As cryptocurrency becomes more commonplace worldwide, crypto futures trading has also gained momentum, as it allows traders to make quick and substantial profits in both rising and falling markets.

While this method is riskier, traders can easily mitigate it with the use of futures trading bots. These systems are basically software that run on predefined rules and algorithms to conduct trading autonomously on behalf of a trader.

However, countless futures trading bots are available, and choosing one that meets your expectations is challenging. This article addresses that conundrum, identifying a selection of the best crypto futures trading bots and explaining the pros and cons of each.

-

- 1. KuCoin - More efficient than any third-party bots

- Pros

- Cons:

- 2. Binance Trading Bot - Meets the needs of all kinds of traders

- Pros

- Cons:

- 3. OKX Trading Bot - A bot with a social touch

- Pros

- Cons:

- 4. Pionex - Simple to operate and no trust issues

- Pros

- Cons:

- 5. Gunbot - Quick, flexible and social

- Pros

- Cons:

-

- 1. KuCoin - More efficient than any third-party bots

- Pros

- Cons:

- 2. Binance Trading Bot - Meets the needs of all kinds of traders

- Pros

- Cons:

- 3. OKX Trading Bot - A bot with a social touch

- Pros

- Cons:

- 4. Pionex - Simple to operate and no trust issues

- Pros

- Cons:

- 5. Gunbot - Quick, flexible and social

- Pros

- Cons:

Show Full Guide

The top automated crypto futures bots – Quick look

The list below highlights the top automated crypto futures bots for 2024:

- KuCoin: The futures bot from this simple and secure cryptocurrency exchange executes traders more efficiently than most third-party bots.

- Binance Trading Bot: Binance offers several different trading bots for futures. These are completely free trading bots, and offer a convenient and safe in-house option for all Binance users.

- OKX Trading Bot: This trading bot offers futures trading with multiple expiry dates. It has a highly competitive fee structure, which traders can reduce further through the use of OKB tokens.

- Pionex: An exchange that offers an array of different trading bots to serve the needs of all kinds of traders and investors. Pionex’s trading fee is lower than most major trading platforms.

- Gunbot: Speed, flexibility and massive user community make this automated futures trading system different from many others. Also, it doesn’t need a cloud service and runs entirely on the user’s system.

Automated futures trading software compared

| Key features | Fees | Customer support | |

| KuCoin | Supports many cryptocurrencies and popular meme coins; Advanced technical analysis; Supports fiat money payments | 0.06% | 24/7, quick and helpful |

| Binance Trading Bot | More than one trading bot for futures; Ability to quickly adapt to different market conditions; Availability of more than 340 derivative trading pairs | 0.05% | 24/7, some complaints of customers support being slow at times |

| OKX Trading Bot | Supports an extensive list of cryptocurrencies; Allows copying of strategy of professional traders; Allows traders to ‘follow’ trading bots created by others on the platform | 0.05% | 24/7, quick and helpfu |

| Pionex | Simple to operate; Allow Cross Margin Futures Grids; Regulated both in the U.S. and Singapore | 0.05% | Customer support through Telegram and email; quick, and helpful |

| Gunbot | Offers 15 distinct automatically executing trading strategies; Doesn’t depend on a cloud service; User friendly interface | One-time licensing fee | 24/7, quick and helpful |

The best crypto futures trading bot – A closer look

Now that you have an idea of the top automated crypto futures bots, let’s take an in-depth look at each.

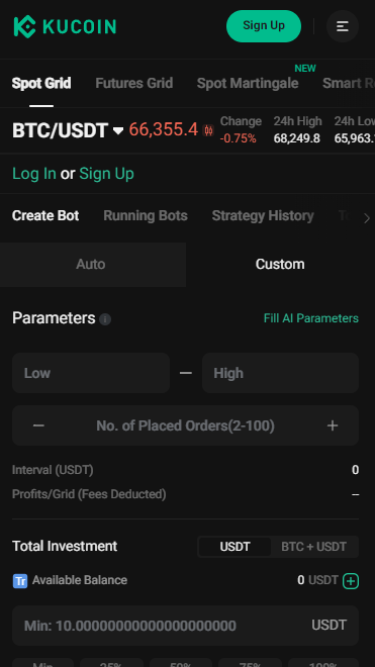

1. KuCoin – More efficient than any third-party bots

With over 25 million traders, KuCoin is a simple and secure cryptocurrency exchange that offers several built-in trading bots, including Grid bots for both spot and future markets. Bespoke-made by KuCoin, these bots are able to implement trades more efficiently than any third-party bots.

This automated futures trading system offers a range of features to help traders maximize their profits and make trading easier. Some of its key features are customizable rules, which allow users to set their own rules depending on their strategies; 24/7 trading; advanced technical analysis and multiple exchanges support.

