As a Dividend Growth Investor, I focus on quality companies that have managed to raise dividends for a certain number of years. Before I research a company however, I tend to look for:

- Trends in earnings per share over the past decade

- Trends in dividends over the past decade

- Dividend payout ratio

- Trends in shares outstanding over time

I can do this easily if I were focusing on just one company at a time, using annual reports for example. However, if I have to screen through a larger list of companies, such as the dividend champions for example, it is definitely a time saver to use a resource that showcases the data in an easy to access format. You may enjoy this list of resources I use.

Q2 2022 hedge fund letters, conferences and more

One of my favorite new investing resources is the site ROIC.AI

I can quickly see trends in earnings, cashflows, revenues, shares over the past 10 - 15 years.

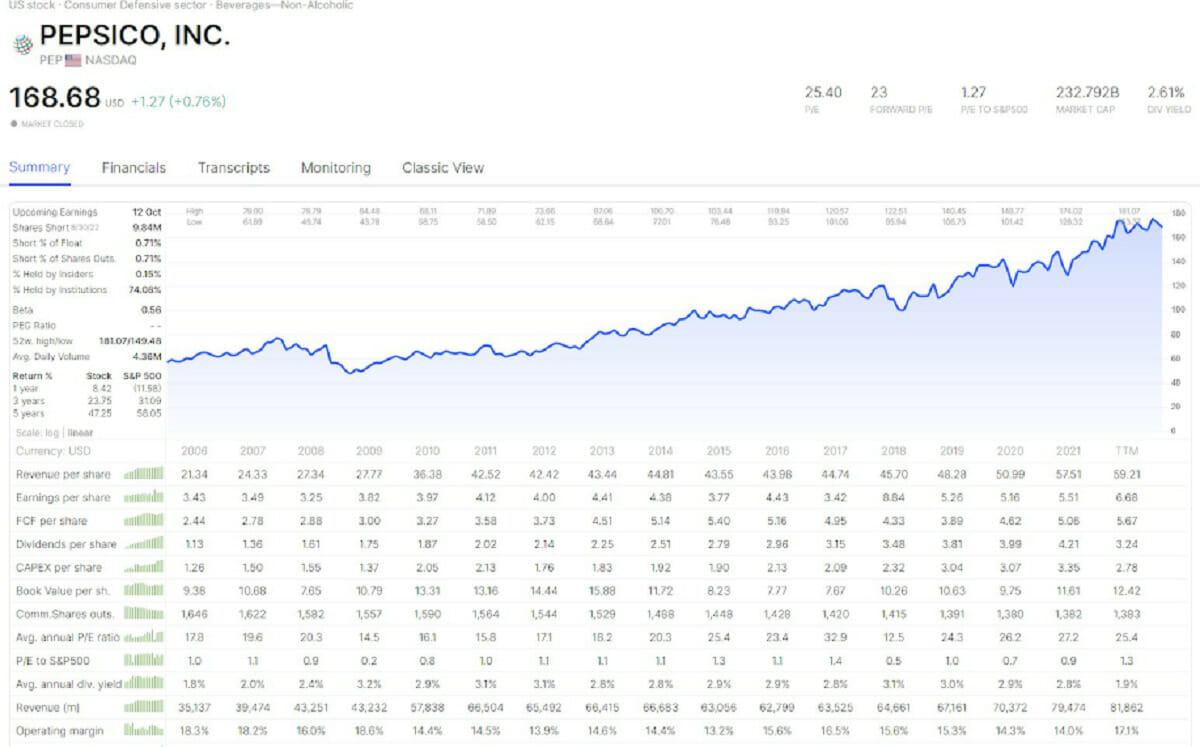

For example, I can see the following data for PepsiCo (NASDAQ:PEP) since 2006. (Source)

I can see trends in revenues per share, earnings per share and cash flow per share. You can also view trends in dividends per share and shares outstanding over the past 16 years.

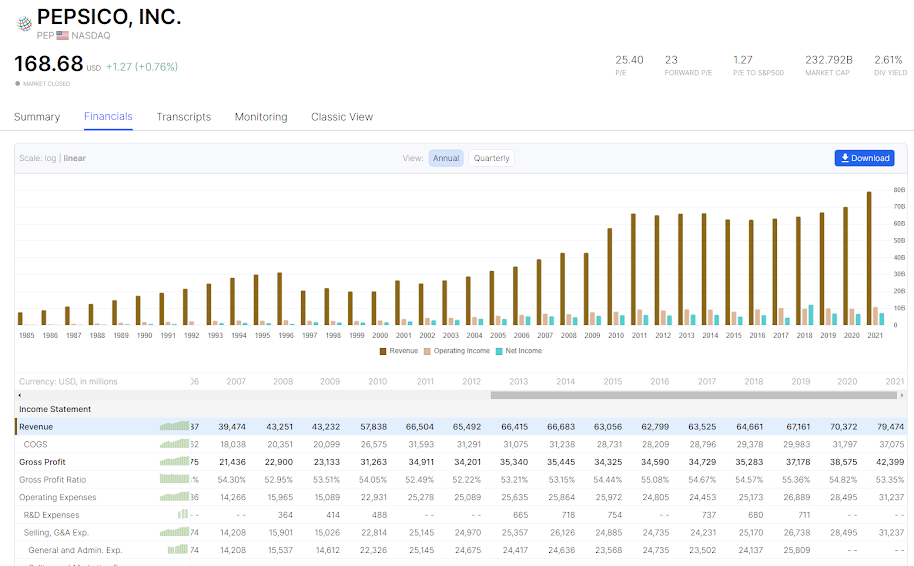

The other neat feature is that the site shows financials for the past 30+ years. This includes trends in Income Statement, Balance Sheet and Statement of Cash Flows. You can view this below:

