Our KuCoin review covers the key features, fees, and digital products. The cryptocurrency exchange landscape is vast, and choosing the right platform is crucial for any investor. KuCoin, known for its extensive altcoin selection and competitive fees, has been a popular contender for years.

This review examines KuCoin’s current state, addressing beginner concerns and experienced trader needs. We’ll explore its recent implementation of KYC (Know Your Customer) protocols, its recovery from a 2020 hacking incident, and the ongoing situation surrounding its founders’ arrests.

Whether you’re new to crypto or a seasoned investor seeking a new platform, this KuCoin review article provides a comprehensive overview of KuCoin’s strengths, weaknesses, and what to expect.

Reader’s note: The numbers, facts, and figures provided in this article were accurate at the time of publishing.

KuCoin review: Our verdict

Often called the “People’s Exchange,” KuCoin has earned its reputation for accessibility and a wide range of features.

KuCoin offers an impressive array of coins and tokens, surpassing many established exchanges. This particularly appeals to users looking to invest in new, innovative projects and lesser-known altcoins.

This advantage is further accentuated by-products such as GemSPACE, which allows users to buy or trade newly listed tokens and take advantage of exclusive, time-limited campaigns designed specifically for these new tokens.

Feature-rich environment

KuCoin is more than just a regular exchange; it’s a complete crypto ecosystem. Its OTC platform provides a wide range of trading options for trading new tokens before their official launch, including spot, margin, derivatives, and pre-market trading.

KuCoin also prides itself on its accessibility and inclusivity. It offers a comprehensive suite of tools for both novice and experienced traders, including advanced charting tools, API integrations, and mobile apps. The exchange supports multiple languages and provides 24/7 customer support, catering to a global audience.

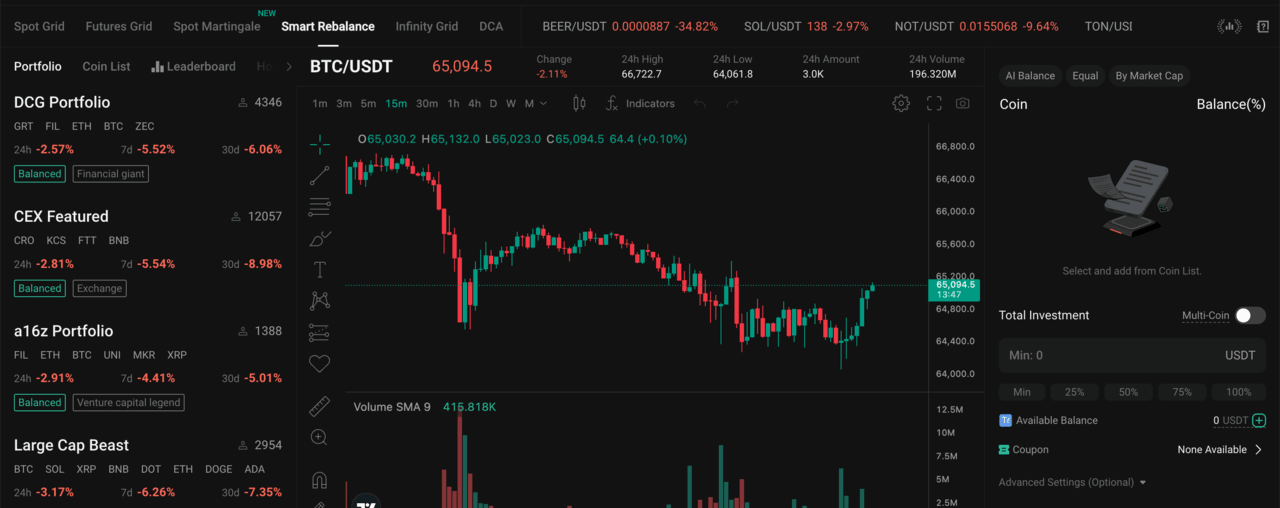

KuCoin provides automated trading through different trading bots, including spot and futures grid, spot martingale, smart balance, DCA, and more. Additionally, KuCoin interacts with its users via social media, contests, and community rewards, fostering a strong sense of community.

KuCoin’s pros and cons

This KuCoin review section examines the platform’s pros and cons to provide a balanced understanding.

Pros:

- Extensive coin selection: Offers over 800 listed cryptocurrencies, including established tokens and promising new ventures.

- Competitive trading fees: Lowers fees for active traders and KCS holders, making it cost-effective for frequent transactions.