KuCoin covers both linear and inverse contracts – the former can be settled in USDT or USDC, while the latter is settled in the underlying cryptocurrency. This futures platform supports many cryptocurrencies and some popular meme coins as well (including Dogecoin, Bonk, FLOKI, Pepe, and Shiba Inu).

Owing to a high volume of trading on its platform, KuCoin offers leverage of up to 100x on popular cryptocurrencies (lower limits on less popular altcoins). In terms of fees, the platform charges 0.06% per slide, which is slightly more than the industry average.

KuCoin supports fiat money payments, including through Visa, MasterCard, bank transfers, and e-wallets. Customer service is available 24/7, and is responsive and helpful.

Overall, KuCoin’s crypto futures bot is simple to operate, supports numerous cryptocurrencies, offers a range of features, and, more importantly, is efficient.

Pros

- Supports both linear and inverse futures contracts.

- Supports many cryptocurrencies and popular meme coins.

- Use AI to maximize returns.

Cons:

- Fees are higher than the industry average.

- Doesn’t offer a demo account.

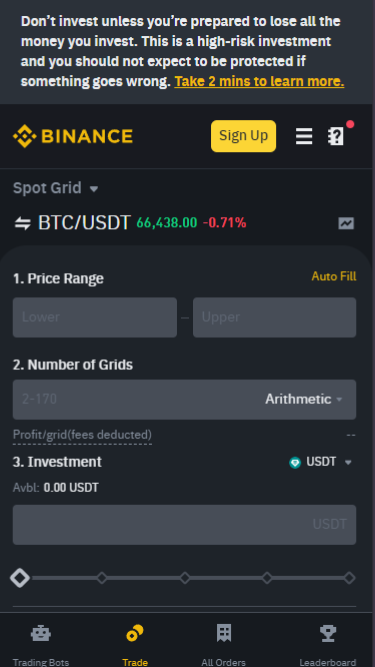

2. Binance Trading Bot – Meets the needs of all kinds of traders

With the highest trading volume of any crypto exchange, Binance Futures dominates the crypto futures market. The platform offers 8 free and easy-to-use automated trading bots, providing a convenient and safe in-house option for Binance users.

Binance Futures Grid is Binance’s best futures trading bot. It uses an automated strategy involving buying low and selling high. The bot efficiently accommodates neutral, long, and short trading approaches while incorporating leverage.

Moreover, the Futures Grid bot can adapt to different market conditions, thereby allowing traders to benefit from the opportunities available in the futures market.

Another futures bot from Binance is the Futures TWAP Bot. This bot breaks down large orders into smaller trades to execute orders that are larger than the order book’s available liquidity, or minimize the price impact during periods of high-price volatility.

Another Binance bot is Futures VP Binance, which uses the Volume Participation trading algorithm to execute large orders based on urgency level.

With Binance trading bots, traders get to choose from more than 340 derivative trading pairs, unlike many other crypto futures platforms that focus on popular coins, such as Bitcoin and Ethereum. Users also get the advantage of choosing from futures contracts denominated and settled in stablecoins or in their respective underlying cryptocurrencies.

In terms of fees, Binance charges 0.05%, but users can get a 10% discount on trading fees when using BNB (Binance Coin). Additionally, Binance boasts of remarkably high-leverage options.

Overall, Binance offers traders different types of crypto futures bots that not only meet their needs, but also adapt easily to different market conditions.

Pros

- Ability to adapt to different market conditions.

- More than one bot is available for futures.

- Option to choose from more than 340 derivative trading pairs.

Cons:

- Customer support has faced criticism for being slow at times.

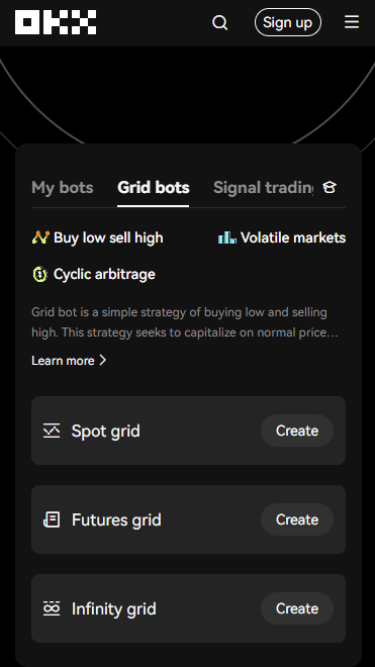

With daily trading volumes worth billions of dollars, OKX offers an array of crypto contracts, including options, perpetual swaps and futures. Moreover, this automated futures trading system supports an extensive list of cryptocurrencies.

For OKX, the maximum leverage limit when trading futures is also 100x, but it is reduced to 20x when trading in ‘full liquidation’ mode.

