With cryptocurrency constantly breaking new ground, more users prioritize privacy and anonymity. No KYC exchanges do not require you to submit ID documents such as your passport or driving license to start trading.

The regulatory landscape can change at any moment. In the future, crypto exchanges may be forced to request all users to undergo a KYC procedure. To save you time and effort, these are the best no KYC cryptocurrency exchanges you can use today.

The Best No KYC Exchanges to Consider in 2024

- MEXC: A feature-rich crypto exchange, that empowers users with a vast asset selection, zero maker/taker fees, and innovative offerings like Launchpad and MX DeFi.

- Bybit: Offers a user-friendly platform for derivatives trading with high leverage options, alongside spot trading and a growing NFT marketplace. Bybit prioritizes security with features like cold storage and multi-signature technology.

- ProBit: A crypto exchange offering a curated marketplace, high-speed trading engine, and utility token (PROB) for fee discounts. It features staking, events, and an affiliate program, catering to active traders and passive investors seeking to earn rewards.

- Phemex: A crypto exchange that combines CeFi’s security with DeFi’s innovation. It offers a Web3 ecosystem with its own token, NFT identity, and DAO governance.

- Lbank: Established in 2015, LBank is a global crypto exchange offering spot, futures, and ETF trading. It offers over 800 cryptocurrencies, diverse payment options, and a user-friendly mobile app, catering to all experience levels.

- HTX: A leading global cryptocurrency exchange offering a vast selection of trading options, DeFi and NFT integration, and advanced analytical tools for a comprehensive user experience.

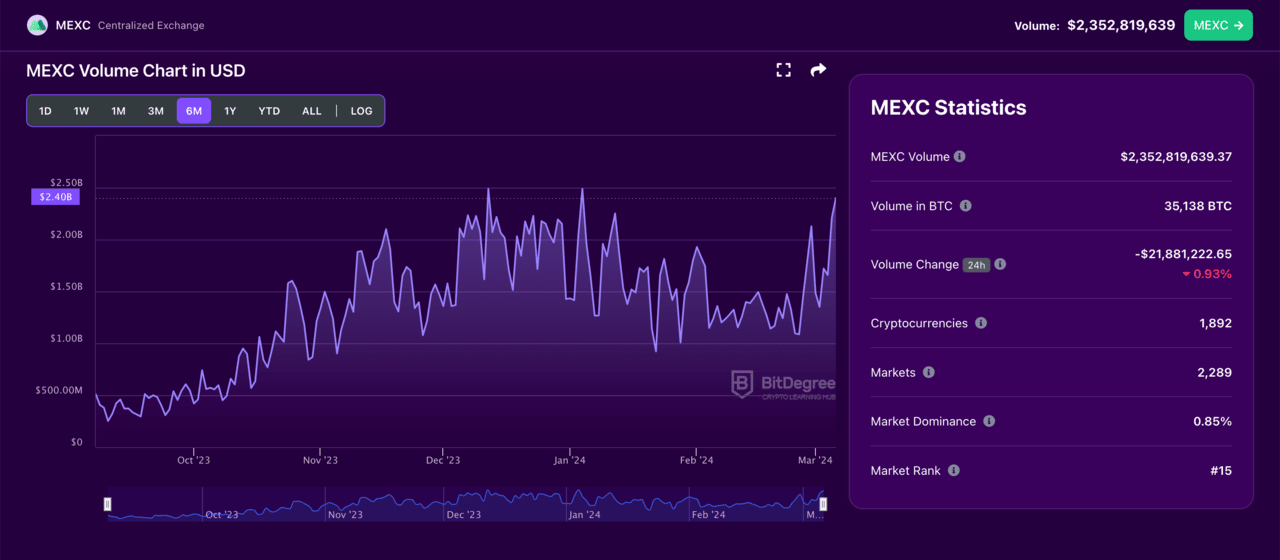

1. MEXC: A Feature-Rich Crypto Exchange for Diverse Traders

MEXC Global, formerly known as MXC, is a centralized cryptocurrency exchange (CEX) established in 2018. It prides itself on high-performance technology and boasts a robust mega transaction matching system.

MEXC has grown rapidly, capturing a significant digital asset trading market share and amassing over 6 million users across 70+ countries. Notably, it was recognized as Asia’s Best Crypto Exchange at the 2021 Crypto Expo Dubai.