- Advanced trading features: Supports margin trading, futures contracts, and trading bots for versatile trading strategies.

- Multiple earning options: This company offers staking, lending, savings products, and more to generate passive income on your crypto holdings.

- Fiat support: This service accepts various fiat currencies for deposits and withdrawals, simplifying entry and exit from the crypto market.

- Security Focus: Includes security features like risk alert systems, account activity alerts, address whitelisting, and more to safeguard user accounts.

- Focus on community: From various participation and earning opportunities to community-driven listing products, GemSpace and GemVote empower users to have a voice on the platform.

- Regular Promotions: Frequent promotional activities and bonuses incentivize users and boost engagement.

- KuCoin Token (KCS) Benefits: Holding KCS unlocks fee discounts, bonus earning potential, and a share of exchange profits.

Cons:

- Complex interface: The trading interface might be overwhelming for beginners.

- Hidden fees: Some user reviews mention complexities with fee structures, potentially leading to unexpected charges.

- Limited staking options: The variety of coins offered for staking might be restricted compared to other platforms.

- Potential for listing unestablished coins: KuCoin’s focus on new listings might introduce users to riskier, unproven cryptocurrencies.

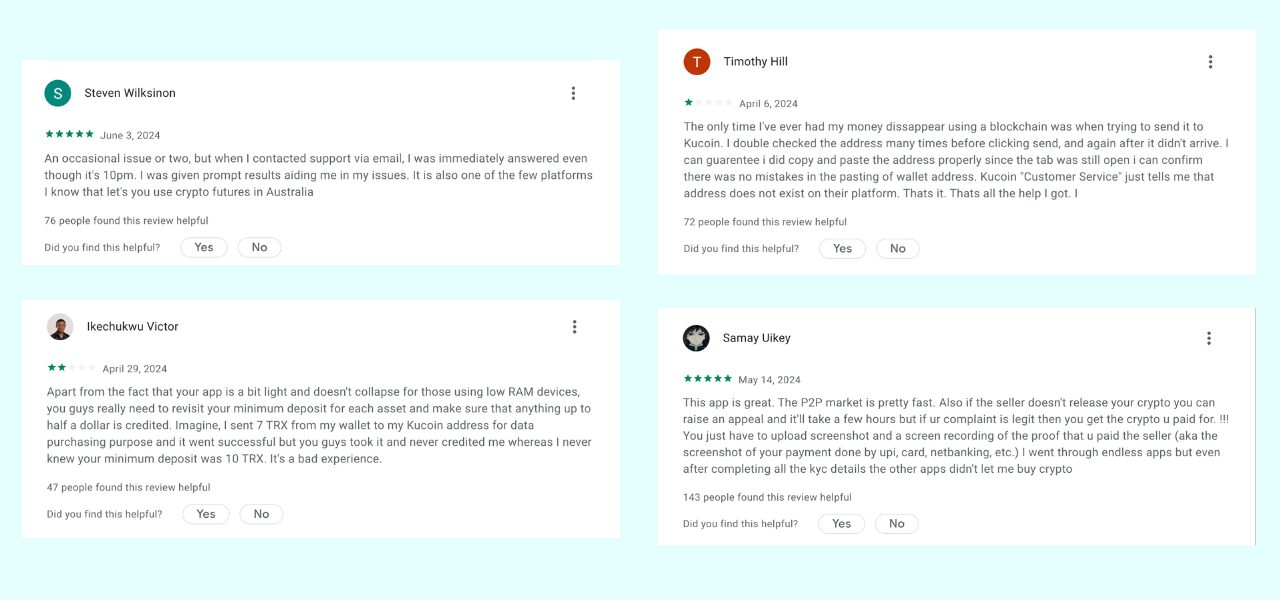

- Customer support: Reviews sometimes mention slow or unhelpful customer service experiences

About KuCoin

KuCoin is a global cryptocurrency exchange founded in Singapore by a team of experienced business specialists with backgrounds in projects like Ant Financial and iBox PAY.

Launched in September 2017 and headquartered in Seychelles, KuCoin has quickly become a prominent player in the cryptocurrency market, attracting millions of traders worldwide with its diverse digital assets and innovative features.

Platform and features

KuCoin supports over 800 individual cryptocurrencies and close to 1,300 trading pairs, making it an ideal platform for traders and investors looking to diversify their crypto portfolios.

The exchange offers a variety of trading options, including spot trading, margin trading, futures trading, and staking. KuCoin is known for its user-friendly interface, robust security measures, and competitive trading fees, which have helped it gain over 30 million users as of 2024.

