The German State of Saxony BTC selling is nearing its end, as almost 90% of its Bitcoin holdings were sold.

The State of Saxony seized 50,000 BTC, worth around $2 billion, from the former operator of movie2k, a pirate movies website. The operator converted the website’s earnings to Bitcoin, believing at the time (2013) that it was untraceable and hoping its value would increase.

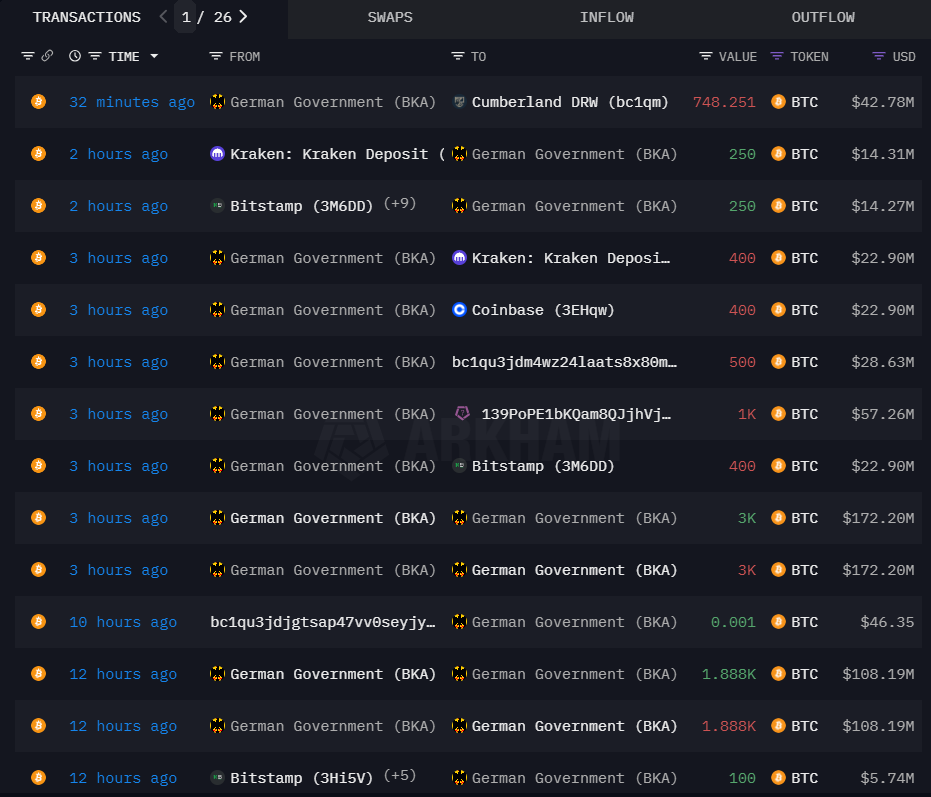

The selling pressure contributed to a decline in Bitcoin price. Blockchain analytics platform Arkham Intelligence shows that only 6,146 BTC are left out of the 50,000, equivalent to around $350 million. The selling is still ongoing at the time of this writing:

source: arkham intelligence

Kraken and Coinbase crypto exchanges have been used in recent transactions. According to Arkham Intelligence, the Bitcoin sent to the German address is likely unsold BTC.

There is speculation that the remaining balance will be sold today. If Bitcoin recovers once the German selling ends, bargain hunters may attempt to pick it up from its lows.

Before the selling, BTC-related tokens—SATS, STX, and ORDI—posted moderate gains during the most recent Bitcoin recovery.

Why ORDI, SATS, and STX?

Ordinals (ORDI) is the native token of the Ordinals Protocol. The protocol utilizes a fraction of a Bitcoin to mint or inscribe NFTs and tokens.

Tokens inscribed on Ordinals are known as BRC-20 tokens. At first, BRC-20 did not receive much exposure until Binance announced a BRC-20 launchpad.

SATS is a meme coin on Ordinals, which has demonstrated strong resilience despite BTC selling.

On the other hand, STX is the native token of Stacks, a platform enabling users to build decentralized applications (dApps) on the Bitcoin blockchain.

In a recovery, BTC-related tokens may post stronger gains than Bitcoin.

It will be interesting to see whether BTC recovery will also affect ongoing presales such as 99Bitcoins that will launch on Ordinals.

Will Bitcoin rebound? All eyes on MicroStrategy

MicroStrategy has been actively buying Bitcoin when the price falls. MicroStrategy holds approximately 226,331 BTC.

According to the form-8k submitted to the US SEC, ‘In April 27, 2024 and June 19, 2024, MicroStrategy acquired approximately 11,931 bitcoins for approximately $786.0 million in cash, using proceeds from the Offering and Excess Cash.’

Once the State of Saxony liquidates all or most of its Bitcoin holdings, it will be interesting to see whether MicroStrategy steps in to ‘buy the dip.’

While the official update may not be instant if large BTC transactions emerge, the speculations may be sufficient to jumpstart a recovery.

Please note that MicroStrategy announced a 10-for-1 stock split on Thursday for those considering buying stock.

source: tradingview

From a technical angle, the key resistance on the 4-hour chart is around $59,250. A firm break above this level may lead to stronger gains.