MEXC Global caters to various trading styles, providing access to spot, margin, and futures trading. Additionally, users can delve into exchange-traded funds (ETFs), encompassing both leveraged and index options. A distinct advantage of MEXC Global lies in its competitive fee structure.

Beyond core trading functionalities, MEXC Global has developed a suite of innovative crypto-related products. Launchpad empowers project teams to launch profitable tokens, while Kickstarter events enable pre-launch token voting and airdrops. Users can also participate in MX DeFi, a platform for new token mining and DeFi staking.

The native token of MEXC Global, MX, serves as a decentralized digital asset built on the Ethereum blockchain. Holding MX grants users exclusive benefits, including trading fee reductions, access to new Launchpad subscriptions, referral rewards, and even offline payments.

MEXC Can Process 1.4M Transactions Per Second

MEXC Global strives to be the preferred platform for novice and experienced traders. Its global presence is evident through key licenses and regulatory approvals in regions like Australia, Estonia, and the United States. To cater to a diverse user base, MEXC Global offers localized language support, fostering a more inclusive trading environment.

The exchange boasts a high-performance trading engine, capable of processing 1.4 million transactions per second, ensuring smooth and efficient trading experiences. Security remains paramount at MEXC Global. Servers are strategically hosted across multiple countries, promoting optimal data integrity and robust security measures.

Overall, MEXC Global presents a feature-rich platform catering to many traders. Its extensive asset selection, competitive fees, and unique token offerings make it a strong contender in the CEX landscape.

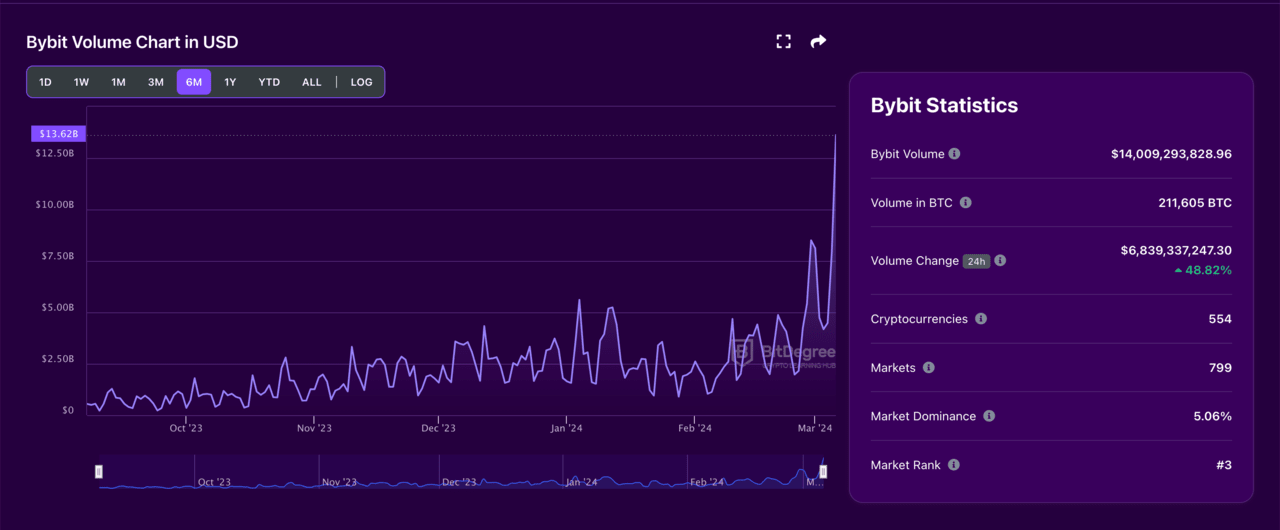

2. Bybit: Popular Cryptocurrency Exchange for Derivatives Trading

Bybit is a cryptocurrency exchange established in March 2018. It has grown to serve over 10 million users globally, offering a comprehensive suite of trading products and features.

This exchange positions itself as a user-friendly platform for beginners and professionals alike, attracting traders with its focus on derivatives like perpetual contracts with up to 100x leverage (excessive usage of the leverage comes with higher risks).

Bybit currently holds the #2 rank globally for derivatives platforms, trailing only Binance.

Global Exchange – User-Friendly Derivatives

Bybit boasts a rich selection of tradable assets, encompassing derivatives, spot trading, and an instant buy crypto option. Its core strength lies in its professional-grade trading engine, renowned for its ultra-fast matching and instant trade execution.