Security and reliability

Security is a top priority for KuCoin. The platform employs multi-layer encryption, micro-withdrawal wallets, and a dedicated risk control department to ensure the safety of user assets.

Despite a significant hack in 2020, where $281 million worth of assets were stolen, KuCoin managed a swift recovery, fully reimbursing affected users and enhancing its security protocols.

Innovation and user engagement

One of KuCoin’s standout features is its focus on community and user engagement. The KuCoin S platform, launched on October 22, 2021, offers social trading and a comprehensive crypto information feed, including token price movements, new listings, crypto news, trending coins, sectors, portfolios, and topics.

Using AI-based algorithms and machine learning, KuCoin S customizes the feed to help users make more informed trading decisions. This platform allows users to connect with fellow traders with similar goals and insights, enhancing the overall trading experience.

Native Token – KuCoin Shares (KCS): KuCoin’s native token, KuCoin Shares (KCS), offers users trading fee discounts and profit-sharing opportunities. KCS holders receive daily dividends from the exchange’s trading fees, making it an attractive investment option.

Commitment to growth: KuCoin continues expanding its offerings, with plans to support more than 1,000 cryptocurrencies. Its combination of a wide range of supported assets, innovative features, strong security measures, and commitment to user satisfaction make it a compelling choice for crypto enthusiasts worldwide.

Overall, KuCoin has carved out a niche in the competitive cryptocurrency exchange market, establishing itself as a versatile and reliable platform dedicated to meeting the needs of its diverse user base.

KuCoin Fees

KuCoin is known for its competitive fees, but navigating them can seem complex.

This section will break down KuCoin’s fee structure, including maker/taker fees, tiered discounts, and how their native token, KCS, can further reduce your trading costs.

We’ll also explore any additional fees you might encounter, like withdrawal fees and leveraged token management fees.

By the end, you’ll clearly understand what to expect when trading on KuCoin.

KuCoin review on deposit and withdrawal fees

| Fee Type | Method | Fee |

|---|---|---|

| Trading Fees | Maker | Varies by trading pair (usually 0.0125%) |

| Taker | Varies by trading pair (usually 0.0125%) | |

| Deposit Fees | Cryptocurrency | Free for most cryptocurrencies |

| Bank Account (SEPA) | Varies | |

| Bank Account (Non-SEPA) | Varies | |

| Debit/Credit Card | Varies (usually 2.5% – 4%) | |

| PayPal | Varies (usually 2.5% – 4%) | |

| Withdrawal Fees | Bitcoin (BTC) | Varies (network fees apply) |

| Ethereum (ETH) | Varies (network fees apply) | |

| USDT | Varies (network fees apply) | |

| Bank Account | Varies | |

| Debit/Credit Card | Varies | |

| PayPal | Varies |

KuCoin review on trading fees

| Service | Purchase Fee | Maker Fee | Taker Fee |

|---|---|---|---|

| Instant Purchase | Not publicly available | Varies depending on trading pair and KCS holding level (generally 0% – 0.02%) | Varies depending on trading pair and KCS holding level (generally 0.06% – 0.1%) |

| Spot Market (Trading Fees) | Not applicable | Varies depending on trading pair and KCS holding level (generally 0% – 0.02%) | Varies depending on trading pair and KCS holding level (generally 0.06% – 0.1%) |

| Futures/Perpetuals (Maker fee / Taker fee) | Not applicable | Varies depending on trading pair and KCS holding level (generally 0% – 0.02%) | Varies depending on trading pair and KCS holding level (generally 0.06% – 0.1%) |

Important notes:

- Trading fees can be reduced by holding KuCoin’s native token, KCS—the more KCS you hold, the lower your trading fees. You can find more details on their fee structure on the KuCoin VIP level page.

- Deposit and withdrawal fees can vary depending on the specific method you use. Before making a deposit or withdrawal, it is always best to confirm the latest fees on KuCoin’s website.

- The maker and taker fees for Spot Market, Futures/Perpetuals depend on your KCS holding level and the specific trading pair. Generally, maker fees can be as low as 0% and taker fees as high as 0.1%.

- When using the KuCoin Trading Bot for spot market trading, you can get discounts on trading fees by paying with KCS tokens. The spot trading fee is calculated at VIP level 0. For futures market trading with the bot, the fee for all trades is 0.06%.

Additional Fees:

- Leverage Tokens: Subscription and redemption fees of 0.1% each and daily management fees (variable).

