Despite WDFC stock’s current frothy valuation, the execs’ modest purchases show strong sentiment

Four company officers of WD-40 Company (NASDAQ:WDFC) last week disclosed purchases of shares that occurred in the approved trading window following second-quarter results on April 6, according to recent filings. This could be seen as a positive sign for the stock as insiders purchasing shares is generally viewed as a strong indication of confidence in the company’s future prospects.

Q1 2023 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

The shares were initially spotted on Fintel's Largest Insider Buying tracking page over the weekend.

The four officers purchased a combined total of 1,493 shares, with each purchase made at a price of $179.08 per share.

The officers who bought stock included President and CEO Steve Brass who purchased $100,000 worth of stock and owns a total of 16,533 shares post transaction. The trade boosted Brass’ ownership of the float to around 1.2%.

Chief People, Culture and Capability Officer Jeff Lindeman was on the list with a transaction worth $97,000, topping up his stake to 2,300 shares.

The group's CFO and Treasurer Sara Hyzer acquired $30,000 worth of stock, growing her position to 1,530 shares.

The final officer on the list was VP of General Counsel/Corporate Secretary Phenix Kiamilev who bought $40,000 worth of shares and owns 1,505 in total post transaction.

When insiders buy shares in their own company, it usually indicates that they believe the stock is undervalued and that they expect the stock price to rise in the future. Additionally, it shows that they are aligned with the interests of shareholders and are committed to the long-term success of the company.

Strong Sentiment

Fintel’s officer sentiment score of 85.69 is bullish on WDFC from the perspective of heightened officer buying activity. The score ranks WD-40 company in 271st rank or in the top 3% when screened against 11,930 other globally screened securities.

In the case of WDFC, the trades have come at a time when the stock is down around pre-Covid levels not seen since 2019. Shares have lost around 50% of their value when compared to sky high share prices above $300 reached in early 2021.

The selling pressure in the stock has been no different to market peers and is the result of its inflated valuation as shares rocketed much faster than the pace of sales and profit growth in recent years.

Q2 Highlights

WD-40 reported its second quarter financials to investors last Thursday, which saw total net sales remain relatively flat at $130.2 million, compared to $130.0 million in the same period last year.

WDFC’s second quarter net income was $16.5 million, declining 15% from the previous year, while year-to-date net income decreased 20% to $30.5 million. Despite this, WD-40's gross margin percentage improved to 50.8% in the second quarter compared to 50.4% in the prior year fiscal quarter.

Steve Brass, WD-40 Company's President and CEO, remains optimistic, stating that the company's revenue growth prospects for the back half of the fiscal year look promising. Brass noted that despite double-digit sales growth in the Americas, sales in the EMEA and Asia-Pacific segments were softer due to pricing disruptions and economic conditions. Nonetheless, the company expects to make a strong comeback in both markets during the second half of the year.

WDFC expects to generate 3.5-7.5% sales growth for the full year to $535 to $560 million with net income of $64.5-68.5 million.

Frothy Valuation

With WDFC set to generate just shy of $70 million of net income for the year, the valuation continues to seem stretched with the company currently trading on a forward price-to-earnings ratio of above 35x, which is well above US market averages.

The chart below from Fintel’s Financial Metrics and ratios page for WDFC stock shows the valuation over time for the shares.

Analyst Thoughts

DA Davidson analyst Linda Bolton Weiser maintained her ‘buy’ recommendation following the results but reduced the target price on the shares to $197 from $207. The analyst thinks that volumes should rise in the final quarter of this year and that gross margins should continue to recover into FY24.

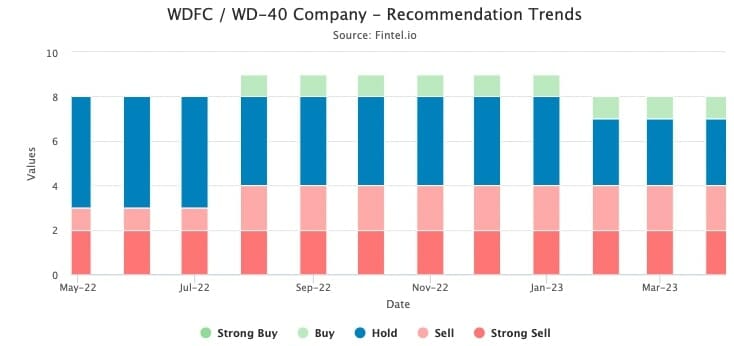

Fintel’s consensus target price of $159.80 suggests analysts in general think the stock is currently overvalued and forecast the price to decline 11.5% over the next year. Most analyst ratings are skewed to ‘hold’ and ‘sell’ recommendations on the stock.

The distribution of ratings is shown in the chart below:

The post Four WD-40 Company Officers Are Bullish, Buying More Stock in the Q2 Trading Window appeared first on Fintel.