Checkpoint Therapeutics is a pharmaceutical company that focuses on the development of novel treatments for patients with solid tumor cancers

Late on Friday evening last week, clinical-stage biopharma company Checkpoint Therapeutics Inc (NASDAQ:CKPT) filed a form 4 with the SEC with information regarding the sale of 276,000 shares by CEO James Oliviero. The transaction was spotted in Fintel’s insider trading tracker over the weekend.

Checkpoint Therapeutics is a pharmaceutical company that focuses on the development of novel treatments for patients with solid tumor cancers. The company was founded in 2014 and includes the following portfolio of products: CK-301, CK-101, CK-103, CK-302 and Anti-CAIX. The company uses a streamlined approach that lowers risk and accelerates the development and commercialization of oncology drugs.

Q2 2022 hedge fund letters, conferences and more

The shares were sold in four transactions occurring between the 17th and 23rd of June. The average price achieved on the sale was $1.09 per share, equating to a total value of ~$301,000.

The transaction leaves Oliviero with 2,562,000 in shares and restricted stock but saw the CEO reduce his position in the company by about 10%. The sale is James’s first transaction in the stock since late April where he had sold 121,000 shares at prices ranging from $1.51 to $1.85.

The sale comes after CKPT’s weak share price performance in 2022 that has seen the stock lose over 67% of its value over the last 6 months. The persistent share price weakness and expected volatility in the coming months were likely contributing factors to the reason for the sell down.

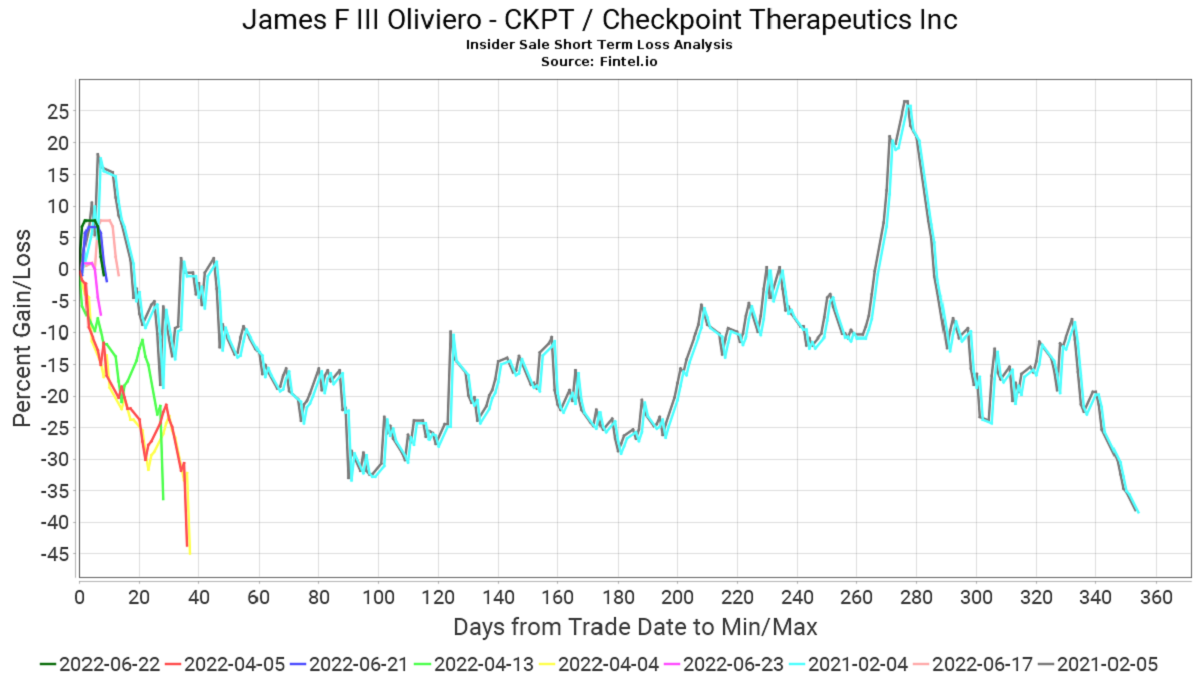

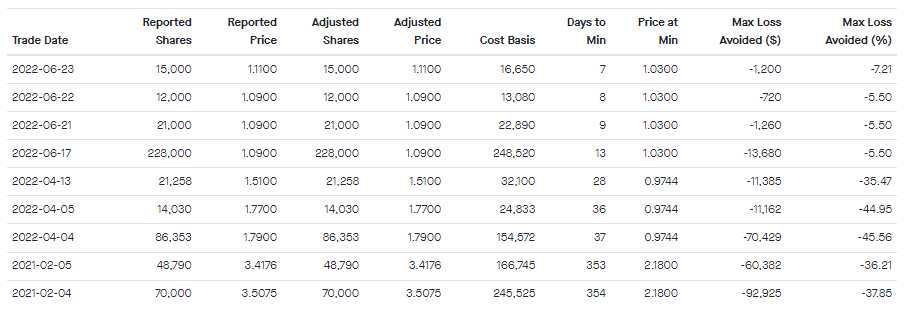

The chart to the right and table below is cited from James Oliviero’s insider trade report and visualizes the percentage and dollar values of the losses that have been avoided from sales during 2021 & 2022.

These insider sales contribute to the bearish Fintel insider accumulation score of 42.40 based on the one net insider that has sold stock in the last 90 days. Insiders own ~7.1% of the total float following the sales.

In comparison, institutional ownership in the stock is also bearish with an ownership accumulation score of 29.80. The weak ownership score ranks the company in the bottom 25% out of 31,673 screened companies. While levels of institutional ownership have risen during the quarter, they remain below the peak levels of ownership experienced in June 2021.

Most recently on the 16th of June, Checkpoint announced positive interim results from their trial of product Cosibelimab from a cohort of 78 patients.

Joseph Pantginis from HC Wainwright & Co believes the data supports the differentiating characteristics of cosibelimab and the firm looks forward to finding out more about the BLA preparation and potential steps for commercialization. Patginis has a ‘buy’ rating and $26 target on the stock.

Matthew Kaplan from Ladenburg Thalmann believes the initial results bode well for the success of Cosibelimab in the future. The firm reiterated their ‘buy’ rating on the stock as they believe CKPT represents an attractive investment opportunity.

CKPT is covered by 5 institutions that all have ‘buy’ rating on the stock with an average target price of $19.80, implying over +1,800% in capital upside. The consensus target price for the stock has remained above $15 over the last 2 years and has risen towards $20 where it has remained firm over the course of 2022.

Article by Ben Ward, Fintel