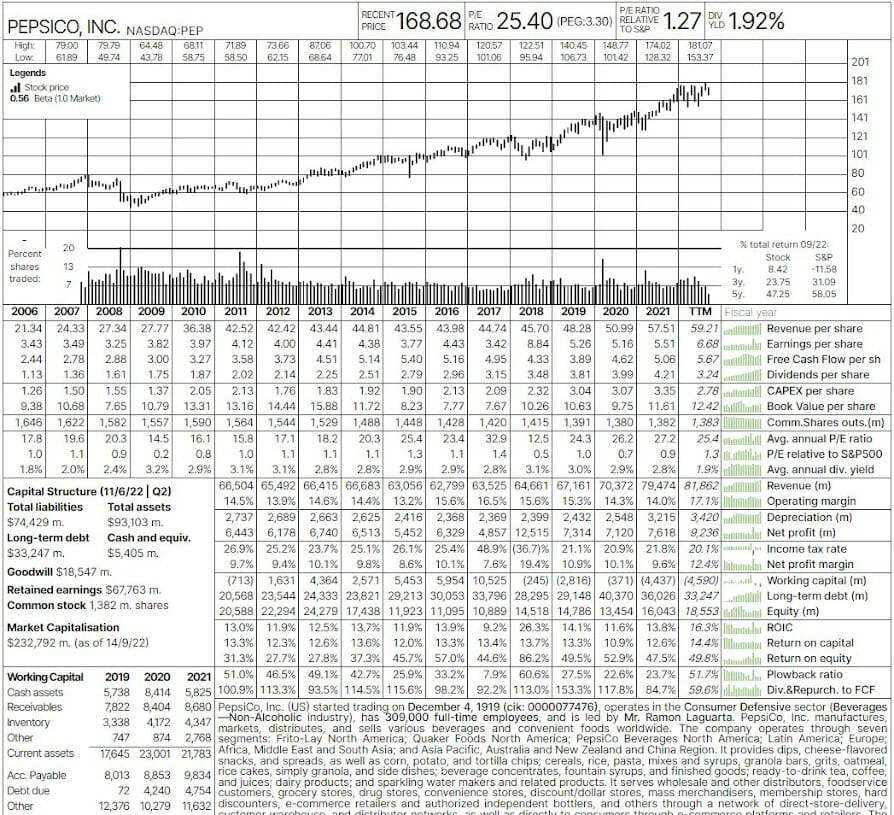

They produce a chart similar to what Value Line reports look like (minus the qualitative review). (classic view)

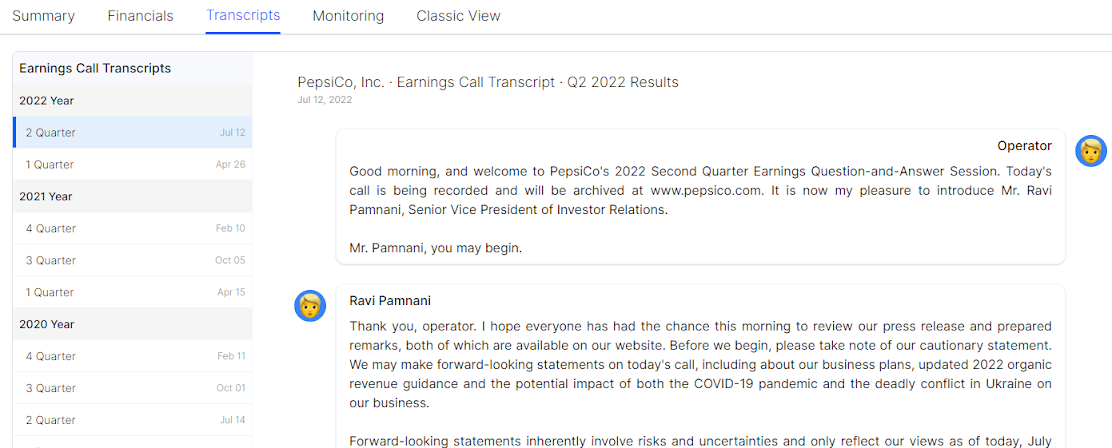

They also provide earnings call transcripts for several years back for free, which is pretty neat as well. (source)

If you want to download the data , you have to subscribe to the paid service or tweet about it.

You can get access to over 37,000 companies in EU, Australia, UK and India if you sign up for their premium service. I guess you can download data as much as you want with it too. I am using the free version.

I am not compensated for writing this post from ROIC. I am just sharing a free resource I found out on the internet, which may be helpful to readers.

I did a quick spot check of the data for several of the dividend champions, and it looked accurate. However, I would encourage you to always try to verify the data for accuracy.

Anytime data is automatically pulled from databases, there is the possibility for inaccuracy. Some readers have reported inaccuracies for Canadian companies listed in the US. Perhaps that's because they do not submit 10-K filings but a 40-F.

The best source is the original source, as in the annual report at the company website or the sec.gov. However, the ability to quickly review data using a site like ROIC can definitely be a time saver.

Relevant Articles:

- 26 Dividend Champions for Further Research

- Dividend Investing Resources I Use

- How to monitor your dividend investments

- Dividend Investing Resources

- How I Manage to Monitor So Many Companies

- Dividend Aristocrats List for 2018

Article by Dividend Growth Investor