The UK government introduced Individual Savings Accounts (ISAs) in 1999 to push people to save or invest more of their disposable income by giving them tax incentives. UK residents over 18 can save or invest up to a set amount (ISA allowance) and never pay tax on it. The interest you earn on the money stashed in a cash ISA, which is like a savings account, is always tax free. Similarly, no tax will be due on the income or capital gains made from your investments held in a stock and shares ISA (investment ISA).

In the current 2024/25 tax year, which ends April 5 next year, £20,000 is the most you can invest in an ISA. The allowance applies across different types of ISA, so if you invest £10,000 in a cash ISA in a single tax year, you can only invest a maximum of £10,000 in your stocks and shares ISA in the same year.

In this guide, we compared several ISA providers and picked the 10 best of them. Read on for our recommendations.

A quick overview of the 10 ISA stocks and shares platforms we are recommending. The list will help you choose the one that suits your investing style, experience and funds:

- Trading 212: The online platform, founded in 2004 in Bulgaria as Avus Capital, has been the No.1 trading app in the UK by downloads since 2016. It offers more than 13,000 stocks and ETFs.

- IG: Set up in 1974 in London as Investors Gold Index, IG is primarily known for its margin trading. It also offers stocks and shares ISAs, with the opportunity to buy the shares of more than 17,000 companies, including 3,925 in the UK. It also offers more than 2,000 exchange-traded funds (ETFs), and bonds.

- Saxo Bank: Founded in Copenhagen, Denmark in 1992, the investment bank’s ISAs offer more than 11,000 global stocks, ETFs, and bonds. The site does a good job of providing stock news as well as video guides on investing. It has more than 1.2 million clients.

- Vanguard: Established in 1975, in Valley Forge, Pennsylvania, the fund management company has more than 50 million clients. It offers more than 85 in-house funds. It pioneered the concept of mutual fund indexing with the introduction of the First Index Investment Trust.

- Freetrade: The relatively new trading platform was founded in 2016 in London. It offers commission-free trading on more than 6,200 stocks and ETFs.

- Interactive Brokers: Founded in 1995 in Manchester, England, it has 1.4 million users and offers more than more than 40,000 UK and global investment options, including stocks and more than 3,000 funds, 1,000 ETFs and 600 investment trusts.

- Hargreaves Lansdown: Founded in 1981 in Bristol, England, the financial services company has more than 1.7 million clients and offers more than 13,000 investments including shares, funds, exchange-traded funds (ETFs) and investment trusts.

- InvestEngine: The London-based platform, launched in 2019, focuses on ETFs. Its DIY portfolios are commission free and the company offers more than 590 ETFs across a variety of asset classes.

- AJBell: The Manchester-based company, founded in 1995, has a variety of options for your stocks and shares ISA. Clients can choose form more than 2,000 funds, 15,000 stocks across more than 24 international markets, more than 450 investment trusts and more than 3,500 ETFs.

- Bestinvest: Founded in London in 1986, by parent company Evelyn Partners, the investment firm has more than 1,600 funds, 1,100 shares, more than 280 investment trusts and more than 350 ETFs available to invest within your stocks and shares ISA. Its roots date back to the 19th century.

- Show Full Guide

Let’s take a more detailed look at the top ISA stocks and shares platforms offered to investors based in the UK.

The platform was one of the first, in 2017, to offer zero commission share trading in the UK, and it is now the most-downloaded trading app in the country. Its ISA doesn’t charge a platform fee, inactivity fee or withdrawal fees either, which explains why the platform has grown so much. Some of the other positives is it allows trading on fractional shares. Also, for the time being, it pays an annual percentage rate of 5.2% interest on uninvested cash in ISAs. It provides chat and email for customer support.

One of Trading 212’s most unique features is it does share lending, a procedure where investors can transfer their shares to a borrower and get daily interest and collateral in return. Investors can choose whether they want to participate in share lending. Trading 212 also has an AutoInvest feature which allows you to build a diversified portfolio and customise it.

