S&P 500 finally turned south in line with the medium-term outlook, in reaction to the wildly underwhelming JOLTS data. Job market deterioration is finally getting reflected as per the Mar/Apr timeing for issues to arrive that I discussed earlier. Unemployment claims rising and finally non-farm payrolls would come to reflect that.

Q1 2023 hedge fund letters, conferences and more

Today‘s employment change is first such a sign, but all eyes are on Friday‘s non-farm payrolls. The bears are aligning for a pleasant surprise as buy the dippers are bound to get increasingly overpowered. Expect more risk-off in bonds and the surge in precious metals to continue at its own pace higher (my star pick for 2023).

Keep enjoying the lively Twitter feed via keeping my tab open at all times – on top of getting the key daily analytics right into your mailbox. Combine with Telegram that never misses sending you notification whenever I tweet anything substantial, but the analyses (whether short or long format, depending on market action) over email are the bedrock.

So, make sure you‘re signed up for the free newsletter and that you have my Twitter profile open in a separate tab with notifications on so as to benefit from extra intraday calls.

Let‘s move right into the charts (all courtesy of www.stockcharts.com).

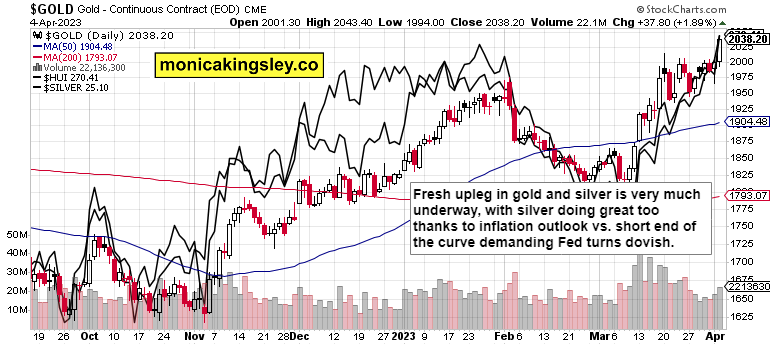

Gold, Silver and Miners

Very fine recession reaction – lower yields sending down the dollar as the Fed can‘t remain this restrictive, the market thinking goes. Silver doing well as inflation is undefeated.

Crude Oil

Oil is consolidating high ground, and would be far less hurt than copper through the recession jitters. Well, I say jitters, but markets obviously have to overcome the misguided no landing first. In doing so, they may very well start questioning the soft landing too...

Thank you for having read today‘s free analysis, which is a small part of my site‘s daily premium Monica's Trading Signals covering all the markets you're used to (stocks, bonds, gold, silver, miners, oil, copper, cryptos), and of the daily premium Monica's Stock Signals presenting stocks and bonds only. Both publications feature real-time trade calls and intraday updates.

While at my site, you can subscribe to the free Monica‘s Insider Club for instant publishing notifications and other content useful for making your own trade moves.

Turn notifications on, and have my Twitter profile (tweets only) opened in a fresh tab so as not to miss a thing – such as extra intraday opportunities. Thanks for all your support that makes this great ride possible!

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice.

Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind.

Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make.

Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.