Investment apps have made investing more accessible, affordable for more and more people in the UK and elsewhere, and investing has become easier than ever before. This has led to a surge in interest in investing, particularly among younger generations.

The key benefit of the apps is that you are able to manage your investments from anywhere, from a phone or laptop, instead of having to call a broker or visit a physical broker’s office. The apps generally have lower fees than brokers and include, in many cases, commission-free trades while using intuitive features to make investing really straightforward.

The best investment apps in the UK are helping stimulate more investment, either through better educational offerings or with robo-advisor services that can automatically invest a person’s money based on their risk tolerance. We analysed 11 of the top-ranking investment apps in the UK.

The 11 top UK investment apps ranked

Breaking down the top best investment apps in the UK by ranking, based on multiple factors:

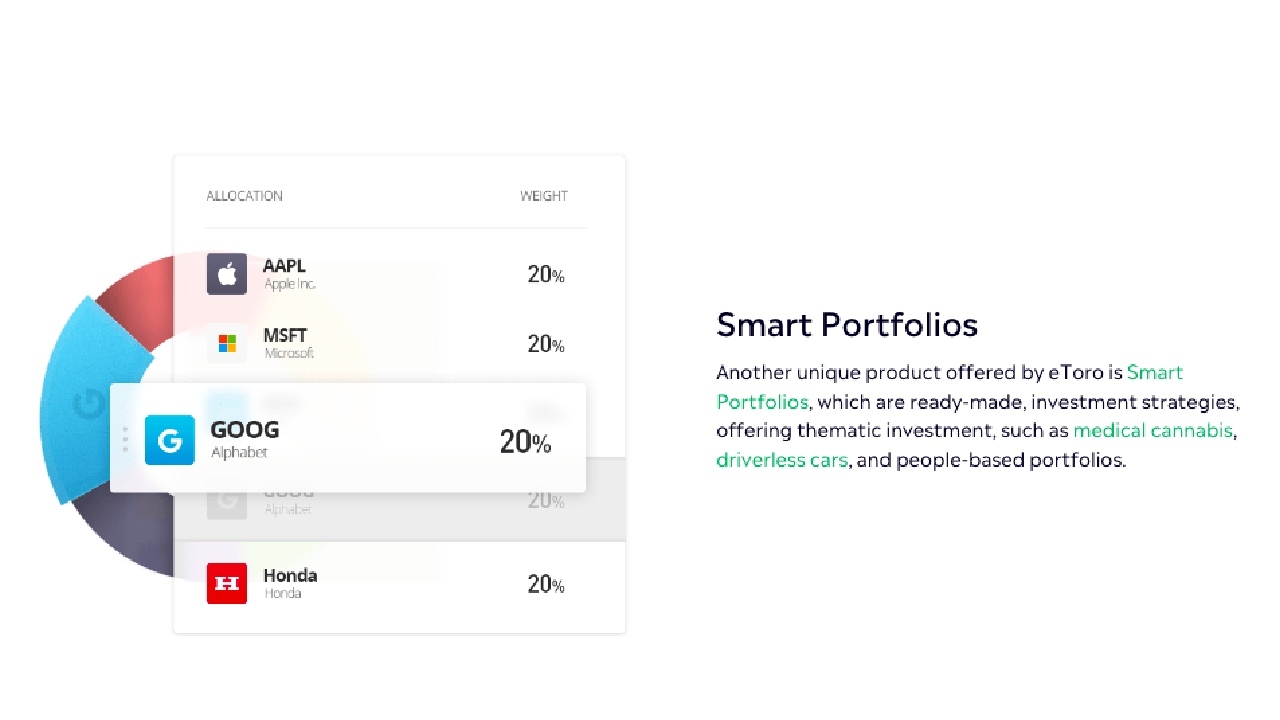

- eToro: A versatile app with thousands of stocks and ETFs. It also has a feature to create smart portfolios, which suits a passive investment style. It’s an investment app with a strong social aspect, including copy trading. The trading and multi-asset investment firm was founded in Israel in 2007.

- Revolut: The London-based global neobank and financial technology company began as an app-only overseas payments service but now it’s involved with investing and has more than 35 million customers worldwide.

- Saxo: Founded in 1992, the Danish company offers three different trading platforms from the simplified SaxoInvestor, to SaxoTraderGo and SaxoTraderPro. It provides access to more than 50 international markets.

- XTB: The platform is based in Warsaw, Poland, and has been around since 2002. It has more than 500,000 customers and offers more than 5,800 investment options, including more than 2,800 stocks. You can also trade commodities, indices and ETFs with XTB.

- Interactive Investor: Its flat platform fee is particularly attractive to larger investors. It has more than 40,000 investments to choose from. The Leeds, England-based company also pays interest on uninvested cash balances on investment accounts, including individual savings accounts (ISAs) and Self-Invested Personal Pensions (SIPPs).

