For weekend reading, Gary Alexander, senior writer at Navellier & Associates, offers the following commentary:

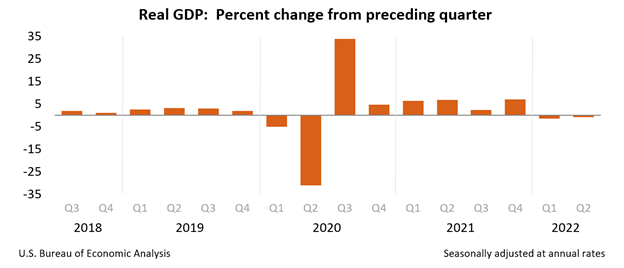

We got the bad news last week. Real U.S. gross domestic product (GDP) for the second quarter decreased at an annual rate of 0.9 percent, according to the first (“advance”) estimate by the Bureau of Economic Analysis (BEA). After an official -1.6 percent decline in the first quarter, that means we MAY be officially in a recession, if the second-quarter figure holds up in the next two releases. (The second estimate will be released on August 25, while the third and final release will arrive in late September.)

Q2 2022 hedge fund letters, conferences and more

This first-half decline is a shocker since it follows a 5.7% real increase in 2021 – the best calendar year since 1984. The good news – if you can call it that – is that “current-dollar” (or nominal) GDP rose 7.8 percent, or $465 billion, to a nearly $25 trillion annual rate, due entirely to inflation. That is noticeably faster than the 6.6 percent nominal growth rate of the first quarter. Now, if we can just get inflation down in the second half while maintaining that peppy nominal growth rate, then real growth will return.

Our main global competitor is doing no better. On the same day our GDP came out, China acknowledged it would miss its annual growth target of +5.5% – by a mile. China’s Politburo said Thursday that their lowest GDP target in decades was an opium pipe dream since second-quarter growth was just +0.4%.

With China, the main GDP drag seems to be their draconian COVID lockdowns in several major cities. (They apparently closed down businesses serving one million people in Wuhan due to four cases without symptoms.) With the U.S. and Europe, the main culprit seems to be extreme Green policies, resembling a cult.

The Biden Administration’s drive toward solar and wind, and the push toward 50% electric cars by 2030, has fueled (pardon the puns) a purposeful policy to drive up the price of gasoline to make electric cars, plus solar and wind, more attractive. Transportation Secretary Pete Buttigieg said as much when he told a House Transportation and Infrastructure Committee, “The more pain we are all experiencing from the high price of gas, the more benefit there is for those who can access electric vehicles.” Gee, thanks!

There is no free lunch with electric cars. The batteries alone require deep mining damage to planet earth, and the electric grid is in danger of overloading and shortages. The North American Electric Reliability Corporation recently warned that two-thirds of the U.S. could experience blackouts this summer. With wind and solar, we all know the limits: The sun doesn’t always shine, and the wind doesn’t always blow. Due to the current heat wave, Texas grid operators told residents not to use major appliances to avoid rolling blackouts and some grid operators are keeping coal-fired plants scheduled to be shut down on tap.

The same thing is happening in Europe. Germany has had to resort to burning oil and coal because its trillion-dollar investment in wind and solar can’t make up for the loss of Russia’s natural gas. There was also an electrical power crisis in Australia last month (their winter) due to too many coal plant closures.

Innovation - Not Intervention - Is the Solution

Fossil fuels were once the “clean” solution to the horse manure that littered our city streets and rural highways. Dead dinosaur bones were also the ecological salvation for killing whales for their oil. John D. Rockefeller “saved the whales” when he developed very low-cost kerosene for middle-class families.

Innovation and the demands of the market provide a better solution than forcing some dictator’s idea of a more elegant solution down our collective throats. At Freedom Fest, one of my roles is “senior judge” (in both age and time served) at Anthem Film Festival. I recently commented on three films on lockdowns here (July 12). Two other featured films are relevant to innovation and the risks to our electrical grid.

America has been the world’s premier innovator for over two centuries, since our establishment of patents in 1641 (and officially in 1792) and copyrights in 1790, allowing inventors to own the fruits of their creativity. But our hold on innovation is fading fast due to outright theft from China and weak protection by U.S. courts, according to “Innovation Race,” a film by director/writers Luke and Jo Anne Livingston.

I was in 7th grade when Russia launched Sputnik, and our science and math classes went into overdrive since it was the first time our adversaries beat us in technology, so my “rocket scientist” dad and other engineers put a man on the moon less than 12 years later, and America got back on top in technology.

Just think of companies founded by Steve Jobs, Bill Gates, Jeff Bezos, Elon Musk, Michael Dell, Larry Page, and Sergei Brin. Even those born overseas (Musk and Brin) came to America for patent protection.

Along came Japan, who mainly copied U.S. technology, then improved it (think cars or cameras), and then came China, which so far has stolen U.S. technology or forced deals whereby U.S. companies may not operate within China unless we share our unique technology so that China can “reverse engineer” it.

China steals about $600 billion per year of U.S. technology, according to our Department of Justice. In his recent memoir, former Attorney General Bill Barr wrote, “In recent years, about 80 percent of all federal economic espionage prosecutions have alleged conduct that would benefit the Chinese state.”

Now, China has stepped up its game by copying our patent system and surpassing America in new patent production, while at home big tech companies are front-running new ideas by small inventors, to the point that the Patent Office has become a “patent death squad,” whereby big money crowds out small inventors. That’s why we’re now losing the “Innovation Race,” says this film, and we need to get back in that race.

“Grid Down, Power Up” (a film by David Tice) frankly scares me, since the Federal Energy Regulatory Commission (FERC) has said that a terrorist attack on just nine substations could plunge the U.S. into a nationwide blackout for 18 months. Since electricity runs our life – including access to food, water, heat, cooling, and medicine – it is credibly estimated that over 80% of us could perish within those 18 months.

Congress has ignored calls for grid expansion and security. Even without a terrorist act or natural event (a sunburst or electromagnetic pulse, EMP), we are stretching our existing grid to the breaking point, even before pushing the world toward 100% electric automobiles. Our devices, even bitcoins, gobble up huge amounts of juice, as do air conditioning in summer and heating in winter for our much larger homes.

I’m not sure what the solution is, but I’m sure that by rewarding innovators we will find a solution. Here are three outliers that need funding. I can’t vouch for any one of them, but VC’s usually find the winners.

- Solar satellite power. My friend and former neighbor, the late engineer Ralph Nansen, wrote “Sun Power,” about harnessing the sun’s energy from satellites rather than solar panels on earth. Huge satellite panels can relay solar power to earth 24/7, no matter cloud cover, for as long as the sun lives.

- Green hydrogen is produced from water and burns very clean. It may be an alternative to natural gas.

- Small nuclear engines or power stations could provide clean electricity or back-up wind or solar.

There are probably far more solutions under development that we haven’t heard about, but developing these sorts of solutions is expensive. That’s where venture capital and patent protection come in. Beyond that cost, we need the government to get out of the business of picking winners by funding bad ideas. Doing economic damage in the name of fighting climate change is hurting our search for the best solutions.