Supported cryptocurrencies

KuCoin offers a vast selection of cryptocurrencies for trading. Users can buy and sell over 810 coins on their Spot market, forming more than 1,290 trading pairs.

This extensive selection and a daily trading volume exceeding $863 million make the Spot market a popular choice for cryptocurrency enthusiasts.

Additionally, KuCoin boasts a thriving Perpetuals/Futures market featuring 318 perpetual contracts. This market’s daily trading volume surpasses $1.5 billion, providing users with opportunities for leveraged trading.

KuCoin key features

KuCoin has established itself as a prominent player in the cryptocurrency exchange market. Known for its wide range of features and user-friendly interface, KuCoin caters to beginners and experienced traders.

While all cryptocurrency exchanges offer similar features, there are certain tools that are unique to each exchange.

Trading Features

| Feature | Description |

|---|---|

| Fast Trade | Buy/sell crypto with fiat using various payment methods, including debit/credit cards and bank transfers. |

| P2P Trading | Trade crypto directly with other users, offering more payment methods and zero fees. |

| Third-Party Channels | Purchase crypto through external platforms like Banxa, with coins transferred to your KuCoin account. |

| Spot Trading | Buy and sell cryptocurrencies at the current market price. |

| Margin Trading | Borrow funds to amplify potential gains or losses in your trades. |

| Futures Trading | Speculate on future cryptocurrency prices via contracts for potentially higher profits. |

| Trading Bots | Automate trading strategies using bots to take advantage of market opportunities. |

| Stop-Limit Orders | Set specific prices for orders to execute automatically, locking in profits or minimizing losses. |

| Trailing Stop Orders | Automatically adjust stop-loss prices as the market moves in your favor. |

| KuCoin Bonus | Hold KuCoin Token (KCS) for trading fee discounts. |

| API Support | Automate trading activities using KuCoin’s API. |

Earning Features

| Feature | Description |

|---|---|

| Staking | Earn rewards by holding certain cryptocurrencies. |

| Lending | Earn interest by lending your crypto holdings to other users. |

| KuCoin Win | Participate in activities to win crypto rewards. |

| Affiliate Program | Earn rewards by referring new users to KuCoin. |

| Savings | Earn interest on deposited crypto, with both flexible and fixed-term products available. |

| KuCoin Earn Select | Higher-risk, higher-reward staking and lending products. |

| Promotional Offers | Frequent promotions for extra rewards on deposits or trades. |

| KCS Bonus | Discounts on trading fees and a share of daily trading fees by holding KCS. |

