Bitcoin was dumped earlier this week due to a $9.6B transfer from Mt. Gox. Although some recovery occurred, concerns regarding a mass BTC liquidation by October remain.

To recap, Mt. Gox was the biggest Bitcoin exchange platform over a decade ago. More than 70% of Bitcoin transactions took place at Mt. Gox. In 2014, Mt. Gox announced it was hacked and lost 800,000 BTC (approx.).

A compromised computer has led to the exploit, which the exchange overlooked for several years.

At the time, they were worth around $460M. After the exploit was revealed, Mt. Gox filed for bankruptcy. Since then, Mt. Gox’s crypto wallets have been closely monitored. Every indication of BTC transfer from the wallets triggered a knee-jerk reaction in Bitcoin’s price.

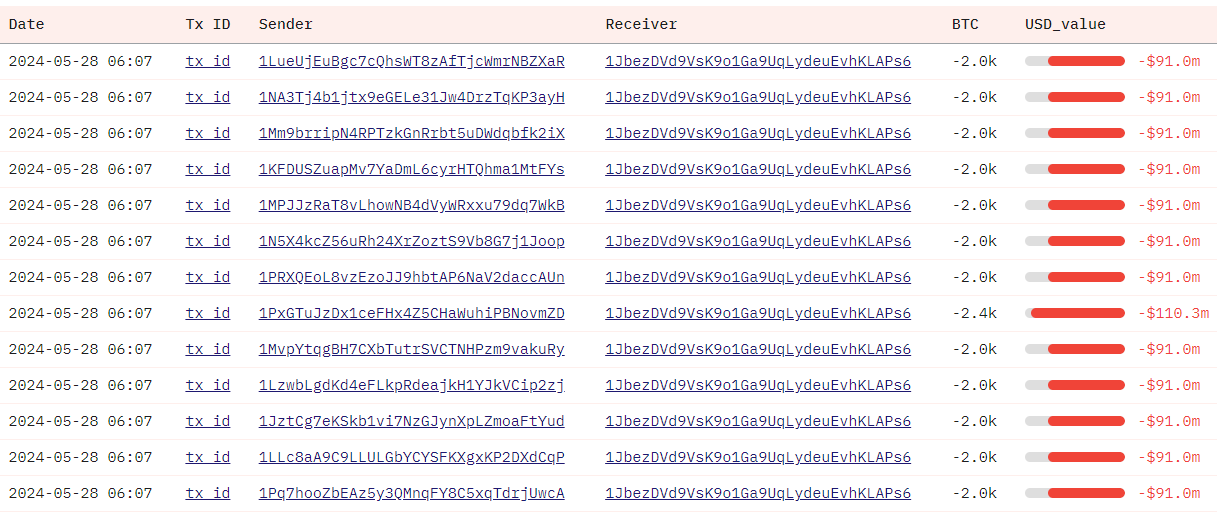

Blockchain analytics platforms, including Dune and Arkham Intelligence, picked up the transactions from Mt. Gox, which sent ripples throughout the market.