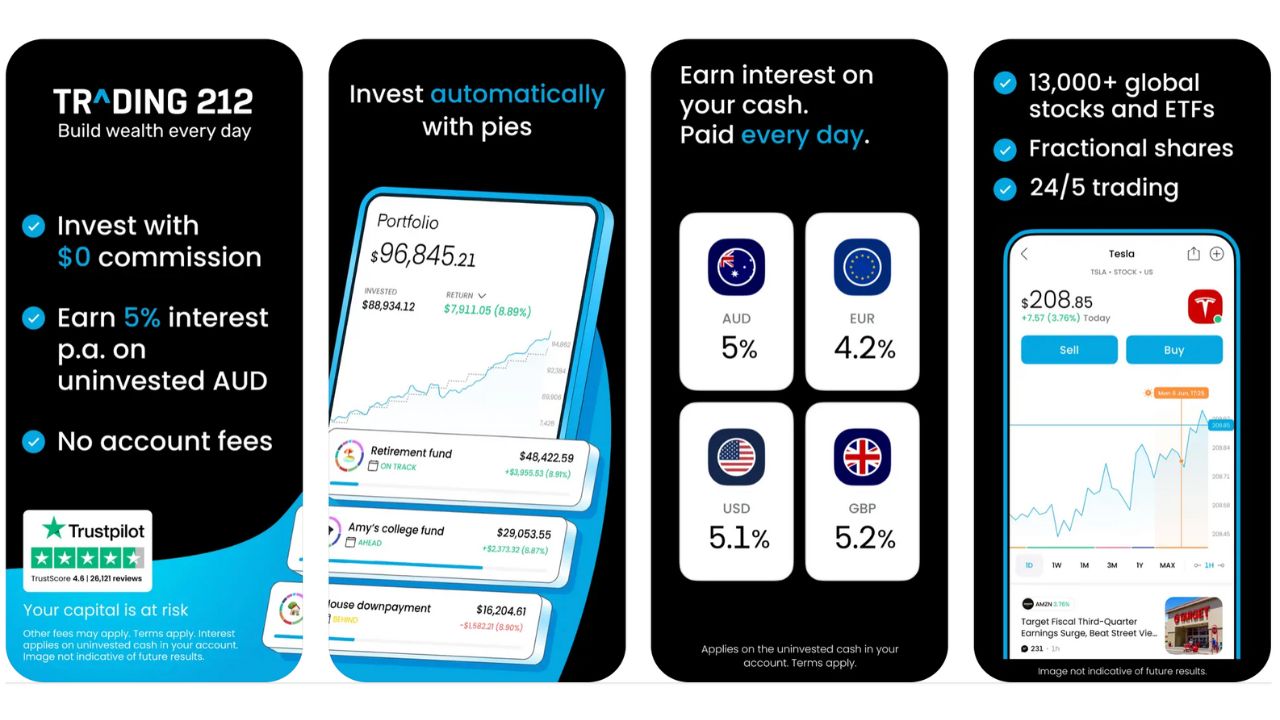

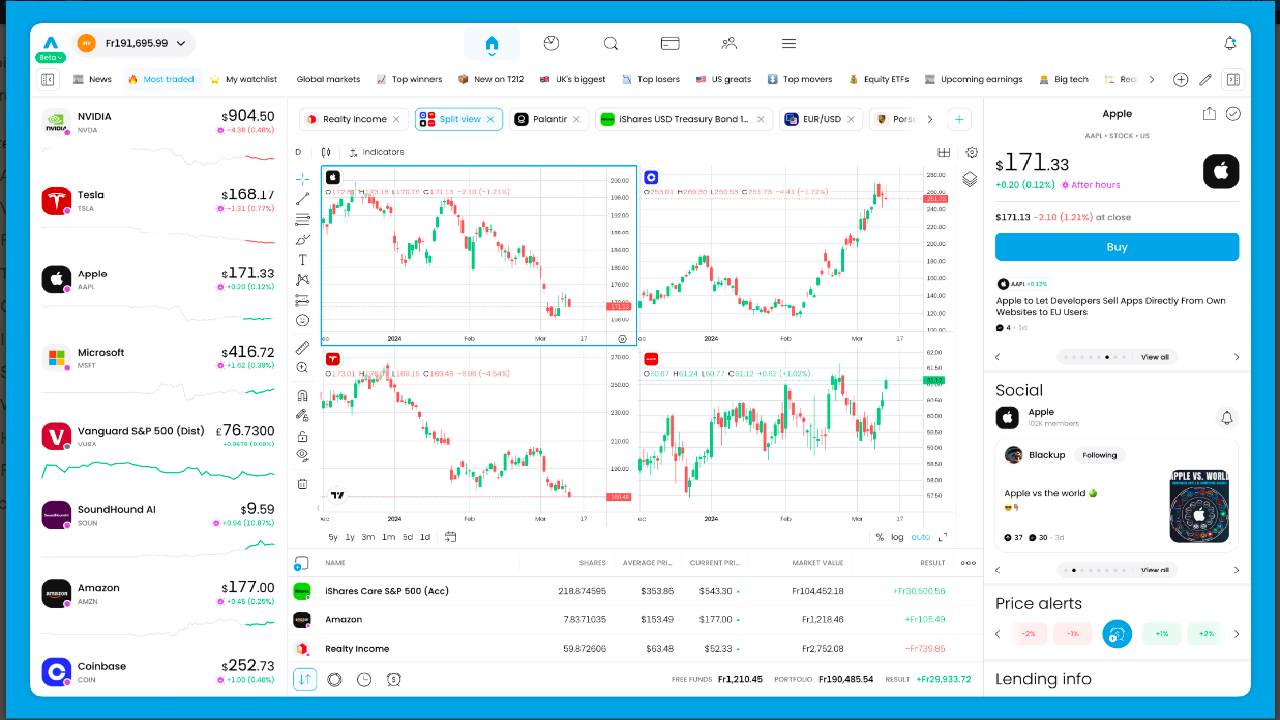

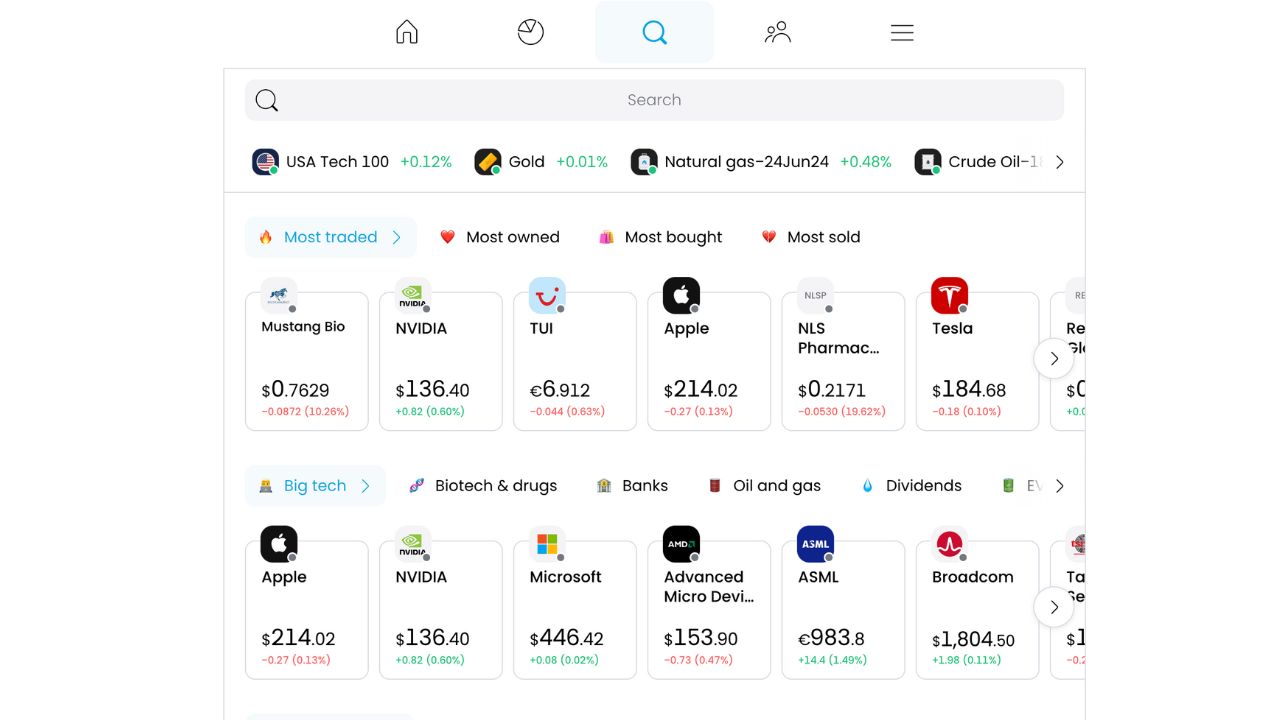

- Trading 212: The London-based platform focuses on inexpensive investing with 12,000 global stocks and ETFs offered. Its app has more than 15 million downloads and includes robo-investing options.