Beyond its core offerings, Bybit provides several valuable features:

- NFT Marketplace: Allows users to explore the world of non-fungible tokens by buying, selling, and trading NFTs.

- Fiat Withdrawals: Users can withdraw their crypto holdings in fiat currency.

- Crypto Loans: Offers crypto loan options, enabling users to leverage their holdings for additional earning potential.

- Copy Trading: Allows users to copy the trading strategies of experienced Bybit traders automatically.

- Crypto Debit Card: Spend crypto holdings directly with the Bybit crypto debit card.

Security is paramount for Bybit. The exchange utilizes a secure cold storage solution to safeguard the vast majority of user funds and its crypto reserves. This “air-gapped” location minimizes the risk of online attacks. Additionally, Bybit employs multi-signature technology for transactions requiring multiple keys to authorize transfers, further mitigating the risk of unauthorized access.

Bybit also prioritizes secure communication by using SSL encryption to protect user data and prevent online snooping. Two-factor authentication (2FA) is another layer of security, along with fund passwords, anti-phishing codes, and new address withdrawal locks.

Bybit Trading Volumes

The exchange strongly emphasizes derivatives trading, particularly with high-leverage options, which requires users to have a significant risk tolerance.

However, Bybit offers more than risk management tools like stop-loss orders and auto margin replenishment. It also provides robust security measures, including cold storage, multi-signature technology, and encrypted communication, which inspire confidence in the safety of user funds.

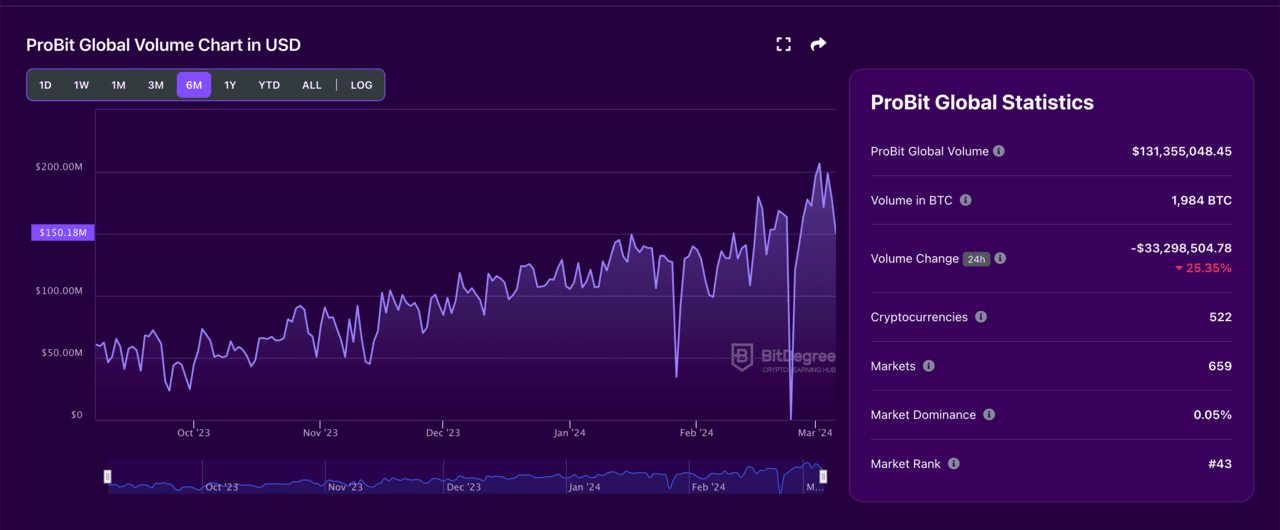

3. ProBit: Fostering Utility with PROB Token and Diverse Features

Unlike other exchanges, ProBit implements a selective listing process, aiming to onboard only ‘quality’ projects. This curated approach, coupled with a high-performance trading engine boasting a reported order-matching speed of over 1.5 million orders per second, positions ProBit as a potentially attractive platform for active traders.

Streamlined Trading and Engaging Ecosystem

ProBit’s native token, PROB, plays a central role in the exchange’s ecosystem. By holding PROB, users benefit from a tiered fee discount structure, effectively reducing trading costs. This utility aspect incentivizes users to hold PROB while promoting cost-effective trading on the platform.

Beyond core trading functionalities, ProBit strives to foster user engagement through various initiatives. The exchange frequently organizes events and competitions, including “buying champion” events like Crypto Cricket and Index Chain, where users can compete for rewards. Additionally, ProBit offers staking opportunities for select tokens, allowing users to earn passive income while supporting the chosen projects.

