- Private Markets ESG AuM to skyrocket – exceeding EUR 1.2tn by end-2025 to account for 42.4% of the total European Private Market assets

- Real Assets are poised to stand at the forefront of this surge with ESG assets expected to account for 33.7% and 40.6% of Real Estate and Infrastructure’s total respective AuM

Q3 2021 hedge fund letters, conferences and more

European Private Market ESG Assets Expected To Skyrocket

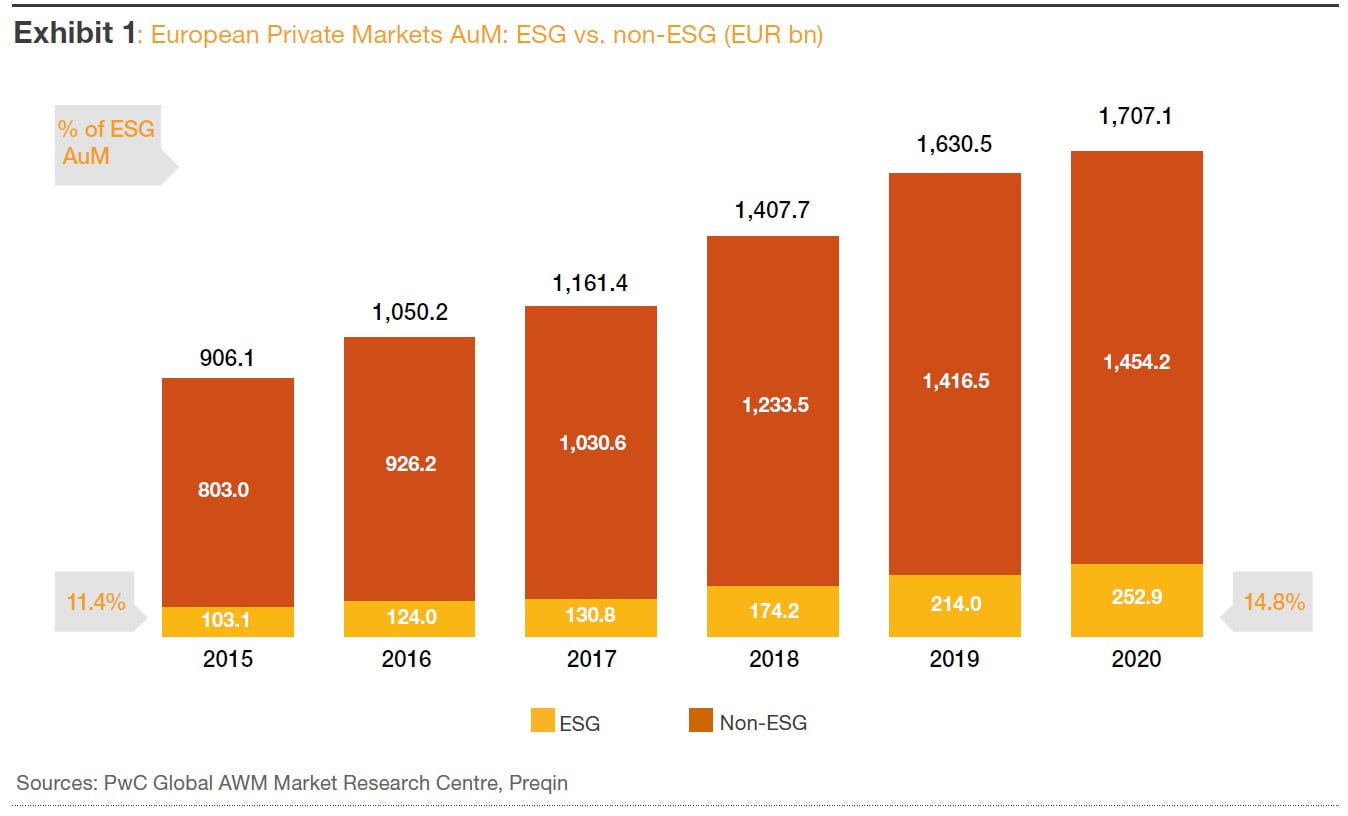

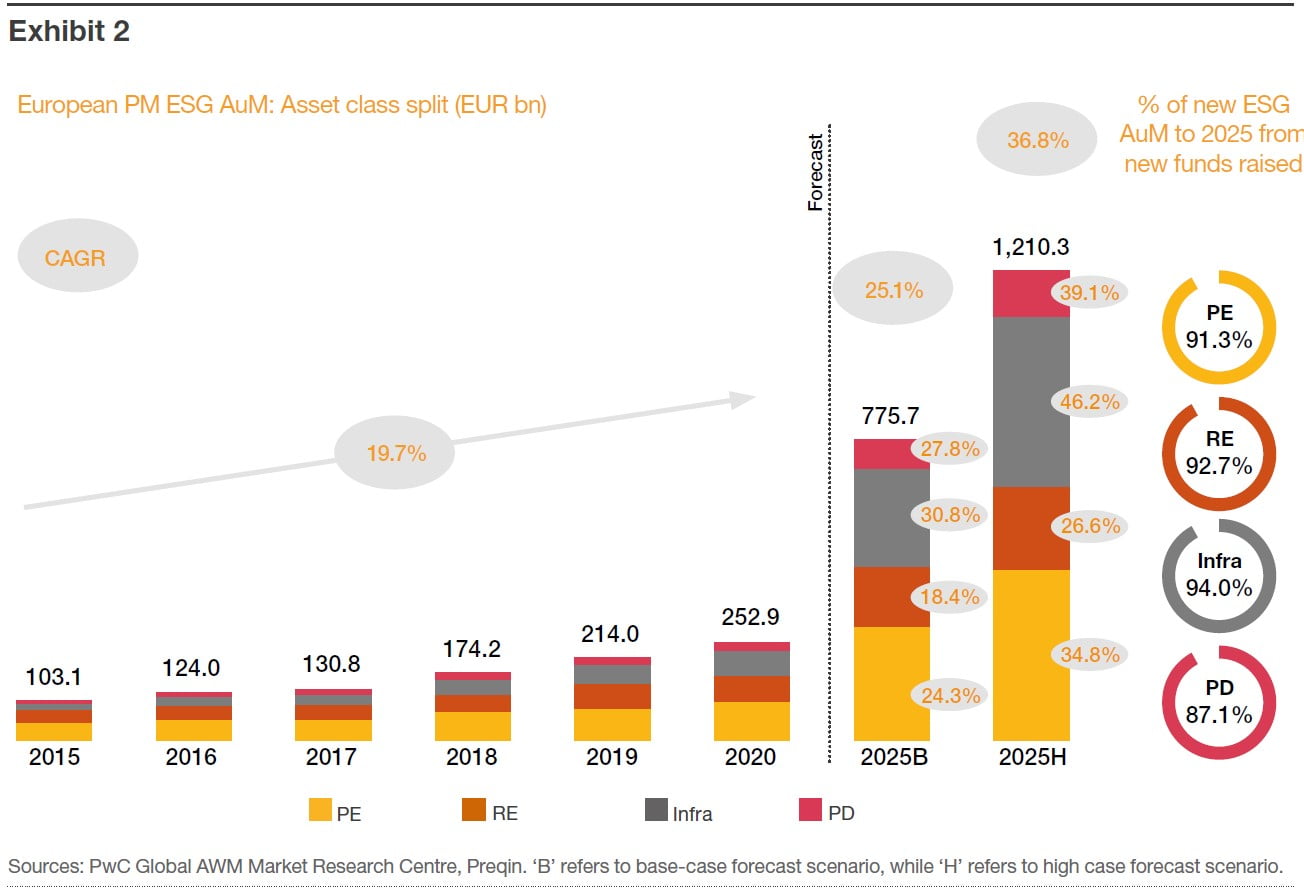

11th October, 2021 – New data from PwC Luxembourg forecasts European Private Market ESG assets will skyrocket to EUR 1.2tn by 2025 - accounting for 27.2% to 42.4% of the entire Private Market industry’s asset base up from 14.8% in-2020, as ESG continues to reinvent the European Private Market landscape at a rate and magnitude unparalleled since the ratification of the AIFMD in 2011.

The report, titled: EU Private Markets: ESG Reboot available here surveys 200 GPs and 200 LPs representing €46.0 trillion global AUM.

PwC Luxembourg also conducted in-depth interviews with a number of GPs and LPs to gather qualitative insights into the future of the industry and the role ESG will play in five years’ time.

Key Findings

The report examines the following themes and uncovers some key findings.

