This Graham-Dodd Stock Screener was developed by x-fin.com on the basis of general approach to security valuation employed by the famous Benjamin Graham and David Dodd. The stock screener compares intrinsic value of a stock with its current market price – the difference between them is called the margin of safety.

Intrinsic value of a stock (V*) is calculated as the sum of the following three components (on a per share basis):

- Tangible book value (TBV), which serves as a proxy for assets’ replacement costs or assets’ fair value in this Graham-Dodd Stock Screener.

- Value attributed to retained earnings, which are defined as the difference between Net Income (NI) and Dividends (Div). The value of this component is calculated as the value of a perpetual bond with the coupon equal to the company’s average yearly retained earnings, and the required rate of return for retained earnings (RRRre) of 20%.

- Value attributed to dividends. The value of this component is calculated as the value of a perpetual bond with the coupon equal to the company’s average yearly dividend (Div) and the required rate of return for dividends (RRRd) of 10%.

The resulting formula looks as follows:

V* = TBV + ((NI – Div) / RRRre) + (Div / RRRd)

Also see some other great tools

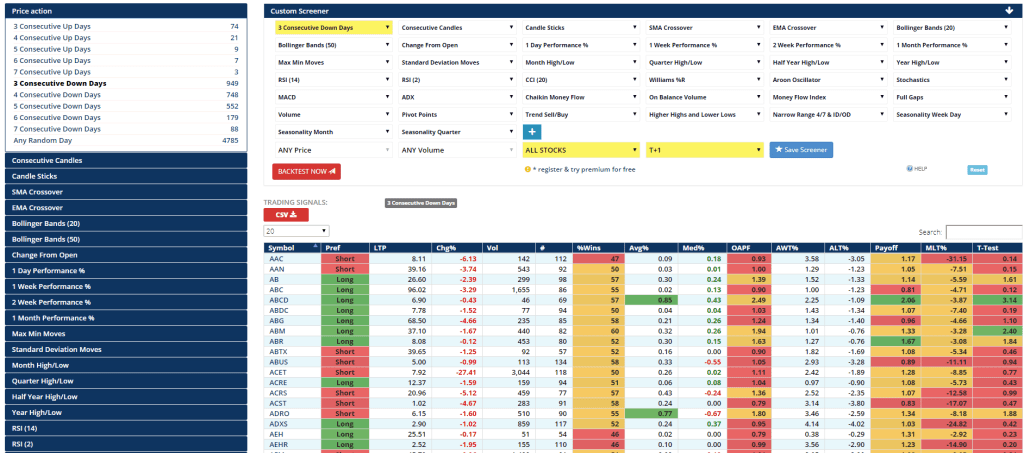

Graham-Dodd Stock Screener

Value investing has had a rough run the past few years, but the logic is sound. If so the Graham-Dodd Stock Screener could be valuable for initial screening of attractive securities (not investment advice).

What stocks are you finding with the tool? Tell us in the comments section!