source: dune

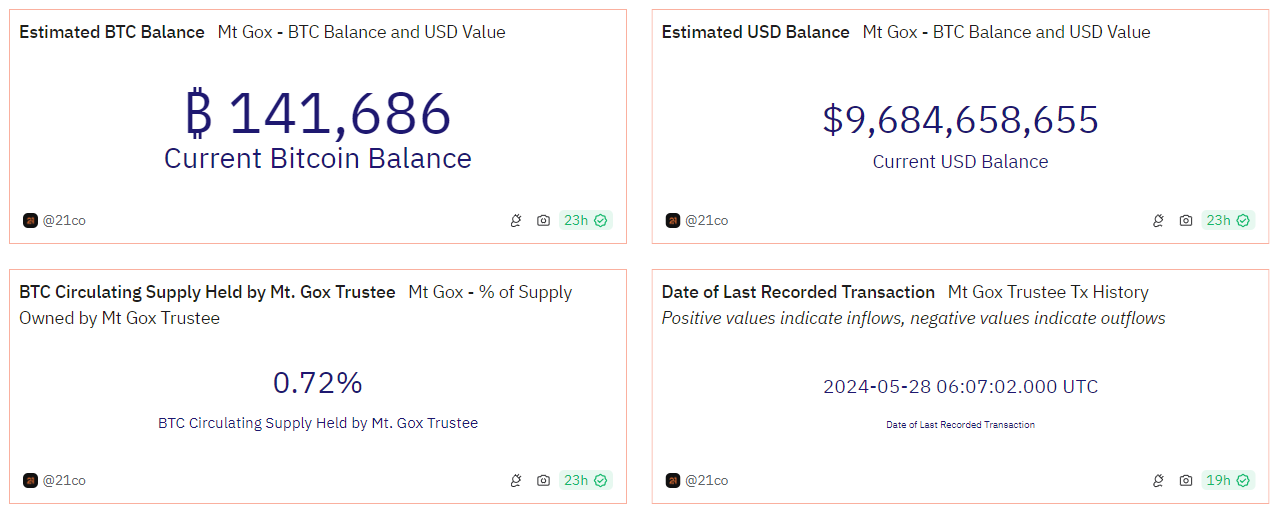

According to on-chain data, Mt. Gox transferred approximately $9.6B, or BTC 141,686, on May 28, 2024. The Bitcoin exchange asked its creditors whether they wanted to be paid in fiat currencies or Bitcoin.

Some fiat repayments were made via PayPal towards the end of 2023. The upcoming repayment may be for those who wish to be prepared in crypto.

As a significant amount of Bitcoin may be liquidated, the market reacted accordingly as the news circulated throughout social media.

source: dune

The deadline by which the repayments are due is October 31, 2024. The market is concerned the repayments will be liquidated, resulting in a firm price depreciation. As a result, Bitcoin edged lower as the news hit the market.

However, is Mt. Gox the big bad wolf the market should fear?

Mt. Gox is not the big bad wolf

When 41,490 BTC that the FBI seized from Silkroad, a black marketplace that operated on the darknet, were to be sold in 2023, Bitcoin was hit with a bearish hammer.

Court documents revealed the following:

‘On March 14, 2023, the Government sold 9,861.1707894 BTC (of the 51,351.89785803 BTC) for a total of $215,738,154.98. After $215,738.15 in transaction fees, the net proceeds to the Government were $215,522,416.83.

source: official court documents

‘Of the Bitcoin forfeited in the Ulbricht case, approximately 41,490.72 BTC remains, which the government understands is expected to be liquidated in four more batches over the course of this calendar year.’

Despite the liquidations, BTC held firm throughout 2023. A ‘crypto winter’ never materialized. While $9.6B is certainly larger, the market conditions are different:

