Deloitte U.S. Forecast: Client Demand Will Drive ESG-Mandated Assets to Comprise *Half* of all Professionally Managed Investments By 2025

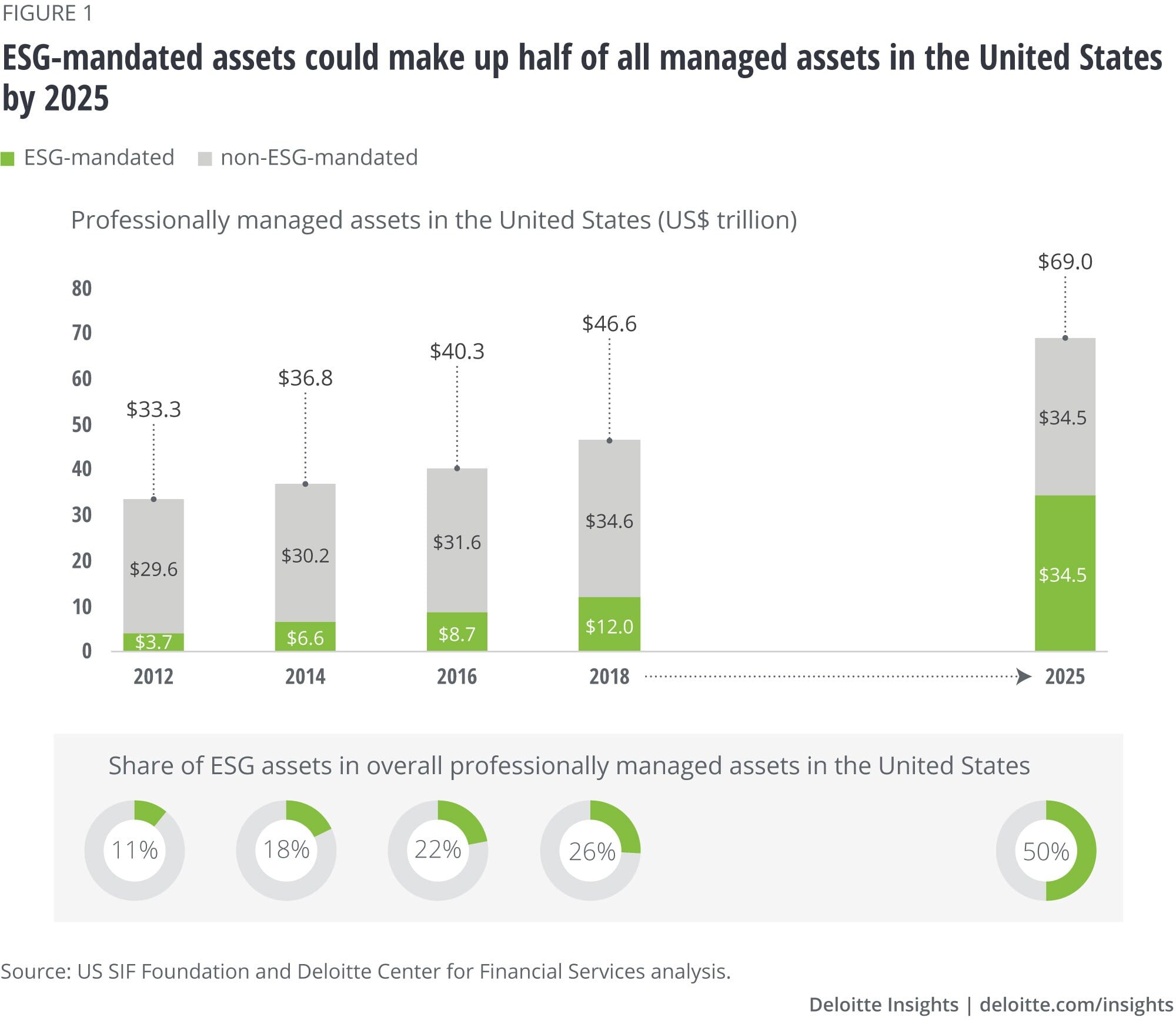

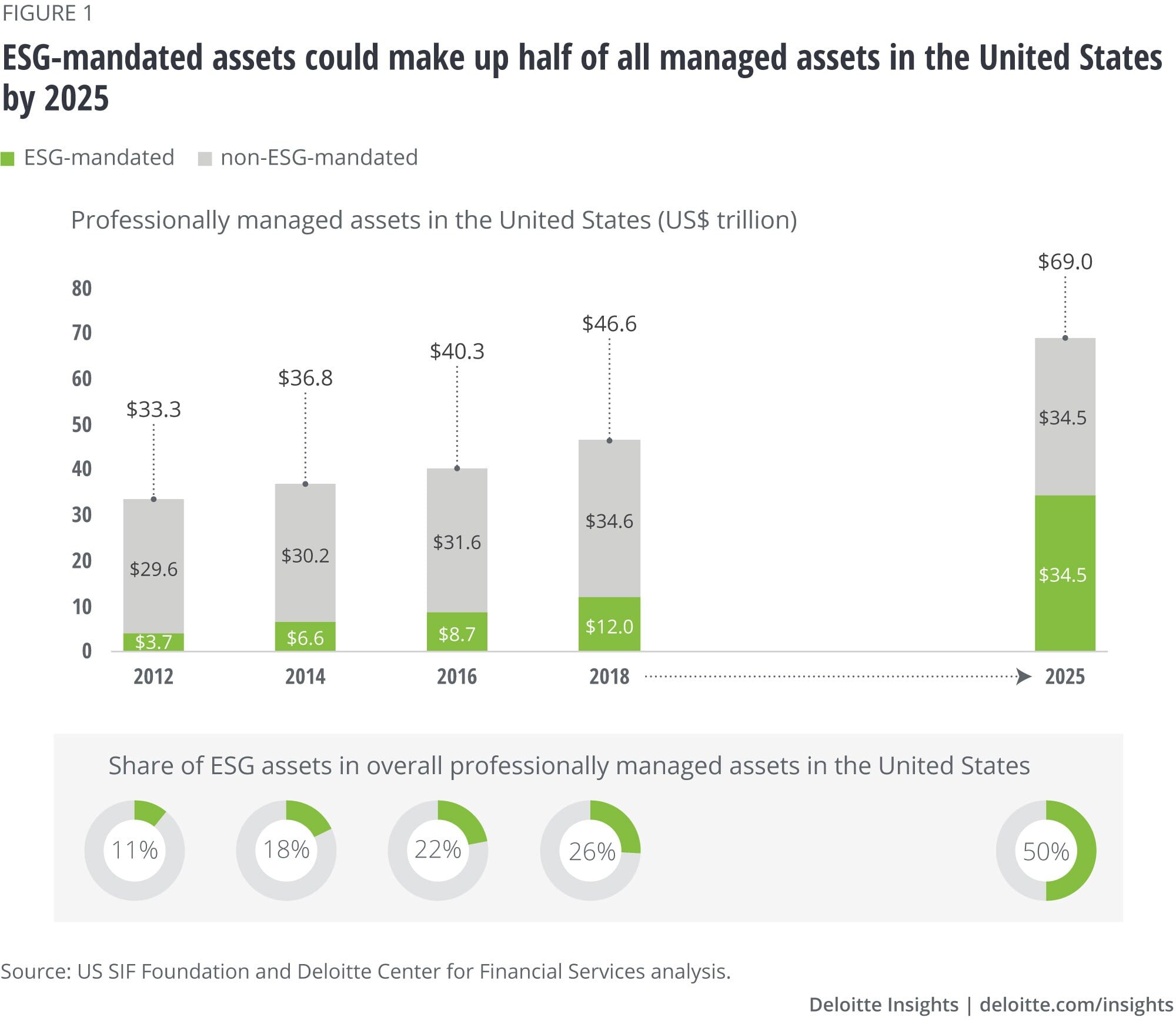

A new report from the Deloitte Center for Financial Services forecasts that client demand will drive ESG-mandated assets to comprise half of all professionally managed investments in the United States by 2025— growing from $12 trillion of assets in 2018 to $34.5 trillion five years from now (the chart below from the report illustrates the rapid growth quite nicely).

Q4 2019 hedge fund letters, conferences and more

What’s more, the report forecasts that investment managers are likely to respond to this demand by potentially launching up to a record 200 new ESG funds by 2023, more than double the amount over the previous three years.

“For an investment manager to capture a greater share of growth in assets under management,” it says, “credibility with investors will likely be critical” and they “should identify any gaps by re-examining their processes through an ESG-principled lens, with an eye on what matters most to today’s investors.” And it has four recommendations that investment managers can take today.

Investing in ESG-mandated assets

Globally, the percentage of both retail and institutional investors that apply environmental, social, and governance (ESG) principles to at least a quarter of their portfolios jumped from 48 percent in 2017 to 75 percent in 2019. While directing investments based on one’s values has been around for decades, discussions between advisors and their clients about ESG investing have become commonplace.

Despite greater adoption within the investment community, the varying approaches to ESG incorporation by investment management firms, regulators, and investors suggest the full potential has yet to be realized. This will likely happen if investment managers routinely consider ESG metrics in all investment decisions. While this scenario seems unlikely in the short term, the Deloitte Center for Financial Services (DCFS) expects client demand to drive ESG-mandated assets to comprise half of all professionally managed investments in the United States by 2025.

According to the DCFS, investment managers are likely to respond to this demand by potentially launching up to a record 200 new ESG funds by 2023, more than double the previous three years. Firms may capture a greater share of this growing allocation to ESG by utilizing emerging technologies for incorporating quality ESG data into the investment decision process, developing products with clear ESG objectives, and embracing an ESG-driven culture across the organization to gain credibility with investors.

As emerging technologies, such as AI, enable better-quality ESG data and the regulatory landscape becomes clearer, institutional, and retail investors are expected to increasingly demand that ESG factors be applied to a greater percentage of their portfolios. In this scenario, ESG assets should continue to grow at a 16 percent compound annual growth rate (CAGR), totaling almost US$35 trillion by 2025.