Discusses the insiders transactions and provides quant analysis on the stock with some sell-side commentary

Shares of digital education management platform Skillsoft (NYSE:SKIL) have risen more than 26% since Wednesday as investors became aware of several insiders who bought shares in the company.

Q3 2022 hedge fund letters, conferences and more

Since re-listing on US equity markets through a SPAC merger with Churchill Capital Corp II in June 2021, Skillsoft shares have drifted more than -85% lower. SKIL shares reached as low as $1.03 at the beginning of the week before rebounding.

A total of four insiders bought Skillsoft shares in the trading window that was open following the release of third quarter results on the 6th of December.

These included the group's CEO Jeffrey Tarr who bought 75,000 shares at an average price of $1.063 each. Following the transaction, Tarr now owns a total of 699,858 shares in the company.

Skillsoft’s CFO Richard Walker also increased his position with a 75,000 share purchase at a $1.068 average price. Walker’s position more than doubled as a result to 114,351 shares after the trade.

The group’s Chairman Patrick Kolek was on the list with a 80,000 stock purchase at $1.06 each and now owns a total of 100,000 shares.

Newly appointed Chief Accounting Officer, Jose Torres made an initial purchase of 50,000 shares at $1.081 each on average. Torres was appointed to the role back in September of 2022, replacing Ryan Murray.

The four insiders rank the stock in 81st position out of 254,817 screened global securities, based on the number of insiders buying shares in the last 90 days.

These transactions contribute to Fintel’s bullish insider sentiment score of 91.02 for the stock. Insiders have bought 0.322% of skillsoft’s float in the last 90 days.

During the third quarter, bookings declined to $132.6 million from $152.3 million in the same quarter of 2021. Skillsoft generated $139.9 million in sales, beating analyst forecasts of around $130 million and adjusted EBITDA of $28 million beating polled estimates of around $25.5 million.

Management made some tweaks to full year guidance, excluding $25 to $30 million of reseller fees.

For the full year, management confirmed they expect to report bookings between $580 to $615 million with GAAP revenue guidance revised to $520 to $550 million. Adjusted EBITDA will be somewhere in the range of $105 to $125 million.

Analyst Raj Sharma from B Riley Securities believes the company is navigating its de-SPACing and recent acquisitions well during a tough economic environment.

Sharma highlighted how the company is paying down debt with $31 million repaid during the quarter bringing the total down to $456 million.

B Riley Securities maintained its $6 target price for its ‘buy’ call on the stock.

Fintel’s average consensus target price of $4.02 remains bullish and suggests there is more than 100% upside to current share price levels.

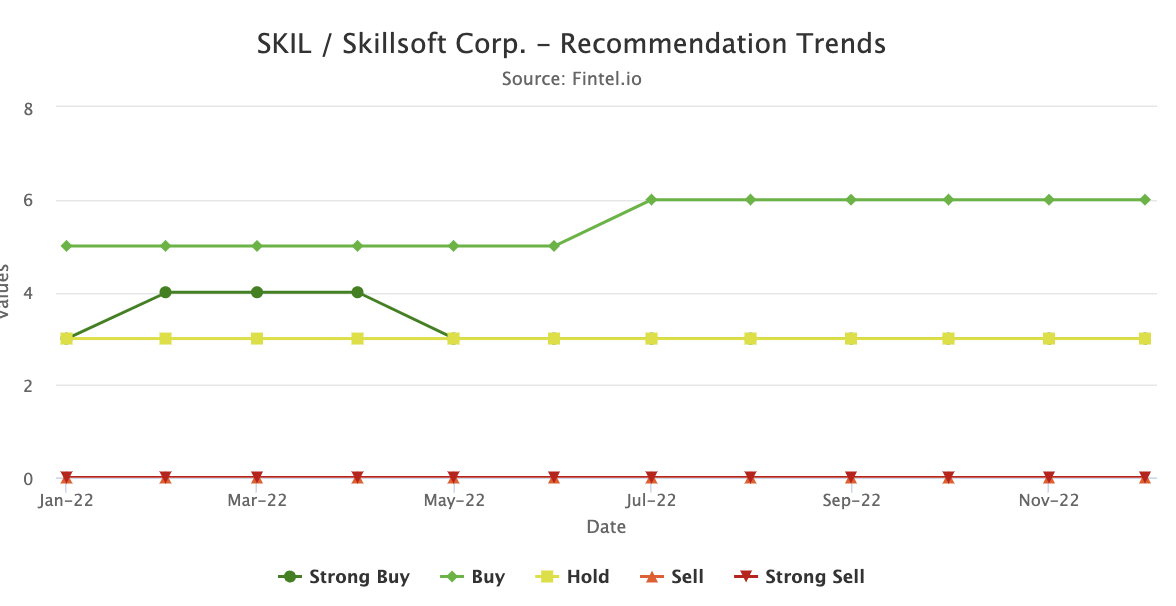

The chart below shows the recommendation trends of analyst calls for SKIL for 2022.

Article by Ben Ward, Fintel