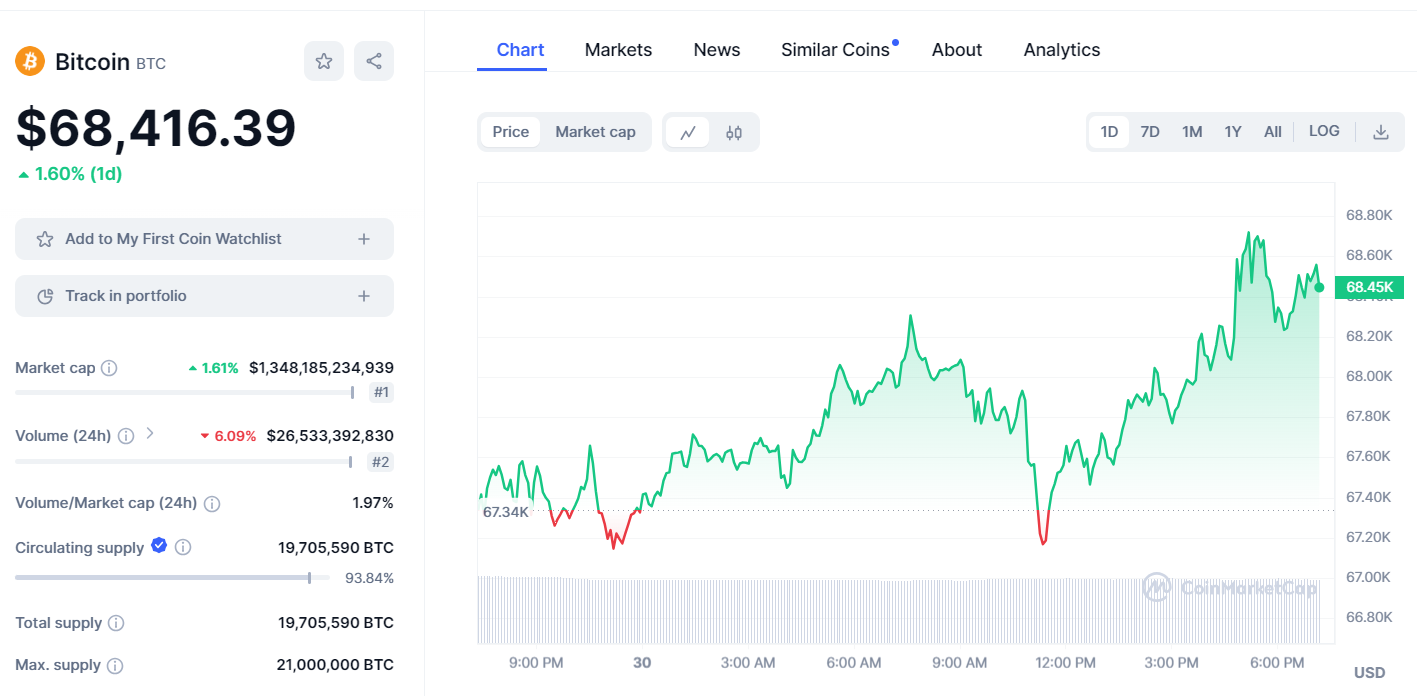

- Bitcoin’s market cap is $1.3T

- Spot Bitcoin ETFs amplified the inflows

- More institutions may add spot BTC ETFs to their clients

- Bitcoin daily trading volumes exceed $20B

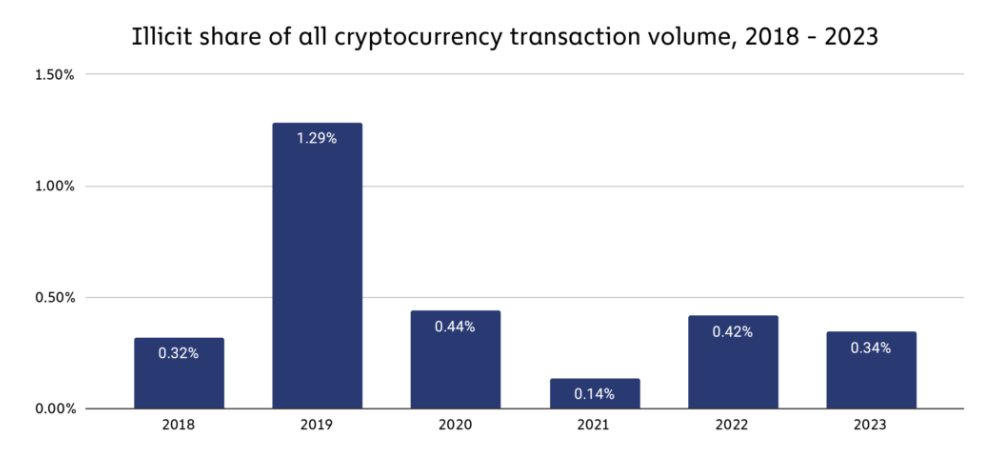

Bitcoin is more widely accepted by regulators than it was in the past. Chainalysis, a blockchain analytics platform shows that in 2023, only 0.34% of crypto transactions were crime-related:

source: chainalysis

In addition to the above, Bitcoin is now accessible in Decentralized Finance (DeFi) platforms. It can be used for on-chain borrowing and lending, providing liquidity, and is staked for an annual yield.

While many may choose to liquidate the BTC repayments, some may invest their BTC holdings in exchange for passive income.

Bernstein, an investment management and research firm, recently released its forecasts for Bitcoin and Ethereum. Bernstein expects Bitcoin to reach $90,000 in 2024 and $150,000 in 2025.

The Bitcoin and Ether ETFs are expected to grow to $450B, which could also positively impact Solana.

Based on the above, not all of Mt. Gox’s creditors may be in a hurry to sell.

The US Presidential elections to dictate Bitcoin trend

The focus may shift to the US elections, due November 5, 2024, rather than Mt. Gox’s repayments. Both Joe Biden and Donald Trump are changing their stance on crypto.

In 2021, Trump said during an interview on Fox Business that cryptocurrencies are ‘potentially a disaster waiting to happen’ and that ‘they may be fake; who knows what they are?’