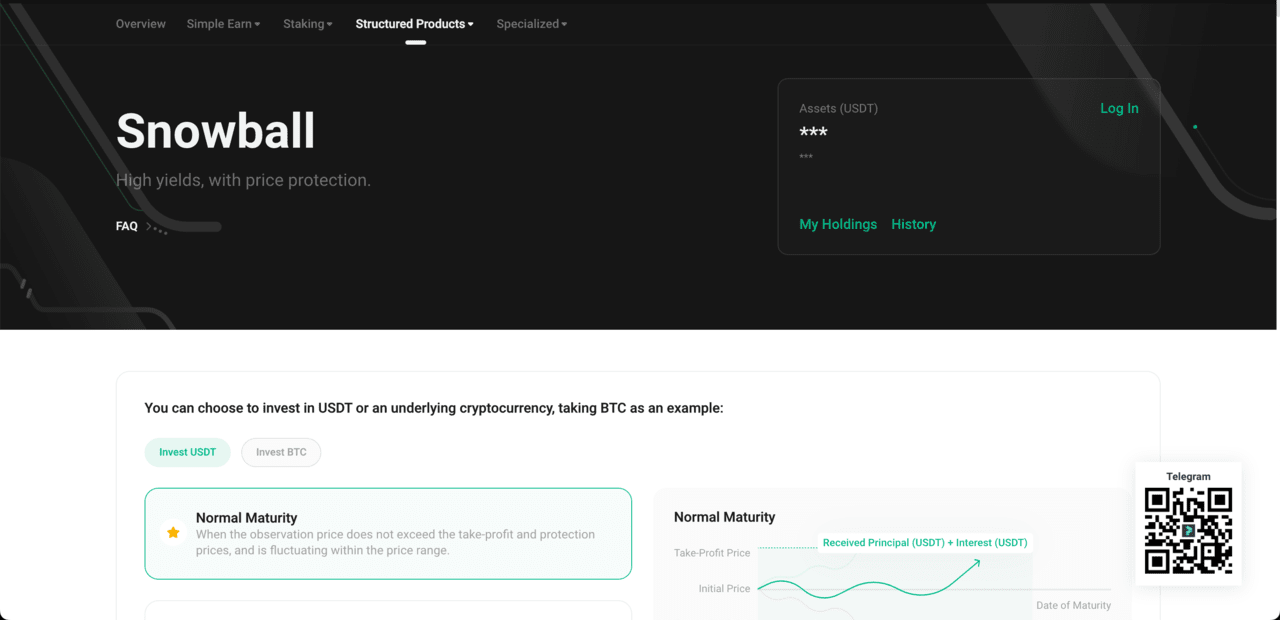

| Dual Investment | Higher-risk, higher-reward based on price movement without principal protection. |

Other features

| Feature | Description |

|---|---|

| Dark Pool | Place large orders privately without affecting the market price. |

| KuCoin Bonus | Hold KuCoin Token (KCS) for trading fee discounts. |

| Promotional Offers | Frequent promotions for extra rewards on deposits or trades. |

| Shark Fin | Low-risk, guaranteed return with potential bonuses if the asset stays within a range. |

| Snowball | Price range protection with early redemption option and capped upside potential. |

| KuCoin Labs | Invests in and incubates early-stage crypto projects. |

| GemVote | Users nominate and vote for crypto projects to be listed on KuCoin. |

| KuCoin Card | Spend crypto at merchants worldwide with competitive conversion rates and cashback rewards. |

KuCoin app review: The mobile app

The KuCoin app is a versatile and feature-rich platform that empowers users to trade, manage their crypto holdings, and explore various earning opportunities – all from the convenience of their mobile devices.

Here’s a closer look at what the KuCoin app offers:

- Spot trading: Execute trades easily, with access to many cryptocurrencies, including popular coins and hidden gems from the altcoin market.

- Margin trading (with a caveat): For experienced users, leverage your holdings with margin trading, but be mindful of the increased risk. (Note: Margin trading might be restricted in your region).

- Staking and lending: Earn passive income on your crypto holdings by staking them or lending them to other users.

- KuCoin Earn: This comprehensive suite offers various options to grow your portfolio, including Pool-X staking, AI-powered trading bots, and soft staking with flexible lock-up periods.

- Fiat support: You can easily buy crypto using various currencies with credit/debit cards or third-party payment providers (availability may vary by region).

Mobile features

- Fast track orders: Place orders with priority execution at a slightly higher fee for time-sensitive trades.

- Stop and limit orders: Set up automated order types to manage risk and secure profits.

- TradingView charts: Analyze market movements with advanced charting tools powered by TradingView.

- Push notifications: Stay informed of price movements, order execution, and account activity with real-time notifications.

- Multilingual support: The app caters to a global audience with support for multiple languages.

- Security features: Secure your account with two-factor authentication (2FA) and other industry-standard security measures.

- Community access: Stay connected with the KuCoin community directly through the app, fostering engagement.

It is worth noting that some features, especially those related to fiat on-ramping and margin trading, might be restricted for unverified users. The app may not offer the full spectrum of features on the KuCoin web platform.

KuCoin review: User ratings

| Platform | Rating | Number of reviews |

| Google Play | 4.5/5 | 195K |

| Apple Store | 4.7/5 | 25k |

| Trustpilot | – | – |

Customer satisfaction

KuCoin’s customer satisfaction is a complex issue. While some users praise its wide selection and past performance, others express concerns about recent developments. Due to legal restrictions, KuCoin is no longer available for US residents.

Another point of contention is KuCoin’s Know Your Customer (KYC) requirements. While some users appreciate the added security, others who previously enjoyed the exchange’s anonymity are unhappy.

There have also been reports of delayed withdrawals, leading some to fear a situation similar to the FTX collapse. However, others defend KuCoin, highlighting its large reserves and claiming these delays are often due to user error.

Overall, KuCoin’s customer satisfaction is divided. Those seeking a user-friendly platform with a vast coin selection may find it appealing, but US residents and those wary of KYC regulations should look elsewhere. It is crucial to do your own research and understand the potential risks before using any cryptocurrency exchange.