This trading bot also allows you to copy the strategy of professional traders or create your own bots based on risk preference and other parameters.

OKX Trading Bot also has the advantage in terms of fees. The bot charges 0.05% per slide on futures, while Options can be traded at 0.03% of the contract value. Additionally, the charges can be further reduced with the use of OKB tokens and substantial trading volumes.

OKX’s other distinctive feature is its trading bot marketplace, which allows traders to ‘follow’ trading bots created by others on the platform.

Along with offering the usual trading features and competitive fee structure, the fact that OKX allows traders to follow and copy other traders’ strategies makes it one of the best crypto futures trading bots.

Pros

- Fees in line with the industry average.

- Trading bot marketplace allows users to socialize.

- Supports many types of contracts with various expiry dates.

Cons:

- Maximum leverage reduces to 20x when trading in full liquidation mode.

- Overdependence on the OKX exchange’s platform and services for trading activities.

4. Pionex – Simple to operate and no trust issues

Pionex, a Singapore-based exchange, offers 12 different trading bots operating on different algorithms and targeting different market conditions, including Spot Futures Arbitrage Bot. This automated futures trading software targets earnings of 15-50% APR with an extremely low-risk arbitrage strategy.

Pionex’s futures bot is simple to operate – you just need to set the bot to be trained and let it run. The bot is free to use, but you need to pay a small trading fee of 0.05%, which is less when compared to other brokers who don’t offer free trading bots.

What makes Pionex better than many others is that it is regulated in Singapore and the U.S. Though Pionex offers customer support only through Telegram and email, it is quick, responsive, and effective.

Moreover, Pionex aggregates liquidity from both Binance and HTX, allowing it to match the orders the bots need to continue performing 24×7. It implies that traders don’t need to worry about bots crashing and burning due to a lack of liquidity.

Pionex also recently introduced Cross Margin Futures Grids, allowing traders to create both a short grid and a long grid and share the margin. Sharing of margin ensures profit from one effectively compensates any margin deficiencies in the other.

Overall, Pionex’s crypto futures trading bot is simple to operate, charges minimum fees, and is secure.

Pros

- No dearth of liquidity.

- Sharing of margin using Cross Margin Futures Grids.

- More secure as it is regulated both in the U.S. and Singapore.

Cons:

- Customer support only through Telegram and email.

- Doesn’t support many fiat currencies.

Gunbot connects crypto traders and exchanges, giving users an automated way to diversify investments. Its strategies, speed, extreme flexibility and substantial user community sets Gunbot apart from other trading bots.

Presently, the platform offers 15 distinct automatically executing trading strategies, and is constantly working to expand its offerings. Traders can use these pre-existing strategies, or create their own. Also, users can share their trading ideas with other members of the trading community.

Gunbot’s other distinctive feature is that it doesn’t depend on a cloud service; rather, users need to install and configure it on their system. This trading bot features a user-friendly interface that is ideal for both beginners and experienced traders.

Gunbot runs entirely on traders’ own systems and supports Windows, macOS, Linux, or Raspberry Pi. It also doesn’t charge a subscription for licensing; rather, users pay a one-time fee, which makes it perfect for accelerating crypto trading.

In terms of the platform itself, Gunbot offers monthly plans starting at $29, annual plans starting from $174, and lifetime plans starting at $199. Upgrades and updates to the software are free.

Gunbot’s independence from cloud service, user-friendly interface, and thriving user community make it one of the best crypto futures trading bots available.

Pros

- Supports Windows, Mac, and Linux.

- Doesn’t depend on a cloud subscription.

- Active community support.

- No recurring costs, as users need to pay a one-time license.

Cons:

- Even though there are no subscription costs, Gunbot’s license fee isn’t cheap.

- Several of its users have complained of encountering technical glitches.

Methodology

We used a combination of methods to compile and review this list of products. We directly tested each platform, analyzed user feedback, and compared key features. This comprehensive approach aimed to provide an informed assessment of the best available options.

Crypto Trading Bot FAQs

Are there trading bots for futures?

How profitable are trading bots?

Do trading bots ever work?

Is it illegal to have a trading bot?

References

- https://www.kucoin.com/learn/trading-bot/kucoin-futures-grid-bot

- https://www.binance.com/trading-bots

- https://www.binance.com/blog/markets/demystifying-the-futures-grid-bot-5592639286007523221

- https://www.okx.com/help/whats-a-futures-trading-bot-and-how-do-you-automate-trades-with-it

- https://www.pionex.com/blog/how-to-use-your-futures-grid-bonus-to-earn-for-free%EF%BF%BC/

- https://www.gunbot.com/support/docs/built-in-strategies/futures-strategies/futuresgrid/