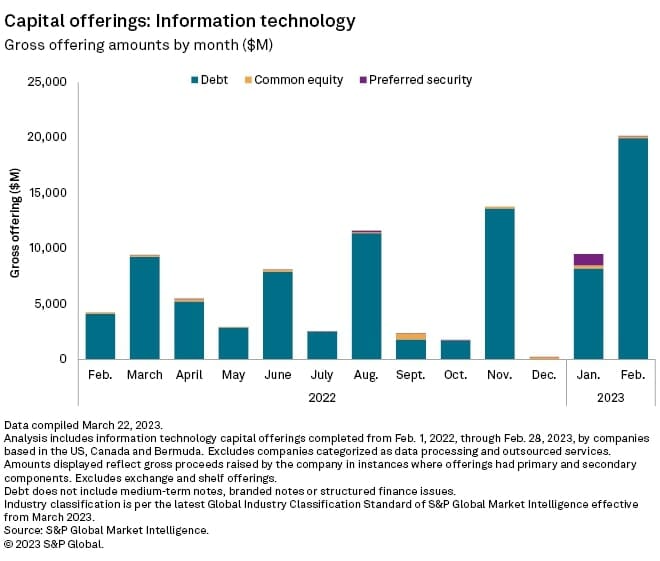

Publicly traded IT companies in the U.S., Canada and Bermuda raised $20.15 billion through capital offerings in February, according to S&P Global Market Intelligence data and analysis.

This is the sector‘s strongest showing so far in terms of capital markets activity since raising $13.77 billion in November 2022. Last month’s total is also more than double the $9.5 billion raised in January.

Q4 2022 hedge fund letters, conferences and more

Surge In Infotech Capital Markets Activity

Key highlights from the report include:

- Debt offerings comprised the largest share of February's infotech capital activity at $19.96 billion. Common equity offerings raised $142.0 million, while preferred security offerings brought in $50.5 million.

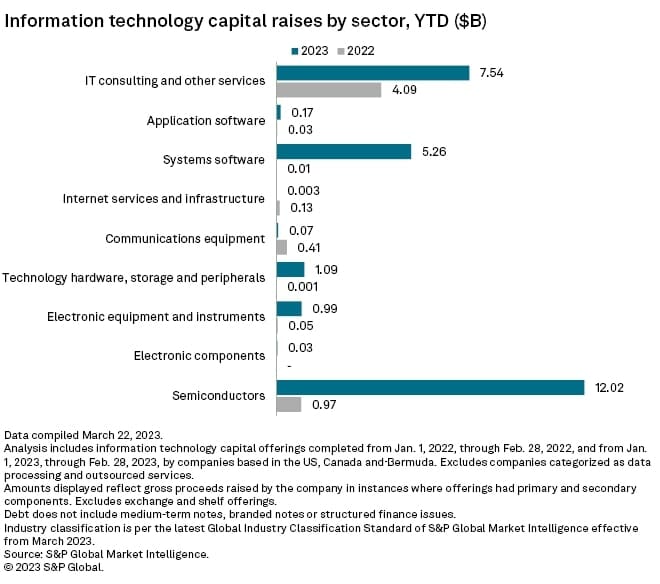

- Semiconductor companies topped other infotech subsectors in raising the most capital as of February-end with $12.02 billion. IT consulting and other services companies ranked second with $7.54 billion, followed by systems software companies with $5.26 billion.

- Intel Corp. and Oracle Corp. dominated the IT sector's capital activity last month.

- Broadcom Inc.'s debt offering in end-March 2022 and Oracle's senior notes offering in November 2022, both amounting to $2.5 billion, tied for the biggest infotech offering in the past 13 months.