Trading Volumes

With a user base exceeding 3 million, ProBit Global offers potentially better liquidity for the cryptocurrencies it lists. While ProBit caters primarily to active traders with its fee discount structure and high-speed engine, it doesn’t neglect passive investors. Staking options and an affiliate program provide avenues for users seeking to generate returns without actively trading.

ProBit’s “trade mining service” adds another layer of utility. By participating in this service, users can earn transaction fee rebates in PROB while trading specific pairs. This unique feature incentivizes trading activity and rewards users with the platform’s native token.

Notably, ProBit prioritizes security, evidenced by their emphasis on cold storage for most assets, FIDO U2F multi-factor authentication, and the use of hardware security keys. This focus on user security is a critical aspect of any cryptocurrency exchange.

4. Phemex: A Hybrid CeFi and DeFi Crypto Exchange

Phemex offers a unique blend of centralized finance (CeFi) and decentralized finance (DeFi) features. Launched in 2019, the platform has quickly gained traction with its user-friendly interface, robust trading engine, and innovative offerings.

Phemex stands out for its “Semi-Centralized” model. This means it leverages the security and speed of a centralized exchange while incorporating elements of DeFi like proof-of-reserves.

This hybrid approach aims to provide users with the best of both worlds: a secure and reliable trading experience with a glimpse into the future of decentralized finance.

- Phemexia Web3 Ecosystem: Phemex is building a comprehensive Web3 world dubbed “Phemexia.” This ecosystem features its own utility token (PT), an NFT called the Phemex Soul Pass (PSP), and DAO governance. PT grants holders staking rewards, trading discounts, and voting rights through “vePT” tokens obtained by locking up PT, while PSP acts as your digital identity, granting access to exclusive features.

- Innovative Platform Features: Users can copy successful traders’ strategies, utilize trading bots, and swap assets peer-to-peer. The platform also features prediction markets, high-yield staking pools, a launchpad for new projects, and an educational “Learn & Earn” program.

- Contests & Prizes: To incentivize user participation, Phemex offers substantial giveaways and rewards users with xPT tokens for referrals.

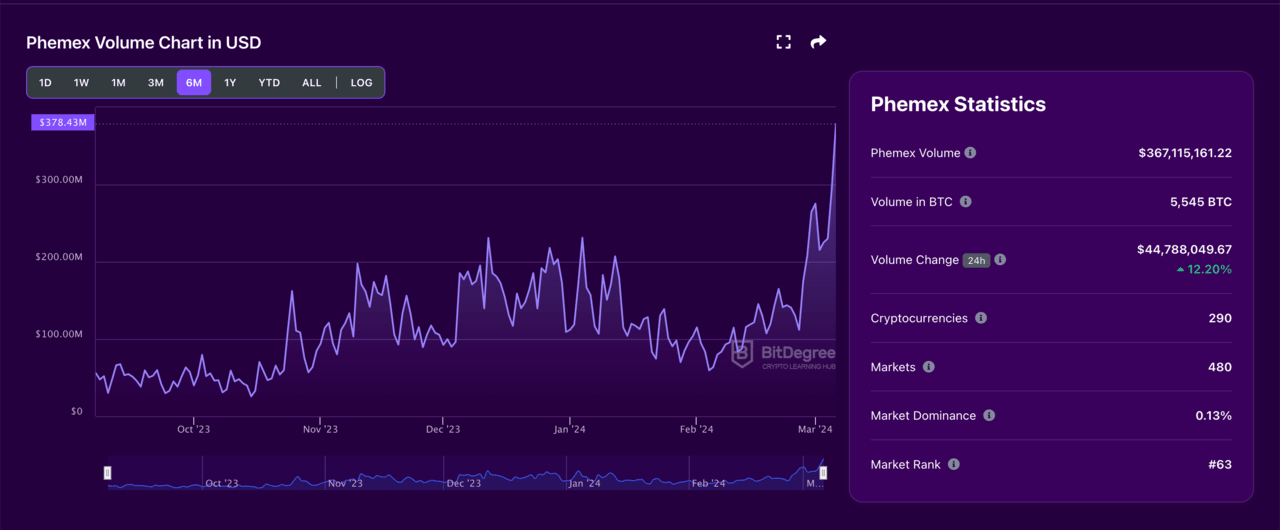

Phemex Trading Volumes

The hybrid CeFi-DeFi model offers a secure and feature-rich trading experience with a taste of DeFi innovation. While Phemex offers a compelling suite of features, it’s important to remember that the PT token is relatively new.