One downside to the platform is it doesn’t allow investors to purchase bonds or mutual funds. Also, while it offers the opportunity to buy 13,000 stocks and ETFs, it gives access to only a limited number of international markets. Also, its educational section is limited, with no news feed. It charges a high conversion fee of 0.15% from one currency to another, and on trades that require currency conversion.

Pros

- Share lending program earns money for customers

- No platform fee, inactivity fee or withdrawal fees

- Ability to earn interest on uninvested cash

Cons

- No bonds or mutual funds available

- Limited international markets

- High charges on currency conversions

The company offers a large range of potential investments for your ISA, as well as two different investment account types. The first is a share dealing account, which is self-managed and designed for experienced investors while offering low commission costs. IG also offers a Smart Portfolio ISA, where depending on your risk profile, your investments are managed for you.

One of IG’s best features is its investment academy, which offers £10,000 in virtual money to invest, essentially a way of allowing new investors to practice without financial repercussions. The academy also offers free online courses, webinars and seminars. It’s a good platform for more frequent traders as regular traders pay £10 for every US trade, but that drops down to free after three trades in a month. On UK trades, it costs £8 a trade but that drops down to £3 per trade if they trade more three times per month.

IG offers multiple ways to contact customer support, including by phone, chat or email. Some of the downsides for IG include that it doesn’t offer trading in fractional shares. Furthermore, it charges a relatively high trading fee of £24 per month for those who make less than three trades a month.

Pros

- Investment academy, which offers free demo money

- Good platform for more frequent traders

- Offers a smart investment portfolio that is managed

Cons

- Trading fee of £24 a month for low volume customers

- No trading of fractional shares

The investment platform gets high marks both for its ease of use, and strong educational offerings, including up-to-date stock news, and customer service (though not of the 24/7 variety). Saxo says it facilitates more than 260,000 trades a day. It also has a chart function with more than 50 technical indicators and a trading signal tool as well as a demo account to practice your trading.

If you hold stocks, ETFs or bonds in your account, you’ll be charged a custody fee of 0.12% in your ISA. However, you can avoid this fee if you enable Saxo’s stock lending program, where it lends out your shares and splits the profits evenly with you. Other ISA charges include a share dealing fee between 0.1% and 0.05%. While Saxo has contracts for difference (CFDs), that type of financial instruments aren’t available for ISAs, due to government restrictions.

Saxo doesn’t charge users to transfer an existing ISA to their platform and it doesn’t mandate an entry or exit fee. It also doesn’t charge an inactivity fee and pays up to 3.91% interest on ISA accounts that have £10,000 or more in uninvested cash.

Pros

- Plenty of technical indicators to help investors

- No charge to transfer an existing ISA to its platform

- Pays interest on accounts with £10,000 or more in uninvested cash

Cons

- Custody fee of 0.12%

- Platform focuses on CFDs, though they aren’t allowed in ISAs

Vanguard offers a wealth of investment options in its stocks and shares ISA, including 85 funds, and it manages all of them. It’s a good platform for those with more invested money as its 0.15% account management fee is capped at £375 per year for accounts over £250,000 for self-managed accounts. A Vanguard managed stocks and shares ISA costs 0.30% of the account on top of the 0.15% account management fee.

Vanguard also offers LifeStrategy funds, which allow an investor to put money in a package of bonds and equities according to his or her level of risk. Another Vanguard feature is it has 11 different target retirement funds that change proportions between equities and bonds as you get closer to retirement. The company pays 2.60% interest on uninvested funds in your account.

The biggest disadvantage for Vanguard is the inability to invest in individual stocks, which makes it less useful for more experienced investors. However, it’s a good choice for inexperienced investors as it provides plenty of educational resources as well as relatively low fees.

