Flagship Pioneering is an American life sciences venture capital firm that is headed by Noubar Afeyan and invests in biotechnology, life sciences, health and sustainability companies.

Flagship Pioneering Increases Stake In Seres Therapeutics

On Thursday post market close, a form 4 was filed by microbe therapeutics company Seres Therapeutics Inc (NASDAQ:MCRB) which revealed the increased stake in the company by insider Flagship Pioneering. News of the release pushed shares 14.4% higher on Friday, giving the stock a renewed boost as it now breaks through a 50% gain from the annual low point seen in mid June.

Q2 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Flagship Pioneering is an American life sciences venture capital firm that is headed by Noubar Afeyan and invests in biotechnology, life sciences, health and sustainability companies.

The form 4 filed with the SEC showed that Flagship Pioneering purchased 8,738,243 shares at $3.15 per share for a total value of $27,525,465.45

The purchase propped up the total balance of shares held by the insider to around 23.5 million which equates to about 25% ownership of the total company.

The accumulation was part of a $100 million secondary direct share offering that was lead by J. P. Morgan as the exclusive agent on the transaction.

Seres noted in the equity raising press release that the company intends to use the net proceeds from the offering for commercial preparation and to manufacture SER-109 for the U.S. market. This will include expanding longer-term commercial manufacturing capacity, advancing the clinical development of SER-109 for the EU market and to generally fund the company's day to day operations.

Other participants in the equity raising included Federated Hermes Kaufmann Funds, Heights Capital Management, Janus Henderson, and Nestlé Health Science.

The participation from various insiders on the register contributed to the bullish Fintel insider accumulation score of 94.24. MCRB’s insider score is the 92nd highest when compared to the 14,513 other companies that have been included in the screen.

Seres has a total of 43 insiders that now collectively own 37.3 million shares or 40.4% of the total float.

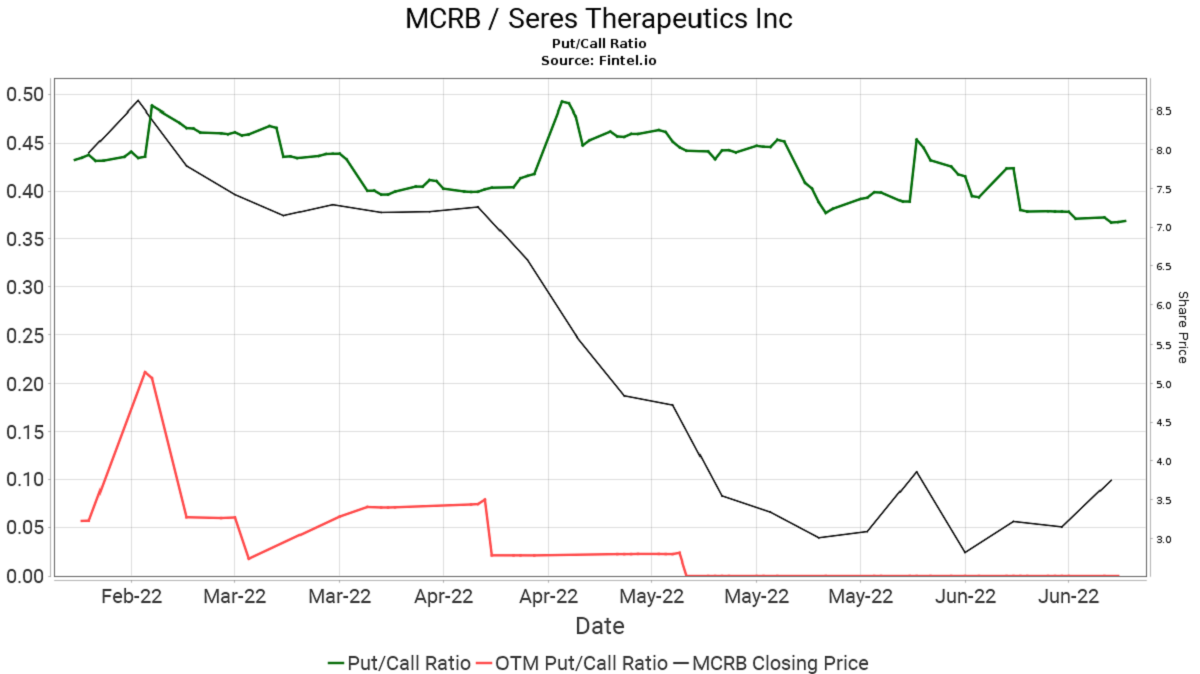

Sentiment in the overall options market also seems bullish with a Fintel put/call ratio of 0.37 which indicates that current open call options interest almost doubles the level of put open interest in the market for the stock.

As MCRB’s share price has slid 54% over the first 6 months of the year, interest in the options market has remained relatively bullish.

The graph to the right illustrates the put/call ratio against the share price’s movements over the first half of 2022.

Prior to the announcement of the equity raising, earlier in June, Seres released confirmatory results from investigational microbiome therapeutic SER-109 ECOSPOR IV.

The study showed that subjects that were treated with SER-109 had a recurrence rate of 8.7% at eight weeks which indicated a 91.3% sustained clinical response which was consistent with the 88% rate observed in the ECOSPOR III study.

Following the release of the confirmatory results, John Newman from Canaccord Genuity noted that he continues to expect FDA approval for SER-109 in C and they see substantial upside for MCRB shares based on the market opportunity for ulcerative colitis and SER-155 development. The firm remains ‘buy’ rated with a $20 target.

Vernon Bernardino from HC Wainwright & Co believes SER-109 is on its way to realizing its potential as the first FDA-approved microbe therapeutic. They see FDA approval as being a positive catalyst for the first half of 2023 and hence reiterate their $25 price target and ‘buy’ recommendation.

MCRB has a consensus ‘overweight’ rating and $14 average target price which suggests 246% potential capital upside could exist in the stock. The consensus target has fallen drastically over the last year following share price movements that have trended lower.

Article by Ben Ward, Fintel