As with any new cryptocurrency, there’s inherent volatility associated with PT. Additionally, the minimum trading volume requirement for obtaining a Phemex Soul Pass may exclude some users from accessing the full range of Phemexia’s offerings.

5. LBank: A Versatile Crypto Exchange Platform

LBank is a CEX platform established in 2015. Headquartered in Indonesia, LBank boasts a global user base and caters to a wide range of investor preferences.

Beyond the typical spot and margin trading, LBank offers a comprehensive suite of financial products, including crypto futures, options, staking, and even ETF trading of crypto assets.

Lbank Beginner to Pro Features

LBank prioritizes accessibility, allowing users to buy and sell major cryptocurrencies like BTC and ETH using over 149 fiat currencies and 20+ payment methods. Its robust spot trading platform offers an intuitive design, live market data, and a lightning-fast matching engine, facilitating seamless cryptocurrency purchases and sales.

Furthermore, LBank caters to those seeking automated strategies by offering grid trading, which automates buying and selling within a specified price range.

For users seeking peer-to-peer (P2P) experiences, LBank’s P2P market facilitates secure transactions between users using fiat currencies. This feature removes barriers to entry and exit from the crypto market while ensuring user control over transactions.

Lbank Trading Volumes

Experienced traders looking to leverage their positions can explore LBank’s derivatives market, offering futures and options contracts. These instruments allow speculation on price movements without directly owning the underlying assets but carry a higher degree of risk.

LBank caters to risk management strategies as well, by offering ETF trading, a basket-based investment approach similar to traditional stock exchanges.

This allows users to diversify their holdings and potentially mitigate risk. LBank also prioritizes user security by obtaining licenses from reputable regulatory bodies like the Financial Crimes Enforcement Network (FinCEN) in the US and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

6. HTX: Trade, DeFi, NFTs, All-in-One

HTX, formerly known as Huobi, is a global crypto exchange established in 2013. Following a strategic rebranding in 2023, HTX has signaled its focus on international expansion, boasting a presence in over 100 countries and exceeding $4 billion in daily trading volumes.

Advanced Tools, Multifaceted Platform

HTX caters to a diverse range of users, from seasoned traders to those new to the cryptocurrency landscape. The platform offers a comprehensive suite of trading options, including spot, futures, and options markets, allowing users to tailor their investment strategies.

For those seeking to learn from experienced investors, HTX provides a copy trading service that enables users to mimic the trades of successful figures within the platform.

Beyond traditional trading, HTX embraces the evolving landscape of DeFi and Web3 technologies. Seamless integration with DeFi ecosystems and Web3 wallets empowers users to manage their decentralized portfolios and interact with leading dApps across finance and blockchain-based gaming.

Furthermore, HTX has integrated an NFT marketplace, catering to the burgeoning interest in digital collectibles.

- Flash Trade: Combines an order book, chart index, and market chart, enabling users to test trading strategies in real time, particularly during periods of high volatility.

- Smart-Chain Analysis: Provides users with insights into various blockchain assets and a comprehensive range of trade indicators, empowering them to make informed investment decisions.

- HTX API: For developers interested in creating automated trading strategies, HTX offers an API that allows users to code their own crypto trading bots.

