The Procter & Gamble Co (NYSE:PG) provides branded consumer packaged goods worldwide. It operates through five segments: Beauty; Grooming; Health Care; Fabric & Home Care; and Baby, Feminine & Family Care. Procter & Gamble is a member of the elite dividend kings list, which includes companies that have managed to raise annual dividends for at least 50 years in a row. That’s not a small feat.

Q1 2023 hedge fund letters, conferences and more

The company increased quarterly dividends by 3% to $0.9407/share yesterday. This dividend increase marked the 67th consecutive year that P&G has increased its dividend and the 133rd consecutive year that P&G has paid a dividend since its incorporation in 1890. (Source)

Management states that this dividend increase reinforces their commitment to return cash to shareholders, many of whom rely on the steady, reliable income earned with their investment in P&G.

This dividend increase was at the slowest annual rate since 2017. It was also lower than my expectations. The table below shows the year that the company raised dividends, the new increased quarterly dividend payment for that year, and the rate of dividend increase for the year. It focuses on the past 20 years of dividend increases for Procter & Gamble:

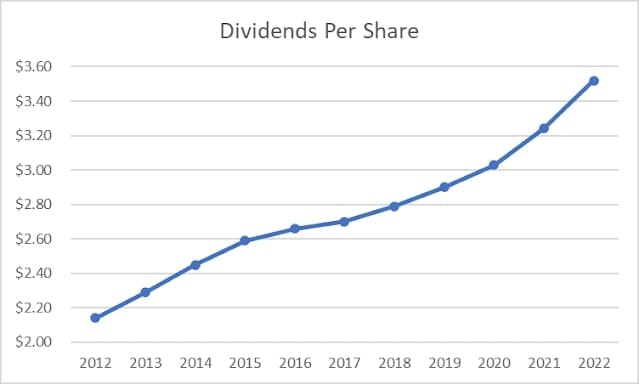

Over the past five years, P&G has managed to increase dividends at an annualized rate of 5.78%. The ten year average is 4.98%.

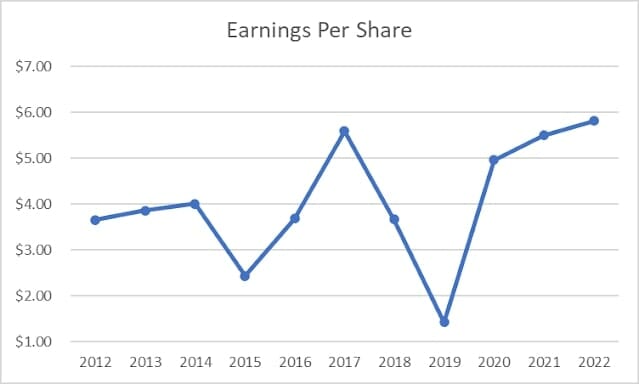

Earnings per share have increased from $3.66 in 2012 to $5.81 in 2022. The company is expected to generate $5.86/share in earnings in 2023.

That being said, the core business is very stable, which means that long-term earnings power should not be affected. However, earnings per share have not grown by much over the past decade. The slowdown in dividend growth is a direct result of the slowdown in earnings per share growth.

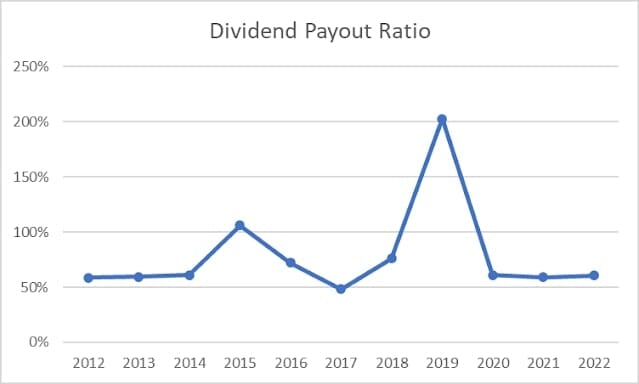

In the past decade, the dividend payout ratio increased from 58% in 2012 to 61% in 2022. A lower payout is always a plus, since it leaves room for consistent dividend growth minimizing the impact of short-term fluctuations in earnings.

Based on forward earnings, it appears that the forward dividend payout ratio is at 64%, which means that the dividend is sustainable.

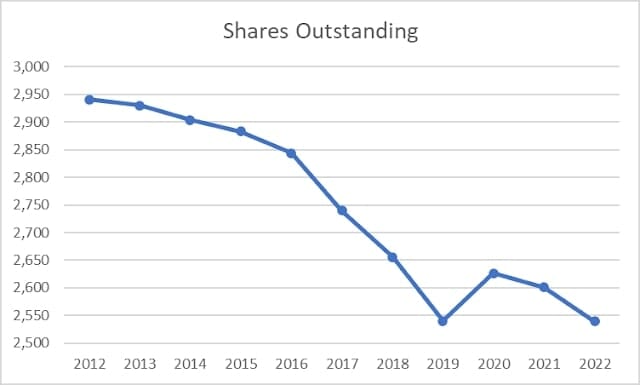

The number of shares outstanding has been decreasing gradually over the past decade too.

It is interesting to look at the company's performance over the past decade for perspective. The stock sold for approximately $81/share a decade ago, earned $3.86/share and paid a quarterly dividend of 56.20 cents/share, for an annual dividend yield of 2.77%. The P/E was at 21.

Fast forward to today, and the company is paying a quarterly dividend of 94.07 cents/share, for a total yield on cost of 4.64%. If we take dividend reinvestment into consideration, a $1,000 investment ten years ago would be generating $65.30 in annual dividend income today.

At the current price, the stock seems overvalued at 25.71 times forward earnings. The stock yields 2.47%. Given the slow dividend growth, it does not seem like a good value today. Perhaps, it could be a better value on dips below $120/share.

Relevant Articles: