ETFGI reports assets invested in the global ETFs industry increased the lead over assets in the hedge fund industry at the end of Q2

LONDON — July 27, 2023 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs ecosystem, reported today that assets invested in the global ETFs industry increased the lead over the assets invested in the global hedge fund industry to $6.56 trillion at the end of Q2 2023 Source HFR for hedge fund data. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in global ETFs industry increased the lead over the assets in global hedge fund industry to $6.56 trillion at the end of Q2.

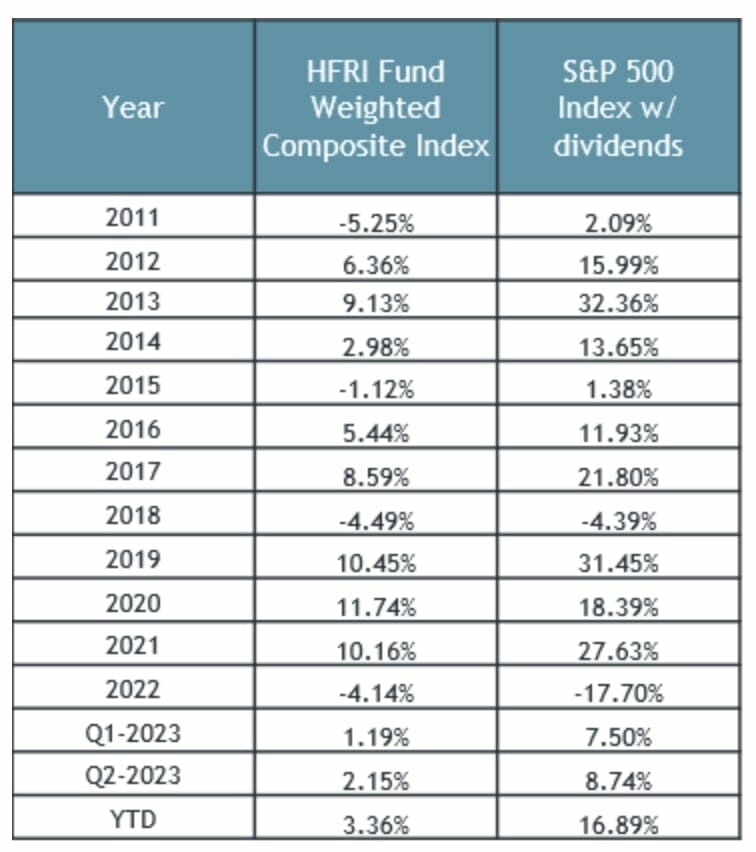

- The HFR Fund Weighted Composite Index was up 2.15%, while the S&P 500 Index with dividends was up 8.74% in Q2.

- The global hedge fund industry gathered net inflows of $3.6 billion while the global ETFs industry gathered net inflows of $235 billion during Q2.

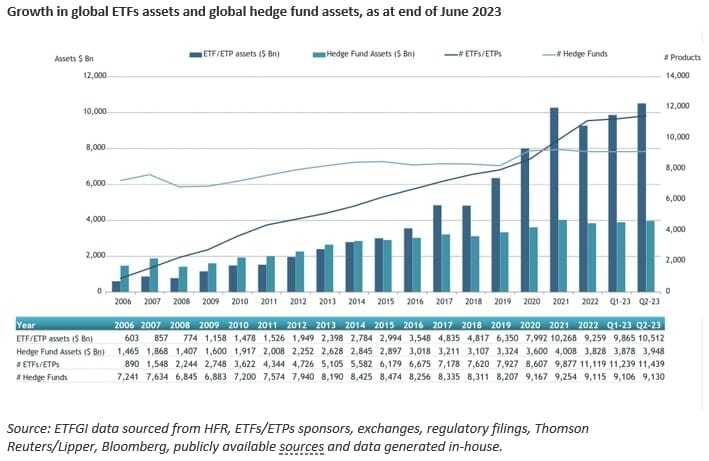

Assets invested in the global ETFs industry first surpassed those invested in the global hedge fund industry at the end of Q2 2015.

Growth in assets in the Global ETFs industry has outpaced growth in the hedge fund industry since the financial crisis in 2008. According to ETFGI’s analysis $10.51 trillion were invested in 11,439 ETFs/ETPs listed globally at the end of Q2 2023, representing an increase in assets of 6.56% over the quarter. Over the same period assets invested in hedge funds globally increased by 1.81%, to $3.95 trillion in 9,130 hedge funds, according to HFR.

In Q2 2023 the performance of the HFRI Fund Weighted Composite Index was up 2.15%, while the S&P 500 Index was up 8.74%.

Article by ETFGI