Pros

- Good platform for conservative traders

- Plenty of educational sources

- Low fees for active investors

Cons

- Inability to invest in individual stocks

- Fees are pricey for passive investors

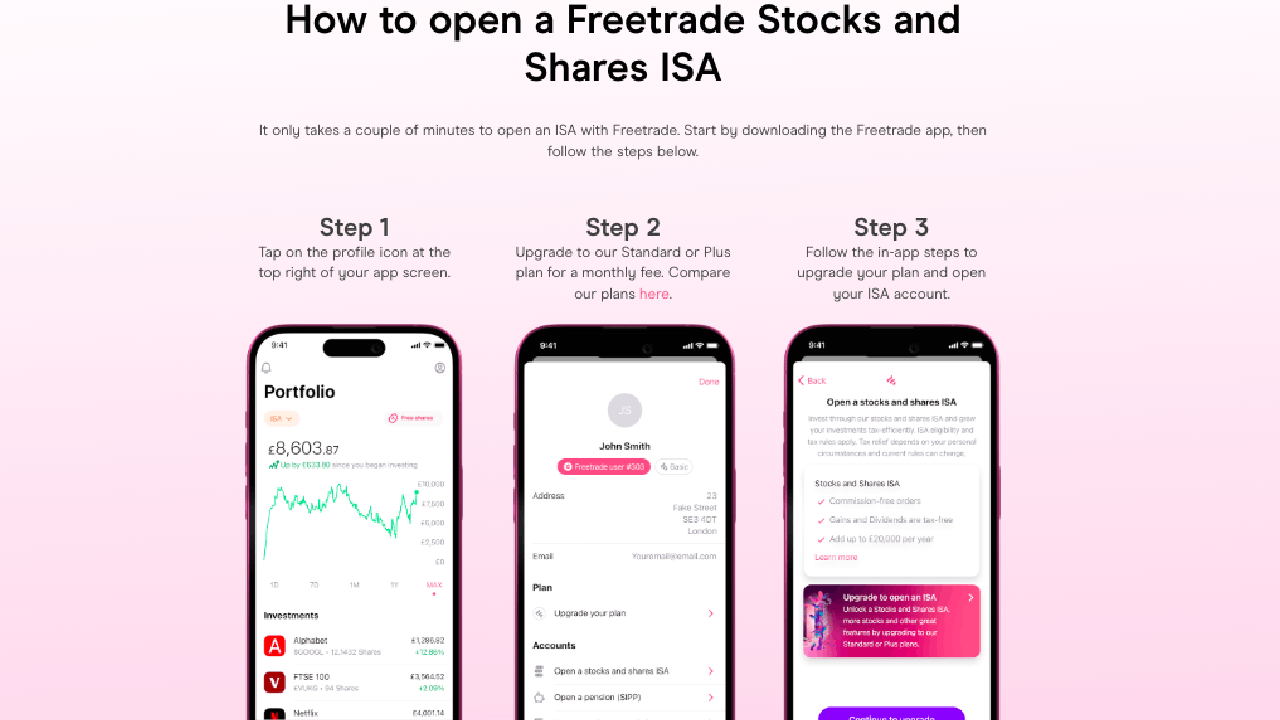

Freetrade is relatively true to its name, one reason why it already has more than 1.5 million customers. Other than a low monthly platform fee, most of the company’s services are free, including the ability to trade with no commissions and no account, inactivity or withdrawal fees. However, for a platform that seems to be designed for inexperienced investors, it doesn’t provide a lot of educational resources. For instance, it has no community forum where you can discuss stocks and other investments.

Freetrade offers more than 6,200 stocks and ETFs, but no bonds or mutual funds. It has commission-free trading in US shares with an ISA, but you will need either a Freetrade Standard account, which costs £4.99 a month or a Freetrade Plus account for £9.99, to have an ISA with Freetrade. Another plus is it allows fractional trading on stocks. It’s important to note that there are costs for buying stocks outside the UK, including a 0.59% currency fee on the Freetrade Standard ISA and a 0.39% currency fee on non-Uk stocks bought on the Freetrade Plus account.

The company also pays interest on uninvested cash in your account. Currently, it pays 3% on the Freetrade Standard account, up to £2,000 and 5% on the Freetrade Plus account, up to £3,000.