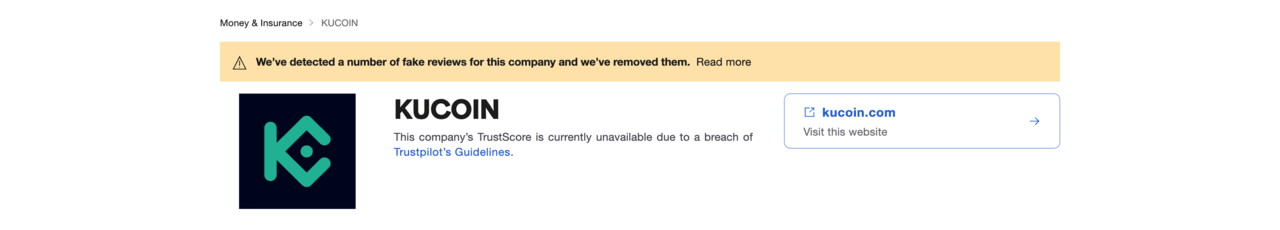

For this KuCoin review, keep in mind the following: Trustpilot has removed several fake reviews for KuCoin, which is why their TrustScore is currently unavailable. This means it’s difficult to gauge user sentiment from that platform. It’s important to consider that negative experiences can be more likely to motivate reviews than positive ones.

So, while user feedback is important, remaining skeptical and research is essential. Always research customer reviews before making a decision.

Customer support

KuCoin offers 24/7 customer support to assist you with any questions or issues you might encounter while navigating their platform. This section will delve into all the available support options KuCoin provides, including:

Is KuCoin Safe?

When it comes to entrusting a platform with your crypto, security is absolutely crucial. Let’s take a closer look at KuCoin’s security measures and its history of past controversies to assist you in making an informed decision:

Security:

- Multi-layered Approach: KuCoin employs a robust security system that includes industry-standard practices like account encryption, secure login protocols, and regular system audits.

- Active Threat Management: Their dedicated security team constantly monitors threats and vulnerabilities and implements proactive measures to safeguard user assets.

- Two-Factor Authentication (2FA): KuCoin strongly encourages users to enable 2FA, adding an extra layer of security to prevent unauthorized access.

- Regular Penetration Testing: They conduct regular penetration tests with external security firms to identify and address potential weaknesses in their systems.

- User Education: KuCoin emphasizes user education, providing resources and guides to help users practice safe online habits and protect their accounts.

Insurance:

KuCoin doesn’t offer direct insurance on user funds in case of exchange hacks or losses. However, it partners with a custodian service called Onchain Custodian to safeguard some of its assets.

Onchain Custodian’s insurance is arranged by Lockton, a reputable insurance company, but it only applies to certain assets held by KuCoin, not user funds themselves.

Here’s a breakdown of what KuCoin offers:

- Insurance for Custodial Funds: A portion of KuCoin’s assets are held with Onchain Custodian, a crypto asset custody platform. These custodial funds are insured by Lockton against theft in case of a security breach. This doesn’t apply to user funds on the exchange.

- Insurance fund for Futures Trading: KuCoin has a separate “Insurance Fund” for futures trading. This fund covers potential losses for liquidated positions when the market price falls below a certain point. It’s not an insurance policy for user accounts but a risk management tool for futures contracts.

While KuCoin utilizes custodian insurance for some of its assets, it’s important to remember that user funds on the exchange are not directly insured.

Proof-of-reserves:

KuCoin builds trust through its Proof-of-Reserves (PoR) system. KuCoin conducts its own regular audits, allowing users to independently verify that KuCoin holds enough assets to cover all user deposits.

These audits generate snapshots of KuCoin’s on-chain reserves, providing a window into the exchange’s financial health.

It’s important to remember that PoR audits are a point-in-time picture and don’t guarantee absolute security or prevent mismanagement. However, regular PoR audits are crucial for maintaining user confidence and demonstrating KuCoin’s commitment to transparency.

KuCoin’s Proof-of-Reserves (PoR) lets users verify their funds are backed by the exchange’s reserves. They take anonymized user balance snapshots and create a Merkle Root for verification. Users can confirm their holdings using a Merkle Proof and the public Merkle Root. For details, visit KuCoin’s Proof-of-Reserves & Audit page.

Past hacks:

In 2020, KuCoin faced a major challenge when hackers stole over $280 million in cryptocurrency. The exchange responded quickly to contain the incident, put extra security measures in place, and even compensated affected users.

This security breach served as a wake-up call for KuCoin, significantly prompting them to improve their security infrastructure and protocols.

Legal issues:

KuCoin operates within a somewhat ambiguous regulatory environment. Although the company is based in a jurisdiction with lenient regulations, it does not possess a comprehensive global license.

