Fintel reports that Voss Capital, LLC has filed a 13D/A form with the SEC disclosing ownership of 3,409,052 shares of Griffon Corporation (NYSE:GFF). This represents 6.0% of the company.

In their previous filing dated Dec. 30, 2022, they reported 2,856,924 shares and 5.00% of the company, an increase in shares of 19.33% and an increase in total ownership of 1.00% (calculated as current – previous percent ownership).

Q4 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Voss said in the filing that it reached an agreement with Griffon appointing the investor's nominee and Chief Investment Officer Travis Cocke to its board.

Voss has also agreed to certain restrictions, voting commitments, and other provisions, including a mutual agreement not to say anything negative about the other party. Griffon agreed to reimburse Voss for reasonable, documented expenses incurred for the agreement in an amount not to exceed $500,000. Additionally, the agreement provides for the appointment of an additional independent director if Voss hits an ownership threshold.

Griffon Corporation is a diversified management and holding company that conducts business through wholly-owned subsidiaries. Griffon oversees the operations of its subsidiaries, allocates resources among them and manages their capital structures.

Griffon provides direction and assistance to its subsidiaries with acquisition, growth opportunities, and divestitures. To further diversify, Griffon also seeks out, evaluates, and, when appropriate, will acquire additional businesses that offer potentially attractive returns on capital.

Gamco Investors, Inc. et al. holds 2,970,157 shares representing 5.30% ownership of the company. In its prior filing, the firm reported owning 3,402,920 shares, representing a decrease of 14.57%. The firm decreased its portfolio allocation in GFF by 1.28% over the last quarter.

Allspring Global Investments Holdings, LLC holds 1,983,496 shares representing 3.54% ownership of the company. In it's prior filing, the firm reported owning 2,132,472 shares, representing a decrease of 7.51%. The firm decreased its portfolio allocation in GFF by 55.60% over the last quarter.

Gabelli Funds Llc holds 1,489,000 shares representing 2.66% ownership of the company. In it's prior filing, the firm reported owning 1,602,500 shares, representing a decrease of 7.62%. The firm increased its portfolio allocation in GFF by 5.07% over the last quarter.

Geode Capital Management, Llc holds 808,305 shares representing 1.44% ownership of the company. In it's prior filing, the firm reported owning 802,143 shares, representing an increase of 0.76%. The firm increased its portfolio allocation in GFF by 9.89% over the last quarter.

What Is The Overall Fund Sentiment?

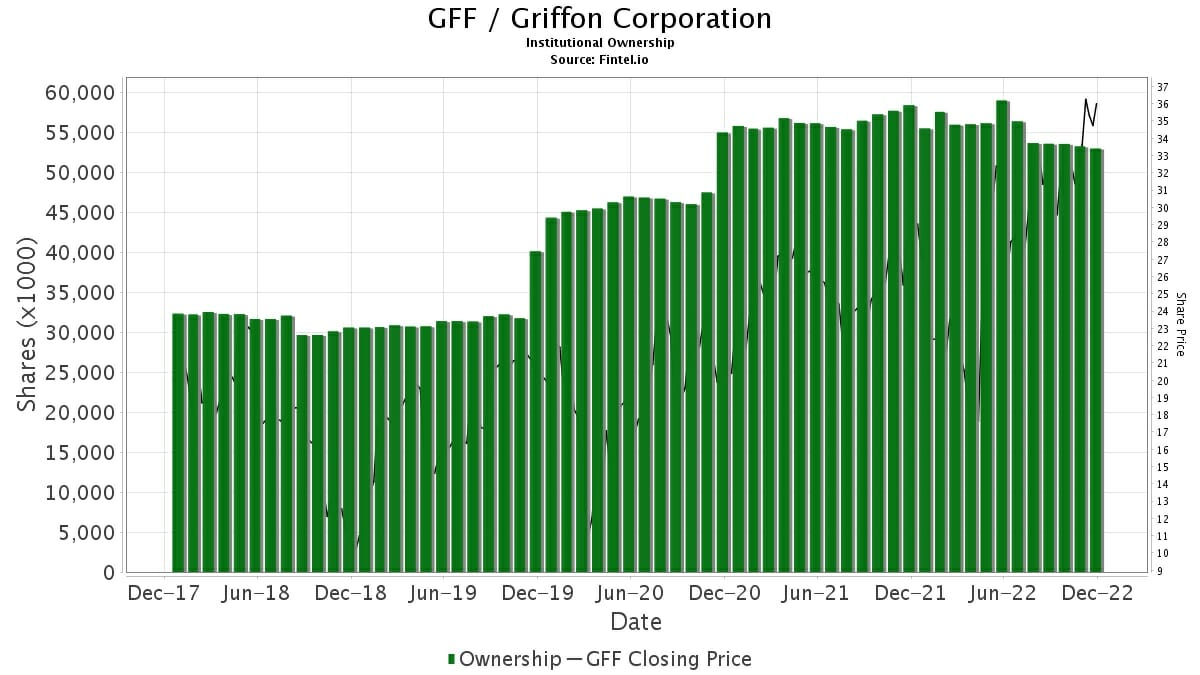

There are 487 funds or institutions reporting positions in Griffon Corporation. This is an increase of 7 owner(s) or 1.46%.

Average portfolio weight of all funds dedicated to Griffon Corporation is 0.2394%, an increase of 17.7073%. Total shares owned by institutions decreased in the last three months by 0.29% to 52,844,280 shares.

Fintel's Fund Sentiment Score is a quantitative model that ranks companies from zero to 100 based on Fund Sentiment. Fund Sentiment is important because it tells you if funds are buying or selling - and in particular how the company ranks compared to other companies in the investing universe.

Click to see the Fintel Fund Sentiment Score for GFF / Griffon Corporation.

Article by Fintel