Whitney Tilson’s email to investors discussing Aphria Inc (NASDAQ:APHA) stock tumbles 19 percent, the company tries covering up its fraud; Large companies in the S&P 500 index are outperforming small one.

Q2 2020 hedge fund letters, conferences and more

Aphria Stock Tumbles 19 Percent

1) Shares of Canadian cannabis company Aphria (APHA) tumbled 19 percent yesterday after the company reported a quarterly loss of C$98.8 million.

Longtime readers may recall that my friend Gabriel Grego of Quintessential Capital exposed massive fraud at the company in an epic presentation at my shorting conference on December 3, 2018, which I covered in my e-mails that day and the day after. Specifically:

Grego said Aphria engineered a mechanism to siphon off money to companies held by insiders in South America and the Caribbean to the detriment of shareholders, according to the report. The short seller said Aphria purchased companies in Argentina, Colombia, and Jamaica in September from Scythian Biosciences Inc., now named SOL Global Investments Corp., which had acquired them shortly before at a "significantly lower" price from three Canadian shell companies.

Hear Gabriel speak at our next conference!

Of the C$98.8 million loss, want to guess how much of it was due to "impairment charges" from those acquisitions? C$64.0 million!

Of course, Aphria claims that these write-downs are due to "the effects of COVID-19 on the Company's expected cash flows," but that's just an excuse to cover up the fraud...

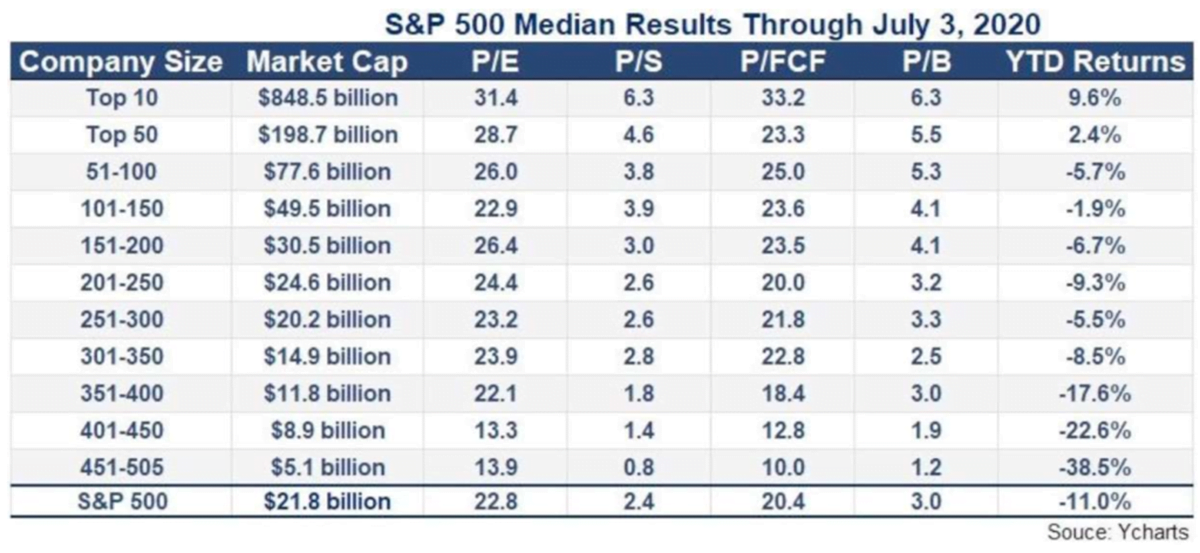

Largest Companies Outperforming Smaller Ones

2) I'm not surprised that the stocks of the largest companies in the S&P 500 Index have done better than the smallest ones so far this year – it's mathematically likely to be true most years – but the degree of outperformance is stunning!