As the crypto markets continued to expand and to be re-elected, Trump changed his views on cryptocurrencies. The Trump campaign announced this week that it would begin accepting donations in cryptos such as Bitcoin, Ethereum, and Dogecoin.

In a post recently shared on Truth Social, Trump wrote the following:

‘I am very positive and open-minded to cryptocurrency companies and everything related to this new and burgeoning industry. Our country must be the leader in the field.’

Bloomberg is reporting that Elon Musk is advising Trump on cryptocurrency policies:

A US President who favors cryptocurrencies (as opposed to the US SEC) may positively impact cryptocurrencies, particularly Bitcoin, due to the spot ETFs.

You may conclude that only Trump’s victory will be cheered by crypto enthusiasts. Biden is aware of Trump’s popularity among crypto investors, which means he is unlikely to sit on the fence.

The battle over SAB 121

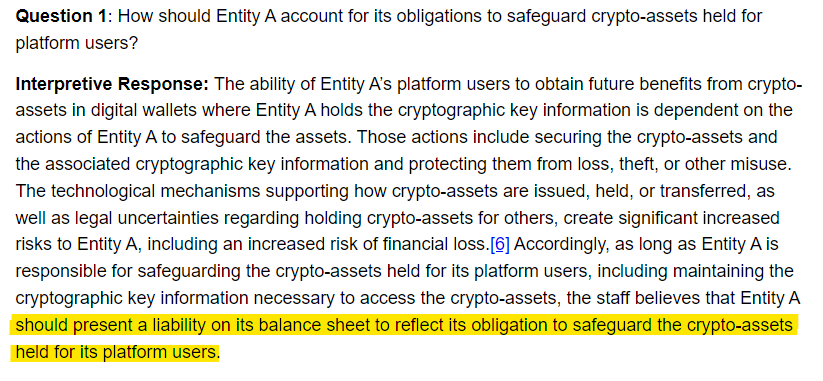

The US Senate voted two weeks ago for a bipartisan resolution on Staff Accounting Bulletin 121 (SAB 121), which prohibits US banks from offering digital asset custody services.

SAB 121 came into effect in 2022. It requires US banks to add digital assets to their balance sheets. However, custodial assets are always off the balance sheet, so US banks cannot offer custodial services for digital assets.

source: SEC

Allowing banks to offer crypto services would be a major milestone for Bitcoin.

Biden is planning to veto the resolution on SAB 121 to support the SEC. Due to Trump’s popularity among crypto fans, vetoing SAB 121 may negatively portray Biden.

Recent reports suggest the Biden administration has contacted key figures in the crypto industry for further guidance on the crypto community and policy.

According to the latest polls, Biden and Trump are tied in Virginia. Biden may be forced to consider pleasing the crypto community.

It is unclear at this stage whether the bipartisan resolution will be vetoed. If no veto is placed, Bitcoin could rally as both Presidential candidates soften their approach to cryptocurrencies.

As a result, the bulls may absorb potential Bitcoin sales from Mt. Gox repayments.

Will Trump’s conviction affect the Presidential race?

Trump was found guilty of 34 counts, including falsifying business records. The sentence will be given on July 11, 2024.

The sentencing will not prevent Trump from running in the elections. The appeal can take months if not years.

However, it may result in fewer votes than the current polls forecast. A conviction may also mean Trump cannot vote in Florida where he lives.

The law in Florida states that convicted felons can only vote after completing their sentence. If Trump is leading the polls following the sentence in July, the crypto markets may react in accordance.

What coins will benefit from a bull run in Bitcoin?

source: CMC

At the moment, most of the cryptocurrencies are correlated to Bitcoin. When Bitcoin posts the next leg higher, meme coins such as Pepe and Dogwifhat will naturally gain momentum.

Ongoing meme coins presales such as Sealana may witness additional flows.

DeFi tokens may also propel higher but some more than others. Solana may be watched as it has the potential to be the next cryptocurrency to star in new spot ETF applications.

Ripple (XRP) will also be a worthy candidate once the dust settles with the US SEC.

The US Core PCE Price Index, due Friday, may provide a glimpse into current inflation. Some volatility is expected as Bitcoin has yet to fully ‘depeg’ from the S&P500. Cryptocurrencies are still affected by the Fed’s monetary policies where inflation plays a vital role.