Pros

- True to its name, many of its services are free

- Pays interest on uninvested cash

- Allows fractional trading on stocks

Cons

- Doesn’t offer bonds or mutual funds

- Lack of educational resources

6. Interactive Brokers: Good ISA for the casual investor

The company offers only stocks and shares ISAs, not cash ISAs, and it doesn’t allow trading on margin on its ISAs. The broker offers investors more protection than some UK-based ISAs because its ISAs are held by its US-based parent, Interactive Brokers LLC, which is regulated by the US Securities and Exchange Commission. Because of this, assets in its ISAs are protected up to $500,000 (including a cash limit of $250,000) in the case of broker bankruptcy, rather than the usual £85,000 coverage available under the UK’s Financial Services Compensation Scheme (FSCS).

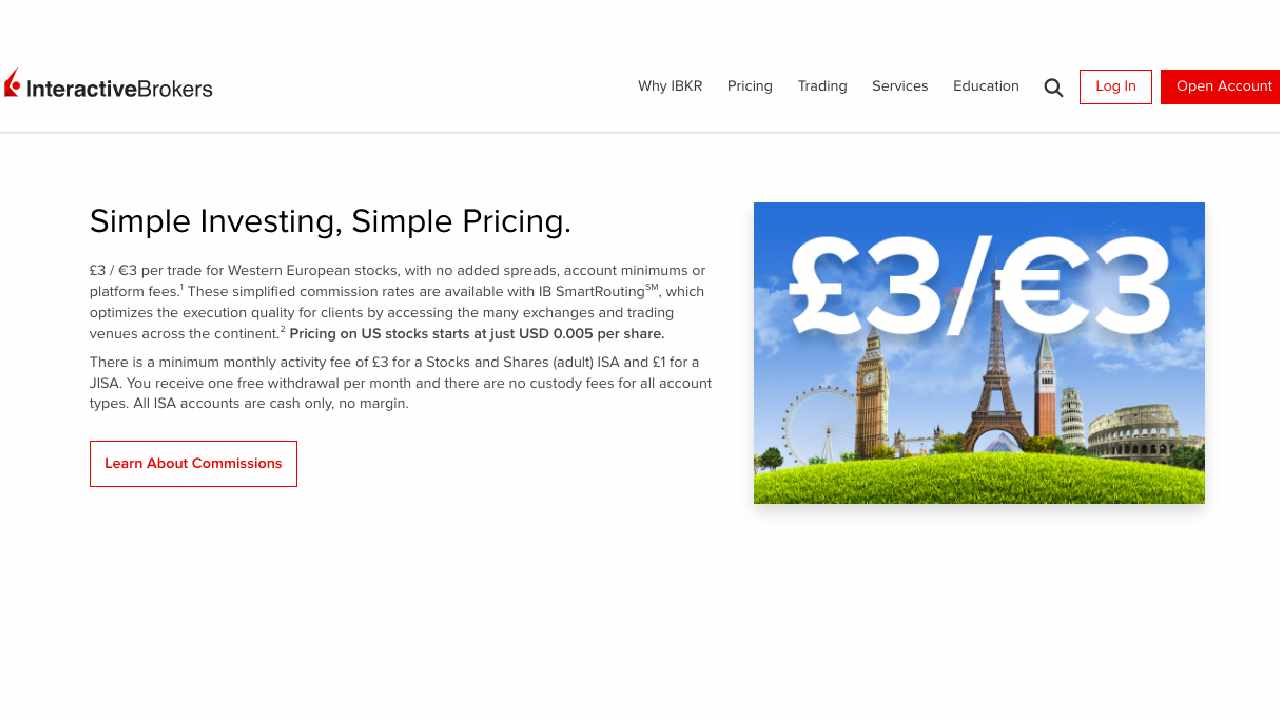

Interactive’s ISAs allow the trading in stocks, including fractional shares, bonds, ETFs and investment funds. Its fees, including its currency conversion fees, are generally low. It charges a commission of £3/€3 for most UK or European stocks. Trading fees for US stocks start at $0.005 per share.