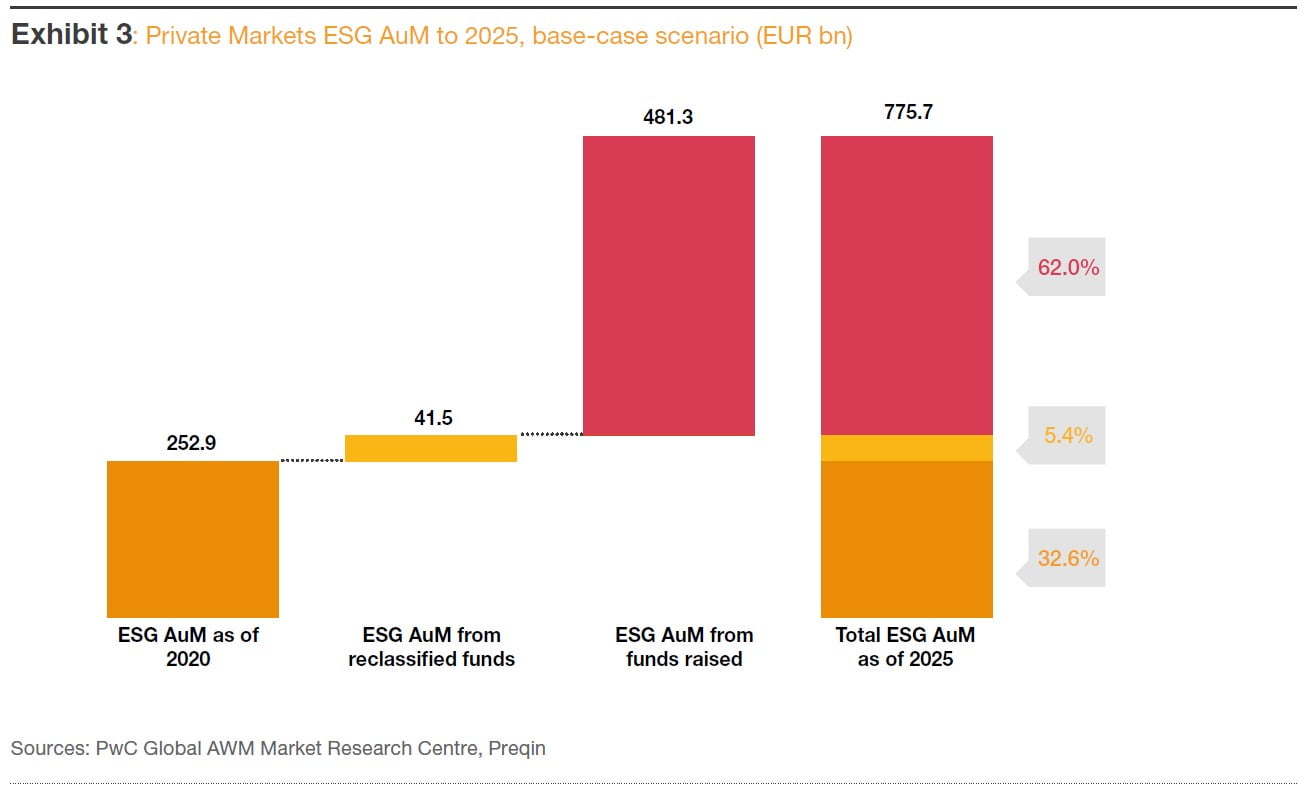

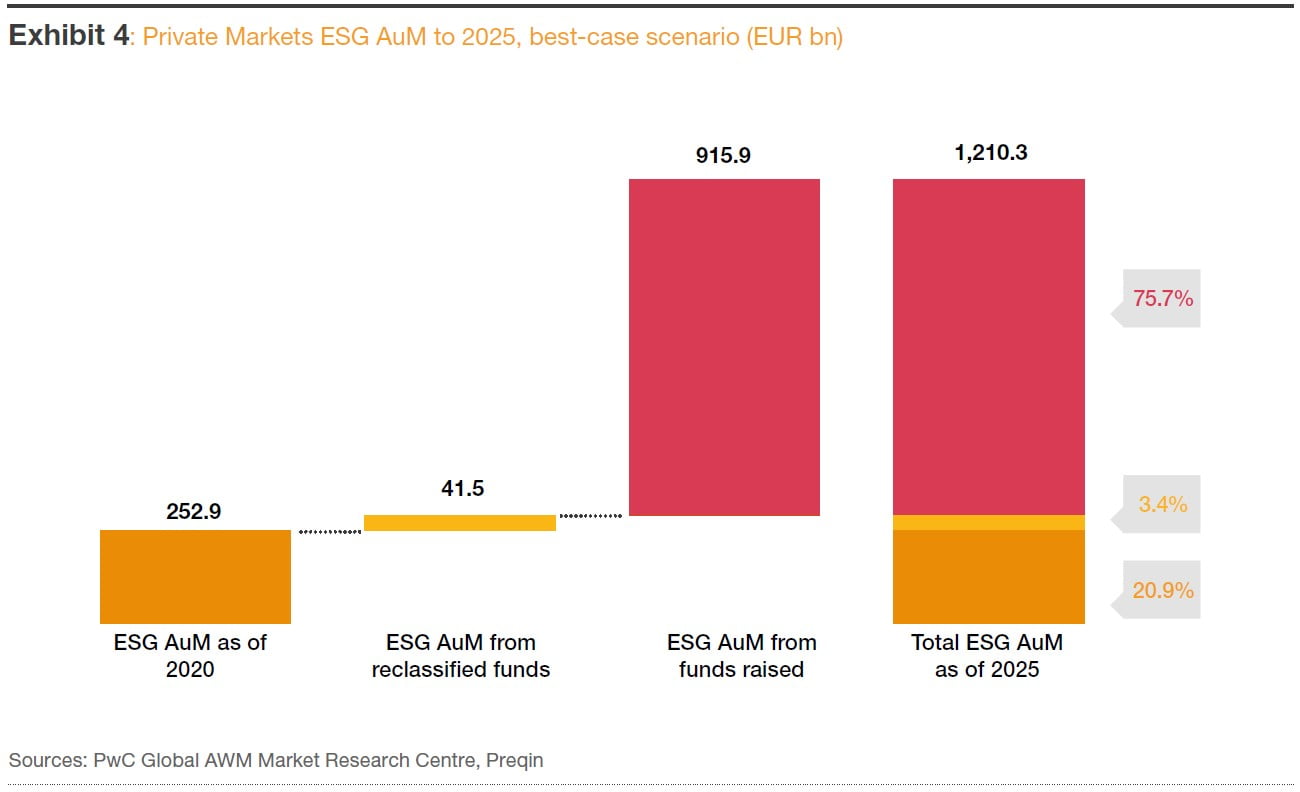

- Reshaping European Private Markets – The best-case forecast would see Private Market ESG funds completely redefining Europe’s existing PM landscape with GPs fully embracing and adapting to the ESG revolution. Should this scenario materialise, Private Market ESG AuM will skyrocket five-fold - exceeding EUR 1.2tn by end-2025 and account for 42.4% of European PM assets. Out of this EUR 1.2tn figure – 75.7% will stem from new funds raised, with existing and reclassified funds accounting for the remaining 20.9% and 3.4% of assets respectively.

- Asset Explosion across Europe - This asset explosion will see Europe alone making up between 31.0% and 35.9% of global ESG Private Market assets - positioning the region at the pinnacle of the global ESG landscape. The sheer extent of Europe’s predominance in this realm will see the region’s influence transcending physical borders and spilling across the world.

- Changing investor behaviour – Survey results indicate 100% of the LPs that do not invest in ESG PM funds plan to do so in the coming 24 months. 63% of the investors surveyed planned to increase their allocation to ESG funds in the same timeframe – with over half targeting increases of between 10% and 20%.

- Spotlight on Asset Classes – The research reveals considerable asset class heterogeneity in terms of current and expected ESG entrenchment.

- Private Equity (PE) - PE ESG AuM will skyrocket to EUR 292.0bn by 2025 under a base case scenario – making up 20.7% of total PE assets. Over 90% of this EUR 193.7bn increase is expected to stem from new funds, representing an over EUR 175bn opportunity for the most proactive GPs.

- Real Estate (RE) - Baseline forecast scenario suggests Real Estate ESG AUM is set to rise by EUR 87.4 bn in the coming five years, reaching EUR 153.2bn and accounting for 33.7% of RE’s overall asset base.

- Infrastructure - Under a base-case scenario, Infrastructure ESG AuM is expected to reach EUR 251.6bn by end-2025, representing 40.6% of total Infrastructure AuM.