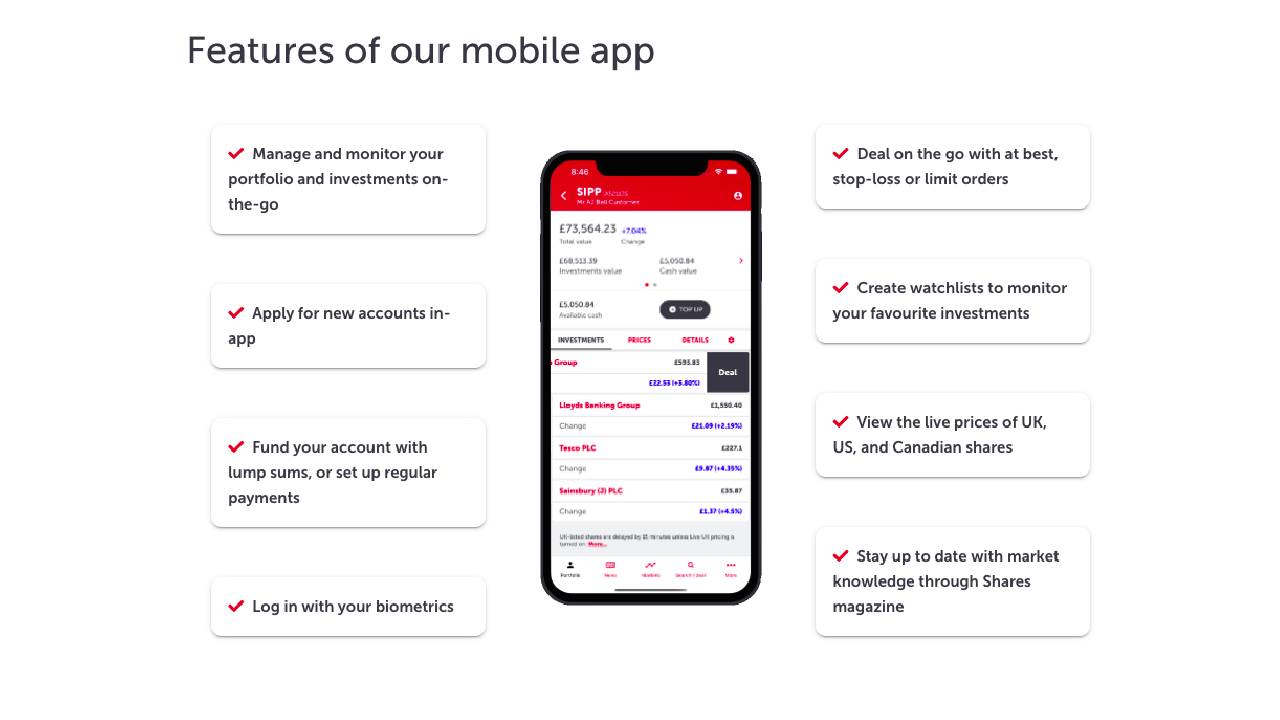

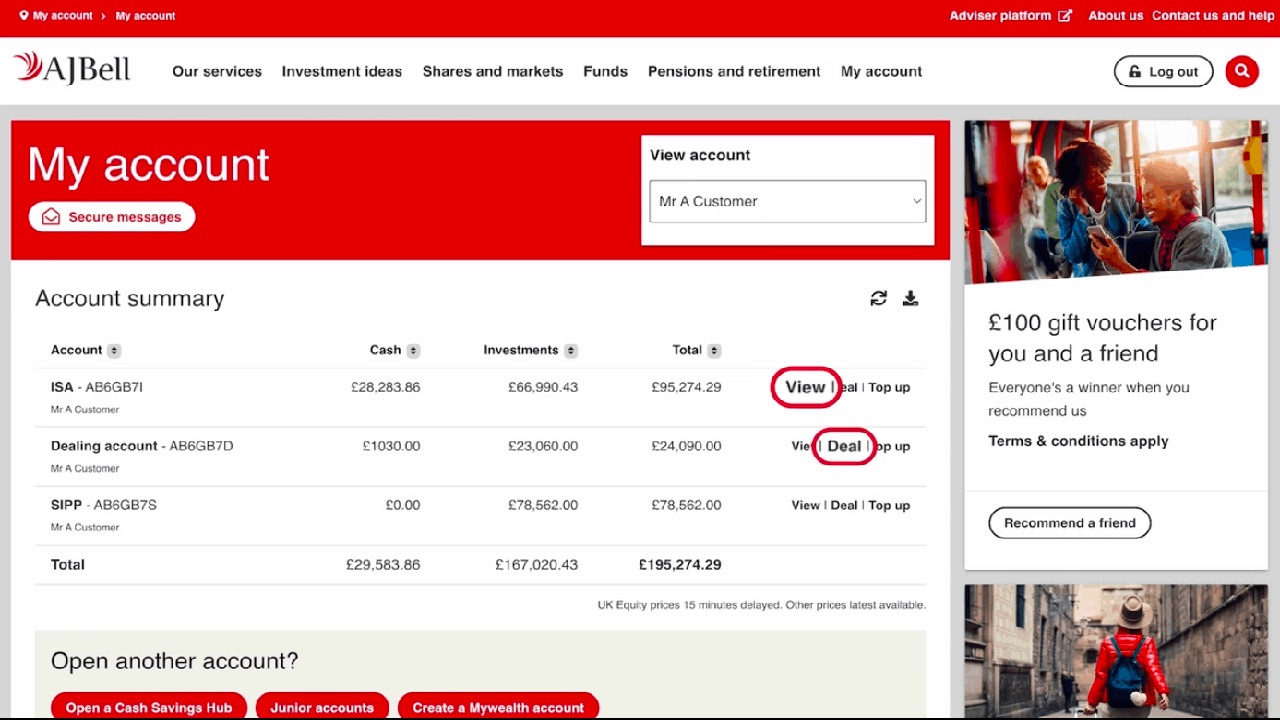

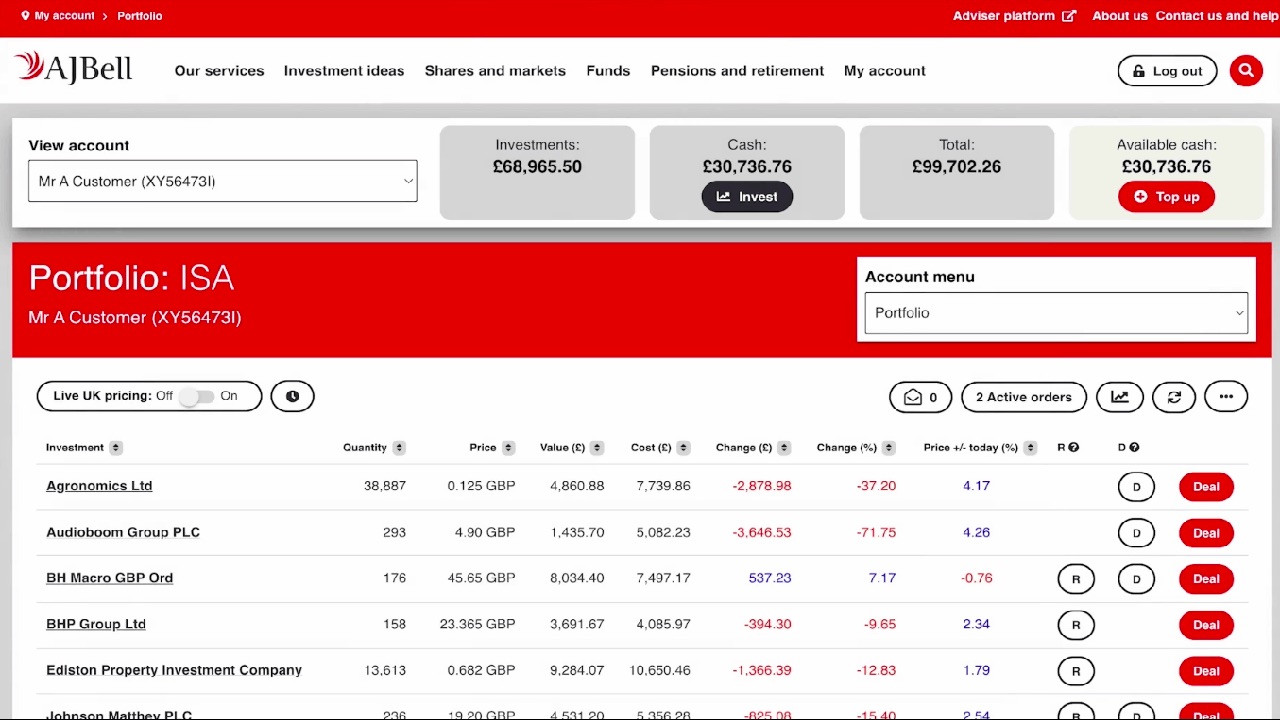

- AJ Bell: Established in 1995, the Manchester, England-based platform is one of the largest in the UK. It’s also a FTSE 250 company and has more than 490,000 clients. It operates in the advised and direct-to-consumer (D2C) market segments.

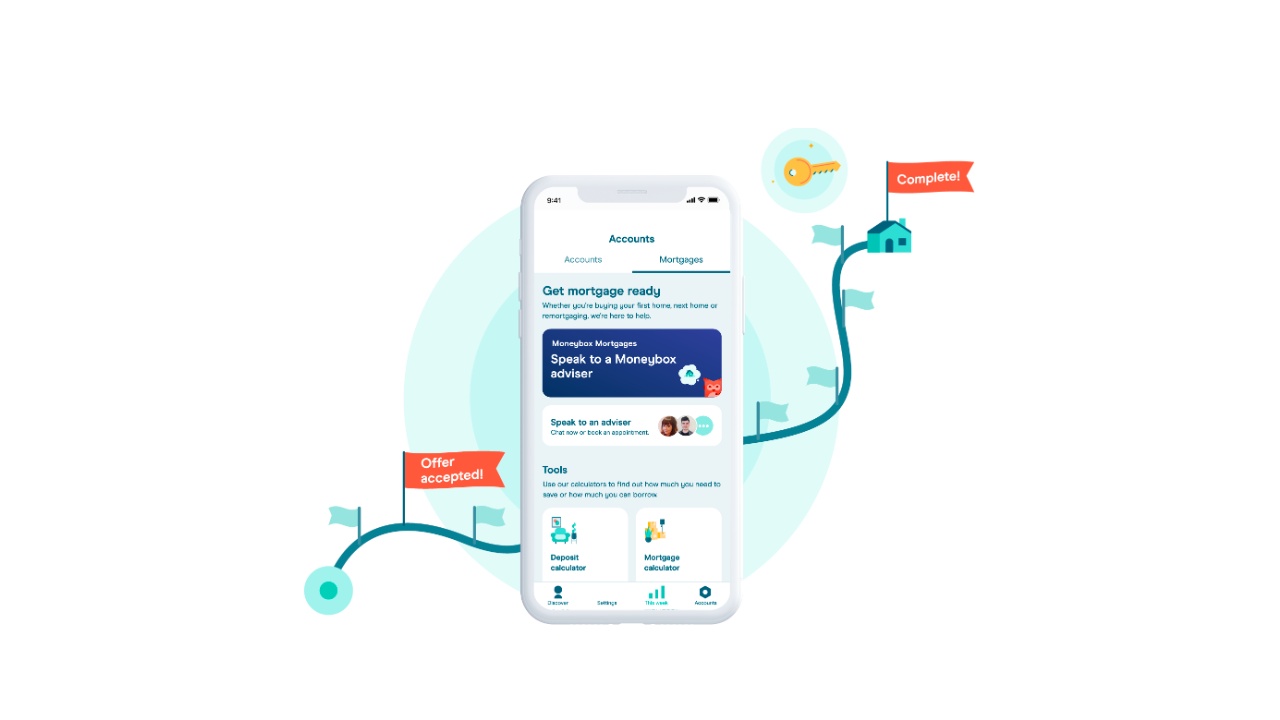

- Moneybox: The London-based savings and investment app, founded in 2015, has more than 1 million users. It has a roundup feature in its credit card designed to boost investments in markets. Basically, if you spend £2.85 on coffee, the app will round up the purchase to £3, putting the extra 15p into the stock market. Over time, that adds up.

- IG: The platform, based in London, was founded in 1974 and has more than 300,000 clients. It’s listed on the London Stock Exchange and is part of the mid-cap FTSE 250 index.

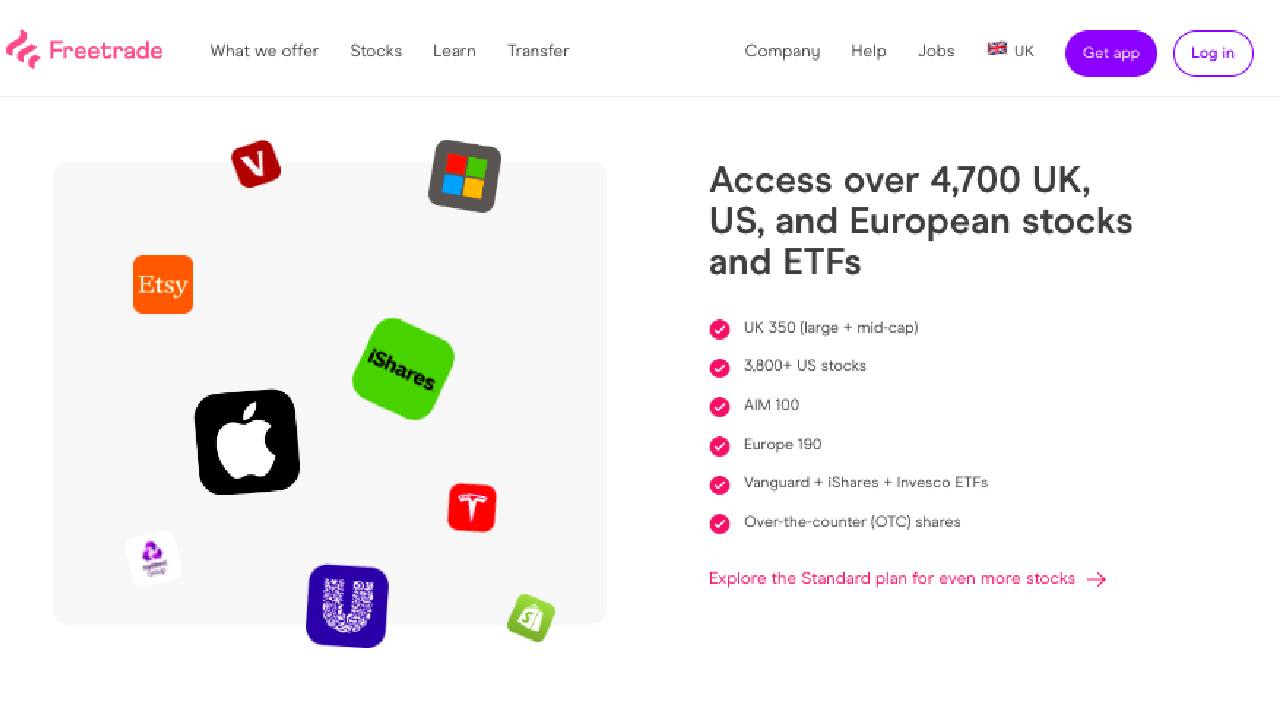

- Freetrade: Founded in 2016 in London, the low-cost investment and trading app has more than 1.4 million users. Its straightforward pricing plans, which include no markup on the spread or commission fees, are popular with investors.