Uninvested cash in its ISAs earn relatively high interest, with a catch. Clients with a net asset value of more than $100,000 earn an annual rate of 4.723% on any cash balances above £8,000 or 4.83% on any cash balances above $10,000. Interest will not be payable on the first £8,000 or $10,000 (or the equivalent value in other currencies) of uninvested cash balances. Another negative is that the company’s website, while it provides plenty of information, can be difficult to navigate.

Pros

- Good financial protection for funds

- High interest rates for uninvested cash

- Allows fractional trading

Cons

- Website can be tricky to navigate

- Interest rates on uninvested cash only begin at £8,000

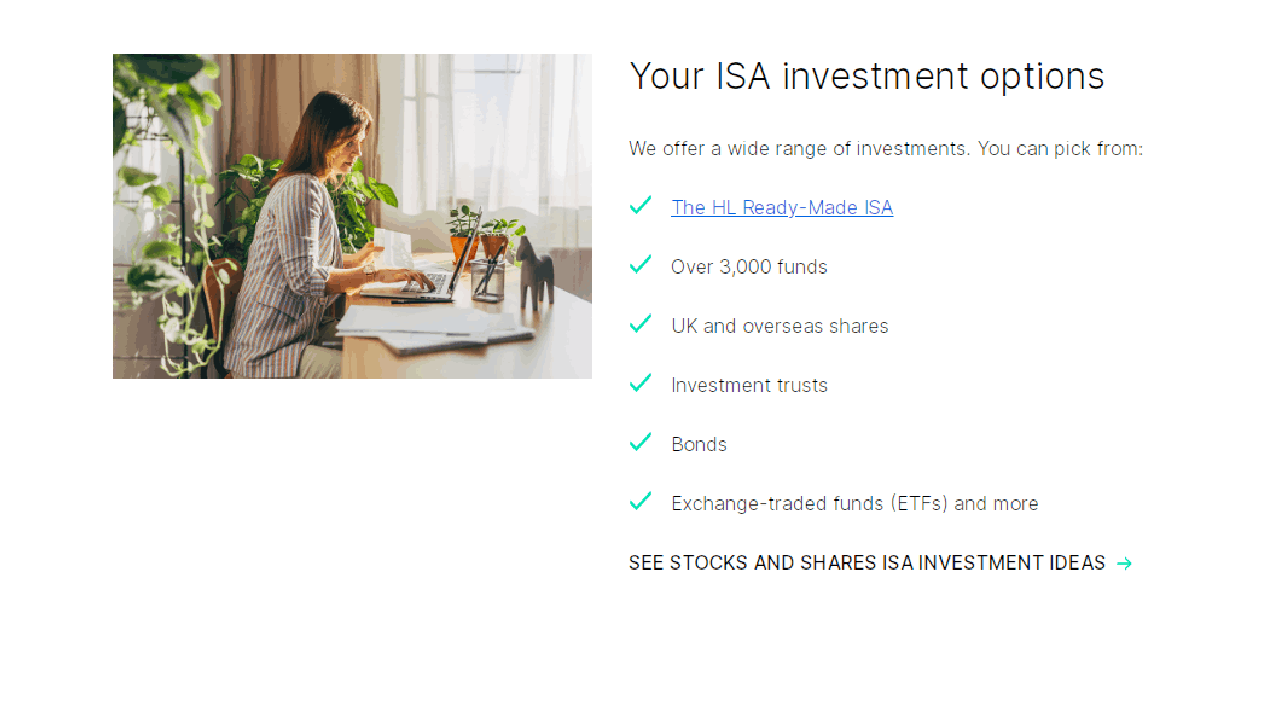

Hargreaves Lansdown holds more funds than any other UK brokerage. The website provides plenty of education opportunities and is easy to use. It also offers six ready-made ISA portfolios as well as plenty of other investment vehicles from shares to ETFs to bonds and mutual funds. You can open an ISA account with the platform for £100 or by setting up a monthly direct debit for £25.

Hargreaves’ website provides plenty of investment tools, and its customer service, which can be reached by email, chat or by telephone, consistently gets high marks.

