottom.

Thank you for having read today‘s free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica‘s Insider Club, which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.