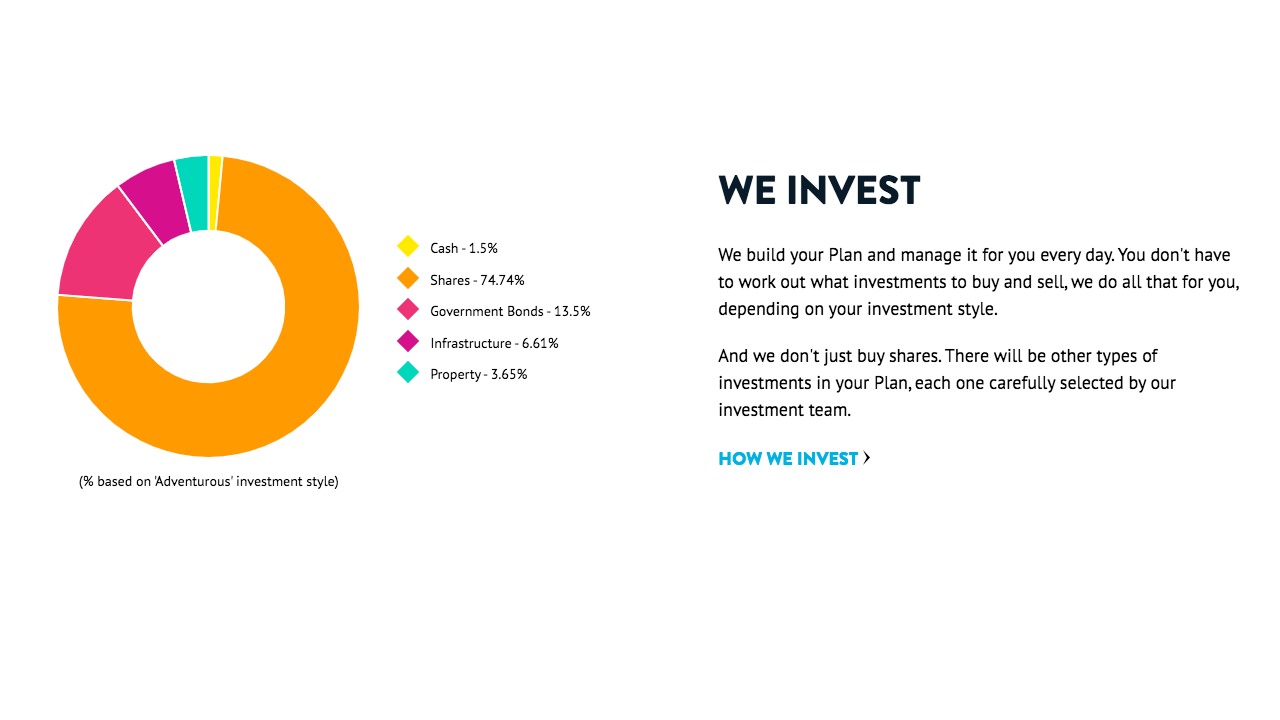

- Wealthify: The Wales-based robo-advisor platform is owned by Aviva, one of the UK’s largest financial institutions. It offers ready-made investments designed to connect customers to portfolios that best align with their risk appetites and investment preferences, including the option to make ethical investments.

-

- 1. eToro: Best investment app for social trading

- Pros

- Cons

- 2. Revolut: Good app for inexperienced investors

- Pros

- Cons

- 3. Saxo: Best investment app for wide choice of accounts

- Pros

- Cons

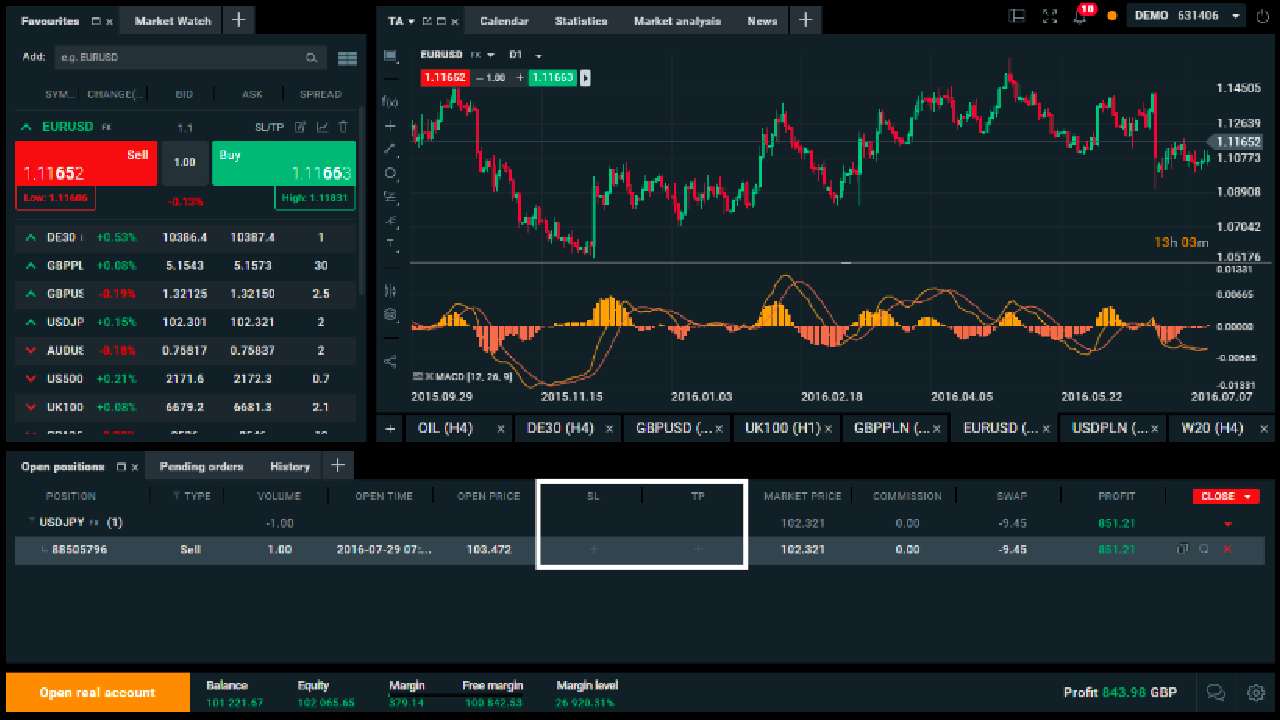

- 4. XTB: Solid app for experienced, active investors

- Pros

- Cons

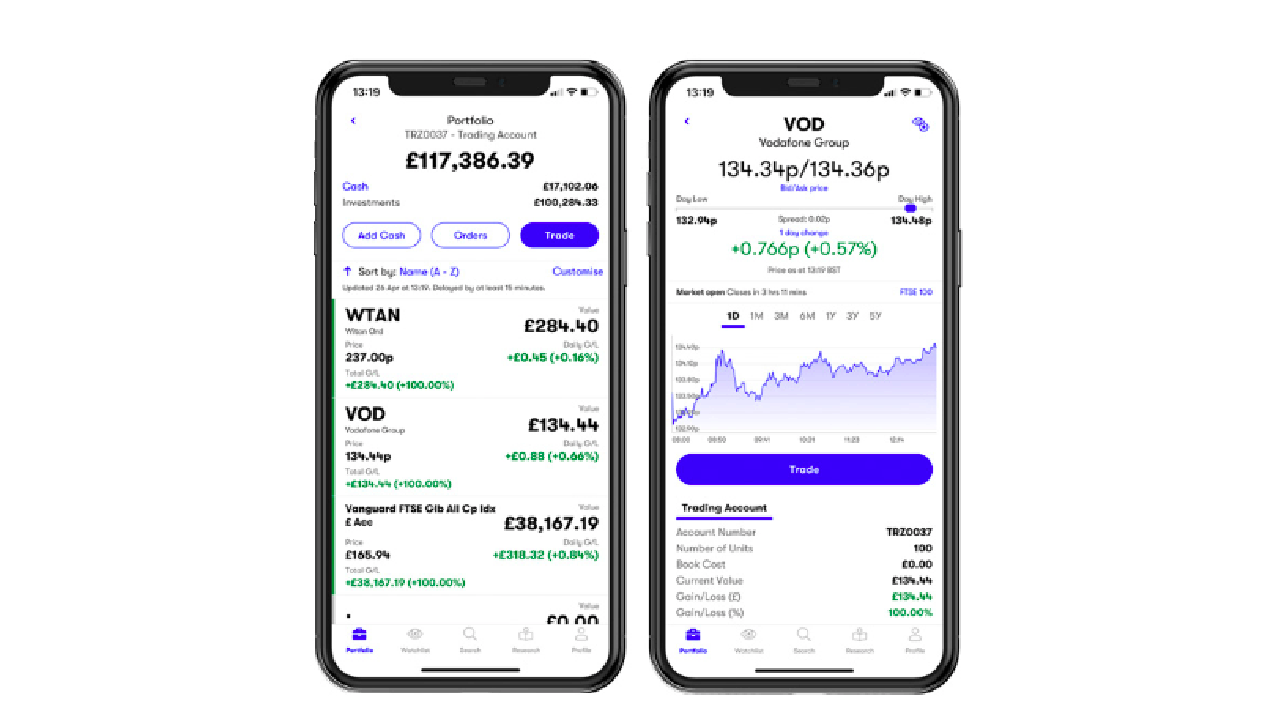

- 5. Interactive Investor: Top investment app for transparency

- Pros

- Cons

- 6. Trading 212: Best interest rates for uninvested cash balances

- Pros

- Cons

- 7. AJ Bell: Best investment app for financial advice

- Pros

- Cons

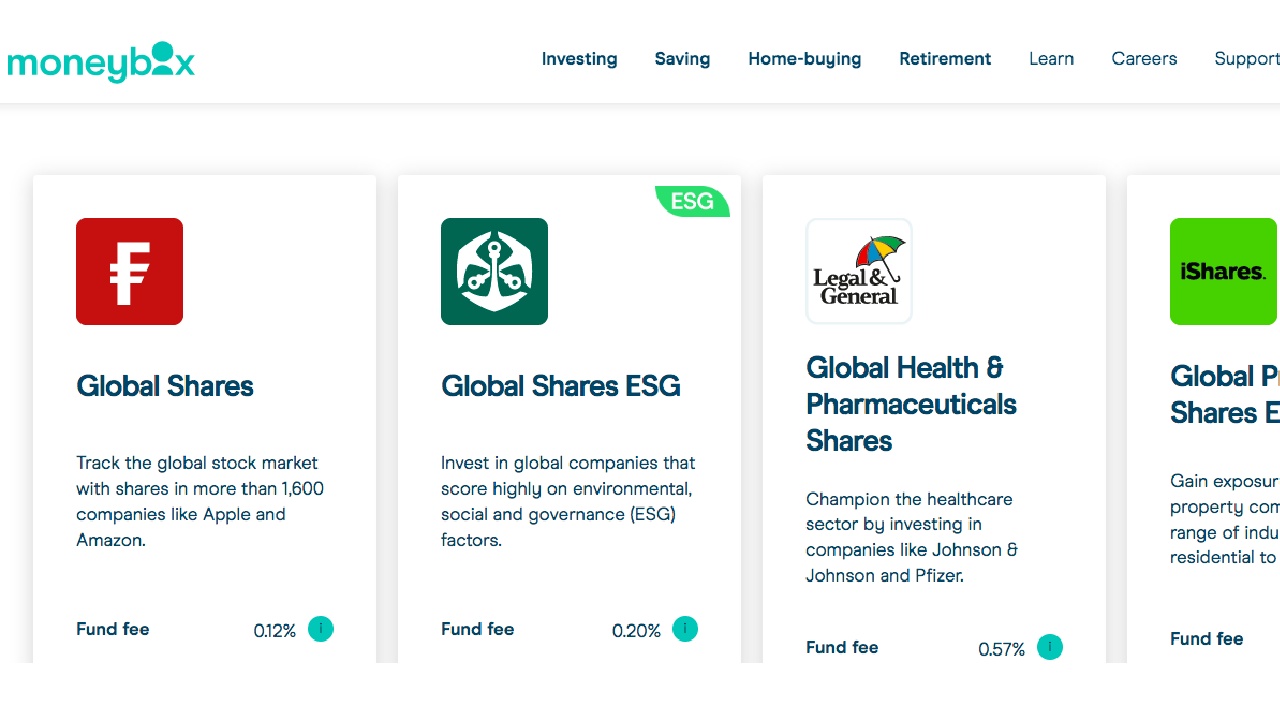

- 8. Moneybox: Best investment app for beginner investors

- Pros

- Cons

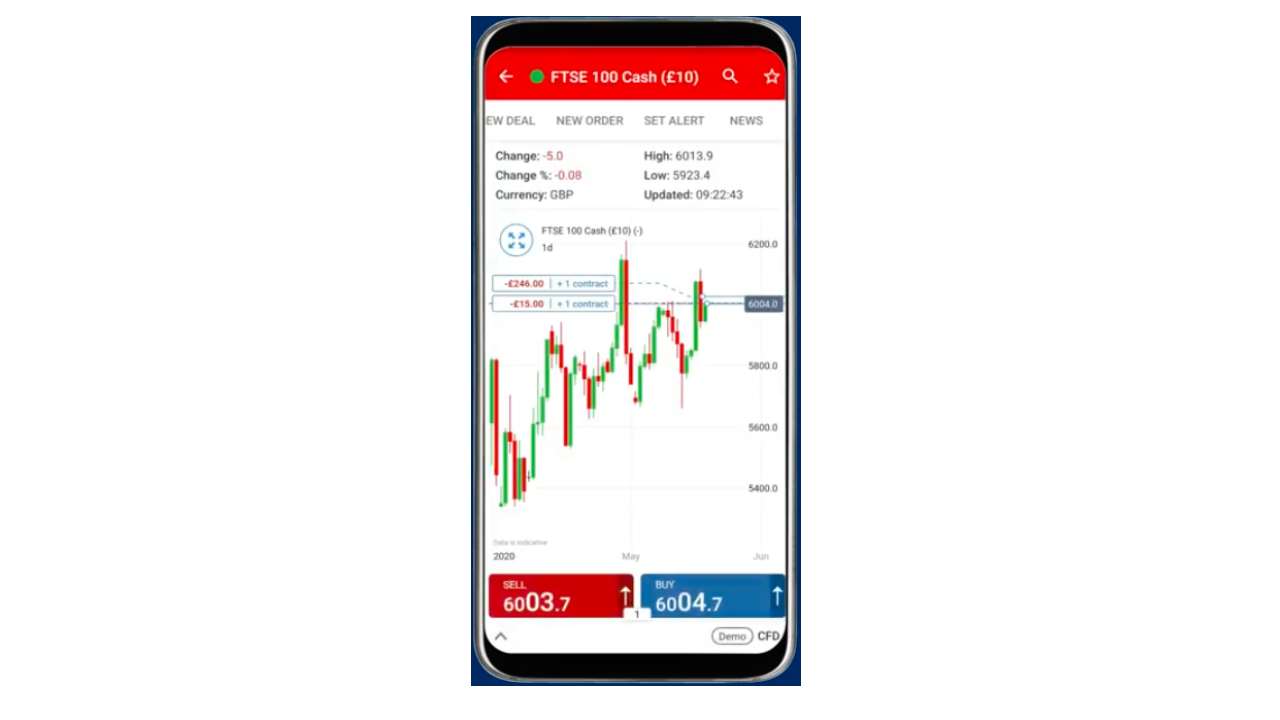

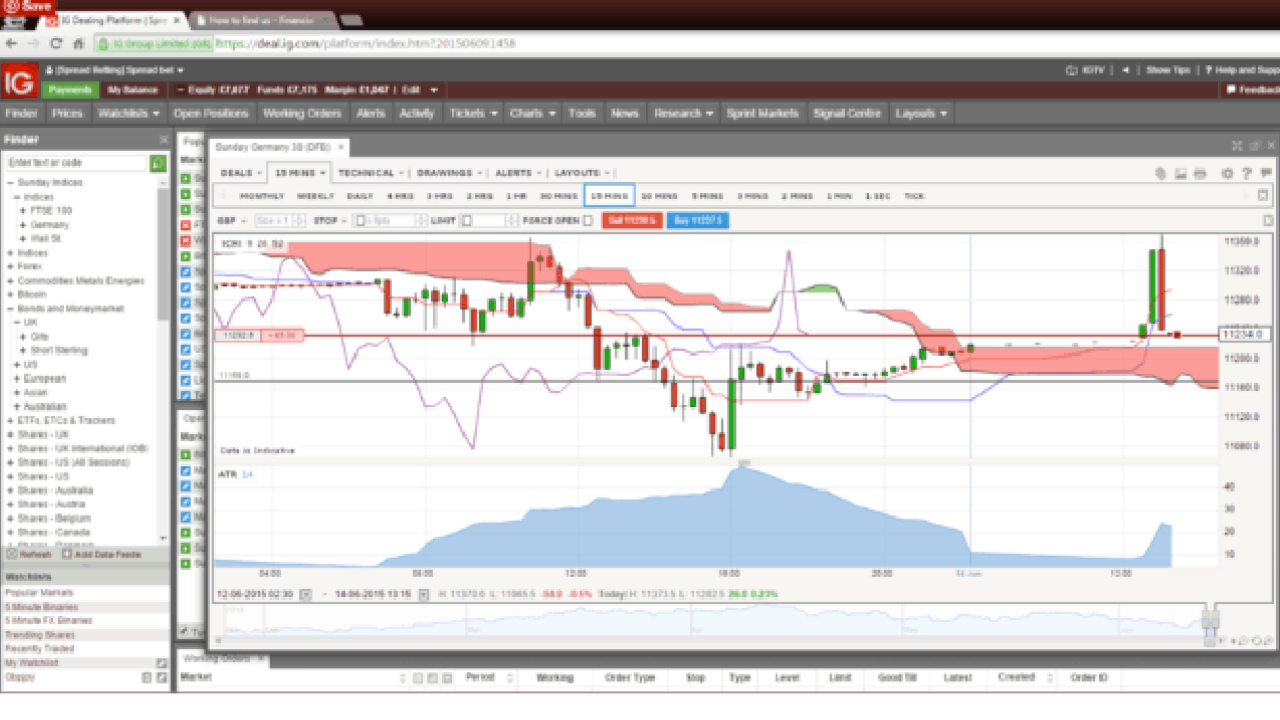

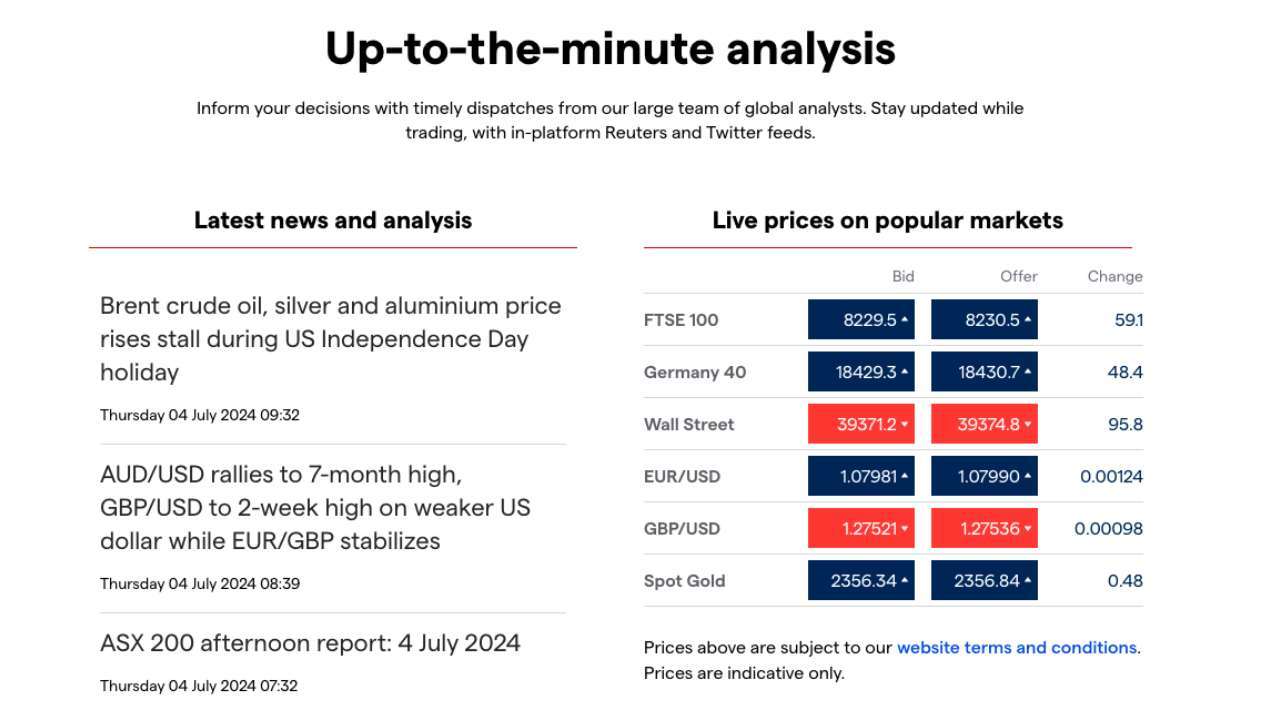

- 9. IG: Plenty of investment options, technical tools

- Pros

- Cons

- 10. Freetrade: Investment app with lots of options for intermediate investors

- Pros

- Cons

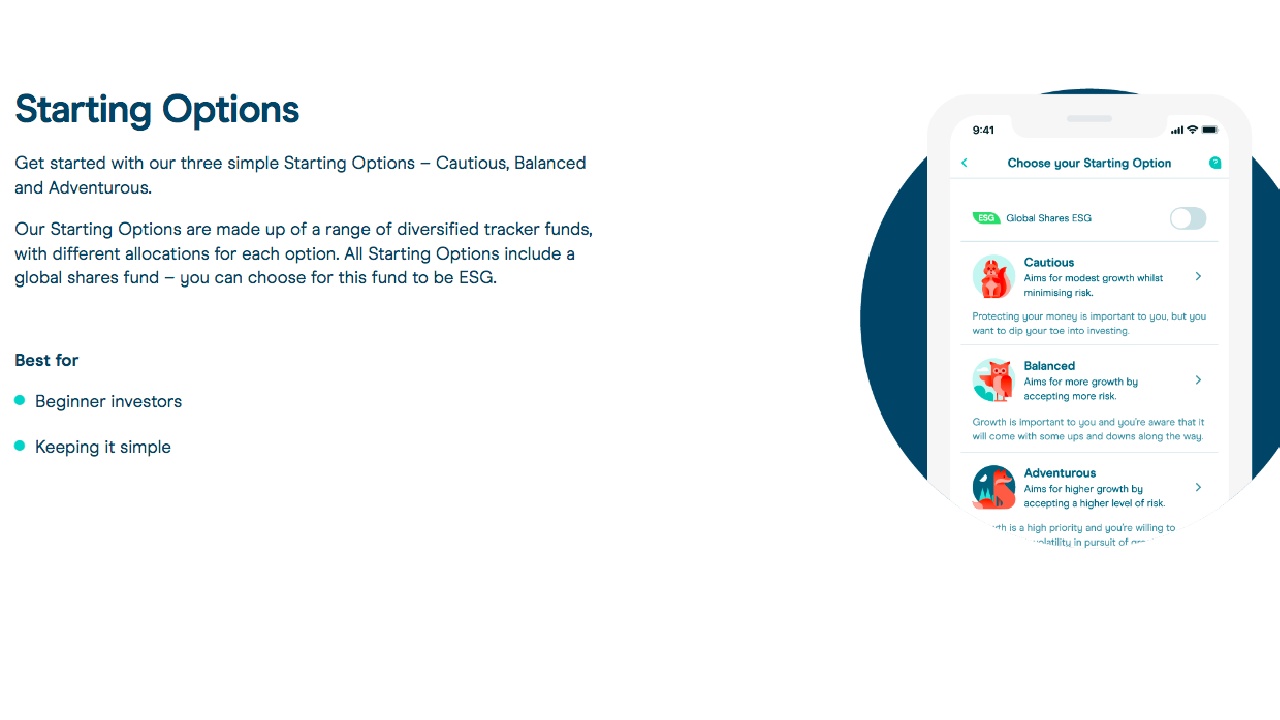

- 11. Wealthify: App focuses on keeping investing simple

- Pros

- Cons

-

- 1. eToro: Best investment app for social trading

- Pros

- Cons

- 2. Revolut: Good app for inexperienced investors

- Pros

- Cons

- 3. Saxo: Best investment app for wide choice of accounts

- Pros

- Cons

- 4. XTB: Solid app for experienced, active investors

- Pros

- Cons

- 5. Interactive Investor: Top investment app for transparency

- Pros

- Cons

- 6. Trading 212: Best interest rates for uninvested cash balances

- Pros

- Cons

- 7. AJ Bell: Best investment app for financial advice

- Pros

- Cons

- 8. Moneybox: Best investment app for beginner investors

- Pros

- Cons

- 9. IG: Plenty of investment options, technical tools

- Pros