One concern, though, is Hargreaves Lansdown can be pricey, particularly for beginning investors. For funds, it charges 0.45% annually on accounts with less than £250,000 in holdings, but that drops to 0.25% on accounts that hold between £250,000 and £1 million and then nothing for accounts with more than £2 million. For shares, it charges 0.45 annually on accounts with less than £10,000, with a maximum of £3.75 per month. So, for example, if you have £10,000 in funds and £3,000 in shares, your account charge would be £58.50 per year. That’s pricey compared to other platforms.

Pros

- You can open an ISA account with the platform for just £100 or by setting up a monthly direct debit transfer of £25

- Has six ready-made ISA portfolios

- Good customer service, educational offerings

Cons

- Pricey fees for lower-end investors

- Websit can be clunky

- Doesn’t support trading on Asian or African exchanges

8. InvestEngine: Basic ISAs platform is a solid choice for inexperienced investors

The platform has made a mark by being competitive on fees and by being easy to use. It focuses heavily on its more than 660 ETFs, including bond, and commodity ETFs, but does not allow investors to trade in individual stocks. Some of the best features of the platform are no account fees, no inactivity fees, a commission-free DIY portfolio service and no ISA transfer fees. If you invest £100 in an InvestEngine account, it will even give you an extra £50 for signing up. One cost to consider is the ETFs used by InvestEngine, like most ETFs, usually have charges ranging from 0.07% to 0.30% per year. That can eat into your returns.

The company offers managed portfolios, for which they charge 0.25% of your account balance a year. Its services are automated, which cuts down on costs, but the lack of human interaction can be seen as a negative for customer service or anyone wishing to get individualized investment advice. While its plethora of ETF offerings does grant exposure to the stock market, InvestEngine would be a frustrating platform for more experienced investors who would prefer to do their own stock selections.

InvestEngine has limited educational features, and the platform doesn’t offer advanced trading instruments or products other than ETFs listed on London Stock Exchange (LSE). That lack of choices, though, may be a good thing for inexperienced investors who might get overwhelmed by a more complex platform.

Pros

- Easy-to-use website

- Generally low fees

- It has a commission-free DIY portfolio service

Cons

- Limited educational resources on platform

- Fewer investment options than many platforms

9. AJ Bell: Has a Wide Array of Investment Options, Educational Resources

The platform has more than 530,000 customers and offers a wide range of investments within its stocks and shares ISA. It has more than 20,000 investment options, including more than 15,000 shares from the UK, Europe, North America and Asia-Pacific, more than 2,100 funds, more than 400 investment trusts and more than 3,500 ETFs.

AJ Bell’s fees for shares trading and buying and selling funds are relatively high, though its percentage-based platform fees are inexpensive for lower-end investors. Account charges for shares is 0.25% of the account, for a maximum of £3.50 per month. Account charges for shares is 0.25%, but that drops down to 0.10% if you hold £250,000 to £500,000 in funds. It falls to 0% if you hold £500,000 or more in funds. The platform charges £5 for share trading, though that drops down to £3.50 if you had 10 or more share deals the previous month. It charges £1.50 for fund transaction. It also offers a low-cost Dodl account, which has a lower platform fee but more limited investment options.

AJ Bell offers above-average educational opportunities for investors, with updated stock news, live webinars. As an extra, every AJ Bell investor receives full access to Shares magazine. Customer support also receives strong marks, with live chat, email and phone support available.

Pros

- Good educational resources, including access to Shares magazine

- Good customer support

- Wide choice of investment options

Cons

- Fees for buying and selling funds are high

- Lower-cost Dodl account is limited in scope

10. Bestinvest: Free financial advice, plenty of options

The platform offers the opportunity to invest in 19 ready-made portfolios, broken down by growth and income levels, level of risk, ESG (environmental, social and governance) criteria and cost. Its stocks and shares ISA also allows you to invest in 423 ETFs, 255 investment trusts, more than 1,600 funds and more than 1,300 stocks. The fees are mid-range compared to competitors.

