According to S&P Global Ratings, nearly 50% of total subnational debt in 2023 and 2024 will be from emerging markets (EM) particularly, China and India and this share will continue to grow even as borrowing slows throughout EMs, per S&P Global Ratings expectations.

Still, the outsized pace of borrowing in these two countries masks significant – and in some cases, mounting – barriers to debt markets for many EM local and regional governments (LRGs), even as infrastructure needs persist.

Q4 2022 hedge fund letters, conferences and more

Debt Burden Of Indian LRGs To Reach 195% Of Revenue in 2024

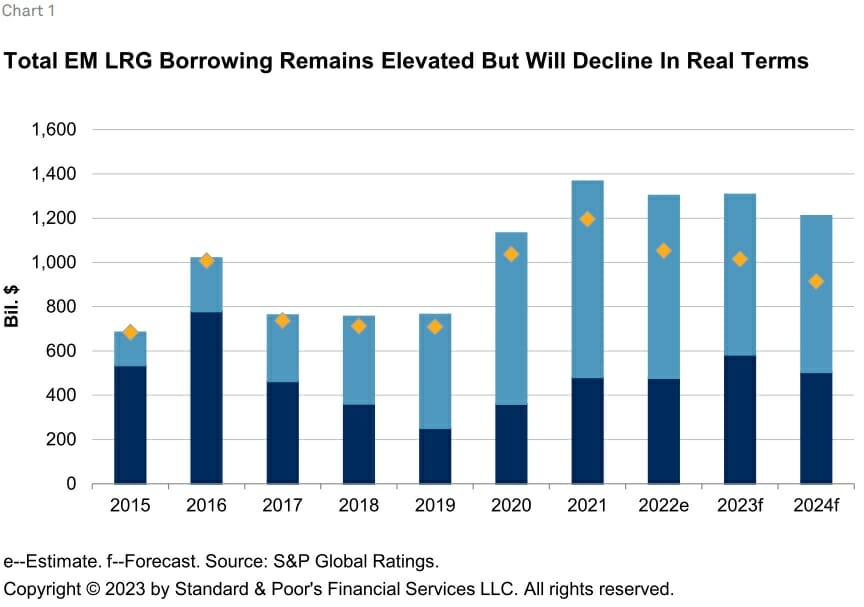

Sarah Sullivant, Credit Analyst, S&P Global Ratings, said: "We expect heavy infrastructure investment programs in China and India will continue to propel global borrowing volume among subnationals in 2023-2024, while other EMs will borrow primarily to refinance existing debt. All of this amounts to projected EM gross borrowing of around $1.2 trillion in 2024, or around 57% of global subnational borrowing, compared with 45% in 2019.”

- China and India will contribute 98% of EM borrowing in 2023 and 2024, primarily to finance infrastructure spending, and throughout other EMs, gross borrowing will decline from an already low base

- Lower net borrowing and inflation dynamics will keep debt burdens broadly stable among EM LRGs, with the notable exception of India

- We believe borrowing capacity and financing needs among many EM LRGs remain high, but obstacles to accessing debt markets persist

- Chinese & Indian LRGS are dominating subnational borrowing

- We expect the debt burden of Indian LRGs will reach 195% of revenue in 2024--the highest share among EMs

Source: S&P Global Ratings