- Cons

- 10. Freetrade: Investment app with lots of options for intermediate investors

- Pros

- Cons

- 11. Wealthify: App focuses on keeping investing simple

- Pros

- Cons

- Show Full Guide

An in-depth look at the best investment apps UK

Take a more detailed look at why we picked each of the best investment apps in the UK, along with their pros and cons. Explore whether they are suited for your investment priorities:

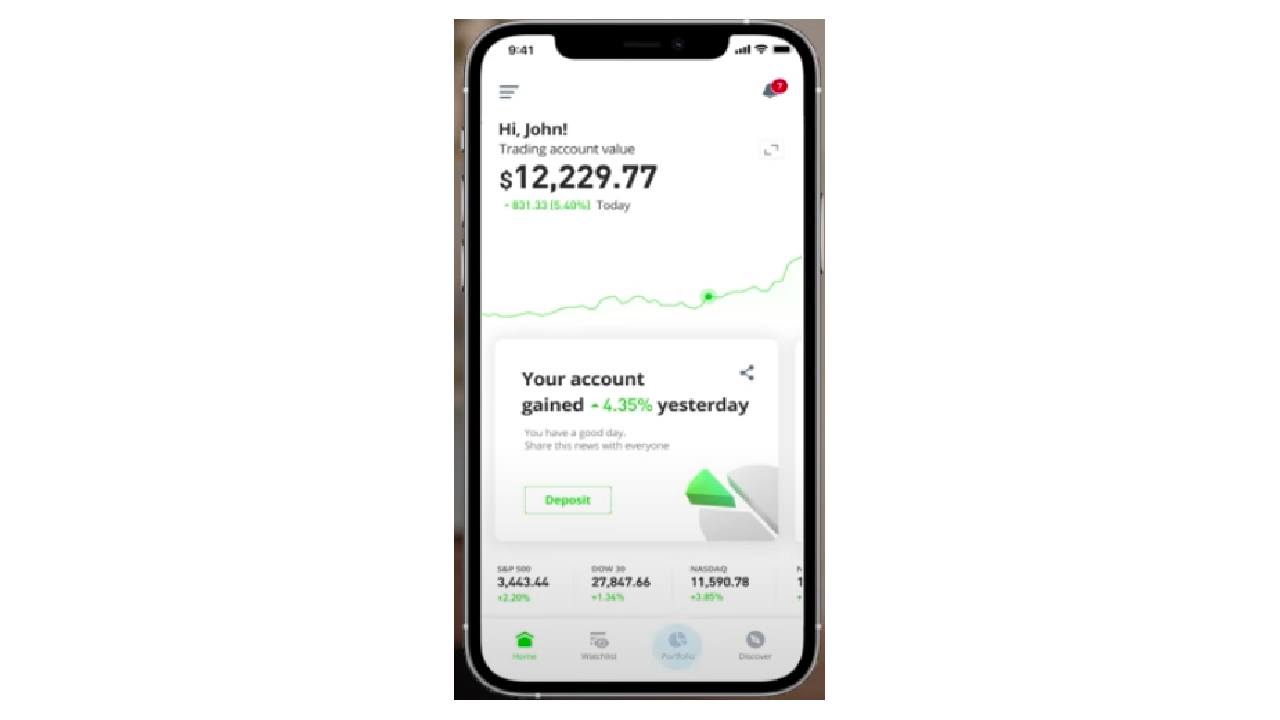

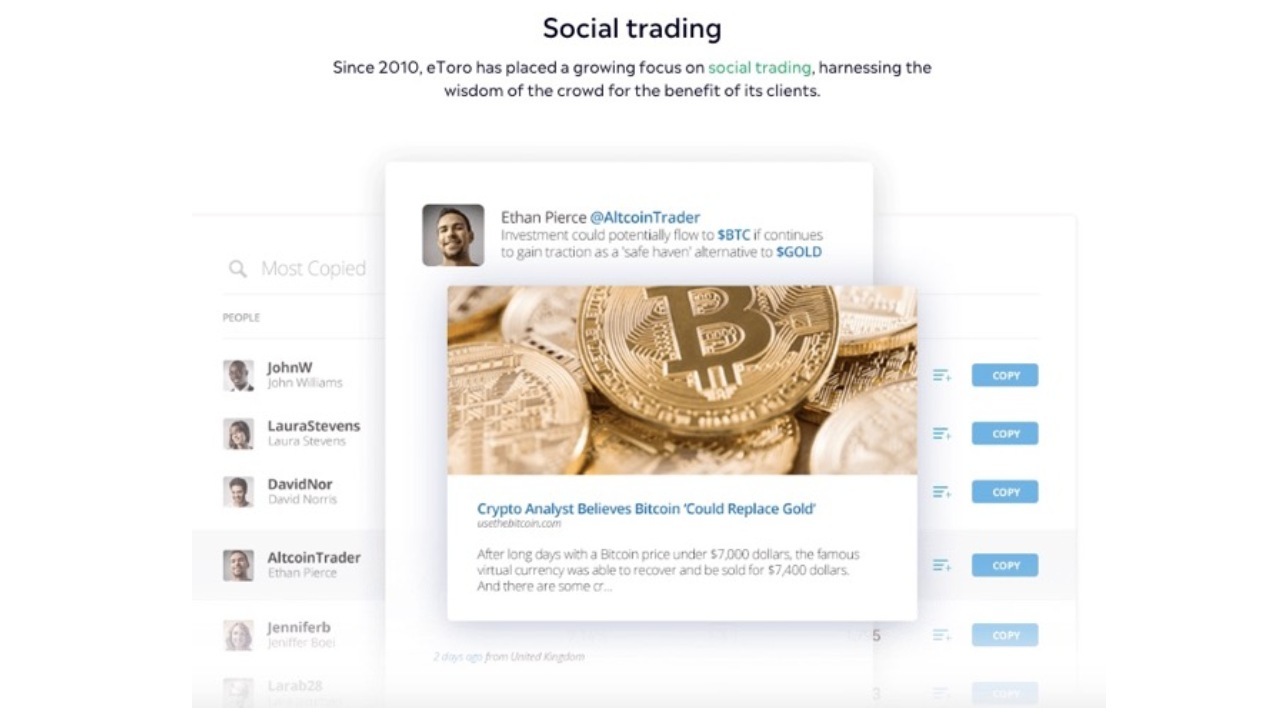

eToro’s user-friendly platform is designed with social trading in mind. Users can connect with other investors and traders, exchange ideas, and share experiences, which speeds up the learning process.

It’s a good app for beginner investors because of the depth of its educational content, including beginner videos, news articles, and a demo account with a virtual $100,000 to practise trading with. One of eToro’s most popular features is the ability to copy the tried and tested trades of successful investors, which is another form of social trading.

The app offers a wide range of assets to invest in, including more than 3,000 stocks, as well as a range of ETFs. UK investors need to first deposit $100, and the minimum deposit that applies after that drops to $10. They can then buy and sell assets without any commission charged. As eToro operates in US dollars, there will be a small currency conversion charge for UK-based investors. The initial deposit for smart portfolios, compiled by eToro analysts, is $500.

eToro’s ETF and stock selection, though, is more limited than that of other apps. EToro has other features, including the ability to buy fractional shares, invest in crypto and CFDs. The fast-growing app has more than 35.5 million users and $9.5 billion in AUM.