Bestinvest is part of Evelyn Partners (once known as Tinley, Smith and Williamson), which has been involved in finance for more than 200 years. Platform fees are as much as 0.2% of an account. Trading in individual shares or ETFs is £4.95 per trade on UK shares and ETFs. While there’s no trading fee on US stocks, there is a 0.05% charge for the currency conversion. It does pay 4.45% interest on uninvested cash balances in your fund.

Its investment research includes guides on ISAs, pensions and investments, together with live webinars on investing topics. One of Bestinvest’s top features is the ability to speak for free to a qualified financial planner. It also offers more personalized investment advice for a flat fee of £295, but the planner won’t make the investments for you. That means you will still need to use the Bestinvest platform to follow that advice. For £495, the advisers will do a more involved health check of the investments in your account, but you will still have to make the investments yourself. Its customer service scores highly, with phone, email and chat services available six days a week.

Pros

- Access to free investment advice

- Generally good customer service

- It has 19 ready-made portfolios, broken down by growth and income levels, level of risk, ESG criteria and cost.

Cons

- Stock choices are limited

- Fees are higher than some platforms

An Individual Savings Account (ISA) is a tax-free savings account for UK tax residents. You can deposit savings into your ISA up to an annual allowance, currently set by UK law at £20,000 for the tax year ending April 5, 2025.

ISAs allows you to invest in a variety of assets, including:

- Individual stocks of companies

- Investment funds (collections of stocks or other investments)

- Bonds (loans you make to companies or governments)

Stocks and shares ISAs all offer the same tax benefits of sheltering your investments from capital gains tax and income tax. However, there can be some variation depending on the provider you choose:

Account Features: Investment options, fees and minimum investment amounts vary depending on the provider. Different providers may offer different account features, such as investment choices, trading platforms, fees, and minimum investment amounts.

Self-Directed vs Managed: Some Stocks and Shares ISAs allow you to manage your investments yourself (buying and selling individual stocks or funds). Others offer managed options where a fund manager makes investment decisions on your behalf for a fee.

Fund Platforms: Certain providers might be platforms that offer access to a wide range of investment funds. This can be a good option for those who prefer a diversified approach without picking individual stocks.

The biggest advantage of a stocks and shares ISAs is they allow you to grow your wealth, tax-free, avoiding taxes on dividends and capital gains.

The biggest disadvantage of stocks and shares ISAs are the limits they may place on investment choices, the amount you are allowed to invest each year (£20,000 for the tax year ending April 5, 2025). Stocks and shares ISAs are best suited for long-term investors. They aren’t designed for those who want to make a lot of moves and short-term investments.

Moving stocks into or out of a stocks and shares ISA is handled by your ISA provider.

Transferring In:

- Not all providers accept transfers: While all ISA providers are required to allow transfers out, not all will accept transfers in. Check with your new provider to confirm their policy.

- Full transfer for current year contributions: If you’re transferring investments you contributed during the current tax year, you’ll need to transfer the entire amount to the new ISA. You can then add any remaining allowance to your new ISA.

- Flexibility for previous years: For contributions from prior tax years, you have more freedom. You can transfer all or just a portion of the holdings.

Transferring Out:

- Relatively straightforward: Generally, transferring ISA holdings out is a simpler process. Your current provider should be able to guide you through the steps.

- Be aware of timelines: Transfers can take some time to complete, so plan ahead to avoid any disruption to your investment strategy.

- Consider tax implications: While ISAs themselves are tax-sheltered, there might be tax implications for transferring certain assets, like employee shares. It’s wise to consult with your ISA provider for clarification.

Methodology: How we made our picks

Not all platforms that provide stocks and shares ISAs will work for everyone. We focused on platforms that provide easy-to-use ways of investing in stocks and shares ISAs. The key items we looked for were investing options within the ISA, educational resources available through the platforms, costs associated with the ISA, including platform fees, trading fees, inactivity fees or withdrawal fees. We also looked at the interest various platforms pay on uninvested cash.