This absence of worldwide licensing may result in constraints in certain regions with more stringent financial regulations.

Consequently, certain features may be limited to users in particular countries. KuCoin has made strides towards complying with regional regulations, including registering with India’s Financial Intelligence Unit (FIU).

Reputation:

KuCoin’s reputation is mixed. The exchange boasts a large user base and is known for its wide variety of tradable cryptocurrencies and competitive fees. However, some Reddit users criticize the exchange for its lack of KYC (Know Your Customer) verification in the past, which some view as a security risk.

In 2023, U.S. prosecutors filed criminal charges against KuCoin, accusing it of violating anti-money laundering laws and operating without a license. The exchange denies the charges, but this incident has undoubtedly tarnished its reputation, particularly among U.S. users.

Despite these controversies, KuCoin maintains a loyal following that praises its user-friendly interface and features. One user comments:

While other aspects appear to align with industry standards, it is common to encounter complaints such as “XXX stole my coins,” which often stem from inaccuracies in the transfer process rather than actual theft. Such occurrences predominantly stem from user error. I have consistently found Kucoin to be exceedingly dependable. It is worth noting that they still maintain reserves of 5 billion after facilitating 2 billion in withdrawals. Therefore, the concerns expressed appear to be unwarranted.

Ultimately, users considering KuCoin should weigh the potential risks and benefits in light of their own priorities and risk tolerance.

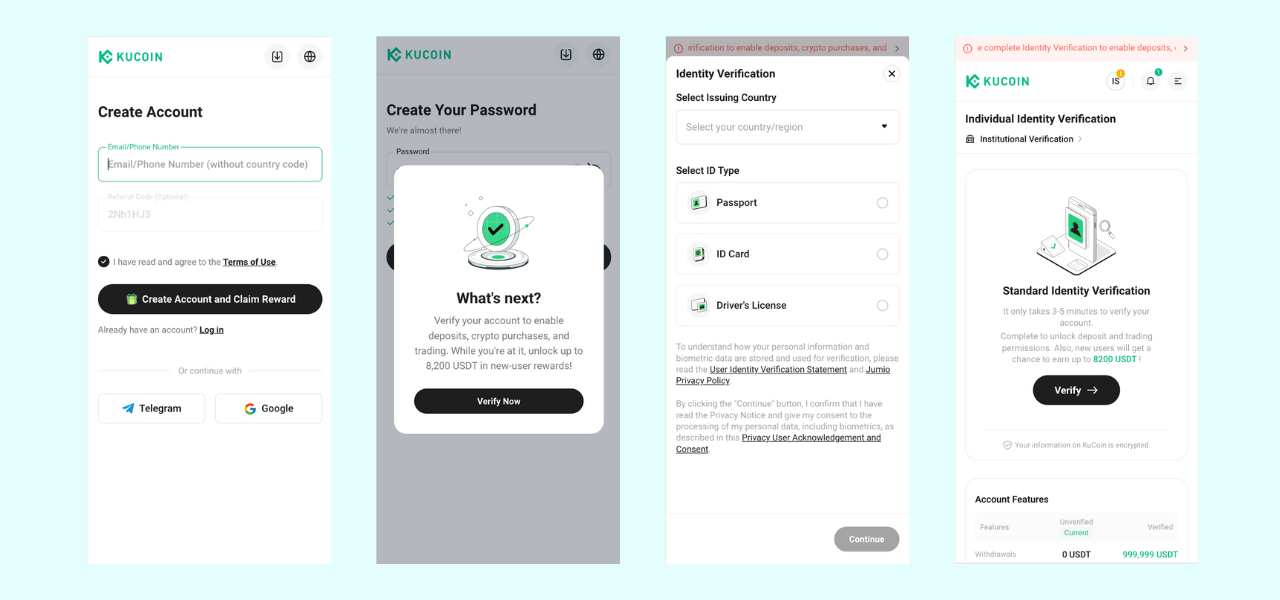

How to sign up to the KuCoin exchange

Ready to embark on your crypto journey with KuCoin? Here’s a step-by-step guide to creating your account:

1. Head to the website:

- In your web browser, navigate to the official KuCoin website.

2. Sign up for an account:

- Look for the “Sign Up” button at the homepage’s top right corner.

3. Choose your registration method:

- You can create your account using either your email address or phone number.

4. Enter your information:

- Provide your chosen email address or phone number.

- We suggest creating a strong password following security best practices (uppercase and lowercase letters, numbers, and symbols).

- (Optional) Enter a referral code if you have one.