Pros

- Ability to do copy trades of successful investors

- $100,000 virtual account for practice trading

- More than 30 cryptocurrencies available to trade

Cons

- Limited customer service

- CFDs are high-risk investments

- High charges on the spread and a $5 withdrawal fee

Your capital is at risk. Other fees apply.

2. Revolut: Good app for inexperienced investors

Revolut has more than 40 million users and just launched a separate platform, Revolut X, exclusively for crypto trading that includes more than 100 tokens. Its app is intuitive and also enables investors to trade in fractional shares, which makes it popular with investors that are just starting out.

The company allows trading in stocks, cryptocurrencies, and commodities and recently added ETFs. However, compared to some other apps, its investment options are limited. Its fees are relatively low for beginning investors, and it has a number of plans, from standard to ultra to choose from, depending on an investor’s priorities.

Pros

- Ability to do trade in fractional shares

- Intuitive app is easy to use

- Low costs on trades

Cons

- Limited customer service

- No mutual funds, bonds or options

- Limited educational resources

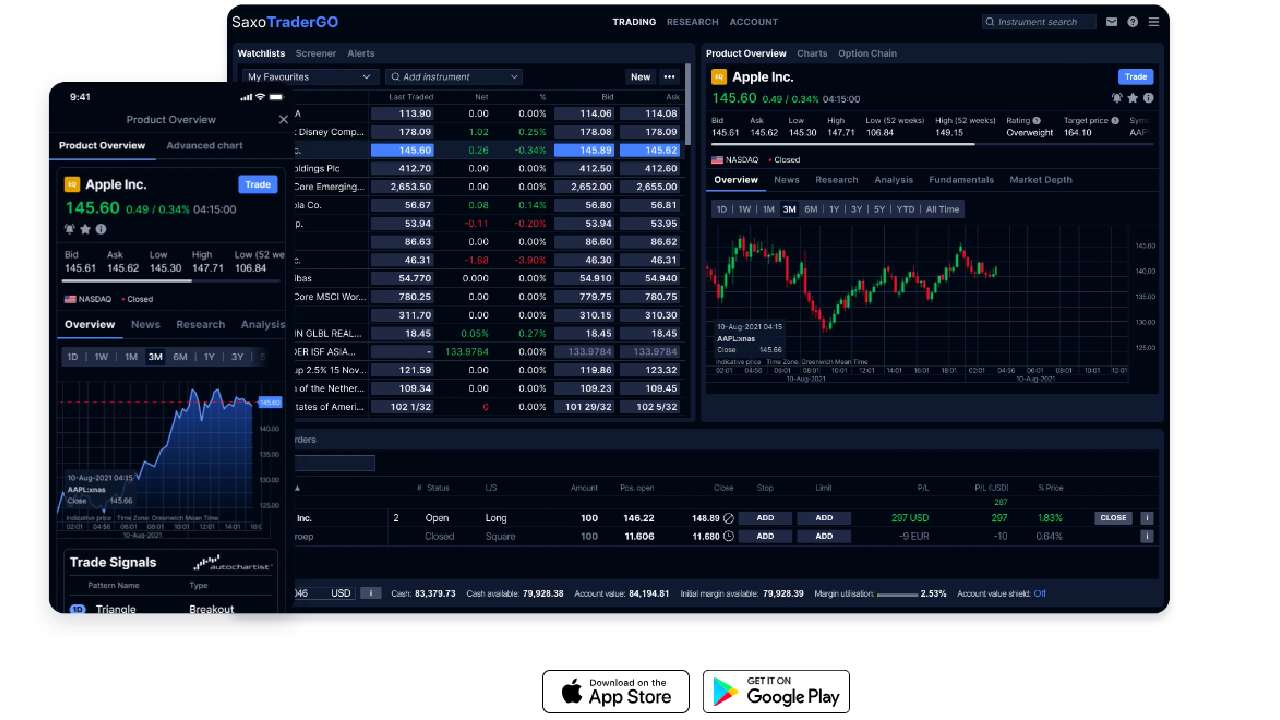

3. Saxo: Best investment app for wide choice of accounts

We selected Saxo as the best investment app for its versatile account range that are each tailored to the needs of investors at varying levels of expertise. The Danish company is one of the pioneers in online trading platforms, having launched its investment offering in 1998. The investment firm, which provides more than 70,000 investment options, has grown to more than $1 million customers and has more than €100 billion in assets under management (AUM).

Some of the positive aspects of the app is its scope, with options to trade on more than 50 international markets, allowing trades in stocks, options, crypto, and forex. It isn’t the least expensive app in terms of fees, but it’s structured in a way that the more you trade, the less you pay per trade, making it a good choice for more active investors.

Saxo offers three different types of accounts, ranging from the beginner-friendly SaxoInvestor, to the higher level SaxoTraderGo and SaxoTraderPro accounts. On the negative side, despite its connection to a bank, it doesn’t offer a savings account as part of the investment app and you can’t buy fractional shares yet on the app.

Pros

- Plenty of investment options

- Good app for active traders

- Three different account types

Cons

- No trading in fractional shares

- No savings account offering

- Relatively high charges on transactions

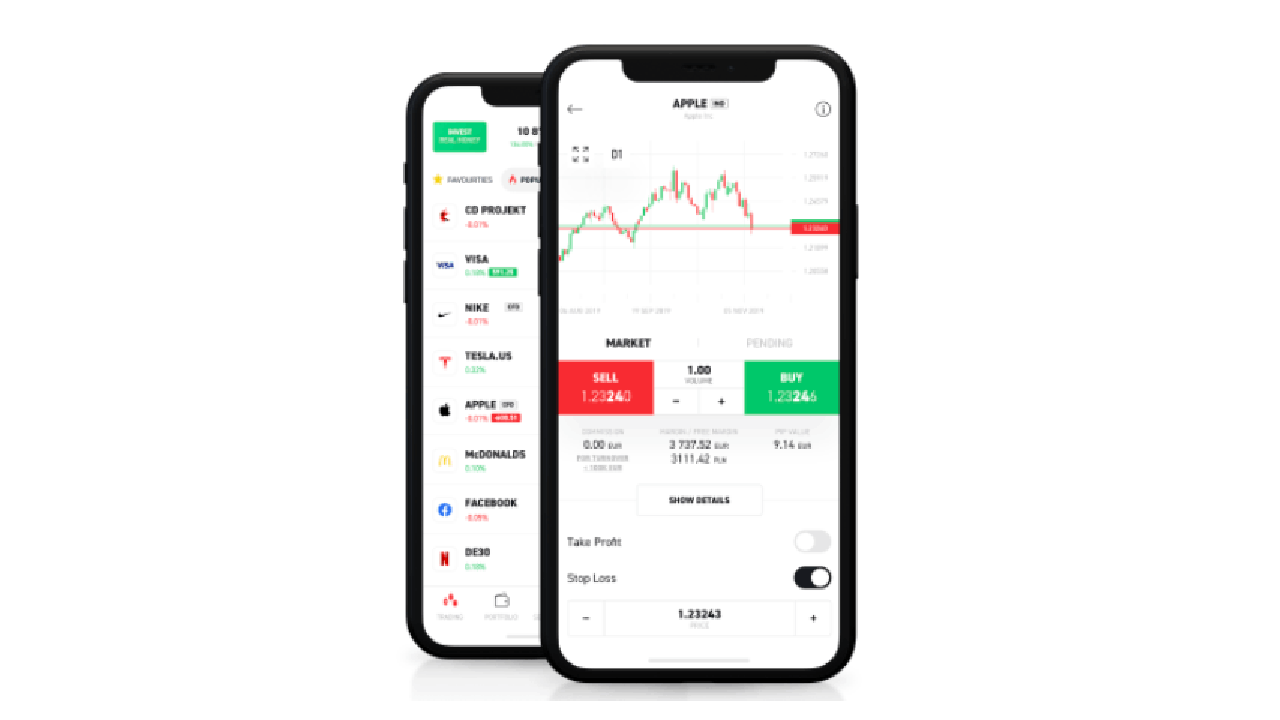

4. XTB: Solid app for experienced, active investors

The platform is a hybrid that can appeal both to beginners and more experienced investors. Its easy-to-use platform and commission-free trading appeals to both types of investors. It also allows trading in stocks, ETFs, commodities and cryptocurrencies through CFDs.

It also has good customer support and educational resources to appeal to inexperienced investors. Much of its focus, though, is on CFDs, which are risky for beginners. It also isn’t a good set-it and forget-it investor as there’s an inactivity fee if there’s no trading for 12 months. Investors who aren’t as active also pay more fees when they do trade.

Pros

- Low fee trading

- Good customer support

- Platform is easy to use

Cons

- Not as good for investors who don’t trade frequently

- Limited product range

- No demo account

Disclosure: 77% of retail investor accounts lose money when trading CFDs with this provider.

5. Interactive Investor: Top investment app for transparency

Interactive Investor’s flat fees make it popular with more active investors for the transparency of its pricing. We also liked that it offers more than 40,000 investment options, including more than 3,000 funds and more than 1,000 exchange-traded funds (ETFs), as well as model investment portfolios. It does not allow trading in forex, fractional shares, or cryptocurrency or foreign exchange, though.

One of the platform’s best features is it pays interest on uninvested cash balances on trading accounts, individual savings accounts (ISAs) and self-invested personal pensions (SIPPs). It also has a consistently updated education and news section to help investors.

While there are few unpleasant fee surprises, paying £3.99 per trade is more expensive than many other apps, though Interactive’s Investor and Super Investor plans give one and two free trades each month, respectively.

Pros

- It pays interest on account balances

- Solid educational and news resources

- Plenty of investment options

Cons

- High cost per trade

- No fractional share trading

- No forex or crypto options

6. Trading 212: Best interest rates for uninvested cash balances

Like Interactive Investor, Trading 212 will pay interest on uninvested cash balances in trading accounts and in the UK, the interest is currently an annual rate of 5.2%, topping its competitor.

The app includes more than 10,000 investment options in stocks and ETFs and has been downloaded more than 15 million times. It doesn’t offer mutual funds, but unlike some online apps, Trading 212 allows fractional trades. The app also offers robo-investing in ready-made pies depending on your level of risk.

