Choice Equities performance update for the month ended August 2020.

Q2 2020 hedge fund letters, conferences and more

Choice Equities Performance Update

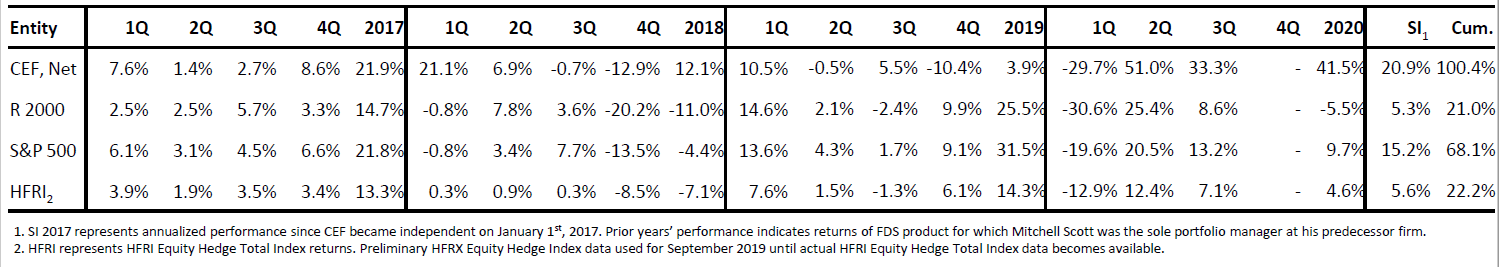

On Choice Equities' performance front this year, we have good new to share as the partnership has generated a +42% net return year-to-date as of the end of August. While I am happy to report this return compares quite favorably to relevant market indices, I am most pleased to share that we have now compounded capital at a ~21% annualized rate of return for the 3.5+ years since inception. During this time, we have soundly outperformed all relevant comparisons, a period which spans two bear markets and a spell of lackluster returns and limited tailwinds for small and mid cap stock, our primary area of focus. More importantly, as our resources grow, I believe the outlook for continued strong performance has only grown stronger.

Alongside this strong investment performance, our firm continues to grow quite nicely with new clients and assets under management. I should note most of this growth has come from friends and family and referrals, and I feel honored to have the privilege of investing a portion of your capital alongside the overwhelming majority of mine. I am also pleased to share we have had a number of limited partners invest via our Founder's Share class, an offering available for $1M+ sized investments that offer advantaged fees and slightly longer lock-up terms. While we currently have capacity in this share class, I anticipate closing this offering, potentially relatively soon, as the business continues to scale.

Finally, as the firm continues to grown on all fronts, I am happy to announce our partnership with NM+Co., a boutique consultancy providing outsourced investor relations services, to assist us in managing relations with our current investors as well as lead our marketing efforts to cultivate and develop new relationships. Nic Michalczewski serves as our lead contact there, and I would be happy to make the introduction to connect you with him at your convenience. He is cc'd on this email for your reference.

As always, if you have any thoughts or comments, please reach out. I hope to connect with you all soon - hopefully in person, and sooner rather than later.

Best,

Mitchell Scott, CFA