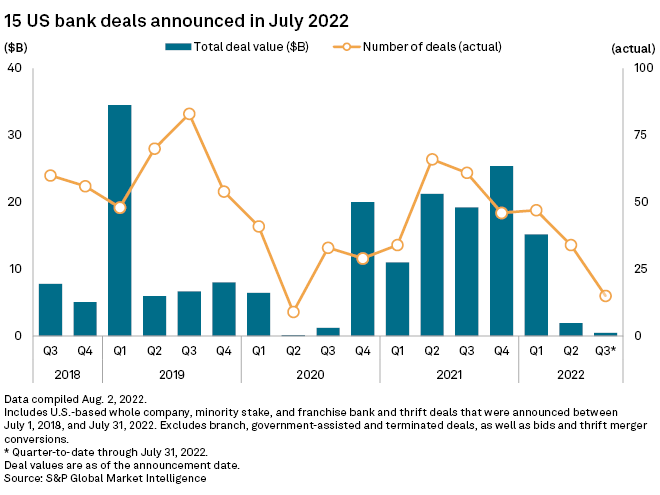

Fifteen U.S. bank M&A deals were announced in July for an aggregate deal value of $457.5 million, according to S&P Global Market Intelligence data.

Other highlights include:

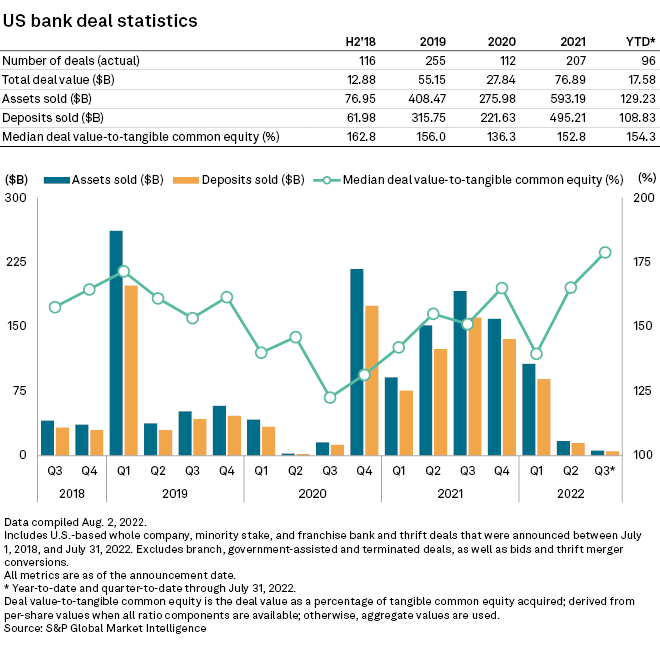

- The median deal value-to-tangible common equity ratio for deals announced in 2022 rose to 154.3%, eclipsing full-year 2021′s 152.8% and 2020’s 136.3%, and just below 2019’s 156.0%.

Q2 2022 hedge fund letters, conferences and more

- Total deal value year-to-date through the first seven months of 2022 was $17.58 billion, down from $38.59 billion over the same period in 2021.

- Texas, Illinois banks remain popular acquisition targets, including Great Plains Bancshares’ and Gregg Kidd’s (private investor) announced acquisitions of Providence Bancshares and the State Bank of Herscher, respectively.

- July deal among top 10 most expensive deals announced since 2021. Bank First Corp. announced acquisition of in-state peer Hometown Bancorp Ltd. for $123.9 million at a deal value-to-tangible common equity ratio of 210.9%, made it the seventh-most expensive deal announced since Jan. 1, 2021.