Another key feature is users can get up to £40,000 in virtual currency to practise trading. The app says it has more than £3.5 billion AUM. It’s a good app for beginner investors because it gets high marks for its intuitiveness and ease-of-use. On the downside, its education section is very basic and limited and its fees for forex trading are relatively high.

Pros

- Interest paid on uninvested balances

- App is easy to use

- Plenty of investment options

Cons

- Educational resources are lacking

- High charges on forex trading

- Limited charging features

7. AJ Bell: Best investment app for financial advice

AJ Bell has more than £102 billion in AUM. It also has more than 484,000 customers, more than twice as many it had just six years ago. The breakdown of its customers is roughly 161,000 advised customers and 323,000 direct-to-consumer customers. It offers more than 20,000 investment options, including shares, funds, ETFs and investment trusts,

The company is known for its high level of customer service and its array of educational and research options for investors and ready-made portfolio options. It’s ranked high by consumers. It has relatively high trading fees and charges for buying and selling funds.

It may be more suitable for investors with smaller portfolios because of its percentage-based fees. It also has a low-cost Dodl account, with an app-only platform. It doesn’t charge for trades but its investment options are limited and it does have an annual management fee of 0.15%. The company pays interest on uninvested cash.

Pros

- Dodl account is a low-cost option

- Interest is paid on uninvested balances

- Solid customer service

Cons

- No forex, options, futures or CFD options

- Relatively high trading fees

- Not as suitable for frequent traders

8. Moneybox: Best investment app for beginner investors

The app is striking a chord with beginning investors and the company has been named to Deloitte’s UK Technology Fast 50 for four consecutive years. It has more than 1 million customers and more than £5 in AUM.

Moneybox’s 0.45% platform fee isn’t ideal for investors with larger portfolios. The app focuses on stocks, ISAs, but lacks advanced features and research tools that more experienced traders may want. It also provides a smaller range of investments compared to some other platforms.

Moneybox’s platform is made for beginners, thanks to an easy-to-use interface and the ability to do robo-investing, perfect for investors who are not comfortable doing stock picking. The ability to trade with zero commission and a small £1 monthly subscription fee is a plus.

Pros

- Easy-to-use interface is good for beginners

- Robo-investing option

- Relatively low fees

Cons

- Lacks advanced features

- Platform percentage fee is high for accounts with more money

- Not as suitable for frequent traders

9. IG: Plenty of investment options, technical tools

The company has been involved in trading since 1974 and allows investors to trade more than 97 currencies and over 19,000 stocks. Investors can also trade ETFs, options and CFDs. It’s a good platform for experienced investors, with advanced charting, research and analysis.

IG’s biggest downside is the cost, particularly for frequent traders. It costs UK investors £8 per trade, though that drops down to £3 per trade if you trade more than three times a month. Its platform is a little complicated for beginner traders.

Pros

- Good educational resources

- Plenty of investment options

- Solid customer service

Cons

- Can be expensive for frequent traders

- Platform may be too complicated for some investors

10. Freetrade: Investment app with lots of options for intermediate investors

The fast-growing app has £1.3 billion in AUM and more than 1.4 million users only eight years after it began operations. It’s a good platform for intermediate investors who are looking for commission-free trading in stocks and ETFs, but not cryptocurrency.

Freetrade has several different pricing plans on what it calls its freemium setup, ranging from £0 in the basic plan, which allows one free trade a month, to the £11.99 a month that includes a SIPP, preferred customer service and up to 5% annual interest on up to £3,000 in uninvested cash.

While it offers fractional trading of shares and more than 6,200 stocks, it doesn’t have as many automated features as some other apps, and no robo-investing option, so it may be more difficult to navigate its site than other apps. It also has limited customer support for the most basic plan.

Pros

- Several different pricing plans

- Good app for intermediate investors

Cons

- Basic plan has limited customer support

- App is not that intuitive

11. Wealthify: App focuses on keeping investing simple

It’s a good platform for set-it and forget-it type investors. It has a robo-advisor platform that allows beginner investors to design a diversified portfolio based on specific risk tolerance levels, from cautious to adventurous. It only costs £1 to begin investing with the app, but it has limited investment options and research and educational resources compared to other platforms.

Because the fee structure is based on how much is in your holdings, it isn’t as desirable to those with larger portfolios. The platform does get high marks for customer support, with live chat service and telephone support.

Pros

- Good customer support

- Robo-advisor platform is available

- Low-cost entry point

Cons

- Could be expensive for those with larger portfolios

- Limited investment options

Top-rated stock trading apps, at a glance

Here’s a quick overview of these 11 investment apps with a summary of their main features and costs:

| Platform | Minimum investment to start account | Account management fees | Investment fund fees | FSCS protection | Trustpilot reviews |

| eToro | First deposit of $100; $10 thereafter | None, but there is a $10 monthly fee if an account has been inactive for more than 12 months | Trading fees vary and are built into the spread | Yes | 4.2 out of 5 stars (23,542 reviews) |

| Revolut | No minimum | 0.12% of total asset value annually | None | No | 4.1 out of 5 stars (153,773 reviews) |

| Saxo | £0 | Custody fee of between 0.15% and 0.9%, depending on the amount in the account | Free for fund trades, but £3 per share trade | Yes | 4.7 out of 5 stars (88,72 reviews) |

| XTB |

| None, but there is a €10 monthly fee if an account has been inactive for more than 12 months | Trading fees are built into the spread and vary | Yes | 3.5 out of 5 start (1,100 reviews) |

| Interactive Investor | $10 |

| Shares and funds £3.99 per trade | Yes | 4.7 out of 5 stars (24,614 reviews) |

| Trading 212 |

| None | None | Yes | 4.6 out of 5 stars (28,669 reviews) |

| AJ Bell | No minimum | Annual platform fee between 0.10% and 0.25%. |

| Yes | 4.8 out of 5 stars (4,893 reviews) |

| Moneybox | £50 | £1 monthly subscription fee; plus 0.45% fee based on total asset value | Free | Yes | 4.4 out of 5 stars (4,070 reviews) |

| IG | £250 to open an account | Flat platform fee of £96 per year | £8 per trade (£3 per trade if you have at least three trades a month) | Yes | 4.1 out of 5 stars (6,786 reviews) |

| Freetrade | £2 |

| None | Yes | 4.0 out of 5 stars (3,952 reviews) |

| Wealthify | £1 | 0.6% | 0.16% to 0.70% | Yes | 4.0 out of 5 stars (2,346 reviews) |

How to choose the best trading app for you

Before you choose a trading app, you have to look at what type of investor you are and your level of risk. If you are a beginning investor, you’ll want an app that includes plenty of educational resources and maybe even has a robo-advisor function. More experienced investors may want to look closely at whether there are any per-trade fees and other fees, plus whether each app’s investment options suit what you’re looking for.

A few things to consider:

- Risk tolerance: How comfortable are you with market changes?

- Time-frame: Are you a long-term or short-term investor?

- Investment style: Are you a hands-on trader or desire passive income investments?

- Investment types: Are you interested in stocks, bonds, ETFs, mutual funds, or other assets?

What assets can you trade on investment apps?

There are plenty of investment options on investment apps, from stocks and bonds, to crypto, to ETFs, to forex, to CFDs, that are available on investment apps. You have to look at each individual app to determine what investment options they would have. Here are some of the potential options:

- Stocks: Users can buy stocks in publicly traded companies, allowing them to have partial ownership.

- Exchange Traded Funds (ETFs): These are collective investment funds that provide exposure to various products.

- Foreign Exchange (Forex): Trade different fiat currencies to benefit from price fluctuations

- Cryptocurrencies: These digital assets can be traded on crypto exchanges. They are becoming more commonplace on popular investment apps.

- Commodities: Economic resources like crude oil, gold, wheat, cattle, natural gas, and sugar.

- Futures: Contracts to buy or sell an asset at a set price on a predetermined date.

How to get started with a UK investment app

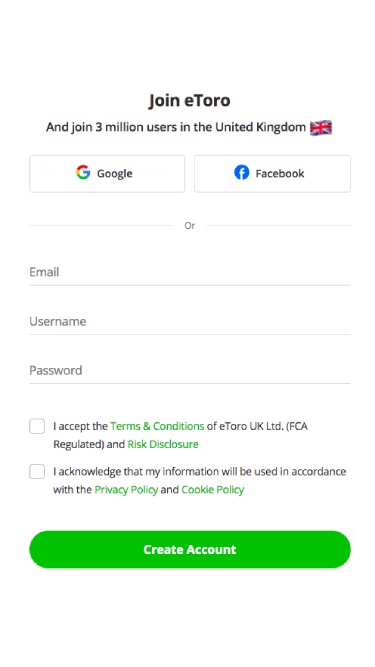

- Visit the website: Each investment app differs. For eToro, for example, you would go to www.etoro.com and click on the “Join Now” or “Trade Now” button.

- Provide personal information: Fill in the required details such as your name, email address, and create a password.

- Accept terms and conditions: Read and agree to eToro’s terms and conditions and privacy policy.

- Verify your email: Check your inbox for a verification email and click the confirmation link.

- Complete account verification: You’ll need to verify your identity and address by providing necessary documents. This is a standard procedure to comply with regulatory requirements.

- Fund your account: Once your account is verified, you can deposit funds to start trading.

About fees and costs

Investment apps, even the ones that advertise free trading, aren’t really free. They are in business to make money and various fees are a big part of their revenue streams.

Some investment apps make their money indirectly from the spread, the difference between the highest price a buyer is willing to pay for a security (ask price) and the lowest price a seller is willing to accept (bid price). Other investment apps charge a set rate per trade or vary the rate per trade depending on how frequently an investor trades. There are also sometimes inactivity fees to encourage investors not to just park their investments. Some investment apps charge a set percentage of each person’s portfolio.

Because of the complex nature of fees, it makes sense to thoroughly check out a company’s web site and, if necessary, ask plenty of questions before signing up.

Selecting the best UK investment apps — Our methodology, explained

We looked for the best investment apps in the UK that could appeal to various types of investors, from beginners to more experienced traders. We graded each of the apps based on their ease of use, customer service, their fees and the depth of their investment options.

It’s important to note that these platforms frequently change their fee structures, so investors need to do their own research before choosing an investment app.