What’s New In Activism – Icahn Drops Kroger Fight

Carl Icahn has dropped a proxy fight focused on animal welfare at U.S. supermarket giant Kroger Co (NYSE:KR). The activist investor recently lost a similar contest against McDonald’s Corp (NYSE:MCD).

In a letter to Kroger shareholders and McDonald’s investors, Icahn argued that the performance of the two companies makes it unlikely that his push for better treatment of pigs will be backed by other shareholders.

Q1 2022 hedge fund letters, conferences and more

Icahn has been pushing against the use of gestation crates at both Kroger and McDonald's.

To arrange an online demo of Insightia's Activism module, send us an email.

Activism chart of the week

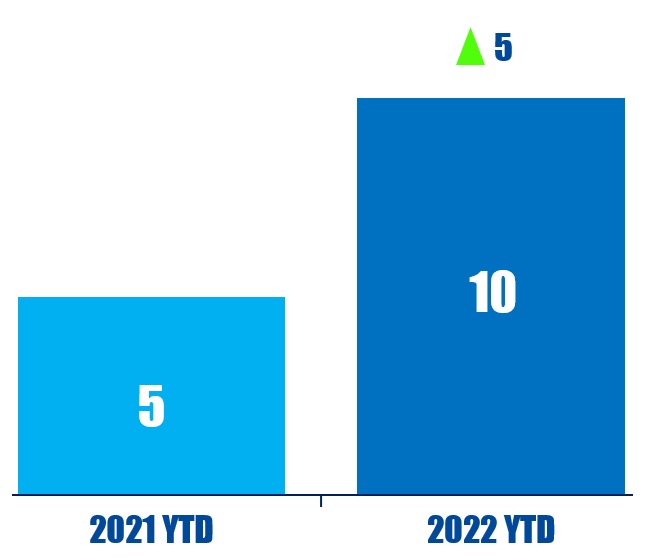

So far this year (as of June 3, 2022), activist nominees have gained 10 board seats at U.K.-based companies. That is compared to five in the same period last year.

Source: Insightia | Activism

What’s New In Proxy Voting - Activist Win At Firearm Manufacturer

Sturm Ruger & Company Inc (NYSE:RGR) shareholders voted in favor of a proposal asking the firearm manufacturer to produce a human rights risk assessment at the company's June 1 annual meeting.

The proposal, submitted by CommonSpirit Health, Mercy Investment Services, and members of the Interfaith Center on Corporate Responsibility's (ICCR), received 68.5% of the vote.

In a press release, ICCR said "As our nation once again tries to process the unimaginable... proponents successfully made the case to their fellow shareholders that gunmakers could not abdicate their roles and responsibilities in helping to stem the carnage perpetrated with the products they sell to the public."

In response to the vote, Sturm Ruger's CEO, Chris Killoy, called the proponents "anti-gun activists" who blindly followed the guidance of Institutional Shareholder Services (ISS) and Glass Lewis, which both endorsed the proposal.

To arrange an online demo of Insightia's Voting module, send us an email.

Voting chart of the week

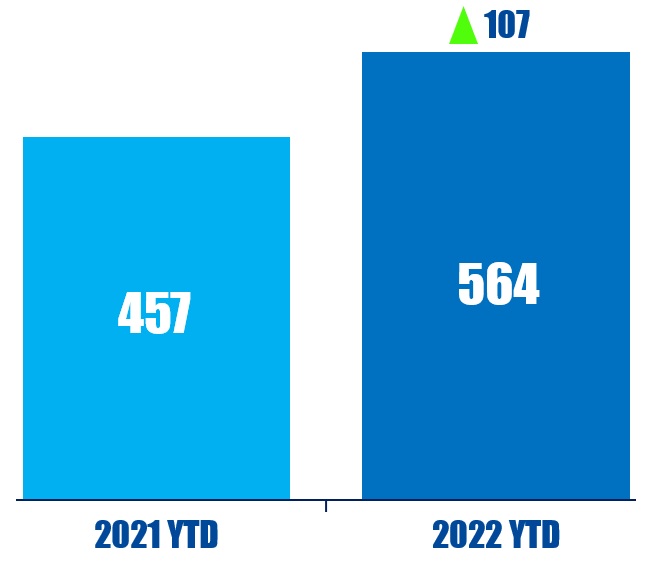

So far this year, there have been 564 shareholder proposals at U.S. company meetings. That is up from just 457 over the same period in 2021.

Source: Insightia | Voting

What’s New In Activist Shorts - Kerrisdale v Lightwave Logic

Kerrisdale Capital revealed a short position in technology platform company Lightwave Logic, Inc. (NASDAQ:LWLG), citing operational challenges and product delays.

In a June 2 short report, Kerrisdale said that the $900 million company has been "stuck in development stage status for more than thirty years," and that despite this, it has not "come close to commercializing anything."

The short seller criticized the $6,000 revenue that Lightwave has generated in the 15 years since it went public. Furthermore, Kerrisdale said that the most damning detail was that "no one knows how to consistently produce" the company's proprietary polymer, a keystone element of the company's product offering.

To arrange an online demo of Insightia's Shorts module, send us an email.

Shorts chart of the week

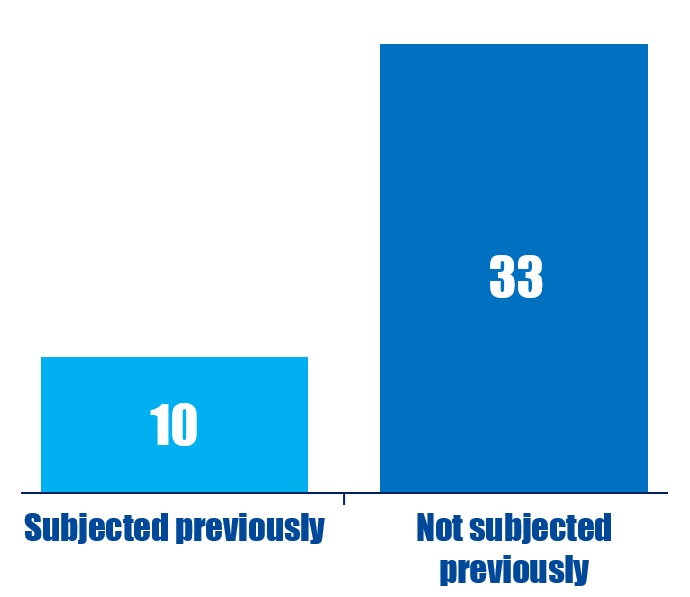

So far this year (as of June 6, 2022), 43 companies have been publicly subjected to an activist short campaign, of which 10 have been subjected to previous activist short campaigns in the past 10 years.

Source: Insightia | Shorts

Quote Of The Week

This week's quote comes from Biglari Capital which renewed its long-running criticism of Cracker Barrel Old Country Store. Read our reporting here.

“We continue to see that a dollar in the hands of current management turns into less than a dollar of value for shareholders.” – Biglari Capital