5. Agree to terms and conditions:

- Carefully review KuCoin’s Terms of Service and Privacy Policy.

- Check the box to indicate your agreement before proceeding.

6. Complete the verification process:

- Depending on your chosen region and desired features, you might encounter two verification levels:

- Basic verification usually involves entering a simple code sent to your email or phone number. This basic level allows you to deposit and trade some cryptocurrencies.

- KYC verification: For full account functionality, including fiat deposits/withdrawals and higher trading limits, KuCoin may require KYC verification. This involves submitting a government-issued photo ID (passport, driver’s license) and potentially a selfie for facial recognition.

7. Congratulations, you’re in!

- Once you’ve completed the verification process (if required for your chosen level), your KuCoin account will be ready to use!

Additional notes:

- KYC requirements and available features might differ based on your location. Always refer to KuCoin’s official website for the latest information.

- Enabling two-factor Authentication (2FA) after signup secures your account and prevents unauthorized access.

KuCoin exchange review methodology: How we scored KuCoin

To ensure a comprehensive and accurate review of KuCoin Exchange for 2024, we followed a systematic approach, including detailed research, hands-on testing, and user feedback analysis.

Research and Data Collection:

- Official sources: Reviewed KuCoin’s official website, blog, and announcements for the latest features, updates, and security measures.

- Industry reports: Consulted industry reports and market analysis to understand KuCoin’s position and reputation in the crypto exchange market.

Hands-On Testing:

- Account creation: Tested the account registration process, including KYC (Know Your Customer) requirements and verification time.

- Trading experience: Conducted trades using various features such as spot trading, margin trading, and futures trading to evaluate ease of use, execution speed, and reliability.

- Payment methods: Tested multiple fiat deposit and withdrawal options, including Fast Trade, P2P trading, and third-party channels, to assess transaction speed and convenience.

- Mobile app: Downloaded and used the KuCoin mobile app to evaluate its functionality, user interface, and performance on iOS and Android devices.

Security Assessment:

- Security features: Evaluated the security measures implemented by KuCoin, including two-factor authentication, address whitelisting, and encryption protocols.

- Incident response: Analyzed KuCoin’s response to past security incidents, such as the 2020 hack, and reviewed subsequent improvements and user compensation.

User Feedback Analysis:

- Customer reviews: Aggregated user reviews from platforms like Trustpilot, Reddit, and crypto forums to gauge overall user satisfaction and joint issues.

- Community engagement: Monitored KuCoin’s social media channels and community forums to understand user engagement and the effectiveness of customer support.

Feature Comparison:

- Competitor Analysis: Compared KuCoin’s features, fees, and services with other leading exchanges like Binance, Coinbase, and Kraken to highlight unique selling points and potential areas of improvement.

- Innovation and Updates: Tracked KuCoin’s introduction of new features and updates, such as trading bots, KuCoin Win, and KuCoin S platform, to assess ongoing innovation and user value.

By integrating these methodologies, we aimed to provide a thorough, unbiased, and practical KuCoin review, helping potential users make informed decisions about signing up and trading on this platform.

As part of our review series, make sure you read our article that analyzes the Bybit exchange.

FAQs

No. Before the US charges over anti-money laundering violations, US-based users could trade in KuCoin with restricted access. KYC is being gradually enforced, preventing US-based traders from using KuCoin. US-licensed exchanges such as Coinbase or Kraken are a better choice.

Yes. KuCoin has a high trust score of 10/10 on CoinGecko and a 4/5 liquidity score. In 2020, a hack led KuCoin to enhance its security. They now offer a $1M bug bounty and more user protection features. However, the U.S. Department of Justice indicted KuCoin for violating the Bank Secrecy Act and anti-money laundering laws.

KuCoin launched in Singapore. It is now based in Seychelles. This strategic move helps it navigate different regulatory environments. Being in Seychelles allows KuCoin to offer a wide range of services globally.

It depends. Coinbase offers a smoother user experience than KuCoin. However, Coinbase has a reputation for poor customer support. If you have a large, risky portfolio, consider moving it to Binance or KuCoin for better support and features.

KuCoin’s popularity stems from its appeal to beginner and experienced crypto traders.

It offers low trading fees, many coins, including hard-to-find altcoins, and access to features like margin trading and staking.

KuCoin has low trading fees and a wide variety of cryptocurrencies. The platform supports margin and futures trading.

It also has robust automated trading options, including trading bots. KuCoin’s mobile app is user-friendly and efficient for trading on the go.