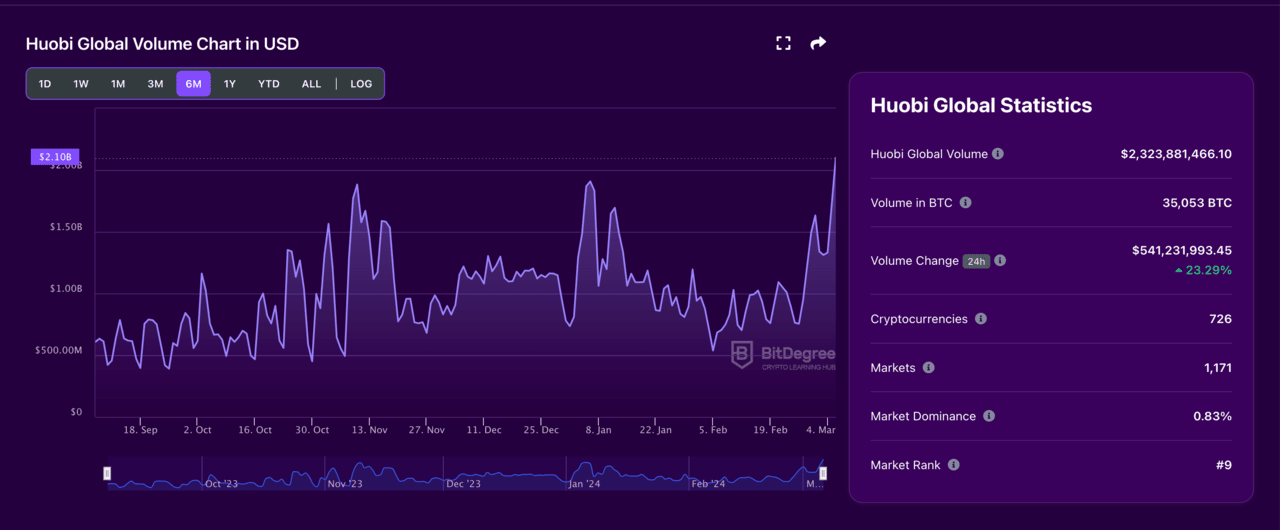

HTX Trading Volumes

HTX offers a compelling proposition for various investor profiles. The platform’s diverse trading options and advanced charting tools cater to experienced traders seeking sophisticated investment strategies.

For those who are new to cryptocurrency, HTX’s copy trading services and educational resources can provide valuable guidance. Additionally, the platform’s integration with DeFi and Web3 technologies positions HTX at the forefront of the evolving financial landscape.

Pros and cons of no KYC exchanges

| Pros | Cons |

| Enhanced Privacy Users avoid sharing personal information, protecting their financial activities from prying eyes. | Increased Illicit Activity The lack of KYC verification makes No KYC exchanges attractive for criminal activities. |

| Faster Sign-Up Process Registration is typically quick and easy, requiring minimal information. | Security Vulnerabilities Without KYC, identifying and preventing fraudulent activity can be harder. |

| Accessibility in Restrictive Regions Users in regions with strict financial regulations may find No KYC exchanges as their only option via VPN. | Limited Features If you choose not to KYC, you will have limited features on the exchange. |

| Potential for Censorship Resistance No KYC exchanges may be seen as more resistant to government control over financial transactions. | Policy can Change Regulatory pressure could lead to the end of trading without KYC at any moment. |

| Private Data Leakage As no KYC was carried out, there is no risk of your documents being leaked. | Higher Fees Some exchanges may impose higher fees for users who do not wish to KYC. |

| Support New Cryptocurrencies No KYC exchanges may be more open to listing new or less popular cryptocurrencies. | Limited Customer Support User support might be limited or non-existent due to the lack of user verification. |

| Appeal to Libertarian Ideals No KYC exchanges align with the philosophy of decentralized finance and individual financial freedom. | Deposit/Withdrawal Limits Restrictions on the amount you can deposit and the amount you can withdraw may be placed. |

US Regulations and Alternatives

For US-based traders, KYC is a requirement for all exchanges. Nevertheless, there are alternatives.

Decentralized Exchanges (DEXs) and non-custodial transaction services emerge as viable options. DEXs operate on a P2P network, eliminating the need for a central authority to hold user funds. This creates anonymity but may result in complexity and lower liquidity than traditional exchanges.

Non-custodial transaction services like MoonPay and Ramp offer another solution. These services act as fiat-to-crypto gateways, allowing users to purchase cryptocurrencies directly with debit or credit cards while being regulated in most states.

MoonPay, for instance, focuses on speed and user-friendliness, facilitating quick crypto purchases with minimal verification depending on the purchase amount. Conversely, Ramp leverages KYC/AML checks from licensed partners, enabling users to buy crypto with various payment methods while being licensed in the United States.

FAQs

References

- https://www.investopedia.com/what-were-the-4-biggest-crypto-stories-of-2023

- https://www.coindesk.com/policy/2024/02/27/htx-withdraws-hong-kong-crypto-exchange-application/

- https://www.cryptotimes.io/2024/02/12/mexc-exchange-imposes-kyc-restrictions-on-chinese-users/

- https://www.globenewswire.com/news-release/2021/10/21/2318329/0/en/MEXC-Wins-Major-Award-at-the-Crypto-Expo-Dubai-Conference.html