- Private Debt (PD) – Research forecasts PD ESG AuM to reach EUR 78.8bn by 2025, accounting for as much as 21.3% of European PD AuM by 2025.

Harnessing ESG’s Value Creation

Will Jackson-Moore, Global Private Equity, Real Assets & Sovereign Funds Leader at PwC commented:

In this fast-evolving landscape, General Partners (GPs) will be increasingly required to adapt along with the winds of change, positioning ESG at the centre of their investment, risk mitigation and ALPHA creation strategies. Those that successfully harness ESG’s sheer value creation and protection potential stand to secure - or even enhance - their competitive positioning.

Olivier Carré, Financial Services Market Leader & Sustainability Sponsor at PwC Luxembourg commented:

GPs are waking up to the fact that ESG provides a strong case for ALPHA. This is illustrated by the fact that GPs, on average, benefited from a premium of between 6% and 10% following ESG implementation within their investment methodologies. While this is by no means negligible, we strongly believe that GPs with strong ESG skills and focus will not only have better investment performance, but also higher shareholder and stakeholder recognition.

About PwC

PwC Luxembourg (www.pwc.lu) is the largest professional services firm in Luxembourg with over 2,800 people employed from 77 different countries. PwC Luxembourg provides audit, tax and advisory services including management consulting, transaction, financing and regulatory advice. The firm provides advice to a wide variety of clients from local and middle market entrepreneurs to large multinational companies operating from Luxembourg and the Greater Region. The firm helps its clients create the value they are looking for by contributing to the smooth operation of the capital markets and providing advice through an industry-focused approach.

At PwC, our purpose is to build trust in society and solve important problems. We’re a network of firms in 155 countries with over 284,000 people who are committed to delivering quality in assurance, advisory and tax services. Find out more and tell us what matters to you by visiting us at www.pwc.com and www.pwc.lu.